A pre-money valuation is a term generally utilized in private value or investment enterprises; it alludes to the estimation of an organization before it opens up to the world or gets different ventures, for example, outer subsidizing or financing. Since adding money to an organization’s monetary record expands its value esteem, the post-cash valuation will be higher on the grounds that it has gotten extra money. A pre-money valuation can be used by external investors, such as venture capitalists and angel investors, to decide how much equity to ask an entrepreneur and his or her start-up company for in exchange for their cash infusion. Venture capitalists and other investors who are not immediately interested in a business often use the term, which is often simply referred to as pre-money.

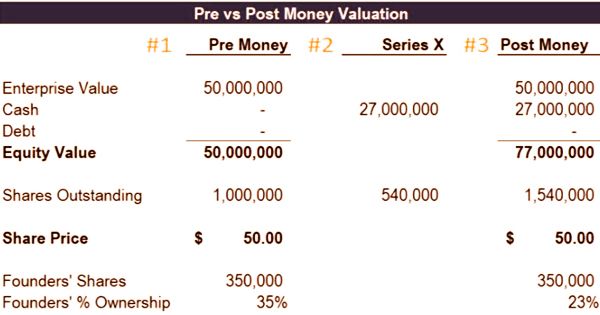

Businesses or organizations frequently conduct market research to determine the success in their emblem reputation strategies. Usually, an enterprise or an employer gets many rounds of financing (conventionally named round A, round B, spherical C, and so on.) in preference to a big lump sum on the way to decrease the risk for traders and to encourage entrepreneurs. It is necessary to remember that the pre-money valuation applies to the company’s overall equity value, not the share price. The share price will be unchanged while the equity value is influenced by the receipt of additional cash.

(Example of Pre-Money Valuation)

Pre-money valuations are distinct from post-money valuations, which assess the value of a business after funding or financing is obtained. There are several different methods of valuing a business, but fundamental formulas include:

Post-money valuation = New Investment × Total Post Investment Shares Outstanding / Shares Issued for New Investment

Pre-money valuation = Post-Money Valuation – Investment Amount

Pre-money is the valuation of a company before any rounds of financing and gives investors a photo of what the agency’s current price can be. However, it isn’t always a static discern, because of this it is able to alternate. A company’s enterprise value (EV) is the fee of the complete commercial enterprise without thinking about its capital structure. It’s important to factor out that a business enterprise’s organization price is unaffected by means of a spherical of investment. Pre-money can be determined simply earlier than a corporation is traded on public markets.

The pre-money valuation might be a figure proposed by a likely speculator. The number could then be utilized as a reason for the measure of subsidizing they will give and how many proprietorships they expect consequently. It’s critical to bring up that the current investors (before the exchange) will have the possession rate weakened by giving new offers. The leadership of the agency would possibly reject pre-valuations proposed by way of others until they reach a quantity that matches the aspirations of the organization. Whilst an enterprise is undergoing a spherical of financing (i.e., Series X), it’s going to should negotiate with buyers approximately the cost of the company. It may be both an excessive and subjective negotiation.

The most common valuation methods are:

- Discounted Cash Flow (DCF)

- Comparable Companies (aka Trading Multiples, or Public Comps)

- Precedent Transactions

Early-stage valuations can also overlap with the pre-revenue sector, meaning that any revenues have yet to be produced. This may be because it still does not have a brand on the market. Since the estimation of an organization can be strongly discussed, and since originators ordinarily have hopeful desires for the business, Venture Capital (VC) firms will commonly utilize favored offers to “bridge the valuation gap.” The valuation of the company will also be calculated by investors, depending on a number of other factors. Comparable companies could be one such indicator.

Financing rounds may be labeled into three sorts: Up round, down round, or flat round. An evaluation of the revenue and market cost of greater established, mature corporations with a similar cognizance and operational approach can serve as a gauge of the ability for pre-cash groups. A profitable growing business normally receives a series of up rounds before it is released, sold, or merged on the stock market. Down rounds are traumatic events for initial shareholders and founders, as they cause considerable dilution of ownership and may harm the credibility of the company.

Information Sources: