Introduction:

This report was assigned as an internship program of BBA Program, IBA, in Unilever Bangladesh Limited (UBL). In accordance with the specifications of the Program, the author will complete the 10 week period of the internship at the organization.

The report will be prepared under the Academic Advisor, Mr. Syed Alamgir Jafar, Associate Professor, IBA and Official Advisor, Mr. Subrata Chakrobortty, Management Accountant-Trade Support, UBL.

Objective of the project:

Broad Objective:

- To identify the channels to invest in based on growth opportunities and threats

Specific Objectives:

The specific targets to be fulfilled were as follows:

- To understand the concept of channels in UBL

- To gain the understanding of channel identifying tools used by UBL

- To classify the channels based on growth opportunities and threats

- To give recommendations based on the results

Scope of the Study:

The scope of the study is very limited. It only focuses on:

- Channel classification tools used by UBL

- Implication of channel classification

- Exploratory Research

The first part of the project was to understand the channel classification process as a whole and to get clear idea about different tools used by UBL. This was done by going through secondary information provided by the Customer Development department of UBL.

- Secondary Research

Then secondary research was carried out to find out the by channel by SKU turnover values. This was done through the internal database of the Customer Development department of UBL. Clarifications regarding the data were provided by Mr. Subrata Chakrobortty.

- Analysis

To analyze the data and to determine the channel to optimize investment, a software template has been used which has been developed by Unilever PLC for internal use.

Limitations:

- Due to the sensitive nature of the data, a lot of the calculations and numerical data could not be included in the report. In some cases, only the descriptive parts have been revealed.

- In case of the turnover figures, only indicative figures has been used due to matters of confidentiality

- Some data will be based on the judgement of the Trade Marketing Manager and the Management Accountant- Trade Support, and might not reflect the actual condition.

Overview of Unilever PLC and Unilever Bangladesh Ltd:

Unilever Bangladesh Limited is a subsidiary of Unilever, world’s one of the largest Household and Personnel Care and Foods Manufacturer with an annul turnover of €39.6 billion or approximately 2,40,000 Crore Taka. Unilever Bangladesh Limited is the leading Household and Personnel Care producer in Bangladesh with 15 brands and numerous sub-brands. They have been here in this country for the last forty years and have a huge manufacturing facility in Kalurghat, Chittagong aside from six other third party production facilities.

Its offices are located in:

| Registered Office | Unilever Bangladesh Limited | |

| 51 Kalurghat Heavy Industrial Area | ||

| P. O. Box # 125 | ||

| Chittagong – 4000 | ||

| Bangladesh | ||

| Corporate Office | Unilever Bangladesh Limited | |

| ZN Tower | ||

| Plot No. 2, SW (1) | ||

| Road No. 8 | ||

| Gulshan – 1 | ||

| Dhaka – 1212 | ||

| Bangladesh |

Unilever PLC:

Unilever is a public limited company of Anglo-Dutch origin that owns many of the world’s consumer product brands in foods, beverages, home care and personal care products. Unilever is one of the world’s largest consumer goods companies with a turnover of nearly €40 billion and more than 200,000 employees. Unilever produces 400 brands across a range of food, home and personal care products and operates in around 100 countries, and the products are sold in about 50 more.

Unilever describes themselves as a ‘multi-local’ multinational, bringing international expertise to the service of people everywhere. They have consumers, employees, business partners and shareholders on every continent.

Unilever is made up of two parent companies: Unilever NV that is based in Rotterdam, Netherlands, and Unilever PLC in London, UK. Both these companies have the same directors and are in effect a single business. The current non-executive Chairman is Antony Burgmans while Patrick Cescau is Group Chief Executive.

Unilever’s major competitors include Procter & Gamble, Nestlé, Mars Incorporated, and Reckitt Benckiser to name but a few.

History:

The self-starter: William Hesketh Lever, the son of a shopkeeper, started selling ‘Sunlight’ soap to workers in the mills of Northern England in 1884 and founded Lever Brothers in 1885.

By 1911 Lever Brothers was producing a third of all UK’s soap. In 1917, he began to diversify into foods, ice cream, acquiring fish, and canned food businesses. Lever’s success was built by exercising power over his work force, heavy brand advertising and a supply of cheap raw materials. Lever bought out competing firms and by 1890 had set up soap factories in Australia, Canada, the US, Germany and Switzerland.

Merger mania: Margarine was first produced commercially in the Netherlands in the 1870s and by 1927 two early manufacturers, Jurgens and Van den Bergh, decided to merge their operations to form Margarine Unie. Attracted by the idea of having a prime market position in soap and margarine, Margarine Unie and Lever combined two years later. Furthermore, and more strategically important, both Lever Brothers and Margarine Unie were competing for the same raw materials, involved in large-scale marketing of household products and used similar distribution channels so a merger was a logical outcome and since 1930, the two companies have operated as one, linked by a series of agreements and shareholders that participate in the prosperity of the whole business.

The African conquest: In 1911 Lever obtained a right to use, within ten years, up to 750,000 hectares of palm-bearing land in Africa. He called his Congo base ‘Leverville’. Lever Brothers soon needed vast amounts of edible oil for their margarine manufacturing plants and also wanted to control their sources of supply so quickly took over the Niger Company and the African and Eastern Trade Corporation. These two ‘giants of Africa’ merged to form the United Africa Company (UAC) in 1929 and acted to forcibly keep prices paid to West African farmers down. These profits then helped UAC diversify into textiles, beer, engineering and more profitable trading activities.

Because of Fads, fancies and convenience: In 1922 Lever Brothers bought Macfisheries and the Wall’s meat company to extend their product range. In the summer when demand for Wall’s sausages was weak, the subsidiary began to make ice cream. With the end of WWII, the convenience foods market boomed and ice creams, frozen meals and oven-ready foods were developed. Now Unilever is developing other exotic products: out-of-season flowers and fruits. For example, Unilever grows carnations in Kenya that are airfreighted to markets in Europe, supplying customers all year round.

Nimble-fingers make fortunes: Unilever grows tea in Africa and is a major buyer at all tea auctions and is also the market leader in most consuming countries. Unilever has 95 per cent of packet tea sales in India and Pakistan. It is able to buy cheaply in the Third World where costs are low and has invested heavily in processing to make things such as ‘instant tea’ that add value when retailed.

Today…: Hidden from public eyes Unilever is developing global uniformity amongst its products. Factories are being shut in Europe as production is centralized into fewer, bigger units. It is also spending increasing amounts of its annual budget on advertising in order to make its goods seem different from each other. The advertisements are designed to capture new types of buyers.

Some Facts about Unilever:

- Worldwide turnover in 2006 was €39.6 billion

- Employed 247,000 people, with 90% of managers locally recruited and trained.

- Its Home and Personal Care and Foods products are sold in 150 countries.

- Almost 72% of Unilever’s sales are generated by its foods division brands.

- In many parts of the world Unilever leads the home care market with brands such as Brilhante, Comfort, Skip and Omo.

- Unilever’s top personal care brands include Lux, Ponds, Sunsilk, Rexona, Axe, and Dove

- Its other famous brands include Dove, Knorr, Lipton, Hellmann’s, Magnum, Omo and Cif.

- It spends about £3.5 billion a year on marketing its brands.

- Every day 150 million people choose Unilever brands to feed their families and to clean their homes.

- In 2006 Unilever spent over €1 billion on research and development – about 2.5% of its turnover.

- Unilever has 111 sites certified to the international environmental management standard ISO 14001.

Table 1: Historical Timeline

| 19th Century | Although Unilever was not formed until 1930, the companies that joined forces to create the business we know today were already well established before the start of the 20th century. |

| 1900s | Unilever’s founding companies produced products made of oils and fats, principally soap and margarine. At the beginning of the 20th century their expansion nearly outstrips the supply of raw materials. |

| 1910s | Tough economic conditions and the First World War make trading difficult for everyone, so many businesses form trade associations to protect their shared interests. |

| 1920s | With businesses expanding fast, companies set up negotiations intending to stop others producing the same types of products. But instead they agree to merge – and so, Unilever is created. |

| 1930s | Unilever’s first decade is no easy ride: it starts with the Great Depression and ends with the Second World War. But while the business rationalises operations, it also continues to diversify. |

| 1940s | Unilever’s operations around the world begin to fragment, but the business continues to expand further into the foods market and increase investment in research and development. |

| 1950s | Business booms as new technology and the European Economic Community lead to rising standards of living in the West, while new markets open up in emerging economies around the globe. |

| 1960s | As the world economy expands, so does Unilever and it sets about developing new products, entering new markets and running a highly ambitious acquisition programme. |

| 1970s | Hard economic conditions and high inflation make the ’70s a tough time for everyone, but things are particularly difficult in the Fast Moving Consumer Goods (FMCG) sector as the big retailers start to flex their muscles. |

| 1980s | Unilever is now one of the world’s biggest companies, but takes the decision to focus on its portfolio, and rationalise its businesses to focus on core products and brands. |

| 1990s | The business expands into Central and Eastern Europe and further sharpens its focus on fewer product categories, leading to the sale or withdrawal of two-thirds of its brands. |

| 21st Century | The decade starts with the launch of Path to Growth, a five-year strategic plan, and in 2004 further sharpens its focus on the needs of 21st century consumers with its Vitality mission. |

Unilever Bangladesh Limited (UBL):

The year 1964 marked a new beginning for Kalurghat in Chittagong. It was in this year that Unilever Pakistan Ltd a subsidiary of Unilever, the Anglo Dutch Consumer goods Company, decided to establish a manufacturing unit in Kalurghat. Unilever started its quest to contribute to enhance the quality of human life, not confining its mission to produce quality branded products, but also providing opportunities of employment, developing ancillary industries, protecting the environment, and propagating community development through social contributions.

In 1964, Unilever started producing mechanized soaps, thus ushering industrialization in the area. Productions started off with Sunlight soap and Lifebuoy soap. Back in those days the average weekly capacity was 50 to 60 tons. After meeting the local demands, surplus was shipped to Pakistan. However, the political scenario was deteriorating and after a ravaging war in 1971, Bangladesh became an independent country. It was after independence that Unilever Bangladesh Ltd was constituted with Unilever owning 60.75% shares and the Government of Bangladesh owning the remaining 39.25% shares.

Post liberation period evidenced accelerated growth for the company. Demand started rising and the company continued its mission to meet consumer needs by producing quality soaps, introducing Lux – the beauty soap and Wheel. Launched in 1972 Wheel entered the mechanised laundry category, traditionally dominated by cottage soaps. It appealed to the consumers with unique care benefits for hand and fabric, a generic weakness in cottage soaps. It gradually became the secret ally of Bangladeshi women by extending the caring hand to ease her daily laundry chores.

The early eighties witnessed expansion of Unilever Bangladesh Ltd through diversification! Calibrating direction, the mission now included enhancing quality of life through other personal products aspiring aestheticism like sparkling white teeth, fresh breath, beautiful hair, and glowing skin. A Personal Product Plant was established to manufacture shampoo, toothpaste, and skin care creams.

In the early 90’s Unilever entered the tea-based beverage market introducing Lipton Taaza, Lever’s flagship packet tea brand, with the objective to be the most preferred tea of the Bangladeshi consumers.

The appetite to innovate and grow was insatiable. New products such as fabric washing powders were manufactured for the first time with formulations technically suitable for conditions in Bangladesh at an affordable price. Such washing powders led the country to witnessing a revolutionary change in washing habits moving from direct application to significantly convenient solution wash.

Product formulations were of international standard and by tapping into the vast know-how base of the parent Company – Unilever, Unilever was able to make the products available to the consumers at an affordable price. The growth of the company provided ample employment opportunities both direct and secondary with attendant fillip to the economy of the country.

Focused on meeting and responding to the needs of our consumers in Bangladesh, the journey to grow and the quest for excellence continue unabated!

Brief History of Brand Launches by Year:

Brands | Year of Launching |

| Lifebuoy | 1964 |

| Lux | 1964 |

| Wheel Laundry Soap | 1972 |

| Sunsilk | 1982 |

| Close Up | 1987 |

| Vim | 1987 |

| All Clear | 1989 |

| Fair & Lovely | 1988 |

| Ponds’ | 1991 |

| Pepsodent | 1991 |

| Taaza | 1992 |

| Surf Excel | 1993 |

| Wheel Washing Powder | 1997 |

| Rexona | 2002 |

| Vim Bar | 2003 |

| Pepsodent Tooth Powder | 2003 |

| Lakme | 2006 |

Table 2: Brief History of Brand Launches by Year

Unilever Bangladesh Limited at a Glance:

| Type of Business | Fast Moving Consumer Goods company with local manufacturing facilities, reporting to regional business groups for innovation and business results. |

| Operations | Home Care, Personal Care and Foods. |

| Constitution | Unilever – 60.75% shares, Government of Bangladesh – 39.25% |

| Product Categories | Household Care, Fabric Cleaning, Skin Cleansing, Skin Care, Oral Care, Hair Care, Personal Grooming, Tea based Beverages |

| Top Brands | Wheel, Lux, Lifebuoy, Fair & Lovely, Pond’s, Close Up, Sunsilk, Lipton Taaza |

| Manufacturing Facility | Unilever has a Soap Manufacturing factory and a Personal Products Factory located in Chittagong. Besides these, there is a tea packaging operation in Chittagong and five manufacturing units in Dhaka, which are exclusively dedicated to Unilever Bangladesh Limited. |

| Employees | Over 4000 people are provided direct employment through Unilever’s factories, distributors, and exclusive manufacturers. |

Table 3: Unilever Bangladesh Limited at a Glance

Unilever Bangladesh Limited Corporate Purpose:

Unilever’s purpose is to meet the everyday needs of people everywhere. To anticipate the aspirations of their consumers and customers and to respond creatively and competitively with branded products and services which raise the quality of life.

Their deep roots in local cultures and markets around the world are their unparalleled inheritance and the foundation of their future growth. They bring their wealth of knowledge and international expertise to the service of local customers – a truly multi-local multinational.

Their long-term success requires a total commitment to exceptional standards of performance and productivity, to working together effectively and to a willingness to embrace new ideas and learn continuously.

They believe that to succeed requires the highest standards of corporate behavior towards their employees, consumers and the societies and world in which we live.

This is Unilever’s road to sustainable, profitable, growth for their business and long-term value creation for their shareholders and employees.

Unilever Bangladesh Limited Mission:

Unilever’s mission all over the world is to add vitality to life. UBL follows this and tries to meet everyday needs for nutrition, hygiene and personal care with brands that help people look good, feel good and get more out of life.

Unilever Bangladesh Limited Goals

- To manufacture high-standard products.

- Promoting products to the highest extent

- Producing large volume to achieve production cost economies.

- Enabling quality products to be sold out at obtainable prices.

Code of Business Principles

The following Unilever’s business principals are also applicable for Unilever Bangladesh Limited.

Standard Of Conduct:

They conduct their operations with honesty, integrity and openness, and with respect for the human rights and interests for their employees. They will similarly respect the legitimate interests of those with whom they have relationships.

Obeying The Law:

Unilever companies and their employees are required to comply with the laws and regulations of the countries in which they operate.

Employees:

Unilever is committed to diversity in a working environment where there is mutual trust and respect and where everyone feels responsible for the performance and reputation of their company. They will recruit, employ and promote employees on the sole basis of the qualifications and abilities needed for the work to be performed. They are committed to safe and healthy working conditions for all employees. They will not use any form of forced, compulsory or child labor. They are committed to working with employees to develop and enhance each individual’s skills and capabilities. They respect the dignity of the individual and the right of employees to freedom of association. They maintain good communications with employees through company based information and consultation procedures.

Consumers:

Unilever is committed to providing branded products and services which consistently offer value in terms of price and quality, and which are safe for their intended use. Products and services are accurately and properly labeled, advertised, and communicated.

Shareholders:

Unilever conducts its operations in accordance with internationally accepted principles of good corporate governance. They provide timely, regular and reliable information on our activities, structure, financial situation and performance to all shareholders.

Business Partners:

Unilever is committed to establishing mutually beneficial relations with our suppliers, customers and business partners. In their business dealings they expect their business partners to adhere to business principles consistent with their own.

Community Involvement:

Unilever strives to be a trusted corporate citizen and, as an integral part of society, to fulfill our responsibilities to the societies and communities in which they operate.

Public Activities:

Unilever companies are encouraged to promote and defend their legitimate business interests. They co-operate with governments and other organizations, both directly and through bodies such as trade associations, in the development of proposed legislation and other regulations, which may affect legitimate business interests. They neither support political parties nor contribute to the funds of groups whose activities are calculated to promote party interests.

The Environment:

Unilever is committed to making continuous improvements in the management of their environmental impact and to the longer-term goal of developing a sustainable business. They work in partnership with others to promote environmental care, increase understanding of environmental issues and disseminate good practice.

Innovation:

In their scientific innovation to meet consumer needs they respect the concerns of their consumers and society. They work on the basis of sound science applying rigorous standards of product safety.

Competition:

Unilever believes in vigorous yet fair competition and supports the development of appropriate competition laws. They conduct their operations in accordance with the principals of fair competition and all applicable regulations.

Business Integrity:

Unilever does not give or receive whether directly or indirectly bribes or other improper advantages for business or financial gain. No employee may offer give or receive any gift or payment, which is, or maybe construed as being, a bribe. Any demand for, or offer of, a bribe must be rejected immediately and reported to management. Their accounting records and supporting documents must accurately describe and reflect the nature of the underlying transactions. No undisclosed or unrecorded account, fund or asset will be established or maintained.

Conflicts Of Interests:

All Unilever employees are expected to avoid personal activities and financial interests, which could conflict with their responsibilities to the company. They must not seek gain for themselves or others through misuse of their positions.

Current Operations

After some recent pruning, Unilever now has a portfolio of about 400 brands globally. However many of these are local that can only be found in certain countries, e.g. Lakme. The brands fall almost entirely in two categories as set out below:

- Food and beverages: this includes brands such as

Ben and Jerry’s

Birds Eye

Brooke Bond

Knorr

Pot Noodle

Ragú

Slim Fast

Magnum

Wall’s

- Home and personal care brands

Axe

Domestos

Dove

Impulse

Lifebuoy

Lux

Lynx

Persil

Thus it comes as no surprise that Unilever’s brands can now be found in one out of every two households in the world.

In Bangladesh, Unilever’s strengths come from:

- Its presence in several product categories

- Various brands

- Numerous variants and pack size

- Wide ranging options to fulfill diverse aspirations and tastes

Tailoring products to satisfy consumers with different needs and means

- Covering the country by hundreds of thousands of outlets

This wide range of products and brands offered by UBL shows the realization of the simple universal fact – “different individuals have different needs”.

In Bangladesh the company operates in four distinct product categories. These are:

- Fabric Wash

- Household care

- Personal care

- Foods

Fabric Wash:

- Wheel Laundry Soap

- Wheel Washing Powder

- Wheel Power White

- Surf Excel

Household care:

- Vim Scourer

- Vim Bar

- Vim Liquid

Personal Care:

- Skin Cleansing:

- International Lux

- Lifebuoy Total

- Lifebuoy Gold

- Lifebuoy Liquid Gold

- Lakme skin care products

- Skin Care

- Fair & Lovely Multivitamins

- Fair & Lovely Body Fairness Milk

- Fair & Lovely Ayurvedic

- Fair & Lovely Antimarks

- Fair & Lovely Menz Active

- Pond’s Nourishing Facial Scrub

- Pond’s Pimple Care Face Wash

- Pond’s Daily Face Wash

- Pond’s Cold Cream

- Pond’s Vanishing Cream

- Pond’s Dream Flower Talc

- Hair Care

- Sun Silk Shampoo

- All Clear Shampoo

- Oral Care

- Close-up Toothpaste

- Pepsodent Toothpaste

- Pepsodent Toothpowder

Foods:

- Lipton Taaza

Organizational Structure:

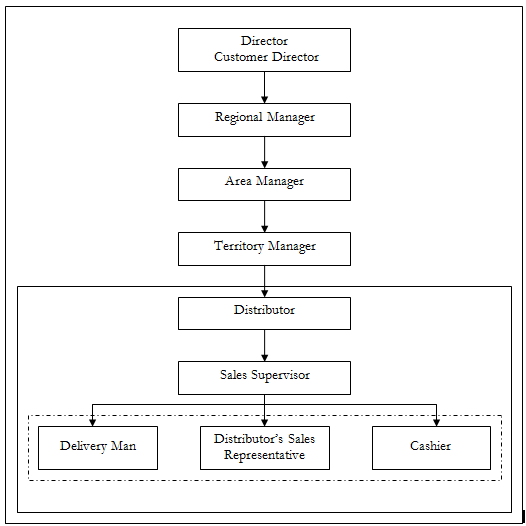

Unilever Bangladesh limited falls under the Southeast Asian region. It has one Chairman who is also the Managing Director (MD). UBL has five different departments. Respective directors head all the five departments. These departments are:

1. Customer Development Department

2. Brands and Development Department

3. Supply Chain Department

4. Human Resource Department

5. Finance, IT & Legal Department

The organization is relatively flat in nature. The managers at various levels besides reporting to their immediate supervisor also directly reports to the director. The management in Bangladesh consists of six layers starting from junior managers to manager Grade V. Apart from management other staffs and operatives also exist in the framework of the company, although those are not seen in the organogram. Each of the departments and their respective structures are shown below:

Figure 1: Organogram till the Directors

Markets Served by Unilever Bangladesh Limited:

Unilever Bangladesh Limited serves all kinds of markets. Its product mix actually caters for almost all types of markets. Following is a detail of the types of markets served.

Broadly speaking, the distribution network of Unilever Bangladesh Limited is vast and reaches all sorts of markets on at least twice a week basis. They serve markets in:

- Urban areas.

- Sub-urban areas (small towns).

- Rural markets.

Out of the total number of retailers in Bangladesh (the total number has been provided by AcNielsen Bangladesh Limited by a census conducted last year) Unilever Bangladesh Limited reaches more than one third of them directly at least twice a week. The other half that is not covered directly are predominantly, small tea shops, small retailers in the deep rural areas like Chittagong hill tracks and unrelated retail outlets like clothes stores etc. So it is evident that there is not much scope for Unilever Bangladesh Limited to expand its direct coverage as almost all related and economically viable outlets are already covered.

The types of outlets that are covered directly are:

- Grocer stores.

- Wholesalers.

- General stores.

- Tea stalls.

- Cosmetic stores.

- Self Service Stores

The few retailers who sell Unilever Bangladesh Limited products but are not served directly are served by the wholesalers which make this channel very important. The company also gives considerable importance to the wholesalers and from time to time special trade promotional activities are done specifically for the wholesalers. One suck kind of activity is known as “Dosti Program”. However, the detail of Dosti program is outside the scope of this report and hence is not elaborated further. This is basically a summary of the markets served by Unilever Bangladesh Limited.

Distribution Network:

Distribution of Unilever Bangladesh Limited products is done by the Customer Development Department. It is a huge network with thousands of field workers working six days a week. It is through their relentless effort that the goods reach the end consumers. The basic structure of distribution is as follows:

The Customer Development Director is the head of the sales or Customer Development team. Apart from others, the regional managers report directly to him. The whole of Bangladesh has been divided into five regions based on geography and sales volume. The regions are:

- Central Metro Region (Dhaka Metro City)

- Central Outer Region (rest of Dhaka Division)

- Eastern Region (Chittagong and Sylhet division)

- Northern Region (Rajshahi Division)

- Southern Region (Khulna and Barisal Division)

Each or these regions have two or more areas headed by the area manager who reports to the regional manager. Each area has three or more territories that are headed by the territory manager who reports to the area manager. The territory manager has his office in the distribution house of the area (in case of multiple distribution house in one territory he usually sits in a central location) and mans an army of sales supervisors, distributor’s sales representatives, cashiers and deliverymen.

The Territory Manager is an employee of Unilever Bangladesh Limited but below him the distributor and others are simply distributor’s employees. When a company becomes distributor of a certain territory, it has to sign a contract where it says that the distributor will have to employ certain number of people in each trade (i.e. cashier, supervisor etc.) and the territory manager of that particular territory will advise the number of people in each trade. The day-to-day work plan of these people will also be set by the territory manager although they will be supervised by the sales supervisor who will report to the distributor and Territory manager.

This contract also says that there will be a room in the distribution house to be used by Unilever Bangladesh Limited employees, primarily by the Territory Manager. In every distribution house there is an issue of dual authority. The problem is the distributor’s sales representatives, cashiers and deliverymen reports to both the distributor and territory manager that can potentially create problems. However, Unilever Bangladesh Limited do not consider their distributors as just a company or person working for them rather they consider the distributors as partners in business where both have the same goal; achieving greater sales volume. By doing this, now there are no issues regarding dual authority and all the territories are running smoothly.

It may be mentioned here that, the distributor’s sales representative (DSR), cashier and deliveryman is one group. The DSR takes the orders from the markets, the cashiers collect the payment as per order and based on orders and payment, the deliveryman delivers the goods to the intended retailers.

This distribution network is very vast and can reach literally any corner of the country any day of the week.

Customer Development – The Function:

The Customer Development team, previously called Customer Management, is responsible for the overall sales and distribution of UBL’s brands across the country. They are the bridge between the Brand Management team and the Consumers. The Customer Development team makes sure that the company meets the everyday needs of people everywhere through ensuring that their brands are always within the reach of their customers and consumers. To do so, pioneering new channels of distribution, ensuring visibility of brands through attractive merchandising, and developing distributors to enhance UBL’s penetration and coverage are crucial responsibilities entrusted upon the Customer Development team.

Increasing competition and the advent of modern trade has compelled customer development to shift from “Traditional Sales” to “Trade Marketing”. With more trade sophistication, the role of Customer Development is evolving into Relationship Marketing where Channel Development, Merchandising, and Distributor Development play a crucial part in keeping the company ahead of competition and in outpacing market change.

In fact, ever since 2006, one difference that has come across the organization is that the CD function has been identified as an important source of growth through the following ways:

- One aligned agenda across the region of “Win with Customers”

- A focused effort on growing share in growing channels and customers through Channel Value Assessment (CVA)

- Going to market as ‘One Unilever’ under Unilever’s new market operating model

- Breaking down functional barriers – specifically with marketing and supply chain by customer marketing and sales and operations activities

- Not accepting mediocrity in stores by means of POP measurement & 3600 marketing

Hence, to be a winning part of the Customer Development team one needs to have:

- Great passion to achieve targets

- Very strong people management skills, good analytical ability

- Strong customer orientation and the ability to develop action plans that can meet both the needs of our customers and the business

- Real enthusiasm and the pace for competitiveness at retail

- Practical creativity that focuses on results

- Real drive to lead a team

- Willingness to work anywhere in Bangladesh

Channels

What is a channel?

A channel is defined as a common group of point of purchase that satisfy the same consumer/shopper needs or characteristics.

Channels of UBL

Background:

In 2002, the HPC Asia Executives concluded that the only way to growth was to adopt a differentiated approach with customers in different channels. Channel stragey dimension was the direct outcome of this strategic decision.

“Channels” and “shopper understanding” was not new to Unilever. Elements of shopper based channel development have existed in one form or another for many years. However, the progrmame endorsed and initiated by the HPC Asia Business Group was the first integrated change management programme with the potential to change the way Unilever goes to market.

Need for channels:

In an ideal world, the greatest way would be to manage each outlet individually. However, in reality that would not be cost effective. On the other hand, treating them all the same way would not various brands to reach full potential. It will make UBL vulnerable to its competitors. So, channels were created to analyze and manage the outlets in groups.

How to define a channel

Shopper Differentiators- shown by characteristics, needs and behavior of people, why people buy (or do not buy) a product/brand-this is discovered by interviews and observation

This drive

Categories and SKUs stocked

And the Outlet Characteristics

This was then translated into observable (visual) characteristics so that the outlets can be identified by looking at them without always interviewing the shopper.

This identication of channels helped identify three sources of opportunites;

- brand share improvement

- numeric distribution improvement through increased coverage

- out of stock improvement

Identified Channels:

As mentioned earlier, the type of outlets serviced by UBL are:

- Grocer stores.

- Wholesalers.

- General stores.

- Tea stalls.

- Cosmetic stores.

- Self Service Stores

Among them while defining channels, grocer stress are broken down in two parts and wholesale is omitted as UBL wants to service the retail outlets by direct coverage. The channels of UBL are:

- Neighborhood Grocer

- Wet Market Grocer

- General Stores

- Tongs

- Shopping Complexes

- Self Service Stores

Neighborhood Grocer:

Where

Neighborhood grocers are located in residential area

Structure

It is housed in a permanent structure

It sells

It sells loose rice, lentils, potatoes, onions in open sacks. In addition, the shop carries household and personal care (HPC) products, milk products and packed food items as biscuits. These shops sell sachets which are hanged from rope/plastic in front of the outlet.

Who

Target shoppers are likely to be male/female shoppers who live in the nearby areas.

Wet Market Grocer:

Where

Wet market grocers are usually found in and around wet markets

Structure

The shop is operated in permanent house and the shop keeper usually operates from a ‘godi’

It sells

Staples such as rice, lentils, potatoes and onion are displayed in the front of the shop on the floor in open sacks. In addition, the shop carries HPC products, milk products and few packed food such as biscuits.

Who

Target shoppers are likely to be middle or lower income shoppers who live in the nearby areas. The shoppers expect a discount on the total bill. Some of these shops also cater to small retailers.

Photo 4: Wet Market Grocer

General Stores:

Where

General stores are located in residential areas or market areas

Structure

The general stores are normally decorated with glass cabinets and offers over the counter service.

It sells

It sells HPC products, cosmetics, packed food, bay food, drinks, health beverages, daily needs and cigarettes

Who

Target shoppers are likely to be male/female shoppers and do not have to be from the nearby area.

Tongs:

Where

Tong is found in male congregation places which includes market areas, ‘ghat’ areas, and residential areas.

Structure

It is a temporary tin-made shop

It sells

It sells beetle leaf, cigarettes, pack and non-packed foods and few HPC daily need items. These shops sell sachets which are hanged from rope/plastic hanger in front of the outlet

Who

Target shoppers are likely to be lower income male shoppers who live/work in the nearby area.

Shopping Complex:

Where

Shopping complexes are located in urban market areas. It is normally situated in the road side.

It sells

It sells ornaments, cosmetics, toiletries, perfumes, toys, show-pieces, stationary, bags, wedding items etc. It offers lot of foreign items. It offers over the counter service.

Who

Target shoppers are likely to be females

Self Service Stores:

Where

Self service stores are located in urban areas

Structure

Self service stores are housed in a permanent building with significantly large shop space.

It sells

It sells almost all the products of urban household’s daily needs. It also sells meat, vegetables, cloths, crockery items etc. Both local and foreign products are available here giving the shoppers a lot of options. All products have a price tag and usually are bar coded.

Who

Target shoppers are likely to be males and females of SEC A & B.

Channel Value Assessment (CVA):

In 2006, Unilever PLC decided to invest in all channels in similar and wanted to optimize investment within channels by identifying the channels with high opportunity of growth and lower threats. Thus the concept of Channel Value Assessment came.

Channel value assessment (CVA) means the assessment of the identified channels in terms of opportunity and challenges. Then, categorize the channels in three different groups: Gold, Silver and Bronze and then invest in the channels according to the priority of the category.

The following are the five different steps followed for CVA:

Stage A: Identify the customers/ channels

In this stage, firstly the channels are listed down and then the information regarding sales, of the current year and the previous year, all the channels is collected. After all the information is collected, the channels are ranked based on their growth of sales and the top 9 are selected. For UBL, since there are only six different channels, all the channels are kept in the final list.

Stage B: Define attributes

In this stage the attributes are defined for assessing each of the channels in each of the dimensions of Healthy Opportunity and Degree of Challenge. Since this template for channel assessment has been developed abroad, the attributes were already defined and were marked as either required or optional. While putting weightings on the attributes, all the required attributes had to be selected and the optional attributes had been selected based on the relevance on our market conditions. While defining weightings, the following guidelines were followed:

- A “zero” weight means that an attribute has not been selected

- No single Required attribute (for example Growth) could have a weighting of less than 10% or more than over 25%.

- Required attributes (R) must have a total weighting of at least 67%.

- Optional attributes (O) must have a total weighting of no more than 33%.

- The sum of the attributes weightings per dimension (Healthy Opportunity and Degree of Challenge) had to reach 100%.

The following table shows the attributes of Healthy Opportunity and respective weightings as deemed plausible by UBL:The following table shows the attributes of Degree of Challenge and respective weightings as deemed plausible by UBL:

The weigtings of the attributes were based on the judgement of Trade Marketing Manager and the Management Accountant- Business Partner, Customer Development.

Stage C: Rub the assessment

Then the data for the specific channels regarding the attributes are collected and the assessment is done. For the quantitave attributes actual values are used such the sales figures and growth figures, but the qualitative attributes are valued with appropriate given options. The options are: Yes/No, Strong/Avearge/Weak or Very High/High/Medium/Low/Very Low. Again, the value for the qualitative attributes were based on the jundgement of the Trade Marketing Manager and the Management Accountant- Business Partner, Customer Development.

The tables in the following pages show the assigning of values in the qualitative assessment table:

1 | 2 | 3 | ||||||||

Maxi weighting | General Store | Neighborhood Grocer | Wet Market Grocer | |||||||

| Dimensions & Attributes: | Value | Score | Value | Score | Value | Score | ||||

| Healthy Opportunity | ||||||||||

| Size | 23% |

| 3% |

| 23% |

| 13% | |||

| Size Overall | 18.0% | 2.4% | 18.0% | 10.7% | ||||||

| Size Foods / HPC / Other | 5.0% | 1.0% | 5.0% | 2.7% | ||||||

| Growth | 21% |

| 10% |

| 14% |

| 12% | |||

| Overall Customer/Channel % Sales Growth | 7.0% | 0.0% | 0.1% | 0.0% | ||||||

| Foods / HPC / Other Customer/Channel Growth | 7.0% | 4.0% | 7.0% | 5.5% | ||||||

| Unilever relative Turnover Growth at Account | 7.0% | 6.2% | 7.0% | 6.6% | ||||||

| Sources of Future Growth | 20% | 7% | 10% | 8% | ||||||

| Future Growth from Market Share Increase | 7.0% | low | 1.8% | medium | 3.5% | medium | 3.5% | |||

| Future Growth from Distribution Increase | 10.0% | low | 2.5% | medium | 5.0% | low | 2.5% | |||

| Financial Strength | 3.0% | high | 2.3% | medium | 1.5% | high | 2.3% | |||

| # of Store Openings | 0.0% | |||||||||

| Relative Profitability | 20% |

| 17% |

| 14% |

| 14% | |||

| Customer/Channel Relative Contribution | 20.0% | 16.9% | 14.1% | 13.7% | ||||||

| Alignment ???? | 5% | 5% | 5% | 0% | ||||||

| Central Buying / Execution Power | 0.0% | very high | 0.0% | high | 0.0% | medium | 0.0% | |||

| Compliance with Efficient Operations Programs | 0.0% | high | 0.0% | medium | 0.0% | medium | 0.0% | |||

| Willingness to share data (forecast/consumer) | 0.0% | high | 0.0% | high | 0.0% | medium | 0.0% | |||

| Other Strategic Initiative Alignment | 5.0% | yes | 5.0% | yes | 5.0% | no | 0.0% | |||

| Marketing Sophistication | 11% | 10% | 5% | 6% | ||||||

| Capability to grow Unilever categories | 5.0% | yes | 5.0% | no | 0.0% | no | 0.0% | |||

| Use of Shopper Data / Consumer Strategies | 0.0% | yes | 0.0% | yes | 0.0% | no | 0.0% | |||

| Speed / Readiness to Introduce New Products | 6.0% | high | 4.5% | high | 4.5% | very high | 6.0% | |||

| Industry / Technology Leadership | 0% | 0% | 0% | 0% | ||||||

| Supply Chain Leadership | 0.0% | yes | 0.0% | yes | 0.0% | no | 0.0% | |||

| Supply Chain Efficiency | 0.0% | high | 0.0% | medium | 0.0% | very low | 0.0% | |||

| Technology Leadership | 0.0% | yes | 0.0% | yes | 0.0% | no | 0.0% | |||

HEALTHY OPPORTUNITY | 100% |

| 51% |

| 71% |

| 53% | |||

| Degree of Challenge | ||||||||

| Dependency | 30% |

| 11% |

| 26% |

| 23% | |

| Unilever Foods / HPC Dependency on Customer (% of Sales) | 15% | 3.0% | 15.0% | 8.1% | ||||

| Brand/Category Dependency on Customer | 15% | medium | 7.5% | high | 11.3% | very high | 15.0% | |

| Reliance on Trade Investment | 25% |

| 16% |

| 16% |

| 16% | |

| Relative %age of Trade TTS | 12% | low | 9.0% | medium | 6.0% | medium | 6.0% | |

| Relative %age of Consumer TTS | 13% | medium | 6.5% | low | 9.8% | low | 9.8% | |

| New Item Entry Cost | 0% | very low | 0.0% | very low | 0.0% | very low | 0.0% | |

| Management Style | 15% |

| 10% |

| 10% |

| 5% | |

| Negotiation Focus (vs Consumer Value Focus) | 5% | medium | 2.5% | medium | 2.5% | very low | 0.0% | |

| Level of Partnership with Unilever Food/HPC Competitors | 10% | high | 7.5% | high | 7.5% | medium | 5.0% | |

| Commitment to Retail Private Label (RPL) | 0% |

| 0% |

| 0% |

| 0% | |

| Commitment to RPL in Food/HPC Categories | 0% | high | 0.0% | medium | 0.0% | very low | 0.0% | |

| Commitment to RPL in All Categories | 0% | high | 0.0% | medium | 0.0% | very low | 0.0% | |

| Spread | 20% | medium | 10.0% | very high | 20.0% | high | 15.0% | |

| Relative cost to serve/outlet | 10% | high | 7.5% | low | 2.5% | very low | 0.0% | |

| Trade Terms | 0% | very high | 0.0% | medium | 0.0% | very low | 0.0% | |

| New Market Entry | 0% | very high | 0.0% | high | 0.0% | very low | 0.0% | |

| Organizational Stability | 0% |

| 0% |

| 0% |

| 0% | |

| Anticipated Level of Future Change | 0% | high | 0.0% | high | 0.0% | very low | 0.0% | |

| Financial Independence | 0% | medium | 0.0% | medium | 0.0% | medium | 0.0% | |

| DEGREE OF CHALLENGE | 100% |

| 54% |

| 75% |

| 59% |

Stage D: Group Strategically

Based on the results on the assessment, when the channels are classified as Gold, Silver or Bronze, the channels of the same color can be grouped, if the characteristics are similar, and business plan can be made accordingly or the channels can be dealt individually. But dealing in groups makes it more cost effective.

Stage E: Apply to Business

Then the plan can be applied to business and regular monitoring has to be done so that the plan is in place.

4 Channel Value Assessment (CVA)- Central Outer Region

The central outer region consists of the towns at the outskirts of the Dhaka metropolitan city. It consists of the following towns:

- Baluka

- Joydevpur

- Manikganj

- Savar

- Mymensingh

- Netrokona

- Sherpur

- Jamalpur

- Tangail

- Karaniganj

- Nowabganj

- Sreenagar

- Adamjee

- Munshiganj

- Narayanganj

- Narshindi

- Sonargaon

During the CVA, the bases for sales figures were as:

Current: February 2006 – January 2007

Previous: February 2005 – January 2006

and the following towns were left out from calculation as the base of previous year was not proper as the towns did not have direct coverage and were serviced by some other town:

- Baluka

- Netrokona

- Nowabganj

- Sreenagar

- Manikganj

- Sonargaon

After the bases and the towns were fixed, the turnover figures of each brand and each SKU of UBL in each of the channels for each of the 12 months were gathered from the internal database, and then accumulated. This was done to find the profitability of each of the channels and to find the growth. Profitability is required as the relative

profitability of the channel to the overall profitability of UBL, is one of the quantitative attributes. Also, the contribution of each channel to the overall turnover and profitability is an attribute for assessment

Stage A: Identify channels/customers

The channels were identified and the turnover figures were put in. From the initial table, the short listed table is made. As UBL has only six retail channels identified, all the channels were short listed.

Your Customers / Channels | Turnover | % | Rank | ||

list : | Feb2005-Jan2006 | Feb2006-Jan2007 | Chg | Previous | Current |

| General Store | 35,367,191 | 43,071,875 | 21.8% | 3 | 3 |

| Neighborhood Grocer | 238,551,328 | 328,486,971 | 37.7% | 1 | 1 |

| Wet Market Grocer | 154,720,115 | 195,579,315 | 26.4% | 2 | 2 |

| Tong | 9,597,931 | 11,614,082 | 21.0% | 5 | 5 |

| Shoping Complex | 27,035,816 | 33,981,859 | 25.7% | 4 | 4 |

| Self Service Store | 95,627 | 166,588 | 5021.1% | 6 | 6 |

The percentage change and the rankings are automatically generated. Then in the second table the channels are short listed.

Your 7 to 25 Customers / Channels | Turnover | % | |

# | selected to be assessed : | Feb2006-Jan2007 | Chg |

1 | General Store | 43,071,875 | 21.8% |

2 | Neighborhood Grocer | 328,486,971 | 37.7% |

3 | Wet Market Grocer | 195,579,315 | 26.4% |

4 | Tong | 11,614,082 | 21.0% |

5 | Shoping Complex | 33,981,859 | 25.7% |

6 | Self Service Store | 166,588 | 5021.1% |

Stage B: Define attributes

The attributes were defined and then the weighting were assigned as given in the following table:

Required / Optional | Attributes: | Weight | Attributes Components: | ||

| HEALTHY OPPORTUNITY | |||||

Total : | 100% |

| |||

R | Size | 23% | Size of Overall Customer/Channel as measured by $/€ Sales | ||

18% | Size Overall | ||||

5% | Size Foods / HPC / Other | ||||

R | Growth | 21% | Historical Growth Rate of Customer/Channel (3 Yr CAGR) | ||

| 7% | Overall Customer/Channel % Sales Growth | |||

| 7% | Foods / HPC / Other Customer/Channel Growth | |||

| 7% | Unilever relative Turnover Growth at Account | |||

R | Sources of Future Growth | 20% | Ability of Customer/Channel to drive future growth | ||

7% | Future Growth from Market Share Increase | ||||

10% | Future Growth from Distribution Increase | ||||

3% | Financial Strength | ||||

0% | # of Store Openings | ||||

R | Relative Profitability | 20% | Profitability of Customer/Channel relative to others | ||

20% | Customer/Channel Relative Contribution | ||||

R | Alignment ???? | 5% | Alignment of Customer/Channel with Strategic Initiatives | ||

0% | Central Buying / Execution Power | ||||

0% | Compliance with Efficient Operations Programs | ||||

0% | Willingness to share data (forecast/consumer) | ||||

5% | Other Strategic Initiative Alignment | ||||

O | Marketing Sophistication | 11% | How Effectively Channel/Customers Markets to Consumers | ||

| 5% | Capability to grow Unilever categories | |||

| 0% | Use of Shopper Data / Consumer Strategies | |||

| 6% | Speed / Readiness to Introduce New Products | |||

O | Industry / Technology Leadership | 0% | Is this customer / channel a leader in the industry? | ||

| 0% | Supply Chain Leadership | |||

| 0% | Supply Chain Efficiency | |||

| 0% | Technology Leadership | |||

|

| ||||

| |||||

| DEGREE OF CHALLENGE |

| ||||

Total : | 100% | ||||

R | Dependency | 30% | Dependency on Customer/Channel | ||

| 15% | Unilever Foods / HPC Dependency on Customer (% of Sales) | |||

| 15% | Brand/Category Dependency on Customer | |||

R | Reliance on Trade Investment | 25% | Customer/Channel Performance against Trade Terms | ||

| 12% | Relative %age of Trade TTS | |||

| 13% | Relative %age of Consumer TTS | |||

| 0% | New Item Entry Cost | |||

R | Management Style | 15% | Customer Commitment to building business through consumer value creation | ||

| 5% | Negotiation Focus (vs Consumer Value Focus) | |||

| 10% | Level of Partnership with Unilever Food/HPC Competitors | |||

R | Commitment to Retail Private Label (RPL) | 0% | How dedicated is Channel/Customer to RPL? | ||

0% | Commitment to RPL in Food/HPC Categories | ||||

0% | Commitment to RPL in All Categories | ||||

O | Spread | 20% | # of outlets Customer/Channel Existence | ||

O | Relative cost to serve/outlet | 10% | Relative cost to serve/outlet | ||

O | Trade Terms | 0% | Capability to Exploit Trade Terms/Price Differences in Region | ||

O | New Market Entry | 0% | Potential to pose threat to local trade environment | ||

O | Organizational Stability | 0% | How stable is this Customer/Channel? | ||

| 0% | Anticipated Level of Future Change | |||

| 0% | Financial Independence |

Stage C: Run the assessment

After the attributes were defined and the weightings given, the assessment table was filled in. Firstly, the quantitative assessment table was filled in; the table below shows the quantitative assessment figures for “Size Overall” and “Size Foods/HPC/Other”:

| Size Overall | maxi weighting: | Size Foods / HPC / Other | maxi weighting: | ||

| 18% |

| 5% | |||

| Previous Year : …. | Current year : …. | Previous Year : | Current year : | |||

Customers / Channels | Total Turnover of Customer/Channel, including non-food categories | Total Turnover of Customer/Channel, including non-food categories | Total Turnover of Customer/Channel in our categories (Foods / HPC) | Total Turnover of Customer/Channel in our categories (Foods / HPC) | ||

| INDEX | INDEX | ||||

| General Store | 35,367,191 | 43,071,875 | 2.4% | 33,340,574 | 40,970,910 | 1.01% |

| Neighborhood Grocer | 238,551,328 | 328,486,971 | 18.0% | 145,857,510 | 203,790,189 | 5.00% |

| Wet Market Grocer | 154,720,115 | 195,579,315 | 10.7% | 82,599,218 | 108,479,917 | 2.66% |

| Tong | 9,597,931 | 11,614,082 | 0.6% | 9,187,911 | 11,320,335 | 0.28% |

| Shoping Complex | 27,035,816 | 33,981,859 | 1.9% | 26,685,630 | 33,564,411 | 0.82% |

| Self Service Store | 95,627 | 166,588 | 0.0% | 45,728 | 147,555 | 0.00% |

The indexes were calculated as a percentage of the highest value and then the index value was automatically generated. For example, for the channel Tong, the index for overall size was calculated by the following formula:

(Tong Turnover / Highest Turnover) X index weighting

In the case of size overall, Neighborhood Grocer has the highest turnover. So the calculation of the index is as follows:

(11,614,082 / 328,486,971) X 18%= 0.63%

The same formula was used for the index calculation of all the quantitative attributes.

In the “Size Foods/HPC/Other” section, the turnover of only HPC was included.

The rest of the quantitative attributes and the indices are show below:

| Overall Customer/Channel % Sales Growth | maxi weighting: | Foods / HPC / Other Customer/Channel Growth | maxi weighting: | Unilever relative Turnover Growth at Account | maxi weighting: |

|

| 7% | 7% | 7% | ||

Unilever total turnover growth at Account relative to Unilever total turnover growth in the countries where the Account is located | ||||||

Customers / Channels | Total Turnover growth of Customer / Channel of all categories | Total Turnover Growth of the Customer/Channel in our categories (Foods / HPC) | ||||

| INDEX | INDEX | INDEX | |||

| General Store | 21.8% | 2.1% | 22.9% | 4.0% | 94.2% | 6.2% |

| Neighborhood Grocer | 37.7% | 3.6% | 39.7% | 7.0% | 106.9% | 7.0% |

| Wet Market Grocer | 26.4% | 2.5% | 31.3% | 5.5% | 100.9% | 6.6% |

| Tong | 21.0% | 2.0% | 23.2% | 4.1% | 93.6% | 6.1% |

| Shoping Complex | 25.7% | 2.4% | 25.8% | 4.5% | 97.3% | 6.4% |

| Self Service Store | 74.2% | 7.0% | 0.0% | 0.0% | 101.3% | 6.6% |

The “Unilever relative Turnover Growth at Account” cell was filled by the formula:

Growth of Channel / Growth of UBL

The following table shows the attributes “Relative Profitability” and “Unilever Foods/HPC Dependency on Customer. The relative profitability was calculated by the following formula:

Profitability of Channel / Profitability of UBL

The dependency on customer was automatically generated.

| Relative Profitability | maxi weighting: | Unilever Foods / HPC Dependency on Customer (% of Sales) | maxi weighting: |

| 20% | 15% | ||

Customer’s/Channel’s contribution relative to the Unilever total Customer’s/Channel’s contribution in the countries where the Customer/Channel is located | ||||

Customers / Channels | Customer / Channel’s share in Unilever business (Foods or HPC) | |||

| INDEX | INDEX | ||

| General Store | 119.9% | 16.9% | 4.7% | 3.0% |

| Neighborhood Grocer | 100.1% | 14.1% | 23.2% | 15.0% |

| Wet Market Grocer | 97.1% | 13.7% | 12.6% | 8.1% |

| Tong | 102.8% | 14.5% | 1.3% | 0.8% |

| Shoping Complex | 142.1% | 20.0% | 3.7% | 2.4% |

| Self Service Store | 110.5% | 15.6% | 0.0% | 0.0% |

The tables below shows the qualitative attributes and what each channel got in the attribute:

1 | 2 | 3 | 4 | |||||||||||||||

Maxi weighting | General Store | Neighborhood Grocer | Wet Market Grocer | Tong | ||||||||||||||

| Dimensions & Attributes: | Value | Score | Value | Score | Value | Score | Value | Score | ||||||||||

| Healthy Opportunity | ||||||||||||||||||

| Size | 23% |

| 3% |

| 23% |

| 13% |

| 1% | |||||||||

| Size Overall | 18.0% | 2.4% | 18.0% | 10.7% | 0.6% | |||||||||||||

| Size Foods / HPC / Other | 5.0% | 1.0% | 5.0% | 2.7% | 0.3% | |||||||||||||

| Growth | 21% |

| 12% |

| 18% |

| 15% |

| 12% | |||||||||

| Overall Customer/Channel % Sales Growth | 7.0% | 2.1% | 3.6% | 2.5% | 2.0% | |||||||||||||

| Foods / HPC / Other Customer/Channel Growth | 7.0% | 4.0% | 7.0% | 5.5% | 4.1% | |||||||||||||

| Unilever relative Turnover Growth at Account | 7.0% | 6.2% | 7.0% | 6.6% | 6.1% | |||||||||||||

| Sources of Future Growth | 20% | 7% | 10% | 8% | 14% | |||||||||||||

| Future Growth from Market Share Increase | 7.0% | low | 1.8% | medium | 3.5% | medium | 3.5% | high | 5.3% | |||||||||

| Future Growth from Distribution Increase | 10.0% | low | 2.5% | medium | 5.0% | low | 2.5% | high | 7.5% | |||||||||

| Financial Strength | 3.0% | high | 2.3% | medium | 1.5% | high | 2.3% | low | 0.8% | |||||||||

| # of Store Openings | 0.0% | |||||||||||||||||

| Relative Profitability | 20% |

| 17% |

| 14% |

| 14% |

| 14% | |||||||||

| Customer/Channel Relative Contribution | 20.0% | 16.9% | 14.1% | 13.7% | 14.5% | |||||||||||||

| Alignment ???? | 5% | 5% | 5% | 0% | 0% | |||||||||||||

| Central Buying / Execution Power | 0.0% | very high | 0.0% | high | 0.0% | medium | 0.0% | medium | 0.0% | |||||||||

| Compliance with Efficient Operations Programs | 0.0% | high | 0.0% | medium | 0.0% | medium | 0.0% | medium | 0.0% | |||||||||

| Willingness to share data (forecast/consumer) | 0.0% | high | 0.0% | high | 0.0% | medium | 0.0% | medium | 0.0% | |||||||||

| Other Strategic Initiative Alignment | 5.0% | yes | 5.0% | yes | 5.0% | no | 0.0% | no | 0.0% | |||||||||

| Marketing Sophistication | 11% | 10% | 5% | 6% | 6% | |||||||||||||

| Capability to grow Unilever categories | 5.0% | yes | 5.0% | no | 0.0% | no | 0.0% | no | 0.0% | |||||||||

| Use of Shopper Data / Consumer Strategies | 0.0% | yes | 0.0% | yes | 0.0% | no | 0.0% | no | 0.0% | |||||||||

| Speed / Readiness to Introduce New Products | 6.0% | high | 4.5% | high | 4.5% | very high | 6.0% | very high | 6.0% | |||||||||

| Industry / Technology Leadership | 0% | 0% | 0% | 0% | 0% | |||||||||||||

| Supply Chain Leadership | 0.0% | yes | 0.0% | yes | 0.0% | no | 0.0% | no | 0.0% | |||||||||

| Supply Chain Efficiency | 0.0% | high | 0.0% | medium | 0.0% | very low | 0.0% | very low | 0.0% | |||||||||

| Technology Leadership | 0.0% | yes | 0.0% | yes | 0.0% | no | 0.0% | no | 0.0% | |||||||||

HEALTHY OPPORTUNITY | 100% |

| 53% |

| 74% |

| 56% |

| 47% | |||||||||

5 | 6 | |||||||||||||||||

Maxi weighting | Shoping Complex | Self Service Store | ||||||||||||||||

| Dimensions & Attributes: | Value | Score | Value | Score | ||||||||||||||

| Healthy Opportunity | ||||||||||||||||||

| Size | 23% |

| 3% |

| 0% | |||||||||||||

| Size Overall | 18.0% | 1.9% | 0.0% | |||||||||||||||

| Size Foods / HPC / Other | 5.0% | 0.8% | 0.0% | |||||||||||||||

| Growth | 21% |

| 11% |

| 7% | |||||||||||||

| Overall Customer/Channel % Sales Growth | 7.0% | 0.0% | 7.0% | |||||||||||||||

| Foods / HPC / Other Customer/Channel Growth | 7.0% | 4.5% | 0.0% | |||||||||||||||

| Unilever relative Turnover Growth at Account | 7.0% | 6.4% | 0.0% | |||||||||||||||

| Sources of Future Growth | 20% | 15% | 16% | |||||||||||||||

| Future Growth from Market Share Increase | 7.0% | very high | 7.0% | very high | 7.0% | |||||||||||||

| Future Growth from Distribution Increase | 10.0% | medium | 5.0% | high | 7.5% | |||||||||||||

| Financial Strength | 3.0% | very high | 3.0% | medium | 1.5% | |||||||||||||

| # of Store Openings | 0.0% | |||||||||||||||||

| Relative Profitability | 20% |

| 20% |

| 16% | |||||||||||||

| Customer/Channel Relative Contribution | 20.0% | 20.0% | 15.6% | |||||||||||||||

| Alignment ???? | 5% | 0% | 0% | |||||||||||||||

| Central Buying / Execution Power | 0.0% | medium | 0.0% | medium | 0.0% | |||||||||||||

| Compliance with Efficient Operations Programs | 0.0% | medium | 0.0% | medium | 0.0% | |||||||||||||

| Willingness to share data (forecast/consumer) | 0.0% | medium | 0.0% | medium | 0.0% | |||||||||||||

| Other Strategic Initiative Alignment | 5.0% | no | 0.0% | no | 0.0% | |||||||||||||

| Marketing Sophistication | 11% | 6% | 6% | |||||||||||||||

| Capability to grow Unilever categories | 5.0% | no | 0.0% | no | 0.0% | |||||||||||||

| Use of Shopper Data / Consumer Strategies | 0.0% | no | 0.0% | no | 0.0% | |||||||||||||

| Speed / Readiness to Introduce New Products | 6.0% | very high | 6.0% | very high | 6.0% | |||||||||||||

| Industry / Technology Leadership | 0% | 0% | 0% | |||||||||||||||

| Supply Chain Leadership | 0.0% | no | 0.0% | no | 0.0% | |||||||||||||

| Supply Chain Efficiency | 0.0% | very low | 0.0% | very low | 0.0% | |||||||||||||

| Technology Leadership | 0.0% | no | 0.0% | no | 0.0% | |||||||||||||

| HEALTHY OPPORTUNITY | 100% |

| 55% |

| 45% | |||||||||||||

|

1 | 2 | 3 | 4 | |||||||

Maxi weighting | General Store | Neighborhood Grocer | Wet Market Grocer | Tong | ||||||

| Dimensions & Attributes: | Value | Score | Value | Score | Value | Score | Value | Score | ||

| Degree of Challenge | ||||||||||

| Dependency | 30% |

| 11% |

| 26% |

| 23% |

| 16% | |

| Unilever Foods / HPC Dependency on Customer (% of Sales) | 15% | 3.0% | 15.0% | 8.1% | 0.8% | |||||

| Brand/Category Dependency on Customer | 15% | medium | 7.5% | high | 11.3% | very high | 15.0% | very high | 15.0% | |

| Reliance on Trade Investment | 25% |

| 16% |

| 16% |

| 16% |

| 13% | |

| Relative %age of Trade TTS | 12% | low | 9.0% | medium | 6.0% | medium | 6.0% | medium | 6.0% | |

| Relative %age of Consumer TTS | 13% | medium | 6.5% | low | 9.8% | low | 9.8% | medium | 6.5% | |

| New Item Entry Cost | 0% | very low | 0.0% | very low | 0.0% | very low | 0.0% | medium | 0.0% | |

| Management Style | 15% |

| 10% |

| 10% |

| 5% |

| 5% | |

| Negotiation Focus (vs Consumer Value Focus) | 5% | medium | 2.5% | medium | 2.5% | very low | 0.0% | very low | 0.0% | |

| Level of Partnership with Unilever Food/HPC Competitors | 10% | high | 7.5% | high | 7.5% | medium | 5.0% | medium | 5.0% | |

| Commitment to Retail Private Label (RPL) | 0% |

| 0% |

| 0% |

| 0% |

| 0% | |

| Commitment to RPL in Food/HPC Categories | 0% | high | 0.0% | medium | 0.0% | very low | 0.0% | very low | 0.0% | |

| Commitment to RPL in All Categories | 0% | high | 0.0% | medium | 0.0% | very low | 0.0% | very low | 0.0% | |

| Spread | 20% | medium | 10.0% | very high | 20.0% | high | 15.0% | medium | 10.0% | |

| Relative cost to serve/outlet | 10% | high | 7.5% | low | 2.5% | very low | 0.0% | very low | 0.0% | |

| Trade Terms | 0% | very high | 0.0% | medium | 0.0% | very low | 0.0% | very low | 0.0% | |

| New Market Entry | 0% | very high | 0.0% | high | 0.0% | very low | 0.0% | very low | 0.0% | |

| Organizational Stability | 0% |

| 0% |

| 0% |

| 0% |

| 0% | |

| Anticipated Level of Future Change | 0% | high | 0.0% | high | 0.0% | very low | 0.0% | very low | 0.0% | |

| Financial Independence | 0% | medium | 0.0% | medium | 0.0% | medium | 0.0% | very low | 0.0% | |

| DEGREE OF CHALLENGE | 100% |

| 54% |

| 75% |

| 59% |

| 43% | |

|

5 | 6 | ||||

Maxi weighting | Shoping Complex | Self Service Store | |||

| Dimensions & Attributes: | Value | Score | Value | Score | |

| Degree of Challenge | |||||

| Dependency | 30% |

| 17% |

| 15% |

| Unilever Foods / HPC Dependency on Customer (% of Sales) | 15% | 2.4% | 0.0% | ||

| Brand/Category Dependency on Customer | 15% | very high | 15.0% | very high | 15.0% |

| Reliance on Trade Investment | 25% |

| 9% |

| 9% |

| Relative %age of Trade TTS | 12% | low | 9.0% | low | 9.0% |

| Relative %age of Consumer TTS | 13% | very high | 0.0% | very high | 0.0% |

| New Item Entry Cost | 0% | very low | 0.0% | very low | 0.0% |

| Management Style | 15% |

| 3% |

| 3% |

| Negotiation Focus (vs Consumer Value Focus) | 5% | very low | 0.0% | very low | 0.0% |

| Level of Partnership with Unilever Food/HPC Competitors | 10% | low | 2.5% | low | 2.5% |

| Commitment to Retail Private Label (RPL) | 0% |

| 0% |

| 0% |

| Commitment to RPL in Food/HPC Categories | 0% | very low | 0.0% | very low | 0.0% |

| Commitment to RPL in All Categories | 0% | very low | 0.0% | very low | 0.0% |

| Spread | 20% | medium | 10.0% | low | 5.0% |

| Relative cost to serve/outlet | 10% | very low | 0.0% | very low | 0.0% |

| Trade Terms | 0% | very low | 0.0% | very low | 0.0% |

| New Market Entry | 0% | very low | 0.0% | very low | 0.0% |

| Organizational Stability | 0% |

| 0% |

| 0% |

| Anticipated Level of Future Change | 0% | very low | 0.0% | very low | 0.0% |

| Financial Independence | 0% | very low | 0.0% | very low | 0.0% |

| DEGREE OF CHALLENGE | 100% |

| 39% |

| 32% |

The result of the attributes of the channels is shown in the following table:

| Customer / Channel | Healthy Opportunity | Degree of Challenge | Size: NIP, Turnover (M) | |

average: | 53% | 50% | ||

| General Store | 51% | 54% | 43,071,875 | |

| Neighborhood Grocer | 71% | 75% | 328,486,971 | |

| Wet Market Grocer | 53% | 59% | 195,579,315 | |

| Tong | 45% | 43% | 11,614,082 | |

| Shoping Complex | 55% | 39% | 33,981,859 | |

| Self Service Store | 45% | 32% | 166,588 | |

Stage D: Group Strategically

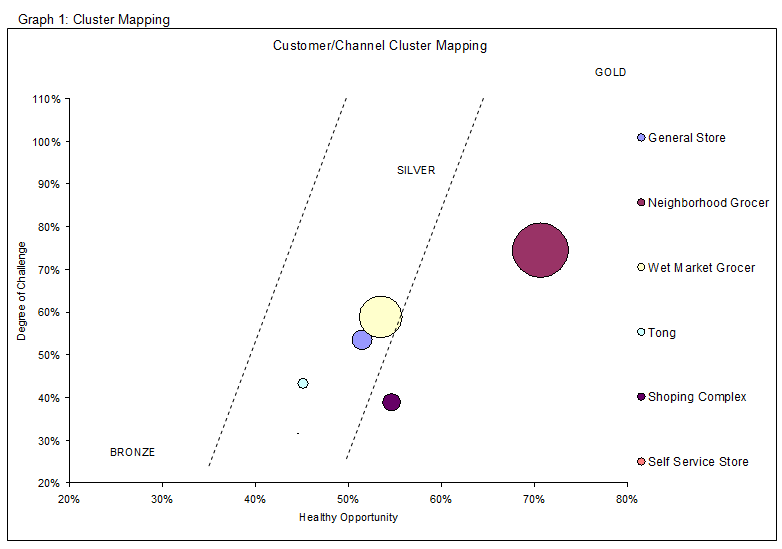

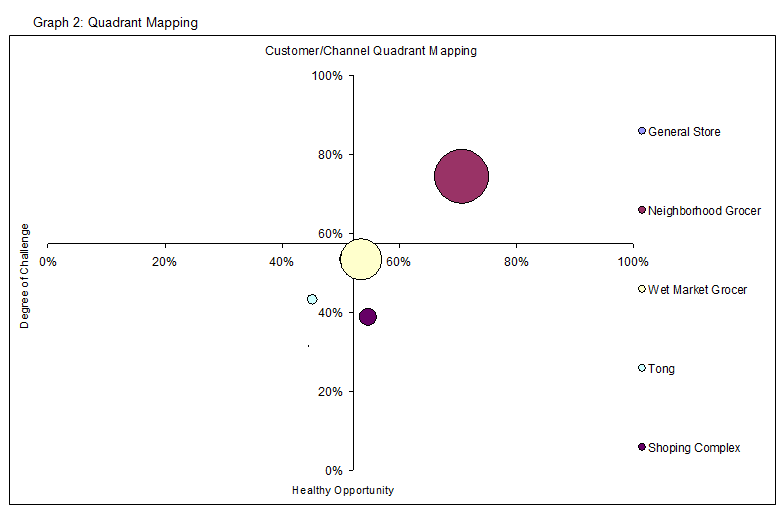

After the attributes are filled in, the overall “Healthy Opportunity” and “Degree of Challenge” is calculated, and the size is determined by the size of turnover. The outputs are two graphs with Healthy Opportunity on one axis and Degree of Challenge on the other. The outputs of CVA- Central Outer Region are given in the next two pages.

The color denotation after channel assessment is as follows:

Gold: Neighborhood Grocer, Shopping Complex

Silver: Wet Market Grocer, Tong, General Store, Self Service Store

The size of Self Service Store, based on its turnover, is very small and is only seen as a dot on the graphs.

Stage E: Apply to Business

After the channels have been classified as Gold, Silver and Bronze, the plan developed for the investment is as follows:

Gold Channels: increase trade investment by 20% on average over last year

Silver Channels: increase trade investment by 10% on average over last year, but for Tong the investment will be at par to last year as their Healthy opportunity till date is below 50%.

The trade investment is going to be in terms of consumer schemes, trade scheme such as: one free in a dozen for the retailer, and in terms of in shop activation.

Moreover, for the Gold channels, a category priority listing in terms of highest turnover has to be done and the dominant category has to be driven through various schemes to drive out or combat the activities of competitors.

For neighborhood grocer the fabric wash category is a dominant one. Both trade schemes and consumer schemes can be given on the category to improve the market better, to be more visible and get the top-of-mind in this channel only.

On the other hand, for shopping complex although opportunity is lower than neighborhood grocer, challenge is also lower. Therefore, any activity to gain channel market share will give the first movers advantage. Again, the hair and skin categories are very dominant in this channel. So, activities should be undertaken to improve the share of this channel through those categories.

Recommendation:

I feel, considering the growth of only one year might be misleading and I feel that the period of comparison should be expanded to at least 3 to 5 years. This will ensure sustainable growth. Also, the attribute of number of stores opening was not given any weighting. This attribute can be very helpful in determining the growth of the channel.

Conclusion:

The Channel Value Assessment is one of a kind initiative to optimize trade investment in terms of the value generated and the contribution of the channel to the overall turnover. By doing so, this will not only help the company, but also the retailer in terms of greater profitability and growth.