National accounts, also known as national account systems (NAS), are the implementation of comprehensive and consistent accounting techniques for measuring a country’s economic activity. These include comprehensive underlying measures based on double-entry accounting. By design, such accounting makes the totals on both sides of an account equal, despite the fact that they each measure different characteristics, such as production and income. The subject is known as national accounting or, more broadly, social accounting as a method.

National accounts are a set of accounts and balance sheets that provide a comprehensive and integrated framework for describing an economy, whether it is a region, a country, or a group of countries like the European Union (EU). In order to arrive at a consistent, reliable, and comparable quantitative description of an economy, this system must be based on common concepts, definitions, classifications, and accounting rules for internationally comparable national accounts.

In other words, national accounts as systems differ from the economic data associated with those systems. National accounts are based on economic concepts and share many common principles with business accounting. A social accounting matrix with accounts in each respective row-column entry is one conceptual construct for representing flows of all economic transactions that occur in an economy.

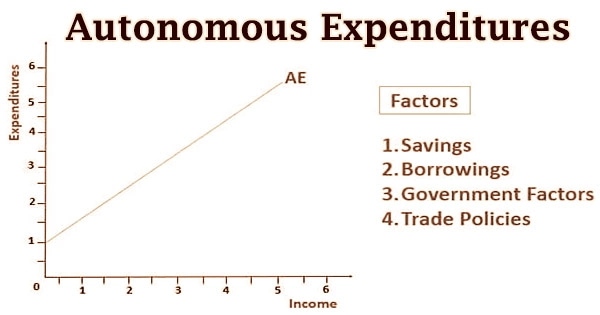

Since the 1930s, national accounting has evolved in tandem with macroeconomics, with its relationship of aggregate demand to total output through the interaction of broad expenditure categories such as consumption and investment. National account economic data are also used for empirical analysis of economic growth and development.

National accounts present the output, expenditure, and income activities of an economy’s economic actors (households, corporations, and government), as well as their relationships with other countries’ economies and wealth (net worth). They present both flows (measured over time) and stocks (measured at the end of time), ensuring that the flows and stocks are reconciled.

In terms of flows, the national income and product accounts (as they are known in the United States) provide estimates for the monetary value of income and output per year or quarter, including GDP. In the case of stocks, the ‘capital accounts’ are a balance-sheet approach with assets on one side (including land values, capital stock, and financial assets) and liabilities and net worth on the other, measured as of the end of the accounting period. National accounts also include measures of asset, liability, and net worth changes over time. These could be flow of funds accounts or capital accounts.

The national accounts contain a number of aggregate measures, most notably gross domestic product (GDP), which is perhaps the most widely cited measure of aggregate economic activity. GDP can be broken down into income (wages, profits, etc.) or expenditure (consumption, investment/saving, etc.). These are some examples of macroeconomic data.

Although detailed national accounts contain a source of information for economic analysis, such as input-output tables that show how industries interact with each other in the production process, such aggregate measures and their change over time are generally of greatest interest to economic policymakers.