Public Finance

Public finance can be defined as the study of government activities, which may include spending, deficits, and taxation. It is that branch of economics, which deals with the management of income, expenditures, and debts of the government. In public finance, the public authorities adjust their income to the needed expenditures. It deals with the income raised through revenue and expenditure spend on the activities of the community and the terms ‘finance’ is money resource i.e. coins. It is the finance sector that deals with the allocation of resources to meet the set budgets for government entities.

The concept of public finance emerged with the formation of governments and public social institutions. This branch of economics is responsible for the scrutiny of the meaning and effects of financial policies implemented by the government. The goals of public finance are to recognize when, how, and why the government should intervene in the current economy, and also understand the possible outcomes of making changes in the market. It pertains to the management of financing activities and expenditures of public authorities like central or state governments and all other public governing bodies. A country’s financial position can be evaluated in much the same way as a business’ financial statements.

The importance of public finance can be clarified from the following functions.

- To Increase the Rate of Saving and Investment: Most of the people spend their income on consumption. Saving is very low so the investment is also low.

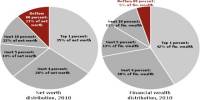

- To Secure Equal Distribution of income and Wealth: Unequal distribution of income and wealth is the basic problem of the underdeveloped countries. The rich are getting richer and richer while the poor are becoming poorer and poorer.

- Optimum Allocation of Resources: Fiscal measures like taxation and public expenditure programmers can greatly affect the allocation of resources in various occupations and sectors.

- Promoting Economic Development: The state can play a prominent role in promoting economic development especially through the control and regulation of economic activities.

- Infrastructure Building: Public finance helps to build up well-development physical and institutional infrastructure.

Richard Musgrave, a renowned Economics professor, terms Public Finance as a complex of problems that are centered around the income and expenditure processes of the government. The objectives of public finance are achieved by managing and drafting policies pertaining to key areas such as taxation, management of public revenue and expenditure, raising and servicing public debt, fiscal administration at various levels. It revolves around the role of government income and expenditure in the economy. However in the modern-day context, public finance has a wider scope – it studies the impact of government policies on the economy.