Moving average convergence divergence (MACD) is a trend-following momentum indicator that depicts the relationship between two market-moving averages. Despite the fact that it is an oscillator, it is seldom used to detect overbought or oversold situations. The MACD is determined by deducting the 26-time frame exponential moving average (EMA) from the 12-time frame EMA. It shows up on the diagram as two lines which sway without limits. Trading signals are produced when the two lines cross, similar to a two-moving-average method.

The MACD is a technical indicator that shows changes in the strength, direction, momentum, and length of a trend in the price of a stock. It gathers data from various moving averages in order to assist traders in identifying potential opportunities near support and resistance levels. Dealers may purchase the security when the MACD crosses over its sign line and sell or short the security when the MACD crosses underneath the sign line. Moving average convergence divergence (MACD) pointers can be deciphered severally, yet the more normal techniques are hybrids, divergences, and quick ascents/falls.

The MACD indicator (also known as an “oscillator”) is made up of three time series determined from historical price data, most commonly the closing price. The MACD series itself, the “signal” or “average” series, and the “divergence” series, which is the difference between the two, are the three series. This was created by Gerald Appel towards the finish of 1970s. This marker is utilized to comprehend the energy and its directional strength by computing the contrast between double cross period spans, which are an assortment of recorded time arrangement. The MACD indicator tells investors whether the price is strengthening or weakening in a bullish or bearish trend.

The main points for an MACD indicator are:

a) Time period or interval, which the user can define. Commonly used time periods are:

- Short-term intervals – 3, 5, 7, 9, 11, 12, 14, 15, day intervals are the most common, but 9-day and 12-day intervals are also popular.

- Long-term intervals include 21, 26, 30, 45, 50, 90, and 200 days; the 26-day and 50-day intervals are the most common.

b) Momentum oscillator line, also known as divergence or MACD, is a simple plot of the difference between two interval moving averages.

c) The signal line is a 9-day exponential moving average (EMA) of divergence results.

d) Typically, a 12-day and 26-day EMA of rates, as well as a 9-day EMA of divergence data, are used, but these values can be modified depending on the trading target and other factors.

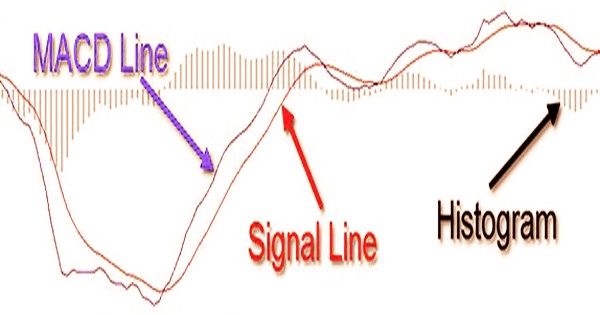

e) The above data is then plotted on a map with the X-axis representing time and the Y-axis representing price to produce the MACD line, signal line, and histogram for the difference between the MACD and signal line, which is shown below the X-axis.

MACD crossing over zero is viewed as bullish while crossing under zero is bearish. Besides, when MACD diverts up from under zero it is viewed as bullish. At the point when it diverts down from over zero it is viewed as bearish. It’s determined by subtracting the short-term EMA from the long-term EMA (26 periods) (12 periods). An exponential moving average (EMA) is a form of moving average (MA) that gives the most recent data points more weight and significance.

The Formula for MACD Is:

MACD = 12-Period EMA − 26-Period EMA

The MACD indicator is made up of three components:

- The MACD line, which measures the distance between two moving averages.

- The signal line is a market momentum indicator that serves as a catalyst for buy and sell signals.

- The histogram, which represents the difference between the MACD and the signal line

Just two lines are taken into account when measuring the MACD: the MACD line and the signal line. By subtracting the 26-period moving average from the 12-period moving average, the MACD line is formed. The MACD’s 9-period moving average is the signal line. The exponentially weighted moving average is another name for the exponential moving average. An exponentially weighted moving average responds more altogether to late value changes than a simple moving average (SMA), which applies an equivalent load to all perceptions in the time frame.

The indicator is called bullish when the MACD line crosses from below to above the signal line. The signal becomes stronger as it descends below the zero line. The MACD line often crosses from above to below the signal line, indicating that the indicator is bearish. The signal becomes stronger as it rises above the zero line. At the point when the value contacts an extraordinary failure, however the MACD doesn’t affirm something similar by making an amazing failure, that is viewed as a bullish difference. In a bearish divergence, the price makes a new peak, but the MACD does not do so on its own. Divergence points will reveal subtle security changes.

The MACD whipsaws during trading ranges, with the quick line crossing back and forth across the signal line. In this case, MACD users usually stop trading or close positions to reduce portfolio volatility. The distance between the MACD and its signal line is often graphed using a histogram. In the event that the MACD is over the sign line, the histogram will be over the MACD’s gauge. In the event that the MACD is underneath its sign line, the histogram will be beneath the MACD’s benchmark. As a future measurement of value drifts, the MACD is less helpful for stocks that are not moving (exchanging a reach) or are exchanging with capricious value activity. As a result, by the time MACD shows the trend, it will have already been completed or nearly completed.

When there is a clear pattern, the MACD indicator should be used. In a range-bound business, it doesn’t work. Since it deals with the real prices of moving averages rather than percentage shifts, it is known as an absolute price oscillator (APO). In contrast, a percentage price oscillator (PPO) calculates the difference between two price moving averages separated by the longer moving average value. The MACD has a positive energy when a more limited EMA moves over the more one, yet when it moves beneath the more EMA, that signs negative force.

Since it is both simple and accurate, the MACD indicator is commonly used. Its success stems from the fact that it provides two distinct signals: the intensity of the trend and the trend’s turning point. The MACD measures the frequency of buy and sell signals as well as whether a trend is up or down. One of the primary issues with difference is that it can regularly flag a potential inversion however then no genuine inversion really happens it delivers a bogus positive. The other issue is that divergence does not always predict reversals. In other terms, it expects too many false reversals and too few true price reversals.

There can be phony signs from the MACD as well; For example, there can be a bullish sign line hybrid however a lofty decrease in cost of a security. Similarly, as with any pointer, the MACD isn’t without defects and ought to be utilized close by other specialized examination instruments. Even in the absence of a true turnaround, a slowing in the price’s momentum sideways or sluggish trending action would cause the MACD to pull away from its prior extremes and gravitate toward the zero points.

To root out false signals and validate real ones, analysts employ a number of methods. The signal line’s MACD crossover means that the acceleration’s path is shifting. When the MACD line crosses zero, it indicates that the average velocity is changing. Traders may decide to utilize a basic moving normal methodology to set their purchase and sell signals, yet this gage can be postponed, which implies the economic situations could change before the exchange is executed. To avoid being “faked out” and entering a position too early, some traders wait for a verified cross above the signal line before entering a position.

Information Sources: