According to a new study, several of the low-carbon policy solutions being deployed by governments may be harmful to households and small enterprises that are less able to bear increased short-term expenditures from energy price hikes.

It also implies that this menu of decarburizing policies, ranging from quotas to feed-in tariffs, may be developed and balanced to benefit local businesses and low-income households, which is critical for reaching ‘Net Zero’ carbon and green recovery.

Researchers from the University of Cambridge sifted through thousands of papers to compile the most complete analysis of commonly used low-carbon policies to date, comparing how they perform in areas like cost and competitiveness.

The research was published in the journal Nature Climate Change today. The researchers also put all of their data into an interactive web tool that allows people to look at evidence from around the world about carbon-reduction programs.

“Preventing climate change cannot be the only goal of decarbonization policies,” said study lead author Dr. Cristina Peñasco, a public policy expert from the University of Cambridge.

“Unless low-carbon policies are fair, affordable and economically competitive, they will struggle to secure public support and further delays in decarbonization could be disastrous for the planet.”

Over 700 separate findings were culled from over 7,000 published studies. These findings were tagged so that they could be compared to over half of the studies that were examined “blindly” by separate researchers to avoid bias.

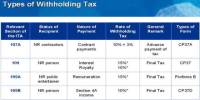

The study’s ten policy “instruments” include forms of investment, such as targeted R&D financing, as well as financial incentives, such as various types of subsidies, taxes, and the auctioning of energy contracts.

Market interventions, such as emissions permits; tradable certificates for clean or saved energy; and efficiency criteria, such as those for buildings, are also included in the programs.

Researchers looked at whether each policy type had a favorable or bad impact in terms of the environment, industry, and socio-economics.

When it comes to “distributional repercussions,” or how evenly costs and benefits are distributed, the research reveals that five of the 10 policy types have significantly more negative than positive effects.

“Small firms and average households have less capacity to absorb increases in energy costs,” said co-author Laura Diaz Anadon, Professor of Climate Change Policy.

Small and medium-sized businesses have found it more difficult to take advantage of new opportunities and adapt to changes as a result of some investment and regulatory policies.

Small firms and average households have less capacity to absorb increases in energy costs. If policies are not well designed and vulnerable households and businesses experience them negatively, it could increase public resistance to change a major obstacle in reaching net-zero carbon.

Laura Diaz Anadon

“If policies are not well designed and vulnerable households and businesses experience them negatively, it could increase public resistance to change a major obstacle in reaching net-zero carbon,” said Anadon.

Feed-in tariffs, for example, compensate renewable energy producers over market prices. However, if these expenses are passed on to households, the less well-off will be forced to pay a bigger amount of their income on energy.

Renewable electricity purchased as “green certificates” can redistribute wealth from customers to energy firms, according to 83 percent of the available evidence, and 63 percent of the evidence for energy levies, which disproportionately affect rural areas.

However, the researchers’ massive data set illustrates how many of these policies may be planned and coordinated to complement one another, spur innovation, and pave the way for a more equitable transition to zero carbon.

Smaller and more scattered sustainable energy projects, for example, can benefit from adjusting feed-in tariffs (FiTs) to be “predictable yet adaptable,” boosting market competitiveness and mitigating local NIMBYism*.

Furthermore, environmental tax revenues might be used to fund social benefits or tax credits, such as reducing corporate tax for small businesses and lowering income taxes, resulting in a “double dividend”: encouraging economies while reducing emissions, according to researchers.

According to the researchers, developing a “balance” of well-designed and complementary regulations can assist various renewable energy providers and “clean” technologies at different times.

Government investment for small-business research and development (R&D) can assist attract other sources of funding, enhancing both eco-innovation and competitiveness. When combined with R&D tax benefits, it favors startups over corporations in terms of innovation.

Smaller firms in “economically stressed” locations might benefit from government procurement, which uses tiered contracts and bidding to boost innovation and market access. As part of any green rebound, this might help “level the playing field” between affluent and poorer places.

“There is no one-size-fits-all solution,” said Peñasco. Policymakers should use incentives for innovation, such as targeted R&D investment, as well as tariffs and quotas, to help people from all walks of life.

“We need to spur the development of green technology at the same time as achieving public buy-in for the energy transition that must start now to prevent catastrophic global heating,” she said.