A phantom stock plan is an employee benefit plan that offers many of the advantages of stock ownership to selected employees (senior management) without actually offering them any company stock. The employer gives the workers a number of units or phantom shares, in compliance with the terms of the plan. The document informs the workers or employees regarding the beginning estimation of the offers alongside different states of the arrangement, for example, the vesting plan, the installment occasions, ghost profit accessibility (assuming any), and that’s only the tip of the iceberg. This sort of plan is in some cases alluded to as shadow stock. Thus if the stock price increases, the volume of the payment will increase and decrease if the stock falls, but without any stock actually earned by the purchaser (grantee).

The workers are entitled to obtain payment in return for their units upon completion of the plan terms. Like different types of stock-based remuneration plans, apparition stock extensively serves to adjust the interests of beneficiaries and investors, incent commitment to share esteem, and empower the maintenance or proceeded with the cooperation of donors. The employee gets a mock stock rather than having real stock. The phantom stock, even though it is not legitimate, follows the price movement of the actual stock of the company, paying out any resulting income. Usually, beneficiaries (grantees) are staff, but may also be directors, third-party suppliers, or others.

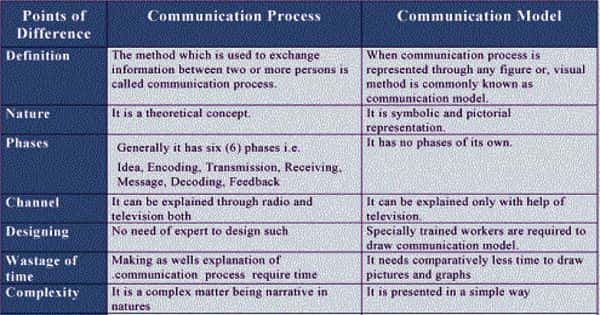

(Example of Phantom Stock Plan)

The measure of the installment will rely on (1) the quantity of vested units they hold, (2) the estimation of the units at the hour of installment, and (3) regardless of whether the arrangement was for the full estimation of their units or carefully the gratefulness in the incentive from the date of the award. However, substantial cash payments to workers must be charged on the beneficiary as ordinary income rather than capital gains which may in some cases interrupt the cash flow of the business. Phantom shares can be used instead of stock options to offer a clear form of equity ownership to potential contributors to the start-growth, up’s as the phantom share grants can be connected to negotiated vesting schedules with the payout attached to a change of control or liquidity event such as an IPO or acquisition.

There are two primary sorts of apparition stock plans. “Appreciation only” plans do exclude the estimation of the genuine basic offers themselves, and may just compensation out the estimation of any expansion in the organization stock cost throughout a specific timeframe that starts on the date the arrangement is conceded. “Full value” plans account for both the value and any appreciation of the underlying stock. Phantom shares may be used as a cash incentive scheme for existing businesses, but some schemes pay out the incentives in the form of shares. Phantom stock awards and vesting arrangements adjust workers’ thought processes to proprietors’ intentions, for example expanding stock costs, while staying away from both available remuneration and the need to give beneficiaries casting a ballot or different rights normally connected with shares.

Phantom shares, as defined, are typically redeemed in cash, and the payment is regarded as a bonus. If the plan agreement requires it however the payment requirement can be met by supplying actual stock to the workers. Phantom stock might be speculative, in any case, it actually can follow through on out dividends and it encounters cost changes much the same as its genuine partner. After a timeframe, the money estimation of the apparition stock is disseminated to the taking interest workers or employees. In general, phantom programs require the grantee, either by seniority or achieving a performance objective, to become vested.

Phantom stock, otherwise called manufactured value, has no intrinsic prerequisites or limitations with respect to its utilization, permitting the association to utilize it anyway it picks. It can likewise be changed at the administration’s attentiveness. Phantom stock can be available after vesting; regardless of whether not paid out if the estimation of the apparition shares is fixed to shares that themselves have esteem. Some businesses may use the phantom stock as an incentive to upper management. Phantom inventory directly connects a financial advantage to a success metric for a business. For workers that meet those requirements, it may also be used selectively as an incentive or a bonus. Phantom stock can be given to each worker, either in as an in all cases advantage or shifted relying upon execution, rank, or different elements.

Phantom stock is handled for accounting purposes in the same manner as deferred cash compensation. More than a verbal promise must be backed by a phantom stock plan. It also provides companies with some limitations in place to include stock value-bound rewards. This can apply to a limited liability corporation (LLC), a sole owner, or S-organizations limited by the 100-proprietor rule. Apparition stock payouts are available to the representative as normal pay and deductible to the organization. They are also, however, subject to specific laws governing deferred payments, which can lead to penalty taxes if not properly followed.

Information Sources: