Portfolio Management Services

of IDLC Investments Limited

Merchant Banking is one of the key capital market activities that were provided by IDLC finance Limited. IDLC is the first financial institution who got the license for Merchant bank activities in January 1998. They started their Merchant bank operations in 1999. Under the merchant banking wing the services such as issue management, portfolio management and Corporate Advisory Services are provided. During 2010 SEC came up with the law which required all the financial institutions to make the merchant banking operation separate. As per requirement of the Securities & Exchange Commission (SEC), IDLC formed a separate subsidiary on May 19, 2010 in the name of „IDLC Investments Limited‟, in order to transfer its existing merchant banking activities to the newly formed entity. IDLC applied to SEC to transfer the existing merchant banking license of IDLC Finance Limited to IDLC Investments Limited. Accordingly, IDLC Investments Limited has started its operations from August 16, 2011 to offer merchant banking services to both our individual and institutional clients. Lastly this report contains overview of IDLC finance and investments, job description, findings and analysis, detailed study on the Portfolio Management Services of IDLC Investments Limited.

OVERVIEW OF THE REPORT:

This report is on the portfolio management services of IDLC Investments Limited and how this portfolio management services help the clients to maintain proper Taxation. This report detailed the whole IDLC Investments Limited as example their services, maintenance, client handling, investment Criteria, adjustment with stock market, portfolio evaluation and so on. This report is also contains with some recommendation which will help them for the further development.

OBJECTIVES OF THE REPORT:

- To provide the detail of portfolio management services

- To clarify the components of portfolio

- To clarify the investments criteria and post evaluation process.

- To provide the construction of Tax certificate

- To provide the Investment rebate

METHODOLOGY:

- Information Used for preparing this Report is collected from IDLC Finance Ltd‟s Website and Annual Reports from IDLC Investments Research Departments Archive.

- Therefore, The Source of Information for this Report is both Primary and Secondary.

- The Financial Analysis Part is Self Generated.

- Websites of Different Company and Organization.

OVERVIEW ON IDLC FINANCE LIMITED:

Industrial Development Leasing Company (IDLC) started its journey in 1985 as the first leasing company of this country. Though IDLC was introduced as a leasing company, it extended its working area and changed the name from Industrial Development Leasing Company to IDLC Finance Limited in August, 2007.

In last 30 years of business, they established themselves as the top financial institution in this industry. From last few years they offered several financial solutions. The Company‟s products and services ranges from home loans, car loans, corporate and SME lease and term loan, structured finance services ranging from capital restructuring and a complete suite of merchant banking and capital market services.

IDLC Finance was established with the collaboration of reputed international development agencies such as:

- Korean Development Leasing Corporation (KDLC), South Korea.

- Kookmin Bank, South Korea.

- International Finance Corporation (IFC)

- Aga Khan Fund for Economic Development (AKFED)

- German Investment and Development Company (DEG)

OVERVIEW OF IDLC INVESTMENTS LIMITED:

As per the requirement of Securities & Exchange Commission (SEC), IDLC formed a separate subsidiary named IDLC Investments Limited on May 19, 2010 in order to transfer its existing merchant banking activities to the newly formed entity. IDLC applied to SEC to transfer the existing Merchant Banking License of IDLC Finance Ltd to IDLC Investments Ltd. Accordingly IDLC Investments Ltd has started its operation from august 16, 2011 to offer merchant banking services to both our individual and institutional clients. Though their primary activity is to construct, maintain and evaluate the portfolio they do dome supporting activities as well. Those are investment banking, research etc.

They have Margin loan department to monitor the margin loan of Capital Invest accounts They also have the finance and control department to assist with the internal and external audit. Sometimes they also perform the functions of Human Resource department when it is required.

Project Part

IDLC Investments Limited mainly fulfills the Merchant Banking activities of IDLC Finance Limited. They manage the different portfolio accounts which are fully supported by high quality capital market research. All the money they get as deposit from clients invests in the capital market equity securities and also some fixed income securities.

NON-DISCRETIONARY PORTFOLIO ACCOUNT:

There is only one kind of account under Non-Discretionary Portfolio Account. In IDLC it is called CAP Invest.

Cap Invest is an Investor’s Discretionary Account that provides margin loan facilities to the investors. This is the only account where client himself manages his portfolio. It means client can buy and sell his own share when he wants to. Though in the margin loan account if Equity to Debt ratio is less than 50% then he has to maintain some bindings and if Equity to Debt ratio is lower than 30% S/He can buy securities that is approved by IDLCIL.

Major Services of Non-Discretionary Portfolio Account

- Extending margin loan facilities to enable investors to earn enhanced return

- Registering the securities, and collecting dividends and bonus shares

- Subscribing to the rights issues

- Keeping the securities in safe custody

- IPO Application

Major Characteristics

- Cap Invest clients will have absolute discretionary power to make their own investment decisions. IDLC, the Portfolio Manager, will provide all support for efficient execution of the trades.

- Clients will be allowed to invest only in the securities carefully selected and approved by the Portfolio Manager.

- The Portfolio Manager will extend Margin Loan to the clients to facilitate enhancement of their return on investments through leveraging.

- All the securities purchased for the clients shall remain in lien in favor of the Portfolio Manager.

- Clients will have access to various research materials on market, industry and companies prepared by the independent research team of the Portfolio Manager.

- Investment in “Cap Invest” will be considered allowable investment for obtaining tax rebate. Additionally, capital gains from investments are currently completely tax-exempt.

- Clients can place Trade Orders through Internet/SMS/Mobile Application.

Minimum Investment: Minimum Investment Amount: Taka 1 Lac.

Policies:

- Margin Call: In the event of the client’s equity falling below 50% of the total debt liability, the Portfolio Manager will call for additional margin deposit from the client to maintain the stipulated equity to debt ratio of the given loan ratio

- Mark to Market (MTM) : MTM is a gradual adjustment process to protect clients equity level. If equity level drops, deposit or partial sell will be required by the next working day to raise it. Any account having Equity to Debt ratio (E/D ratio) below 30% will be auto adjusted through daily Mark-to-Market (MTM).

Equity to Debt Ratio: Total Equity / Total Liabilities.

Netting: Client can sell the security and able to buy another security with that amount. Netting is only applicable for the margin account

Settlement:

- IDLCIL will send Daily Trade Data to the panel broker through email within 9.45 AM.

- IDLCIL will send the Approved List Of Securities (ALOS) to the panel broker, which are approved by IDLCIL Research team.

- Panel Broker will send executed trade data through email by 3.30 pm on every trading date.

- On the client‟s account, share will be matured on T+2 days

- On the client‟s account, Fund will be matured on T+3 days

Discretionary Portfolio Account:

Currently there are 4 type of account managed under Discretionary Portfolio Account. These accounts are fully managed by the portfolio manager. Investor cannot take decisions regarding buying new stock or selling existing stock but investor can check his portfolio when needed.

Portfolio manager is also responsible for sending quarterly portfolio report through email. All types of account and there description are given below

MAXCAP

MAXCAP is a personalized discretionary investment account designed for high net worth clients, both individuals and institutions. IDLC Investments Limited, Portfolio Manager, will follow a disciplined investment process and structured approach to build portfolio, tailored to specific needs and constraints.

MAXCAP account is ideally suitable for any individual having little or no experience of investing in the capital market of Bangladesh. MAXCAP also allows experienced investors and institutions to achieve greater sector and style diversification in their investment portfolios.

Key Features

- Minimum Investment Amount (Individual): BDT 10 Lacs

- Minimum Investment Amount (Corporate): BDT 10 Lacs

- Minimum Investment Horizon: 1 Year

Margin Loan Facility: Based on investor‟s preference

Key Benefits

- Analysis and periodic review of individual risk profile and investment objectives.

- Make the best investment decision by the amount of money client is going to give.

- Reconstruct the portfolio when market risk is high.

- Risk control and portfolio performance reviews on a regular basis

- Periodic reporting of the portfolio and financial status

- Portfolio Manager will adopt a clear and transparent investment process in terms of portfolio composition, stock selection, trade execution, monitoring and rebalancing. The investment process has been carefully designed to ensure

- Independent professional judgment and responsibility in each area of decision making.

- Elimination of all sorts of conflicts of interest.

- Fair dealing and objectivity in every transaction.

- Compliance of law and other fiduciary duties.

Investment Approach:

Adopt a Top-down Approach to determine appropriate sector allocation and security selection to build a strong portfolio. Use both fundamental and quantitative analysis for managing the investments. Portfolio manager will focus on the long term profit.

Composition of the portfolio:

Portfolio Manager will invest only in capital market securities (both debt and equity) approved by the Securities and Exchange Commission and/or Bangladesh Bank. In order to protect the capital and increase the profit potential, funds may be invested, as a defense strategy, in quoted/unquoted debt securities, depository instruments, or fixed deposit accounts.

- Funds will not be invested in private venture capital

- Funds amounting to more than 30% of total assets will not be invested in unlisted equity/debt securities, including IPO and pre-IPO private placements.

- Funds amounting to more than 30% and 60% of total assets will not be allocated in a single security and single industry respectively.

Risk Aspect & Return

Investment in the stock market is a subject to risk. MAXCAP account is providing a significant amount of profit from 2007. Past performance cannot ensure the future investment.

- Portfolio return is significantly dependent on the macro economic situation and the capital market in particular.

- Appropriate balancing between different asset classes may not be achieved due to absence of an active debt market.

- The value of the portfolio assets may be affected by uncertainties such as political or social instability, adverse climatic condition, regulations of the country.

Risk Control Measures

- First, the Portfolio Manager will set appropriate limits on downside shortfall in securities, industry and portfolio levels

- Second, the Portfolio Manager will try to minimize risk by selecting fundamental and potential securities and achieving adequate diversification

- Finally and most importantly, the Portfolio Manager will continuously monitor the performance of portfolio and the capital market conditions. Portfolio will be actively balanced in line with the changed market scenario, if it is deemed prudent.

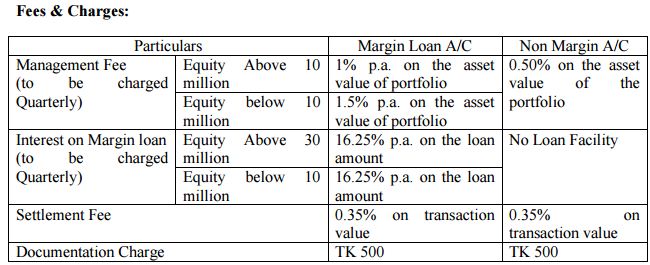

Fees and Charges:

Documentation Fee: Taka 500Management Fee: 2.50% p.a. on the value of the securities,

This management fee will be accrued per day basis and charged on a quarterly basis. This will be charged as follows and show in the portfolio Accrued fees and charges:Market value of the securities on that day*2.5% / 360

- Settlement Fee: 0.35% on the transaction value

- Early Exit Fee (within 1st year of investment): 0.50% on the withdrawal/closing amount

- Early exit amount* 0.50%

- Annual CDBL account renewal fees: BDT 500

Profit Loss sharing Scheme:

By the name of this account it is easily understood that IDLCIL shares the profit or loss with the client. Normally this sharing rate is client 70:30 IDLCIL. This account actually shows that how good they are in portfolio management.

Features:

- Year-end profit sharing opportunity

- Skilled professional service at the minimum cost

- Tax rebate opportunity for individuals

- Profit and loss will be shared will be proportionally

Key Information

- Minimum Investment Amount (Individual): BDT 10 Lacs

- Minimum Investment Amount (Corporate): BDT 10 Lacs

- Minimum Investment Horizon: 2 Years

Composition of the Portfolio: Portfolio Manager will invest only in capital market securities (both debt and equity) approved by the Securities and Exchange Commission and/or Bangladesh Bank. In order to protect the capital and increase the profit potential, funds may be invested, as a defense strategy, in quoted/unquoted debt securities, depository instruments, or fixed deposit accounts.

Fees and Charges:

- Documentation Fee: Taka 500

- Management Fee: 3.50% p.a. on the value of the securities,

- This management fee will be accrued per day basis and charged on a quarterly basis. This will be charged as follows and show in the portfolio

- Accrued fees and charges: Market value of the securities on that day*3.5% / 360

- Settlement Fee: 0.35% on the transaction value

Early Exit Fee (within 1st year of investment): 0.50% on the withdrawal/closing amount

Early exit amount* 5%

Annual CDBL account renewal fees: BDT 500

Capital Protected Scheme

This is the only portfolio management service which ensures that the client will not have any loss in future. Even If the market falls dramatically they will not have any loss but they may not earn any profit.

Features:

- Higher growth potentials with the combination of both money market and equity market investments

- 100% capital protection

- Zero downside risk when unlimited upside potential

- Skilled professional service at the minimum cost

- Tax rebate opportunity for individuals

Key Information

- Minimum Investment Amount (Individual): BDT 10 Lacs

- Minimum Investment Amount (Corporate): BDT 10 Lacs

- Minimum Investment Horizon: 3 Years 6 Months

Composition of the Portfolio: Portfolio Manager will invest only in both capital market securities (both debt and equity) and money market securities approved by the Securities and Exchange Commission and/or Bangladesh Bank. In order to protect the capital and increase the profit potential, funds may be invested, as a defense strategy, in quoted/unquoted debt securities, depository instruments, or fixed deposit accounts.

Fees and Charges:

- Documentation Fee: Taka 500

- Management Fee: 3% p.a. on the value of the securities,

This management fee will be accrued per day basis and charged on a quarterly basis. This will be charged as follows and show in the portfolio Accrued fees and charges: Market value of the securities on that day*3% / 360

Settlement Fee: 0.35% on the transaction value

Early Exit Fee (within 1st year of investment): 0.50% on the withdrawal/closing amount

Early exit amount* 6%

Annual CDBL account renewal fees: BDT 500

Easy Invest:

We are very familiar with the banking DPS system; this account has the similarity with that.

Only dissimilarity is bank does not accept the extra amount of money as deposit, IDLCIL does.

Features

- Flexible and affordable investment plan

- Disciplined and systematic approach

- Reduced risk because of cost averaging

- Professional fund management backed by strong research

- Tax rebate opportunity

- Capital gain is tax exempted

- Accidental death insurance coverage up to 1 lac BDT

Key Information

- Minimum Investment Amount (Individual & institutions): start from 3000 TK

- Minimum Investment Horizon: 5, 10, 15 and 20 Years

Fees and Charges:

- Documentation Fee: Taka 500

- Management Fee: 3% on the portfolio per year

- Settlement Fee: 0.50% on the transaction value

Early Exit Fee (within 1st year of investment): 5% on the withdrawal/closing amount before 1 year

1% after 1 Year

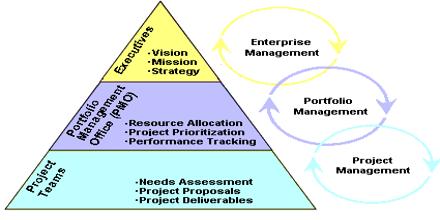

PORTFOLIO MANAGEMENT

Portfolio Management is the primary work of IDLCIL. All other department is working as a supporting wing of portfolio management. As example Research Department, they work as a supportive department. They show the portfolio manager where to invest.

Portfolio management takes the decisions where to invest and when to buy or sell. He is also responsible if the value of portfolio falls too much.

Duty towards Client:

- Send the portfolio through email.

- Answer to the Quarries

- Tax advice

- Provide Tax Certificate

- Buy and Sell

- Change Investment when necessary

- Provide Transaction Statement

- Frequent Communication

Here is the format of portfolio which is maintaining by IDLC Investments Limited. This portfolio is given without number and name of the shares because of confidentiality issue.

CONSTRUCTION OF THE PORTFOLIO:

Construction of the portfolio considers few components. All the components of a portfolio and their clarification are given below. After the portfolio construction how it going to help to make a Tax certificate is given below.

As portfolio numbers are very confidential issue so I am going to construct a portfolio with an example. Though this portfolio is for an imaginary person but it‟s share price is real (30th June, 2015). I have taken the price of 30th June as it is the last date of financial year. All the Tax Certificates are made for this date which must be supported by the portfolio.

EXAMPLE:

Suppose Mr. “A” opened a CAP Invest ((Non-Margin) Account in IDLC Investments Limited on

1st March, 2015. He deposited 2,000,000.00 BDT in IDLCIL. He receives Approved Securities List, Investment Advice from the portfolio manager. He also earned 20,000.00 as dividend from IDLC Securities Limited January 2015.

We would like to see where he invested the capital, operation process, performance and evaluation of the portfolio on the 30th June, 2015 with the Tax Certificate.

FINDINGS AND ANALYSIS

In last three months i found some issues where IDLC Investments Limited improve them and can find them in a more comfortable place. These improvements actually help both IDLC and clients. Sometimes a single line of additional information can satisfy clients and IDLC employees can save their time by not answering 10 extra question.

- Tax Certificate does not show how much investment rebate clients will get.

- Portfolio statement does not show the netting ability of the client.

- Portfolio statement also does not show the total withdrawal for this current period which is directly related to the tax certificate.

- Non-Discretionary Portfolio Account which is maintained by the clients has to write the order book. If the order book is not available then IDLCIL give him message manually which is time consuming and costly.

- Another problem in Non-Discretionary Portfolio Account is trade block or open. If order book is not available or if client overbuy from his account then IDLCIL block him from trade which takes a lot of time. For the client it may cause a lot of financial damage.

- Know Your Client is doing in a manual process which means it is maintained only in hardcopy. If there is any problem like fire, damage by insects before the audit then all this KYC has to done again.

RECOMMENDATION:

- If IDLCIL add investment rebate in there software right before the Advance Income Tax Column it will be really helpful for the clients. When clients come to take their Tax Certificate they always ask that how much investment rebate they will get.

- Netting ability is how much share they can buy with the sold amount of money on that particular transaction day. This netting ability should show in the portfolio statement. If it is shown in the portfolio statement then client can make a pre-budget about the trade.

- Withdrawal for the current period is a very important element of the Tax Certificate which should be supported by the portfolio statement.

- IDLC Investments should add auto message or email option in their software. Whenever the order book is not available clients will get the message or email. This software will also notify the client if the order book is about to finish. Employees have to only input the data.

- In terms of overbuy treatment should be the same. If any client overbuy from his account then he will be automatically block from trade. When he will sell some securities and will be in his limit trade will be automatically open.

- KYC should be done in Microsoft Excel and then print it out. If they maintain a Microsoft Excel then it will be very helpful for further use.

CONCLUSION:

IDLC Finance dose there Merchant Banking activities and Capital market operations through subsidiaries. IDLC is the leading non-banking financial institution from last few years. Their subsidiaries help them to get the position they are holding.

IDLC Investments Limited running their operations so smoothly. They are having big individual and institutional client who are really potential. In last fifty Initial Public Offering (IPO), IDLC introduced fourteen of them which indicated Industrialists are also in favor of them. After 2010,

So many non-banking financial institutions could not run their operations as smoothly as they did before. IDLC Investments had few problems at that time but they recover very quickly. In that time they gained a lot of loyal clients.

The Capital Markets operation of IDLC Finance Ltd was offered since 1999 but its activities started increasing gradually during 2007 onwards. And by 2010 this division became the most dominant contributor to the revenue and profit of entire IDLC Finance Ltd. And Now IDLC is determined to improve these services further in order to strengthen their position in capital markets and contribute heavily in making this market efficient in near future.