Origin Of The Report: As a partial requirement of BBA program I need to go for internship to gather practical experience and need to submit the report regarding that practical knowledge. This report is originated after completing the BBA program from Department of Marketing under State university of Bangladesh This report is the outcome of the assigned internship, suggested by the supervisor, Mr. Sabbir Ahmed Department of Marketing, State university of Bangladesh.. The report will definitely increase the knowledge of other students to know the banking industry of Bangladesh, and the various services DBL is providing to be the premier financial institution in the country. Objective Of The Report: The primary objective of the study is to meet the partial requirements for the fulfillment of the course ‘practical orientation in Banks’.

- The core objectives of the practical orientation program in banks are as follows –

- To fulfill the partial requirement of BBA Program.

- To familiar with the working environment in bank.

- To apply theoretical knowledge in the practical field.

- To observe and analyze the performance of the specific branch and the bank as a whole.

- To be acquainted with day to day functioning of service oriented banking business.

Scope Of The Report: The scope of the report was to find the financial aspect of the operation of the bank. An infrastructure of organization has been detailed, accompanied by company corporate perceptive and look into the future. The scope of this report is limited to the overall descriptions of the bank, its services, and its position in the industry, and its competitive advantage. The scope of the study is limited to organizational setup, functions, and performances. Methodology Of The Report: This report is prepared based on information collected from different sources. But despites this I have emphasized more on my practical observation. Almost the entire report consists of my practical observation. It has followed specific methodology to prepare this report worthy.

- Population: Population size in this report covers all the branches of Dhaka Bank Ltd located all over in our country.

- Sample: The Dhaka Bank Limited, Dhanmondi Branch.

Sources Of Data: Primary sources:

- Observation of banking activities.

- Conversation with employees, experts’ opinions of Dhaka Bank Limited, Dhanmondi Branch.

Secondary sources:

- Daily diary (containing my activities of practical orientation of Dhaka Bank Limited) maintained by me.

- Corporate Portal of Dhaka Bank Limited maintained by IT division

- Bangladesh Bank economic review

- Different websites

- Other published documents provided by Dhaka Bank Limited.

Limitations Of The Report: There are some lacks of information due to some limitations. It is very difficult to collect all the information within 2 months time. * Confidential information regarding past profit or product cost, financial information was not accurately obtained. Alike all other banking institutions, DBL is also very conservative and strict in providing those information. In those cases, I have relied upon some assumptions, which in result have created certain level of inaccuracy. Still, I had tried my best in obtaining that sensitive information, as much as possible. * Time constraint was another limitation restricting this report from being more detailed or analytical. The relationship mangers at the operation or strategic level of the concerned department are awfully busy with meeting their targets. So, it was very difficult for me to get them free and obtain some practical ideas regarding their expectation and opportunities regarding my topic. But they have given me practical ideas whenever they get free time. With all these limitations I tried my best to make this report authentic and worth reading.

Banking System In Bangladesh:

Historical Overview:

Bangladesh inherited its banking structure from the British regime and had 49 banks and other financial institutions before the Partition of India in 1947. The Dhaka Bank established in 1806 was the first commercial bank in the Bangladesh region of British India. Bengal Bank, the first British-Patronized modern bank established in India in 1784, had opened its two branches in 1873 in Sirajganj and Chittagong of Bangladesh region. Later in 1862, the Bengal Bank Purchased the Dhaka Bank and opened its first branch in Dhaka in the same year by reconstituting and merging the Dhaka Bank. Thereafter, another branch of Bengal Bank was opened in Chandpur in 1900. A number of other branches of Bengal Bank were opened in this region and some branches had been closed in Course of time. There were six other branches of Bengal Bank in operation in the territory of Bangladesh until the Partition of British-India in 1947 and these branches were at Chittagong (1906), Mymensing (1922), Rangpur (1923), Chandpur (1924), and Narayanganj (1926). Following the emergence of Pakistan in 1947, Stat Bank of Pakistan, the Central Bank of the country, came into being in July 1948. Later, the National bank of Pakistan, a strong commercial bank was set up in 1949. In all, 36 scheduled commercial banks were in operation in the whole Pakistan until 1971. Pakistanis owned most of these banks and only three of them namely, National Bank of Pakistan, Habib Bank Ltd. and the Australasia Bank Ltd, had one branch of each in East Pakistan in 1949. During 1950-58, there other Pakistani-owned banks, Premier Bank Ltd., Bank of Bhowalpur Ltd. and Muslim Commercial Bank, had opened their branch in East Pakistan. Four Pakistan-owned banks, the United Bank Ltd., Union Bank Ltd., Standard Bank Ltd. and the commerce Bank Ltd. Conducted banking business in the Province during 1959-1965.But all of them Had their headquarters in west Pakistan. East Pakistan had only two banks Owned by local business groups white headquarters in Dhaka. These were the Eastern Mercantile Bank Ltd. (Presently Pubali Bank Ltd.) And Eastern Banking Corporation Ltd. (Presently Uttara Bank Ltd.) established in 1959 and 1965 respectively. In the beginning of 1971, there were 1130 branches of 12 banks in operation in East Pakistan. The foundation of independent banking system in Bangladesh was laid through the establishment of the Bangladesh Bank in 1972 by the Presidential Order No. 127of 1972 (which took effect on 16th December, 1971). Through the Order, the eastern branch of the former State Bank of Pakistan at Dhaka was renamed as the Bangladesh Bank as a full-fledged office of the central bank of Bangladesh and the entire undertaking of the State Bank of Pakistan in, and in relation to Bangladesh has been delivered to the Bank. Bangladesh Bank has been entrusted whit all of the traditional central banking functions including the sole responsibilities of issuing currency, Keeping the reserves, formulating and managing the monetary and credit policy, regulating the banking system, stabilizing domestic and external monetary value, preserving the par value of Bangladesh Taka, fostering economic growth and development and the development of the country’s market. The Bangladesh Banks (Nationalization) Order enacted in 1972 nationalized all banks except foreign ones. Six nationalized banks were formed through merging the existing banks of the period. The rate of growth and development of banking sector in the country was extremely slow until 1983 when the government allowed to establish private banks and started denationalization process: initially, the Uttara Bank in the same year and thereafter, the Pubali Bank, and the Rupali Bank in 1986. Growth pattern of banks during the period 1973-1983. There were no domestic private commercial banks in Bangladesh until 1982; When the Arab-Bangladesh Bank Ltd. commenced private commercial banking in the country. Five more commercial banks came up in 1983 and initiated a moderate growth in banking financial institutions. Despite slow growth in number of individual banks, there had been a relatively higher growth of branches of nationalized commercial banks (NCBs) during 1973-83. There number had increased from 1512 in 1973-74 to4603 in 1982-83.

Current Structure Of Banking Institutions:

Following is the country’s banking system as on 30 December 2000. Nationalized Commercial Banks (4)

- Sonali Bank (1972),

- Janata Bank (1972),

- Agrani Bank (1972),

- Rupali Bank (1972).

DFIs/Specialized Bank (5):

- Bangladesh Krishi Bank (1973),

- Bangladesh ShilpaBank (1972),

- Bangladesh Shilpa Rin Sangstha (1972),

- Rajshahi Krishi UnnayanBank (1987),

- Bank of Small Industries & Commerce Bangladesh Ltd. (1988)

Domestic Private Commercial Banks (27):

- Pubali Bank (1972, Denationalized in1983),

- Uttara Bank (1972, Denationalized in 1983);

- Arab Bangladesh (1982),

- IFIC Bank (1976, Started full-fledged banking on 24 June 1983),

- Islami Bank Bangladesh (1983),

- National Bank (1983),

- The City Bank (1983),

- United Commercial Bank (1983),

- The Oriental Bank ( Formar Albaraka Bank ,1987)

- Eastern Bank (1992),

- National Credit And Commerce Bank (1993),

- Prime Bank (1995),

- South East Bank (1995),

- Dhaka Bank (1995),

- AL-Arafah Islami Bank (1995),

- Social Investment Bank (1995),

- Dutch Bangladesh Bank (1996),

- Mercantile Bank(1999),

- One Bank (1999),

- Exim Bank (1999),

- The Premier Bank (1995),

- Standard Bank (1999),

- Bangladesh Commerce Bank (1999),

- Mutual Trust Bank LTD(1999),

- The Trust Bank (1999),

- Bank Asia (1999), and

- First Security Bank (1999);

Foreign Private Bank (13):

- American Express Bank (1996),

- Credit Agricole Indosuez (1980),

- ANZ Grindlays Bank (1949),

- Standard Chartered Bank(1965),

- Habib Bank (1976),

- State Bank of India (1975),

- National Bank of Pakistan (1994),

- Muslim Commercial Bank (1994),

- City Bank N.A (1995),

- The Bank of Nova Scotia (1999),

- Hanvit Bank (1996),

- Al Faysal Islami Bank of Bahrain EC (1997),

- Hong Kong Shanghai Banking Corporation (1996), Bank Of Tokyo- Mitsubishi (Representative Office).

[Note: Years in the bracket indicate year of establishment] The list above is exhaustive for the scheduled banks. There are now ten non- scheduled banks in Bangladesh, and they are Jubilee Bank in Khulna, Naray- anganj Co-operative Bank, Eden Bank, Sayedppur Commercial Bank, The Comilla Co-operative Bank, Dinajpur Industrial Bank, Rajshahi Bank, Sanker Bank, Madaripur Commercial Bank, and Faridpur Banking Corporation. But data are not available on their Performance, as they do not require submitting returns to the country’s central bank. Contrary to the scheduled banks, the non-scheduled banks are not subject to the regulation of the Bangladesh Bank. Bangladesh Samabaya Bank Ltd. (BSBL), the apex institution of all central co- operative societies, co-operative land mortgage banks, central sugarcane growers associations, Thana co-operative societies, and other societies in the country. Any of the above societies can be a member of the samabaya Bank and on 30 June 1999 the bank had 511 members. Total deposits and advances of the BSBL on 30 June 2000 stood at Tk.2.20 cores respectively. The authorized and paid up capitals of the bank were Tk.10.00 cores and Tk.3.20 cores respectively. It accumulates loan able investible funds through borrowing from the Bangladesh Bank against the repayment guarantee of the government of Bangladesh.

CHAPTER-2

Overview Of The DBL

Background Of The Company: Bangladesh economy has been experiencing a rapid growth since the 90s. Industrial and agricultural development, international trade, inflow of expatriate Bangladeshi workers remittance, local and foreign investments in construction, communication, power, food processing and service enterprises ushered in an era of economic activities. Urbanization and lifestyle changes concurrent with the economic development created a demand for banking products and services to support the new initiatives as well as to make channel consumer investments in a profitable manner. A group of highly acclaimed businessmen of the country grouped together to respond to this need and established Dhaka Bank Limited in the year 1995. The Bank was incorporated as a public limited company under the Companies Act. 1994. The Bank started its commercial operation on July 05, 1995 with an authorized capital of taka. 1,000 million and paid up capital of Tk. 100 million. The paid up capital of the Bank stood at taka. 1289 million as on 31 December 2006. The Shareholders’ Equity (capital and reserves) of the Bank as on 31 December, 2006 stood at tk.2551 million, including the sponsor’s capital of Tk. 338 million. The bank has 37 branches including two Shariah-based branches and an offshore banking outlet across the country and a wide network of correspondents all over the world. The bank has plans to open more branches in the current fiscal year to expand the network. The bank offers the full range of banking and investment services for personal and corporate customers, backed by the latest technology and a team of highly motivated officers and staff. In its effort to provide Excellence in Banking services, the bank has launched fully automated phone banking service, joined a countrywide shared ATM network and has introduced a co-branded credit card. A process is also underway to provide e-business facility to the bank’s clientele through online and home banking solutions. The Commitments: DHAKA BANK values its customers. Each customer’s expectations of superior services and products are bank’s prime moves. Dhaka Bank has reached its 13 year in banking. On this joyous occasion, Dhaka Bank highlighted its core values. These are –

- Patience

- Focus

- Goal

- Experience

- Loyalty

- Care

- Sincerity

- Foresight

- Punctuality

- Trust

- Knowledge.

The Mission: To be the premier financial institution in the country providing high quality products and services backed by latest technology and a team of highly motivated personnel to deliver Excellence in Banking. The Vision: At Dhaka Bank we draw our inspiration from the distant stars. Our team is committed to assure a standard that makes every banking transaction a pleasurable experience. Our endeavor is to offer you razor sharp sparkle through accuracy, reliability, timely delivery, cutting edge technology, and tailored solution for business needs, global reach in trade and commerce and high yield on your investment. Our people, products and processes are aligned to meet the demand of our discerning customers. Our goal is to achieve a distinction like the luminaries in the sky. Our prime objective is to deliver a quality that demonstrates a true reflection of our vision- Excellence in Banking. The Values:

- Customer focus

- Integrity

- Teamwork

- Respect for the individual

- Quality

- Responsible citizenship.

Strategies:

- Establish DBL as one of the top five successful private commercial banks by 2009.

- Build a strong deposit base.

- Introduce new products & services and upgrade existing products & services at comparatively low cost in order to assure quick respond to the changing demands in the market.

- Strengthen corporate identity and values.

- Bring the entire system under a very advanced IT platform.

- Socialize and present the bank to the community as a corporate partner.

Goals:

- Increase revenue 20% each year.

- Achieve cost synergy by 20%

- Reduce cost of funds to 7%

- Reduce dependence on bank deposits to ensure continuous flow of core funds through base deposit.

- Change deposit mix time vs. transaction accounts to 60:40.

- Reduce non-performing loan to less than 1% of total assets.

Objectives: The prime objective of DBL is to deliver a quality that demonstrates a true reflection of their vision-Excellence in Banking. Improve the quality of lone and services, and diversify the sources of revenue.

- Focus on Current, Savings & Short Term Deposit Accounts to reverse the ratio (26:74) with Fixed Deposit Receipt.

- Take immediate action required to reverse the rise of cost of fund.

- Increase fee based income: increase volume & fee of Letter of Credit & guarantee, increase export and exchange earnings.

- Reduce operating cost by at least 20%.

Corporate Social Responsibility: In the era of Societal Marketing Concept, each organization has to pay attention to customers and society. Because customers are very well known about substitute and they do prefer to build relation with such organization which really thinks about CSR. Dhaka Bank is committed to their corporate responsibility toward the community. They allocate 2% of their tax profit for CSR practices each year. They have also taken numerous initiatives towards social welfare and community development. They also donated-

- Bangladesh Institute of Research and Rehabilitation in Diabetes, Endocrine & Metabolic Disorders (BIRDEM).

- Center for Women and Child Health (CWCH)

- Bangladesh Eye Foundation

- SEID Trust

- MotijheelGovt.BoysHigh School

- IdealSchool and College

- BADCHigh School

- Bangladesh under-19 Cricket team

- 20thBangladesh International Junior Tennis

- Dhaka Bank Independence Day Inter Club Tennis and Squash Tournament 2006

- Pacific Hospital Limited for treatment of poor patients

- Chhayanaut

- Anti-Drug Campaign in Chittagong

- ShahidZiaurRahmanShishuHospital

- Individual assistance for treatment.

Board Of Directors: Chairman: Mr. Altaf Hossain Sarker Vice Chairman: Mr. Mohammed Hanif Directors: Mr. Abdul Hai Sarker Mr. A.T.M. Hayatuzzaman Khan Mr. Matin Uddin Ahmed Barabhuiya Mr. Khondoker Monir Uddin Mr.Md. Amirullah Mr. Aminul Islam Mr. Abdullah Al Ahsan Mr. M.N.H. Bulu Mr. Jashim Uddin Mr. Shameem Hussain Managing Director: Mr. Khandoker Fazle Rashid Deputy Managing Director: Mr. Abu Musa (Risk Management) Deputy Managing Director: Mr. Tanweer Rahim (Business Banking) Deputy Managing Director: Mr. Kaiser Tamiz Amin (Operations) Company Secretary: Mr. Arham Masudul Huq Existing Branches: Dhaka Bank limited has 45 conventional branches and 2 Islamic Banking branches. The registered office (Head Office) of Dhaka Bank Limited is at Biman Bhaban, 100 Motijheel C/A, Dhaka-1000. The detailed list of Dhaka Bank Limited branches is as follows:

| ADDRESS | Adamjee Court (GF), 115-120 Motijheel C/A, Dhaka-1000 |

| BANGSHAL BRANCH | |

| ADDRESS | 88 Shaheed Syed Nazrul Islam Sharani, 1st-2nd Floor, Bangshal, Dhaka-1100 |

| BANANI BRANCH | |

| ADDRESS | 73/B Kemal Ataturk Avenue, Banani, Dhaka-1213 |

| IMAMGANJ BRANCH | |

| ADDRESS | 1, Imamganj Lane, Imamganj Bazar, Dhaka |

| ISLAMPUR BRANCH | |

| ADDRESS | 6-7 Islampur Road, Islampur , Dhaka-1100 |

| FOREIGN EXCHANGE BRANCH | |

| ADDRESS | Biman Bhaban (1st floor), 100 Motijheel C/A, Dhaka-1000 |

| UTTARA BRANCH | |

| ADDRESS | House # 01, Road # 13, Sector # 1, Uttara, Dhaka-1230 |

| DHANMONDI BRANCH | |

| ADDRESS | House # 500, Road # 7, Dhanmondi R/A, Dhaka |

| DHANMONDIBRANCH | |

| ADDRESS | Summit Centre (1st floor), 18 Karwan Bazar, Dhaka-1215, |

| AMIN BAZAR BRANCH | |

| ADDRESS | Market Complex (1st floor), Amin Bazar Jame Mosque, Amin Bazar, Savar, Dhaka |

| EPZ BRANCH | |

| ADDRESS | ZoneServiceBuilding, Room # 51, DEPZ Ganakbari, Savar, Dhaka |

| FANTASY KINGDOM BRANCH | |

| ADDRESS | ChowdhuryPlaza, Jamgara, Savar, Dhaka |

| ISLAMIC BANKING BRANCH, MOTIJHEEL | |

| ADDRESS | Sara Tower (1st floor), 11/A Toynbee Circular Rd., Motijheel, Dhaka 1000 |

| GULSHAN BRANCH | |

| ADDRESS | Plot # 7, Block # SE(D), Holding # 24, Gulshan Avenue, Gulshan-1, Dhaka-1212 |

| AGRABAD BRANCH | |

| ADDRESS | Chamber House, 38 Agra bad C/A, Chittagong |

| KHATUNGANJ BRANCH | |

| ADDRESS | 292-293 Khatunganj Road, Khatunganj, Chittagong |

| JUBILEE ROAD BRANCH | |

| ADDRESS | 183 Jubilee Road, Chittagong |

| ISLAMIC BANKING BRANCH, AGRABAD | |

| ADDRESS | Sadharan Bima Sadan (GF), 102 Agra bad Commercial Area, Chittagong |

| NARAYANGANJ BRANCH | |

| ADDRESS | 26-29 S. M. Maleh Road, Tanbazar, Narayanganj |

| MADHABDI BAZAR BRANCH | |

| ADDRESS | 8 Bank Road, Madhabdi Bazar,Narshingdi |

| BELKUCHI BRANCH | |

| ADDRESS | Jamuna Shopping Complex, Mukundaganti Bazar, Belkuchi, Sirajganj |

| LALDIGHIRPAR BRANCH | |

| ADDRESS | 960 Laldighirpar, PS. Kotwali, Sylhet |

| MOULVIBAZAR BRANCH | |

| ADDRESS | SR Plaza (1st floor), 1151/3,M. Saifur Rahman Road, (Pachim Bazar)Moulvibazar |

Organizational Structure Of Dhaka Bank Limited: Designations are in ascending order- Chairman Board of Directors Executive Committee Managing Director Additional Managing Director Deputy Managing Director: Senior Executive Vice President Executive Vice President Senior Vice President Vice President Senior Assistant Vice President First Assistant Vice President Assistant Vice President: Senior Principal Officer Principal Officer Senior Officer: Probationary Officer Junior Officer Assistant Officer Organizational Hierarchy:

| Managing Director |

| Deputy Managing Director |

| Senior Executive Vice President |

| Executive Vice President |

| Senior Vice President |

| Vice President |

| Senior Asst. Vice President |

| First Asst. Vice President |

| Asst. Vice President |

| Senior Principal Officer |

| Principal Officer |

| Senior Officer |

| Officer |

| Probationary Officer |

| Junior Officer |

| Asst. Officer/Asst. Cash Officer |

| Trainee Asst. Officer/Trainee Asst. Cash Officer |

| Telephone Operator |

| Trainee Telephone Operator |

Departments Of DBL:

Dhaka Bank maintains the jobs in a proper and organized considering their interrelationship that are allocated in a particular department to control the system effectively. Different departments of DBL are as follows:

- Human resources division

Dhaka Bank Limited recognizes that a productive and motivated work force is a prerequisite to leadership with its customers, its shareholders and in the market it serves. Dhaka bank treats every employee with dignity and respect in a supportive environment of trust and openness where people of different backgrounds can reach their full potential. The bank’s human resources policy emphasize on providing job satisfaction, growth opportunities, and due recognition of superior performance. A good working environment reflects and promotes a high level of loyalty and commitment from the employees. Realizing this Dhaka Bank limited has placed the utmost importance on continuous development of its human resources, identify the strength and weakness of the employee to assess the individual training needs, they are sent for training for self-development. To orient, enhance the banking knowledge of the employees Dhaka Bank Training Institute (DBTI) organizes both in-house and external training.

- § Personal banking division :

The personal banking department deals with the consumer credit schemes such as the personal loan, car loan, education loan, tax loan, personal secured loan that are tailored to meet the demand of individual customers. The manager of DBL credit who approves and administers all the activities heads this department. The approval officer mainly rejects or approves the credit requests. After being checked by the approval officer, the credit requests go to the processing officer for further processing of the application.

- § Treasury division:

Their main job is to take decisions regarding purchase and sell of foreign Currency. The purpose of treasury’s operations is to utilize the funds effectively and arrange funds at a lowest possible rate of interest, through maintaining effective relationship with other banks and following the Government rules and foreign exchange regulations

- § Computer & information technology division:

This department gives the software and hardware supports to different departments of the bank. As Dhaka Bank is engaged in online banking, the role of IT is very crucial for the bank. This department is the most active department of DBL where employees always stand by to solve any problems in the system. The managers and executives of IT division work continuously to develop the total IT system of DBL so that it can be operated with ease, accuracy, and speed. Since its journey as commercial Bank in 1995 Dhaka Bank Limited has been laying great emphasis on the use of improved technology. It has gone to online operation system since 2003. And the new banking software Flex Cube is under process of installation. As a result the bank will able to give the services of international standards. In 2009 Dhaka Bank become a member of the EI Dorado inter bank fund transfer network which allows real time electronic fund transfer between customers of member banks. To achieve better economics of scale & efficiency in transaction processing the IT Division played a key role in the centralization of Trade Finance & Credit operations in 2009.

- § Credit division:

The borrowing capacity provided to an individual by the banking system, in the form of credit or a loan. The total bank credit the individual has is the sum of the borrowing capacity each lender bank provides to the individual. Credit Policy Committee is composed of the managing director, the general manager, the Chief Risk Officer and the assistant general manager responsible for credits. Committee meets every other week, evaluates the banks overall lending portfolio and determines principles and policies regarding portfolio management. Dhaka Bank Ltd.was rated by Credit Agency of Bangladesh Ltd. on the basis of audited Financial Statements as on December 31, 2009.The summary is presented below:

| Status | 2009 | 2008 |

| Long Term | A1 | A+ |

| Short Term | ST-2 | ST-2 |

Credit Rating Agency of Bangladesh Ltd. has assigned A1 rating in the Long Term & ST-2 in the Short Term. In 2008 Credit Rating information & Services Ltd awarded A+ in the long term &ST-2 in the short term.

- § Operation division:

This is an integral and vital part of the bank. The services department ensures smooth operation and functioning within and between all the departments of DBL. It also provides continuous support to the core banking activities of DBL. The manager of services heads the department who formulates and manages various critical issues of the services function of DBL. He is followed by a group of executives who are the heads of various subsidiary divisions that operate within the services department. The services department is considered as the backbone of all other departments.

- § Finance & accounts division:

This is considered as the most powerful department of DBL. It keeps tracks of each and every transaction made within DBL Bangladesh. It is headed by manager of FCD who ensures that all the transactions are made according to rules and regulation of DBL group. Violation of such rules can bring serious consequences for the lawbreaker. The functions of FCD are briefly discussed below along with an organ gram of the department. § Audit & risk management division The Risk Management Division is responsible for measuring risks that the Bank might face in the course of its operations, developing corporate risk management policies and ensuring that risks remain within the limits in which the Bank prefers to bear such risks in line with its own strategic targets and risk appetite. The primary goal of risk management is to provide capital to businesses in line with their risks (economic capital), maximize risk-adjusted return and increase the added value. The risk management function consists of Market Risk, Credit Risk and Operational Risk Management Units. Bank Risk Committee, Asset-Liability Committee (ALCO), Credit Policy Committee, and Operational Risk Management Committee are the other risk management bodies. The committees are MANCOM ALCO. As per Bangladesh Bank instruction “BASEL Implementation Team” has been formed which will be responsible for proper implementation of BASEL capital adequacy guidelines in the Bank. The guidelines have been issued by Bangladesh Bank recently but the target date for implementation is 31st December 2009.

Chapter -Three

Products & Services Of DBL

Different banking products and services are being offered exclusively to the Non Government Organizations and international projects in Bangladesh and its staff, both local and expatriate, based in Bangladesh. With the assistance of the Marketing Team, who have prior experience of serving diplomatic missions with other multinational banks, the Bank has tailored-made a list of products to address the NGO / International Organization’s unique banking requirements in Bangladesh. Dhaka Bank Limited is committed to developing and delivering to the corporate relationships total banking solutions while ensuring a level of service that exceeds customer expectations.

Retail Banking: In 2001 DBL. introduced its personal banking program responding to the market demand for a complete range of modern banking products & services. On 14th July 2002, DBL launched a new product-Excel Account which is first of its kind in Bangladesh. Designed exclusively for the salaried executives, Excel Account offers a packaged solution to companies and organizations in processing their employees’ salaries and funding employees’ loans. In 2009, Dhaka Bank further consolidated its position as a leading bank in the country consumer banking arena.

Deposit Double:

Deposit Double is a time specified deposit scheme for individual clients where the deposited money will be doubled in 6 years. The key differentiators of the product will be:

- Amount of deposit – The minimum deposit will be BDT 50,000.00 (either singly or jointly). The client will have the option of depositing any amount in multiples of BDT 10,000 subject to a maximum of taka 20, 00,000 in a single name and taka 35, 00,000 in joint name.

- Tenure of the scheme – The tenure of the scheme will be 6 years.

- Premature encashment – If any client chooses to withdraw the deposit before the tenure, then she/he will only be entitled to prevailing interest rate on savings account in addition to the initial deposit. However, withdrawal of the deposited amount before one year will not earn any interest to the depositor(s).

- OD facility against deposit – Clients will have the option of taking advance up to 90% of the initial deposited amount. The lending rate will be tied up with the interest rate offered on the deposit.

| Product features | |

| Deposited amount | Min taka 50,000 (singly or jointly) with multiples of taka 10,000 Max taka 20,00,000 (in single name) taka 35,00,000 (in joint name) |

| Initial deposit date | Any day of the month |

| Tenure | 6 years |

- Govt. charges – The matured value is subject to taxes and other Govt. levies during the tenure of the deposit.

Deposit Pension Scheme: Dhaka Bank is well poised to be the leading Personal Banking business amongst the local private banks. Bank’s conscious efforts in brand building, introducing and supporting new packaged products, developing PB organization along with non-traditional delivery channels have resulted in good brand awareness amongst its chosen target markets. Installment based savings schemes are a major category of saving instruments amongst mid to upper middle-income urban population. DPS is an installment based savings scheme (Deposit Pension Scheme) of Dhaka Bank for individual clients. The key differentiators of the product will be

- Amount of monthly deposit – The scheme offers the clients the flexibility of tailoring the amount of monthly deposit based on his monthly cash flow position. The minimum monthly deposit will be BDT 500.00 The client will have the option of depositing any amount in multiples of BDT 500.00 subject to a maximum of taka 20,000.

- Flexible tenor of the scheme– The client has flexibility of deciding on the tenor of the scheme in-terms of number of months. However, the minimum tenor would be 48 months and the maximum would be 144 months.

- Flexibility to open any number of DPS account– A client can open maximum five DPS accounts in client’s name, in his/her spouse’s name or in the name of his/her children or in joint names with any of his/her family members.

- Bonus point – if the client continues the scheme up-to maturity then at maturity, the client will be awarded a bonus 1% on the total deposit amount. However, to qualify for the bonus point, client may default in paying maximum 2 installments within the tenure of the DPS.

- Premature encashment – if any client closes the deposit account before one year, s/he will not be entitled to any interest. Account running more than a year will be eligible for the prevailing interest offered in the savings account.

- Late payment fee – Clients failing to deposit any installment will pay 5% late payment fee on the deposit installment amount as late payment fee, which will be realized at the time of depositing the next deposit Installment.

- Payment through account – Clients will have to open an account with Dhaka Bank Limited and a standing instruction will be executed for auto-debit to effect the monthly installment.

- OD facility against DPS – Clients will have the option of taking advance up to 90% of the deposited amount at the time of application. However, to be eligible for the OD facility, the account must be at least 2 years old or the minimum ticket size of the advance will be taka 20,000.00.

Restrictions & client eligibility:

- Any Bangladeshi citizen attaining 18 years of age will be eligible to avail this product by opening an account in any of the branches of DBL. Branch will ensure compliance with account opening formalities.

- A minor operated by the legal guardian may also open the account.

- The tenor and the deposit amount agreed by the applicant and accepted by the Bank at the time of opening the account cannot be changed afterwards.

Closure of account: The account will immediately cease to operate in case of the following:

- Death of the account holder and Failure to pay 5 consecutive installment

Settlement of the account: Documentation – In order to open the account, the account holder will execute the following documentation:

- Fulfilling account opening formalities

- Filling up the DPS application form

- 2 copy pass port size photograph of the applicant

- 1 copy passport size photograph of the nominee attested by the applicant

- Product name Special Deposit Scheme:

- Product features

| Deposit amount | In multiples of taka 50,000 However the minimum deposit will be taka 1, 00,000 (singly or jointly) and the maximum taka 50, 00,000 (singly/Jointly). |

| Initial deposit date | Any day of the month |

| Interest due | One month after the initial deposit date the interest will be credited to the savings/current account. |

| Tenure | 3 Years |

| Monthly income on taka 100,000 | taka 791.66 subject to tax on customer account |

- Opening an account Clients must have or open a savings account through which initial deposit will be collected. The monthly interest accrued on the deposit will be disbursed to the client through this savings/current account.

- Deposit mode The depositor(s) will have the option of making the initial deposit to the new / existing savings account in cash or through an account payee cheque.

- Interest payout mode Interest payout mode should be transfer to savings account.

- Interest payout frequency Interest payout frequency should be monthly.

- Renewal / redemption instruction Maturity / renewal instruction should only be “Renew principal and redeem interest” or redeem interest & principal

- Closure of account The account will immediately cease to operate in case of death of the depositor

- Settlement of account The account will be settled in line with the instructions laid down in the account opening forms in case of death of the accountholder.

- Premature encashment If any client chooses to withdraw the deposit before the tenure, then s/he will only be entitled to prevailing interest rate on savings account in addition to the initial deposit. However, withdrawal of the deposited amount before one year will not earn any interest to the depositor(s). Amount already paid to the clients monthly along with the tax should be adjusted accordingly.

- Settlement of pre-mature encashment

| Premature encashment before maturity, but after one year | The client will be entitled to prevailing interest rate on the savings account | The interest already credited to the clients account on a monthly basis to be adjusted against principal deposit at the time of premature encashment |

| Premature encashment before maturity and before one year | The client will be entitled no interest | The interest already credited to the clients account on a monthly basis to be adjusted against principal deposit at the time of premature encashment |

- OD facility against deposit Clients will have the option of taking advance up to 90% of the deposited amount at the time of application. The prevailing lending rate will be affected against the advance.

- Documentation In order to open the account, the account holder will execute the following documentation:

- Fulfilling account opening formalities

- Filling up the SDS application form

- 1 copy passport size photograph of the applicant

- 1 copy passport size photograph of the nominee attested by the applicant

- Restrictions &client eligibility

- Any Bangladeshi citizen attaining 18 years of age will be eligible to avail this product by opening an account in any of the branches of DBL. Branch will ensure compliance with account opening formalities.

- A minor operated by the legal guardian may also open the account.

- The deposited amount and the tenure agreed by the applicant and accepted by the bank at the time of opening the account cannot be changed afterwards.

Excel Account: Excel Account has been tailored in the manner of having both asset and liability characteristics blended into a single product for salaried individuals employed in any institution. On virtue of this product, prospective clients receive a credit interest based on the credit balance available in the account. The clients will also be required to pay the bank OD interest if the balance of the account becomes overdraft. What is the maximum tenure for availing this facility? The tenure of the account will be for 3 years maximum, having renewal facility for every year until the client resigns from the institution. Is there an OD facility against the Excel account? OD facility is a pre-embedded feature of the Excel Account. An OD limit is given to the account up to the amount of the salary of the individual employed at the institution. What is the offered Interest rate? For a credit balance this facility provides an interest rate of 4.5% p.a. based on the daily balance of the account. If in the case, the account is utilized for an OD limit, the debit balance will be subject to a debit interest rate of 16% p.a. What other features are available with the Excel account? At current, the Excel account is featured with ATM Facilities. Very soon, Dhaka Bank Ltd. will be offering debit card facility with Excel Account. Pre-requisites for availing the Excel account:

- The institution to which the individual is employed must have salary account maintained with the bank.

- The institution must have a corporate guarantee maintained with the bank.

Govt. charges: The account is subject to taxes and other Govt. levies during the tenure of the deposit. Salary Account: Dhaka Bank has launched a special package of savings account for employees belonging to institutions with which Dhaka Bank has a corporate agreement. With this package salaried employees of these institutions enjoy interest on a daily balance. The key features of the salary account are:

- Interest to be calculated on a daily balance basis

- No periodic service charge

- ATM card facility

- Credit card facility

- On-line banking facility

- Internet & SMS banking facility

Income Unlimited:

The management of Dhaka Bank Limited is pleased to launch Special Deposit Scheme, a new liability product on May 04, 2005.

- § Product Name– Income unlimited

- Products features

| Deposit amount | In multiples of taka 50,000 however the minimum deposit will be taka 1, 00,000 (singly or jointly) and the maximum taka 50, 00,000 (singly/jointly). |

| Initial deposit date | Any day of the month |

| Interest due | One month after the initial deposit date the interest will be credited to the savings/current account. |

| Tenure | 3 years |

| Monthly income on taka 100,000 | taka 1,000 subject to 10% Income Tax |

| Rate of interest | 12% (simple) |

- § Opening an account – Clients must have or open a savings account through which initial deposit will be collected. The monthly interest accrued on the deposit will be disbursed to the client through this savings/current account.

- § Deposit mode – The depositor(s) will have the option of making the initial deposit to the new / existing savings account in cash or through an account payee cheque.

- § Interest payout mode – Interest payout mode should be transfer to savings account.

- § Interest payout frequency – Interest payout frequency should be monthly.

- § Renewal / redemption instruction – Maturity / renewal instruction should only be “Renew principal and redeem interest” or redeem interest & principal

- § Closure of account – The account will immediately cease to operate in case of death of the depositor

- § Settlement of account – The account will be settled in line with the instructions laid down in the account opening forms in case of death of the accountholder.

- § Premature encashment – If any client chooses to withdraw the deposit before the tenure, then s/he will only be entitled to prevailing interest rate on savings account in addition to the initial deposit. However, withdrawal of the deposited amount before one year will not earn any interest to the depositor(s). Amount already paid to the clients monthly along with the tax should be adjusted accordingly.

- § Settlement of pre-mature encashment

| Premature encashment before maturity, but after one year | The client will be entitled to prevailing interest rate on the savings account | The interest already credited to the clients account on a monthly basis to be adjusted against principal deposit at the time of premature encashment |

| Premature encashment before maturity and before one year | The client will be entitled no interest | The interest already credited to the clients account on a monthly basis to be adjusted against principal deposit at the time of premature encashment |

- § OD facility against deposit – Clients will have the option of taking advance up to 90% of the deposited amount at the time of application. The prevailing lending rate will be affected against the advance.

- § Documentation – In order to open the account, the account holder will execute the following documentation:

ü Fulfilling account opening formalities ü Filling up the SDS application form ü 1 copy passport size photograph of the applicant ü 1 copy passport size photograph of the nominee attested by the applicant Restrictions & client eligibility: Any Bangladeshi citizen attaining 18 years of age will be eligible to avail this product by opening an account in any of the branches of DBL. Branch will ensure compliance with account opening formalities. ü A minor operated by the legal guardian may also open the account. ü The deposited amount and the tenure agreed by the applicant and accepted by the bank at the time of opening the account cannot be changed afterwards. Smart Plant: What is Smart Plant? Smart Plant offers you to multiply your initial cash to 10 times in 6 years. You are required to deposit at least taka 10,000 or multiple of it to avail the opportunity. In single name you can deposit maximum taka 50, 00,000. Dhaka Bank shall contribute 4 times of your deposited amount to build up a fund for issuance of Smart Plant. What is the maturity period of Smart Plant? Maturity period of the Smart Plant is 6 years. What would be the matured value? The total Smart Plant amount (your deposit + bank contribution) will double in 6 years. For example; if you deposit taka 10,000, bank shall contribute taka 40,000, altogether the Smart Plant amount will be taka 50,000. On maturity (after 6 years) the Smart Plant amount will be taka 1,00,000¹. How can I repay bank contribution? You will repay the bank contribution amount in 72 equal installments. After repayment of all installments the matured value will be credited in your savings account1. Is there any late payment fee on equal monthly installment? If you fail to pay the installment within the due date, a late payment fee of 2% per month of the installment amount will be charged. Is there any age limit for availing this opportunity? If you are a Bangladeshi with an age more than 18 years and not exceeding 54 years, you can avail Smart Plant. Can I discontinue Smart Plant? Yes, you can discontinue the Smart Plant subject to the following.

- Before the 1st year, no interest

- After 1st year, prevailing savings rate.

- Closing fee is 1% of your deposited amount or subject to minimum Taka 500.

Do I require opening a Savings Account? Yes you are required to open a Savings account or Smart account to maintain the Smart Plant. Can I take loan against my Smart Plant contribution? You will have the option of taking advance up to 90% of your contributed amount. The lending rate will be tied up with the interest rate offered on the deposit. What will happen if I die before Smart Plant maturity? Your nominee shall get matured value of Smart Plant if you demise prematurely before completing Smart Plant period. However, death from self-inflicted injury, suicide during the first year of insurance coverage, AIDS and HIV related disease, abuse of alcohol or drugs, war, or riot, or civil commotion, illegal act/criminal activity, death due to any reason within the first 3 months of coverage except for accidental death, natural disaster viz. earth quake, tsunami etc. Gift Cheque: Dhaka Bank has recently refurbished its gift Cheque. The features of the gift cheque are as follows:

- Can be encashed at any branch even if the encashing branch is not the issuing branch of the instrument.

- Interest will be applicable only if the instrument is encashed after three months from the date of issue in the following manner:

- No Interest if encashed before three months from the date of issue.

- 6% if encashed after three months and before twelve months from the date of issue.

- 7.25% if encashed after twelve months from the date of issue.

- The gift cheque may be encashed using either of the two modes, (a) cash or (b) fund transfer. Encashment of gift cheque is not allowed over clearing.

- No service charge is applicable

- Dhaka Bank Limited issues gift cheques in three denominations of tk.100, tk.500 and tk.1000

Personal Loan: As part of establishing a Retail Banking franchise of Dhaka Bank Limited, the bank has successfully launched Personal Loan. The product is a term financing facility to individuals to aid them in their purchases of consumer durables or services. The facility becomes affordable to the clients as the repayment is done through fixed installment s commonly known as EMI (equated monthly installment) across the facility period. Depending on the size and purpose of the loan, the number of installments varies from 12 to 48 months. Target market:

- Salaried employees of institutions in the Dhaka, Chittagong and Sylhet markets.

- Professionals who are self employed and have at-least 3 years of independent practice in the area of profession.

- Businessmen who are permanent residents of Dhaka, Chittagong and Sylhet metropolis with at least 3 years of continued operation in the line of business.

Restrictions & client eligibility:

- Loans are restricted to Bangladeshi nationals falling in the categories mentioned below The minimum age for any borrower will be 21 years and the maximum age 57 years with a minimum verified Gross Family Monthly Income of BDT 10,000.

| Salaried employees |

| ||||||

| Professionals |

| ||||||

| Businessmen |

|

| Loan amount limits under the program | Type of Loan | Minimum loan amount | Maximum loan amount |

| Personal | BDT 25,000 | BDT 500,000 |

| Particular | Processing Fee | Interest Rate | Loan Amount |

| For businessman | 2% | Up to 2 Lac: 20% Above 2 Lac: 20.5% | Max 5 Lac |

| For salaried (general) & professional | 1.5% | Up to 2 Lac: 18.5% Above 2 Lac: 18% | Max 5 Lac |

| Amount | EMI in months | |||

| 12 | 24 | 36 | 48 | |

| 25,000 | 2,292 | 1,249 | – | – |

| 50,000 | 4,584 | 2,497 | – | – |

| 75,000 | 6,876 | 3,745 | – | – |

| 100,000 | 9,168 | 4,993 | 3,616 | – |

| 150,000 | 13,752 | 7,489 | 5,423 | – |

| 200,000 | 18,336 | 9,985 | 7,231 | – |

| 300,000 | 27,504 | 14,978 | 10,846 | – |

| 400,000 | 36,672 | 19,970 | 14,461 | 11,750 |

| 500,000 | 45,840 | 24,963 | 18,077 | 14,688 |

Car Loan: As part of establishing a personal banking franchise of Dhaka Bank Limited, the bank has successfully launched Car Loan. The product is a term financing facility to individuals to aid them in their pursuit of has a car of their dream. The facility becomes affordable to the clients as the repayment is done through fixed installment s commonly known as EMI (equal monthly installment) across the facility period. Depending on the size and purpose of the loan, the number of installments varies from 12 to 60 months. In case of brand new cars the loan tenure will be maximum 72 months. Target market:

- Salaried employees of institutions in the Dhaka, Chittagong and Sylhet markets.

- Professionals who are self employed and have at-least 3 years of independent practice in the area of profession.

- Businessmen who are permanent residents of Dhaka, Chittagong and Sylhet metropolis with at least 3 years of continued operation in the line of business.

Restrictions & client eligibility:

- Loans are restricted to Bangladeshi nationals falling in the categories mentioned below The minimum age for any borrower will be 25 years and the maximum age 52 years with a minimum verified Gross Family Monthly Income of BDT 45,000.

| Loan amount limits under the program | Type of Loan | Minimum loan amount | Maximum loan amount |

| Car | Not specified | taka 20,00,000 |

Vacation Loan:

Like the Car Loan, Vacation Loan of Dhaka Bank Limited is a term financing facility to individuals to aid them in their pursuit of spending a vacation in the country or abroad. The facility becomes affordable to the clients as the repayment is done through fixed installment s commonly known as EMI (equal monthly installment) across the facility period. Depending on the size and purpose of the loan, the number of installments varies from 12 to 48 months. Targeted market : The target market for personal loan mainly comprises of the following categories –

- Salaried employees of institutions in the Dhaka, Chittagong, Sylhet markets and where Dhaka Bank operates.

- Professionals who are self employed and have at-least 3 years of independent practice in the area of profession.

- Businessmen who are permanent residents of cities where Dhaka Bank operates with at least 3 years of continued operation in the line of business.

Restrictions & client eligibility : Loans are restricted to Bangladeshi nationals falling in the categories mentioned below The minimum age for any borrower will be 21 years and the maximum age 57 years with a minimum verified Gross Family Monthly Income of BDT 10,000.

| Salaried employees |

| ||||||

| Professionals |

| ||||||

| Businessmen |

|

| Loan amount limits under the program | Type of Loan | Minimum loan amount | Maximum loan amount |

| Vacation | BDT 25,000 | BDT 5,00,000 |

| Particular | Processing Fee | Interest Rate | Loan Amount |

| For businessman | 2% | Up to 2 Lac: 20% Above 2 Lac: 20.5% | Max 5 Lac |

| For salaried (general) & professional | 1.5% | Up to 2 Lac: 18.5% Above 2 Lac: 18% | Max 5 Lac |

| Amount | EMI in months | |||

| 12 | 24 | 36 | 48 | |

| 25,000 | 2,292 | 1,249 | – | – |

| 50,000 | 4,584 | 2,497 | – | – |

| 75,000 | 6,876 | 3,745 | – | – |

| 1,00,000 | 9,168 | 4,993 | 3,616 | – |

| 1,50,000 | 13,752 | 7,489 | 5,423 | – |

| 2,00,000 | 18,336 | 9,985 | 7,231 | – |

| 3,00,000 | 27,504 | 14,978 | 10,846 | – |

| 4,00,000 | 36,672 | 19,970 | 14,461 | 11,750 |

| 5,00,000 | 45,840 | 24,963 | 18,077 | 14,688 |

Home Loan:

The product is a term financing facility to individuals to aid them in their purchases of apartment or house or construction of house. The facility will become affordable to the clients as the repayment is done through fixed installment as commonly known as EMI

(equal monthly installment) across the facility period. Depending on the size of the loan, the maximum period of the loan would be 180 months (15 years).

Target market: The target market for Home Loan will be mainly focused in Dhaka and Chittagong. However, strong recommendation from branches operating in other areas will also be facilitated with the major concentration on the following category –

- Salaried employees of institutions with minimum 3 years continuous service

- Self-employed professionals who are self employed and have at-least 5 years of independent practice in the area of profession. (Example: Doctors, Dentists, Engineers, Chartered Accountants, Architects who are members of their professional institutes.)

- Businessmen who are permanent residents of Dhaka, Narayangonj, Chittagong and Sylhet with at least 5 years of continued operation in the line of business.

Restrictions & client eligibility:

- Loans are restricted to Bangladeshi nationals falling in the categories mentioned below: The minimum age for any borrower will be 21 years with a maximum age 50 years (at the time of application). The minimum verified Gross Family Monthly Income of the applicant should be BDT40; 000.The family income will include only the income of the applicant and spouse.

- The maximum permitted Equal Monthly Installment (EMI) paid by the borrower should be no more than the 33% of the Family Monthly Disposable Income (FMDI) of the borrower per month.

- In calculating FMDI, we propose to use the following industry standard formula: Proven income of obligor PLUS proven income of spouse (if the spouse is working) LESS current monthly loan obligations (if any), other monthly fixed obligations (rent, children’s education, monthly food expenses, etc).

| Loan amount limits under the program | Minimum loan amount | Maximum loan amount |

| BDT 500,000 | BDT 3,500,000 |

- The maximum loan tenor for different amount of loan is proposed to be as following:

| Loan Amount | 5 lac to less tan 10 lac | 10 Lac to 35 lac |

| Max Tenure | 5 yrs | 10-15yrs (negotiable)* |

- * The tenor will be decided at the discretion of the management.

Any Purpose Loan: Any Purpose Loan is a term financing facility to individuals to meet their immediate requirements. The facility becomes affordable to the clients as the repayment is done through fixed installments commonly known as EMI (Equal Monthly Installment) across the facility period. Depending on the size and purpose of the loan, the number of installments varies from 12 to 48 months. This facility is available for Salaried Employees, Self Employed / Professionals or Businessmen. Loans are restricted to Bangladeshi nationals within 21 years to 57 years age limit with a minimum verified Gross Family Monthly Income of BDT 10,000. The amount of loan may vary from BDT 25,000 to 5, 00,000 depending on the applicant’s requirement and repayment capability.

| Particular | Processing Fee | Interest Rate | Loan Amount |

| For businessman | 2% | Up to 2 Lac: 20% Above 2 Lac: 20.5% | Max 5 Lac |

| For salaried (general) & professional | 1.5% | Up to 2 Lac: 18.5% Above 2 Lac: 18% | Max 5 Lac |

Click here to find your nearest branch.

Other Retail Banking Products:

- Current, Savings & FD accounts

- 24 hours banking ATM card: In order to add value to product & services DBL. has reduced the annual fee of the card from taka. 1500 to taka. 500 per year. Clients can now settle BTTB & Grameen phone bills using ATM card.

- DBL Credit card: The cash advance limit has been increased to 50% from 25%. The unique feature of this service is to deliver the Credit Card within only 7 days against security; and for unsecured card it only takes 10 days. DBL. also offer spouse Card absolutely free of cost.

- Any branch banking and phone banking (absolutely free of cost).

- Foreign currency accounts (NFCD & RFCD).

Corporate Banking: Corporate Banking business was performed fairly well despite a sluggish credit demand in the market. This year priority has been given to expand business in low risk sectors. Besides we have designed a comprehensive risk management system to monitor and control our asset quality. Letter of Credit, Guarantee, Import & Export Finance, Syndicate Loan, Project Financing, Leasing, Working Capital Financing etc. all are Corporate Banking Products.

Securitization Of Assets:

A powerful and effective means of generating funds for a certain category of institutions, securitization of assets is still in its infancy in the need however for such a service is great and there is a lot of support from multilateral financial institutions, such as the World Bank and the Asian Development Bank, for such activities to be developed further in this country. Dhaka Bank intends to take up this challenge and play a significant role in ensuring that securitization of assets becomes a normal part of the range of financial instruments available for organizations who can count on a steady, but piecemeal, flow of revenue and want to translate this stream into cash resources with which to carry out further lending activities to new customers. Some practical issues still need to be settled such as those concerning pricing, or the legal framework, but it is expected that, as Dhaka Bank and other institutions pursue more such securitization activities these will be resolved.

Finance & Advisory Services:

Given the needs of its large and varied base of corporate clients Dhaka Bank will be positioning itself to provide investment banking advisory services. These could cover a whole spectrum of activities such as guidance on means of raising finance from the local stock markets, mergers and acquisitions, valuations, reconstructions of distressed companies and other expert knowledge based advice. By this means Dhaka Bank hopes to play the role of strategic counselor to blue-chip Bangladesh companies and then move from the level of advice to possible implementation of solutions to complex financing problems that may arise from time to time.

Syndication Of Fund:

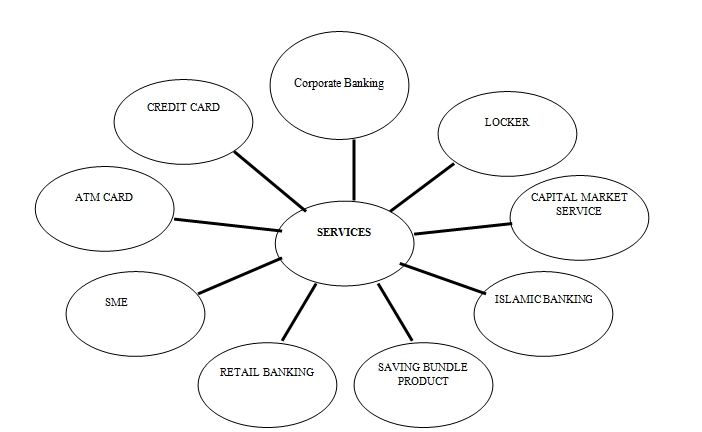

There has been a surge in the number of syndication deals closed in the last few years. 2004 was an exceptionally good year for syndicated deals for the local commercial banks also for the foreign banks. The total number of syndications in 2004 exceeded 10 totaling over tk. 10 billion. This rise in the number of syndications can be primarily attributed to the prudential lending guidelines of the Bangladesh Bank. A commercial bank may provide funded facilities up to a maximum of 15% of its equity. Due to this reason, projects with sizeable costs need to approach more than one bank for their debt requirements and therefore the demand for syndications exist. Credit risk diversification has led many international companies to introduce credit derivatives that are actively being traded. Securitization of assets is one such credit risk derivative that allows Financial institutions to diversify their portfolios. In 2009 due to slow investment in the state of global economic meltdown in the whole world. Therefore, investors adopted a go-slow strategy to initiate new ventures, which subsequently deters the credit growth in project financing. At Dhaka Bank Ltd.the syndication & structured finance unit was setup in October 2004.The unit has successfully closed 14 syndicated deals till the year 2009.This year DBL has arranged 2 syndication deals for a total amount of BDT 1,535.00 million. Deposit of the economic slowdown in the year 2009, the activities of the team ended on high note as we have been able to close 2 syndicated deals as the Lead Bank & 7 deals as participant with other banks. Small & Medium Enterprises: Dhaka Bank has come forward to extend its services towards Micro and Small & Medium Enterprises. Since inception, the Dhaka Bank has held socio-economic development in high esteem and was among the first to recognize the potentials of SMEs. Dhaka Bank pursues & tried to perfect through out 2008 has been significally applied in 2009 in lending various fund & non fund based loans & advances to a wide array of customers through existing as well as a no. of new SME Branch & Service Centers. The Bank was quite optimistic about surpassing the portfolio of 2008.The appetite of investors for borrowed funds seems to be growing again & Banks network too is expected to be expanded through opening of another 6 to 7 SME Branch &Service centers across the country by the end of 2009.Signing of a new refinancing deal on “Solar Energy”, Solar panel assembling plant & ETP with Bangladesh Bank is another major reason behind this optimism. Dhaka bank’s involvement : Recognizing the SME segment’s value additions and employment generation capabilities quite early, the Bank has pioneered SME financing in Bangladesh in 2003, focusing on stimulating the manufacturing sector and actively promoting trading and service businesses. The SME unit has used the year 2006 diligently in building its capabilities and has furthered its portfolio to address the needs of small enterprise with a portfolio growth of 2000% compared to year-end 2005. Story of a successful branch in SME financing : The bank started branch operations at Belk chi Sirajgonj in April 2003. Prior to the bank’s intervention, the weaving community did not have the financial strength to stock their products till “Eid ul Fitr” when the annual sale takes place. Traders were taking advantage to the situation by buying up entire productions at low prices and liquidating stocks just before “Eid”. With financial services from Dhaka Bank Limited, the weavers have converted to power looms, significantly increased profitability and reduced the involvement of middlemen. They are now working on institutionalizing the learning and applying them in other areas across Bangladesh, particularly in textiles, light engineering and other manufacturing clusters. Already we have identified several clusters and are working on improving access to finance within these clusters. Services Of DBL:  Personal Banking: Amongst Private Sector bank’s, Dhaka Bank has already made its mark in the personal banking segment. The promotions like “Baishakhi Offer”, a strategic tie up with Electra International Limited, distributor of Samsung brand products, and “Freeze the Summer Campaign” a strategic tie-up with Esquire Electronics Limited, distributor of Sharp/General Brand electrical appliances saw Dhaka Bank to experience more than a reasonable growth on the personal banking business in 2008. Corporate Banking: Providing a tailored solution is the essence of our Corporate Banking services. Dhaka Bank recognizes that corporate customers’ needs vary from one to another and a customized solution is critical for the success of their business. Dhaka Bank offers a full range of tailored advisory, financing and operational services to its corporate client groups combining trade, treasury, investment and transactional banking activities in one package. Whether it is project finance, term loan, import or export deal, a working capital requirement or a forward cover for a foreign currency transaction, our Corporate Banking Managers will offer you the right solution. You will find top-class skills and in-depth knowledge of market trends in our corporate Banking specialists, speedy approvals and efficient processing fully satisfying your requirements – altogether a rewarding experience. Their experience in handling Corporate Banking business covers a wide span of businesses and industries. You can leverage on our expertise in the following sectors particularly: Telecom, media and technology Textile, ready made garments Edible oil, consumer and diversified industries Shipping, ship breaking, steel and engineering Energy, chemicals and pharmaceuticals Cement and construction Financial institutions Floating of public issues: The bank assists companies to underwrite public issues. Dhaka Bank has successfully participated in a number of issues. Loan syndication: DBL participates in a number of loan syndication arrangements involving foreign investment has been highly acclaimed. The projects we have handled as the lead arranger or co-arranger with other banks and financial institutions include production and export oriented ventures in power generation, cement production, food processing and a large undertaking in leisure and amusement. Islamic Banking: Dhaka Bank Limited offers Shariah based Islamic Banking Services to its clients. The bank opened its First Islamic Banking Branch on July 02, 2003 at Motijheel Commercial Area, Dhaka. The second Islamic Banking branch of the bank commenced its operation at Agra bad Commercial Area, Chittagong on May 22, 2004.Dhaka Bank Limited is a provider of on line banking services and any of its clients may avail Islamic Banking services through any of the branches of the bank across the country. Dhaka Bank Islamic Banking Branches offer fully Shariah based, Interest free, Profit-Loss Sharing Banking Services. Dhaka Bank Shariah Council is closely monitoring its activities. Besides, Dhaka Bank is an active member of Islamic Banking Consultative Forum, Dhaka and Central Shariah Board of Bangladesh. Capital Market Services: Capital Market operation besides investment in treasury bills, prize bonds and other Government securities constitute the investment basket of Dhaka Bank Limited. Interest rate cut on bank deposits and government savings instruments has contributed to significant surge on the stock markets in the second half of 2004, which creates opportunities for the Bank in terms of capital market operations. The Bank is a member of Dhaka Stock Exchange Limited and Chittagong Stock Exchange Limited. Capital Market Division conducted a total trade of tk.2, 045 million against tk.1, 164 million in 2005. Gross Operating profit from Capital Market Services Division is tk.39.80 million against tk.5 million in 2005. ATM Card Services: Features:

Personal Banking: Amongst Private Sector bank’s, Dhaka Bank has already made its mark in the personal banking segment. The promotions like “Baishakhi Offer”, a strategic tie up with Electra International Limited, distributor of Samsung brand products, and “Freeze the Summer Campaign” a strategic tie-up with Esquire Electronics Limited, distributor of Sharp/General Brand electrical appliances saw Dhaka Bank to experience more than a reasonable growth on the personal banking business in 2008. Corporate Banking: Providing a tailored solution is the essence of our Corporate Banking services. Dhaka Bank recognizes that corporate customers’ needs vary from one to another and a customized solution is critical for the success of their business. Dhaka Bank offers a full range of tailored advisory, financing and operational services to its corporate client groups combining trade, treasury, investment and transactional banking activities in one package. Whether it is project finance, term loan, import or export deal, a working capital requirement or a forward cover for a foreign currency transaction, our Corporate Banking Managers will offer you the right solution. You will find top-class skills and in-depth knowledge of market trends in our corporate Banking specialists, speedy approvals and efficient processing fully satisfying your requirements – altogether a rewarding experience. Their experience in handling Corporate Banking business covers a wide span of businesses and industries. You can leverage on our expertise in the following sectors particularly: Telecom, media and technology Textile, ready made garments Edible oil, consumer and diversified industries Shipping, ship breaking, steel and engineering Energy, chemicals and pharmaceuticals Cement and construction Financial institutions Floating of public issues: The bank assists companies to underwrite public issues. Dhaka Bank has successfully participated in a number of issues. Loan syndication: DBL participates in a number of loan syndication arrangements involving foreign investment has been highly acclaimed. The projects we have handled as the lead arranger or co-arranger with other banks and financial institutions include production and export oriented ventures in power generation, cement production, food processing and a large undertaking in leisure and amusement. Islamic Banking: Dhaka Bank Limited offers Shariah based Islamic Banking Services to its clients. The bank opened its First Islamic Banking Branch on July 02, 2003 at Motijheel Commercial Area, Dhaka. The second Islamic Banking branch of the bank commenced its operation at Agra bad Commercial Area, Chittagong on May 22, 2004.Dhaka Bank Limited is a provider of on line banking services and any of its clients may avail Islamic Banking services through any of the branches of the bank across the country. Dhaka Bank Islamic Banking Branches offer fully Shariah based, Interest free, Profit-Loss Sharing Banking Services. Dhaka Bank Shariah Council is closely monitoring its activities. Besides, Dhaka Bank is an active member of Islamic Banking Consultative Forum, Dhaka and Central Shariah Board of Bangladesh. Capital Market Services: Capital Market operation besides investment in treasury bills, prize bonds and other Government securities constitute the investment basket of Dhaka Bank Limited. Interest rate cut on bank deposits and government savings instruments has contributed to significant surge on the stock markets in the second half of 2004, which creates opportunities for the Bank in terms of capital market operations. The Bank is a member of Dhaka Stock Exchange Limited and Chittagong Stock Exchange Limited. Capital Market Division conducted a total trade of tk.2, 045 million against tk.1, 164 million in 2005. Gross Operating profit from Capital Market Services Division is tk.39.80 million against tk.5 million in 2005. ATM Card Services: Features:

- Cash withdrawals – up to tk.1 lac per day

- Utility payments – T&T, Mobile phones, DESA, etc.

- Multi-account access

- Fund transfers

- Mini statements

- PIN change

Credit Card Services: Get it in just 7 days, or free! Dhaka Bank Limited brings you your everyday credit card in the shortest possible time. We recognize that you need your card every day. That is why we have developed processes to guarantee delivery of your card in just 7 days when you apply for a fully secured card; for an unsecured card it will be ready in just 10 days. Otherwise we will give you the card free – the subscription fee completely waived! What you can do with your Dhaka Bank credit card: Everything you would expect from a credit card. You can use it at all the merchant locations that display the Vanik Card sticker. That’s not all. You can also use it at all the locations that display the card sticker. And that’s a whopping 1,700 merchants and more than 50 products and services. What’s more, we are always increasing our merchant locations. An updated list is available from our card centre. Free spouse card: Your spouse needs a card too for everyday use. That is why we offer a card to your spouse absolutely free. Your spouse can enjoy the same facilities as you do. So, you won’t have to worry about whether either of you are carrying enough cash. Convenience: Unlike other cards, all branches of Dhaka Bank Ltd. can accept your bill payments and handle your card service requests. You may open an account as well with any of these branches to conduct all your banking and card service requirements under one roof. Flexible repayment options: Dhaka Bank credit card offers you credit facility absolutely free up to a maximum of 45 days. You get 15 days time from the date of statement to repay your dues. You can pay in full within 15 days (and save money; no interest accrued, no payout) or in part. The minimum amount required to pay is 1/12th of the total amount or taka. 200 (whichever is higher). The revolving credit line of your card allows you to select payment terms to suit your other financial commitments. Quick replacement: If card has been lost or stolen, a replacement will be sent to the client within a couple of days. But remember to report the loss as soon as you have detected it. Once reported, there will be no liability on fraudulent. Locker Services: A client could use the locker facility of Dhaka Bank Limited and thus have the option of covering your valuables against any unfortunate incident. DBL offer security to our locker service as afforded to the Bank’s own property at a very competitive price. DBL would be at your service from Saturday through Thursday from 9:00 am to 4:00 pm. Lockers are available at Gulshan, Banani, Dhanmondi, Uttara, CDA Avenue & Cox’s Bazar Branch. Online Banking Services: Dhaka Bank Limited introduces Net Banking and intends to maintain the lead with enhanced facilities through this media. Client can get access to real time account information through the Internet. Transfer money from his/her account, utility bill payment and more. Through on–line banking services, clients can deposit to and withdraw from his/her account held with a particular branch up to a limit of taka: 10,000.00 through any branch of Dhaka Bank Limited Internet Banking Services: Through Internet banking the client can access the account to view and print the balance account statement for last 20 (twenty) transactions. Small & Medium Enterprise (SME): Dhaka Bank has come forward to extend its services towards Micro and Small & Medium Enterprises. Since inception, the Dhaka Bank has held socio-economic development in high esteem and was among the first to recognize the potentials of SMEs. Dhaka Bank’s involvement: Recognizing the SME segment’s value additions and employment generation capabilities quite early, the Bank has pioneered SME financing in Bangladesh in 2003, focusing on stimulating the manufacturing sector and actively promoting trading and service businesses. The SME unit has used the year 2006 diligently in building its capabilities and has furthered its portfolio to address the needs of small enterprise with a portfolio growth of 2000% compared to year end 2005. Story of a successful branch in SME financing: The bank started branch operations at Belk chi Sirajgonj in April 2003. Prior to the bank’s intervention, the weaving community did not have the financial strength to stock their products till “Eid-ul-Fitr” when the annual sale takes place. Traders were taking advantage to the situation by buying up entire productions at low prices and liquidating stocks just before “Eid”. With financial services from Dhaka Bank Limited, the weavers have converted to power looms, significantly increased profitability and reduced the involvement of middlemen.

| 3.2.11 Retail BankingAmongst private sector banks, Dhaka Bank has already made its mark in the retail banking segment. The promotions like “Baishakhi Offer”, a strategic tie up with Electra International Limited, distributor of Samsung brand products, and “Freeze the Summer Campaign” a strategic tie-up with Esquire Electronics Limited, distributor of Sharp/General Brand electrical appliances saw Dhaka Bank to experience more than a reasonable growth on the Retail Banking business in 2004. In the year 2007, Dhaka Bank Ltd. has signed MOU with 8 (eight) renowned car dealers namely: Haq’s Bay, Car House Ltd., The Sylhet Car, Car Port, Legend Car, Nippon Auto Trading, M/s. Kabir Enterprise and Capital Motors. The MOU empowers car buyers to avail DBL Car Loan at a reduced rate of 15%. This MOU will be valid for two years. Dhaka Bank will continue the MOU signing campaign with other renowned car dealers in and around Dhaka and Chittagong. Dhaka Bank also launched the operations of VISA Card and has replaced all its VANIK Card holders with VISA Cards. Dhaka Bank has also offered a special promotion for Eid regarding interest charging on each purchase of items while using the DBL VISA Card. No interest will be applicable for any purchase made during the two Eid months. |

They are now working on institutionalizing the learning and applying them in other areas across Bangladesh, particularly in textiles, light engineering and other manufacturing clusters. Already we have identified several clusters and are working on improving. Savings Bundle Product: Choose the right key: Dhaka Bank Saving Bundle Product is the first of its kind in Bangladesh. A unique blend of all flexibilities of a current account and provision high interest on daily balance and monthly interest paid savings account in three schemes, namely-

- Dhaka Bank Silver Account

- Dhaka Bank Gold Account

- Dhaka Bank Platinum Account