Normal profit (NP) is an economic concept that defines when, in a perfectly competitive market; the total profits of a company are equal to its total costs. This implies that the corporation makes adequate profits to cover the total cost of production and stay competitive in its respective industry. Standard profit arises when the difference between the net income of a company and the overt and implied costs combined is equal to zero. On the off chance that an organization reports a normal profit, it implies that the pay it gets for staying in business is higher than the open door cost that it loses by utilizing the assets to create the great. Nonetheless, an organization is said to cause misfortunes if its remuneration is lower than the open door cost lost to create the great.

(Normal Profit)

In macroeconomics, during periods of perfect competition, an industry is anticipated to experience normal benefits. The reward is greater than the cost of opportunity that the organization loses for successfully utilizing its capital and delivering a given product. If the earnings of a company are smaller than its sales, the company would incur losses. To remain in operation, it must meet a minimum threshold. Normal profit and monetary benefit are financial contemplations while bookkeeping benefit alludes to the benefit an organization covers its budget summaries every period. Besides, on the grounds that the ordinary benefit is equivalent to zero, it doesn’t imply that the firm isn’t gainful. The NP thinks about the compelling utilization of the association’s assets to its incomes.

When it faces large implied costs, normal profit and economic profit can be measures that an organization can want to weigh. Implicit costs apply to the opportunity cost of the production factors that the business already owns and that it needs to give up in order to use its capital. Standard profit (NP) typically exists when economic profit is negligible or if profits are equal to overt and implied costs. Then again, express cost alludes to the genuine costs that an organization acquires towards work compensation, landowner lease, crude material expense, and different costs. Express expense is anything but difficult to evaluate, while verifiable expense isn’t effectively quantifiable.

The formula of Normal Profit (NP): Normal profit = total revenue – total costs

Where total costs =

Explicit costs (rent, labor costs, raw materials +)

Implicit costs (opportunity cost of capital/working elsewhere)

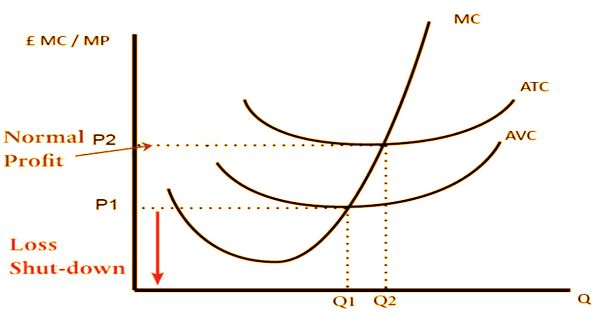

Normal profit diagram

Normal profit occurs at an output where average revenue (AR) = average total costs (ATC)

If the economic profit is equal to zero, a corporation will be in a state of normal profit, which is why normal profit is often called ‘zero economic profit.’ If a majority of the overall expenses are taken up by implied costs, the normal profit will be the minimum earnings threshold that the corporation must earn to remain in business. Standard profit can be considered as the minimum amount of earnings required to justify an operation when significant implied costs are involved. Although normal profit is equal to zero, it does not mean that zero profit is generated by the company. Instead, it compares how well the corporation uses its capital to produce income.

In contrast to bookkeeping benefit, typical benefit and monetary benefit contemplate certain or opportunity expenses of a specific endeavor. The financial benefit is the contrast between all-out incomes and the complete expenses of a business, where the absolute expense incorporates both express and certain expenses. The financial benefit can be either a positive worth, zero worth, or a negative worth. It is necessary to consider the two components of the total cost when attempting to measure financial and normal benefit. Explicit costs are readily quantifiable and typically require an expense-bound transaction. The formula for economic profit is as follows:

Economic Profit = Total Revenues – (Implicit Costs + Explicit Costs)

When new organizations enter the market, there will be an expansion in the gracefully of wares. It will cause a critical decrease in item costs, and in the long haul, the financial benefit will be zero. Organizations may dissect monetary and ordinary benefit measurements while deciding if to stay in business or while thinking about new sorts of expenses. Normal profit metrics may also be used to assess if there is a monopoly or oligopoly state and necessary measures for regulatory action to improve a market in the direction of more equalized competition.

Companies gain positive economic profits in uncompetitive markets because of the market dominance of dominant firms, the lack of competition, and the barriers to entry that exist. Companies may cooperate to reduce the availability of goods and artificially sustain high prices. It is technically possible for a corporation to function at zero economic profit and a normal profit with a significant accounting profit since normal profit requires opportunity costs.

Information Sources: