INTRODUCTION

In today’s world, practical knowledge is essential to understand the real world and to apply knowledge for the betterment of the society as well as business. Education from the theoretical knowledge is obtained from courses, which is only the half way of the subject matter. Practical knowledge has no alternative. The perfect coordination between theoretical and practical is of paramount importance in the context of the modern business world in order to resolve the dichotomy between these two areas. Therefore, an opportunity is offered by Dept. of Finance, Daffodil International University, for its potential business graduates to get three months practical experience, which is known as “Internship Program”. I have completed this internship program in “Trust Bank Limited”. Internship program brings a student closer to the real life situation and thereby helps to launch a career with some prior experience.

This paper is entitled to ‘An Analysis of Deposit Product of Trust Bank Ltd – A Study on Mirpur Branch’ originated from the fulfillment of the internship program. For the internship program, each student is attached with an organization. My internship was at Trust Bank Ltd., Mirpur Branch. During my internship, I had to prepare a report under the advisor of Md. Shahjahan Mina, Professor, Department of Finance, Daffodil International University.

1.2 Objectives of the Study

The main objective of this internship report is to evaluate the deposit product of “Trust Bank Limited’, to identify how the bank is providing facilities to its client through its deposit products & to suggest remedial measure for the development of the deposit product of “Trust Bank Limited’’. More specifically, the objectives are:-

To identify different deposit products of Trust Bank Limited.

To describe deposit products of Trust Bank Limited.

To identify limitations, if any, of existing deposit products of Trust Bank Ltd.

To recommend some suggestions to overcome the problems identified in deposit products of TBL.

1.3 Methodology

The research is of exploratory type. To conduct the research both primary and secondary data have been used.

Primary Data Source: The sources of primary data are: employees of TBL, Mirpur Branch and customers of TBL, Mippur Branch. Data have been collected from employees through discussion and informal conversation. No formal questionnaire has been used.

Secondary Data Source: Secondary data source are annual report (2007), company profile, report from Head office, various document from deposit department, website of TBL.

Target Population: The target population for this study consists of two groups. They are:

I. All employees of TBL, Mirpur branch.

II. All customer of TBL, Mirpur branch

Sampling Technique: Respondents have been selected based on nonprobability sampling technique. Five employees have been selected for data collection based on judgmental sampling technique. Customers have been selected based on convenience sampling technique. Data have been selected through discussion and informal conversation. Descriptive method has been used to analyze data

Reliability of the data: The data collected are highly reliable in the sense that all data presented in the report are used by the TBL. The auditor report in the financial statement and the correspondent with different desks generate information which helped to compose the report successfully.

1.4 Scope of the Study

The study is confined to deposit products of Trust bank limited, Mirpur Branch. The study basically focused on the area of deposit products of this bank.

In the organizational part the focus has nearly been given on the background History and formation of the TBL, its structure, strategies and the expansion speed.

The learning part emphasizes the theoretical explanation of deposit products of the bank and its related important dimension like various facilities of those deposit products, several features of those deposit products, terms and conditions, interest rates, duration of various deposits products, charges, documents and others requirements for opening those deposits and closing of deposit account.

1.5 Limitations of the Study

The Present study was not out of limitations. In preparing the Report, I have experienced some acute problems that have, to some extent, affected the presentation of the report. The acute problems were-

a) Secrecy: Every organization has its own secrecy that is not revealed to others. While collecting data the branch management did not disclose much information for the sake of organizational confidentiality.

b) Time constraint: It is something like impossible to cover the entire aspect of all deposit products and their performance phenomena exploiting a three month time period while an employee or an officer is awarded with one or two year probationary period to do his or her particular job.

c) Inadequate Access to Information: The main constraint of the study is inadequate access to information, which has hampered the scope of analysis required for the study.

d) Personal Knowledge: Limitation of the personal knowledge is another one. Since knowledge knows know bound, so this report is incapable to present all things with more depth.

e) Comparison status: I had very little opportunity to compare the deposit product of TBL and their performance with that of other contemporary and common size banks. It was mainly because of the shortage of time and internship nature.

In spite of all the drawbacks faced, everything has been managed well. I believe the report is a quality report on deposit products of Trust Bank limited (TBL).

Part – 02

ORGANIZATIONAL PART

2.1 An Overview of the Trust Bank Ltd

Trust Bank Ltd. (TBL) is one of the leading private commercial bank which established under the Bank Companies Act, 1991 and incorporated as a Public Limited Company under the Companies Act, 1994 in Bangladesh on 17 June, 1999 with the primary objective to carry on all kinds of banking businesses in and outside Bangladesh. .They has a spread network of 40 branches across Bangladesh and plans to open more branches to cover important areas of the country to provide banking service. In the year 2007 the authorized capital of the bank was Tk.200.00 crore and paid-up capital was Tk. 116.67 crore only .The bank gained success very early because of its very strong financial backup of the Army Welfare Trust.

TBL is the scheduled commercial bank, which conducts its operation as per the rules and regulations of Bangladesh Bank. The bank obtained license from Bangladesh bank on 15 July, 1999 and started its operation from November, 1999. The Army Welfare Trust (AWT) is the main sponsor of the Bank, and it has already floated public shares in the capital market for its conversion into a public limited company. The Board is headed by the chief of army staff, Bangladesh Army as Chairman. Besides, there are eight other in-service senior army officers of Army Head Quarters acting as the members of the Board. The Managing Director is also the member of the Board.

At present the bank has 40 branches across the country and has plans to open more branches very soon. TBL aims at optimizing profit with a view to allowing good returns on the investor’s money. Within nine years of its operations the Bank has strengthened its capital base by increasing reserve and retained earnings. With a wide range of modern corporate and consumer product Trust Bank Limited has been operating in Bangladesh since 1999 and has achieved public confidence as a sound and stable bank.

In 2001, the bank introduced automated branch banking system to increase efficiency and better customer service. In the year 2005 the bank moved one steps and introduced ATM services for its clients. Since the bank business volume increased over the years and the demand of the customer enlarged in manifold, different products have been introduced to meet the demand of the customers and the growth of the bank.

In 2007, Trust Bank successfully launched Online Banking Service which facilitates Any Branch Banking, ATM Banking, Phone Banking, SMS Banking and Internet Banking to all customers. Customers can deposit or withdraw money from any branch of Trust Bank nationwide without need to open multiple accounts in multiple branches.

Via online Services and Visa Electron (Debit Card), ATMs now allow customer to retrieve 24×7 hours account information such as account balance check through statement of account and cash withdrawals.

Trust Bank introduced Visa Credit Card to serve its existing and potential valued customers. Credit card now can be used at shops & restaurants all around Bangladesh.

Trust Bank is a customer oriented financial institution. It remains dedicated to meet up with an ever-growing expectation of customers because at Trust Bank customers always at the center.

In addition to ensure quality customer service related to general banking, the bank also deals in Foreign Exchange transactions. The bank also extended credit facilities to almost all sectors of the country‘s economy. The bank has also plan to invest extensively in the country’s industrial and agriculture sectors in the coming days. Such participation would continue in the further for greater interest of over all economy. For clients financial and banking needs the bank is keen to constantly improving its services and launching new and innovating products towards fulfillment of growing demands of its customers.

2.2 Philosophy of TBL

At present the bank has as many as 40 branches across the country and it is committed to become equal service providers compatible with the norms of commercial schedule bank. It renders all types of personal, commercial and corporate banking services to its customers within the preview of the Bank Companies Act, 1999 and in line with the directives and policy guidelines laid down by Bangladesh bank. The main philosophy of the Trust Bank is – “Serves with Trust.”

2.3 Objectives of the Bank

The Trust Bank Limited has been established with the objective of providing efficient and innovative banking services to the people of all sections of our society. One of the notable strengths of this bank is that it is backed by the disciplined and strongest Institution of Bangladesh i.e. Bangladesh Army and there is a synergy of welfare and profits in the dynamics of this institution. Trust Bank is service-oriented industry and they are committed to ensure customized qualitative and hassle free services along with the focus to broaden the clientele base. The bank has extensively in the country’s industrial and agricultural sectors in the coming days. The bank is committed to contribute as such as possible within its limitations for the economic growth and for ensuring value of its available resources.

2.4 Vision statement of ‘‘Trust Bank Limited’’

Trust Bank aims to provide financial services to meet customer expectations so that customers feel that they are always there when they need Banking service, and can refer them to their friends with confidence. They want to be a preferred bank of choice with a distinctive identity.

So we may able to highlight them as follows-

To become a preferred bank of choice with a distinctive identity.

To provide financial services to meet customer expectations so that customers feel TBL is always there when they need, and can refer to their friends with confidence

To build a sustainable and respectable financial institution.

To be a leading Commercial Bank, with a social focus, assisting in the economic development of the country.

The profit of the bank used for the Socio-economic development of the members of the Bangladesh Army and thereby the nation as a whole.

2.5 Mission statement of ‘‘Trust Bank Limited”

The mission of the Trust Bank is to make banking easy for their customers by implementing one-stop service concept and provide innovative and attractive products & services through their technology and qualified human resources. They always look out to benefit the local community through supporting entrepreneurship, social responsibility and economic development of the country.

The mission of the Trust Bank is as follows-

To make banking easy for customers by implementing one-stop service concept and provide innovative and attractive products & services through technology and qualified human resources.

To look out to the local community through supporting entrepreneurship, social responsibility and economic development of the country.

Achieving sound and profitable growth in Assets & Liabilities, with focus to maintain non-performing assets at acceptable levels

To build long-lasting, credible and mutually dependable relationships with customers.

Efficiently managing interest and operating costs

To excel in rendering superior customer service

To be the preferred employer among Banks in Bangladesh

2.6 Trust Bank’s Value

Trustworthy.

Dependable.

Professional.

Dynamic

Reliable.

Fair.

2.7 SWOT Analysis

SWOT Analysis is an important tool for evaluating the companies Strengths, Weaknesses, Opportunities and Threats. It helps the organization to identify how to evaluate its performance and can scan the macro environment, which in turn would help the organization to navigate in the Turbulence Ocean of competition. Following is given the SWOT analysis of The Trust Bank:

Every organization is composed of some internal strengths and weaknesses and also has some external opportunities and threats in its whole life cycle. The following will briefly introduce Trust Bank’s internal strengths and weaknesses, and external opportunities and threats.

Strengths:

Sponsored by Bangladesh Army, the largest and most organized group in Bangladesh.

Well-capitalized Bank with potential to increase capital base.

Homogenous Board of Directors.

Top management banking by Army’s highest position holders.

Computerized customer services.

Customers’ faith as a stable dependable Bank.

Trust Bank provides its customers excellent and consistent quality in every service. It is of highest priority that customer is totally satisfied.

Trust Bank draws its strength from the adaptability and dynamism it possesses. It has quickly adapted to standard in terms of banking services.

Trust Bank has also adapted state of the art technology to connect with the world for better communication to integrate facilities.

Trust Bank is in a financially sound position backed by the enormous resource base of Army Welfare Trust. As a result customers feel comfortable in dealing with the Bank.

All levels of the management are solely directed to maintain a culture for the betterment of the quality of service and development of a corporate brand image in the market through organization wide team approach and open communication system.

Weaknesses:

Trust Bank has very limited human resources compared to its financial activities. There are not many people to perform most of the tasks. As a result many of the employees are burdened with extra workloads and works late hours without having any sufficient compensation packages. This might cause high employee turnover that will prove to be too costly to avoid.

Limitation of information system (PC Bank). Pc Bank is not comprehensive banking software. It is desirable that a more comprehensive banking system should replace PC bank system.

Hierarchy Problem treated as a weakness for the Trust Bank, because the employee will not stay for a long. So there will be a change of brain drain from this bank to other bank.

Advertisement Problem is another weakness for Trust Bank. Their media coverage is so much low that people do not know the Bank thoroughly.

Opportunities:

Public confidence as a financially stable Bank, backed by the Bangladesh Army.

Control and monitoring of the borrowers can be handled in a more consolidated manner. Less opportunity of bad debts.

Secured market minimizing risk factors.

More branches at different areas.

Sophisticated Telecommunication Infrastructure; The Bank has already introduced on line modern facilities to its customer.

The Trust bank can pursue diversification strategy in expending its current line of business. They don’t serve only the army but also the civilians.

Threats:

Mergers and acquisitions: The worldwide trend of mergers and acquisition in financial institutions may need to concentrate and competitors are increasing in power in their respective areas.

Frequent fluctuations of foreign exchange rates and particularly latest world economic recession may adversely affect the business globally.

Due to high customer demand, it is expected that more financial institutions will be introduced in this sector very shortly. And we have already seen such cases in our country that lots of new banks are coming in the scenario with new services. Trust Bank should always be prepared for the competition in the coming years.

Frequent changing of interest rate against deposit & lending.

Contemporary Banks like Dhaka Bank, Dutch Bangla Bank, Prime bank, Mutual Trust Bank, Mercantile Bank are its major rival as competitors.

Default culture is also very familiar in our country, and it’s also a great threat for the Bank.

2.8 Management Team of Trust Bank Limited

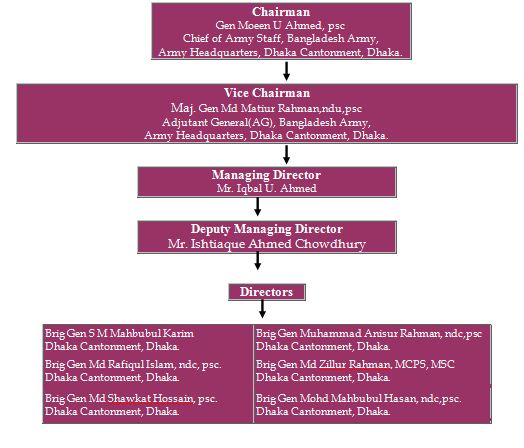

Chart: Board of Directors of Trust Bank

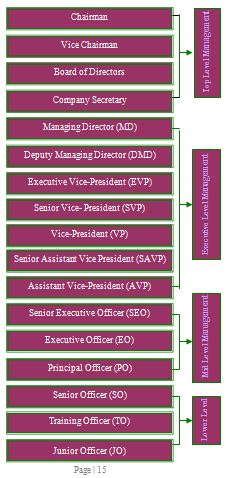

2.9 Management Hierarchy of Trust Bank Limited

2.10. A Branch Network

No | Branch Name |

| 1 | Corporate Head Office,PeoplesInsuranceBuilding, 36 Dilkusha C/ADhaka. |

2 | Principal Branch, Dhaka Cantonment, Dhaka |

3 | Dilkusha Corporate Branch, Dhaka |

4 | Sena Kalyan Bhaban Branch, Motijheel, Dhaka |

5 | Dhanmondi Branch, Dhaka |

6 | Gulshan Corporate Branch, Dhaka |

7 | Mirpur Banch, Dhaka |

8 | Savar Cantonment Branch, Dhaka |

9 | Radisson Water Garden Hotel Branch, Dhaka |

10 | Agrabad Branch, Chittagong |

11 | Khatunganj Branch, Chittagong |

12 | CDA Avenue Branch, Chttagong |

13 | Chittagong Cantonment Branch, Chittagong |

14 | Sylhet Branch, Sylhet |

15 | Jalalabad Cantonment Branch, Sylhet |

16 | KhwajaYunusAliMedicalCollege & Hospital Branch, Sirajganj |

17 | Bogra Cantonment Branch, Bogra |

18 | Rangpur Cantonment Branch, Rangpur |

19 | Momenshahi Cantonment Branch, Mymensingh |

20 | Jessore Cantonment Branch, Jessore |

21 | Millenium Corporate Branch, Dhaka |

22 | Commilla Cantonment Branch, Comilla |

23 | Shaheed Salauddin Cantonment Branch, Ghatail Tangail |

24 | Uttara Corporate Branch, Dhaka |

25 | Halishahar Branch, |

26 | Beanibazar Branch, Sylhet |

27 | Moulvibazar Branch, Sylhet |

28 | Goalbazar Branch, Sylhet |

29 | Naval Base Branch, Potenga Chittagong |

30 | Kawran Bazar Branch, Dhaka |

31 | Feni Branch, Noyakhali |

32 | Joypara Banch, Dhaka |

33 | Joydepur Branch, Gazipur |

34 | Narayanganj Branch, Narayanganj |

35 | Narsingdi Branch, Narsingdi |

36 | Asugonj Branch, Asugonj |

37 | Jubilee Road Branch |

38 | Shahajalal Uposhahor Branch |

39 | Merchant Banking Division |

40 | Khulna Branch,Khulna |

2.10. B Domestic Branch Network

Trust Bank Limited opened several new branches within Dhaka City. Besides, recently it has opened new branch at Khulna. It has planned to open few more branches in Dhaka City very soon. The branches which are operating in different areas of Bangladesh are the following-

2.11 Nature of Business

Trust Bank Limited offers full range of banking services that include:

Deposit banking.

Loans & advances facilities.

Export facilities.

Import facilities.

Financing in land.

International remittance facilities.

Foreign Exchange transactions.

2.12 The Principal Products or Services of the Trust Bank Limited

In addition to usual commercial lending the bank has the following loan and deposit products:

Investment or Retail Products

2.12. A. Loan Products

Household Durable Loan.

Doctors Loan.

Educational Loan.

Travel Loan Hospitalization Loan.

Any purpose Loan.

Apon Nibash Loan.

CNG Conversion Loan.

Marriage Loan.

Advance against Salary Loan.

2.12. B. Deposit Products

Fixed Deposit Receipt (FDR).

Trust Smart Savers Scheme (TSS).

Trust Money Double Scheme (TMDS).

Trust Money Making Scheme (TMMS).

Monthly Benefit Deposit Scheme (MBDS).

Lakhopati Savings Scheme (LSS).

Interest First Fixed Deposit Scheme (IFFDS).

2.12. C. Islamic deposit products

Mudaraba Term Deposit.(MTD)

Al-Wadiah Term Deposit (ATD)

2.12. D. International Trade

International Banking,

Private foreign Current Account.

Non Resident Foreign Deposit Account.

Travelers’ Endorsement (Cash and Travelers Cheque).

Remittance of Foreign Currency.

Import and Export Transaction.

Foreign Exchange Dealing.

Purchase of Foreign Currency Drafts, Cheques, Travelers Cheques Wage Earner’s Development Bond.

2.12. E. Other Services

Local Remittance- DD, TT, and PO etc. & Inter Branch Transactions.

Trust Tele Banking

Trust SMS Banking.

Trust Internet Banking.

Credit/debit/ VISA Card.

Passport Service.

Locker Service.

2.13 Product or service that accounts for more than 10% of the company’s total revenue:

Revenue incomes during the past years are as follows:

| Description | 2007 | 2006 | 2005 |

| Net Interest income | 667,804,877 | 400,001,365.00 | 167,072,156.00 |

| Income from Investments | 299,490,240 | 170,817,002.00 | 194,479,592.00 |

| Commission, Exchange and Brokerage Income | 307,901,831 | 247,921,395.00 | 129,924,730.00 |

2.14. Distribution of Products and services:

Trust Bank provides products and services through 40 branches nationwide and through Q-cash, shared ATM.

2.15. Competitive Condition in the Business:

The banking sector comprises of four major nationalized commercial banks, two agriculture banks and a large number of private commercial banks including about a dozen foreign owned private banks. They severely compete for deposits and are in search of sound investment/lending targets. Despite stiff competition, Trust Banks’ earning has gone up significantly, especially for its professionally managed operation, sound investment/lending operation, deposit collection.

2.16 Employees’ Position (As on 31.12.2007)

Number of employees at 31 December, 2007 was 850; (31 December, 2006 was 508).

2.17 Passport service

Most recently Trust Bank Ltd. has introduced passport issue & renewal service in the Bank for the general public. People don’t need to go to the Passport Office to get new passport or for renewal of passport. The Bank will work as an agent of the passport office. The Bank will receive necessary papers & documents directly from the public for renewal and issuance of new passport, and will charge Tk.200.00 as service charge in addition to the prescribed fee of the govt. for issuance of passport. The Bank will forward the papers and documents (received from the applicant) to the passport office; Passport office will issue the passport after examining the papers and documents within the prescribed time and will forward the passport to the respective Bank. The applicant will come to the bank after a certain (prescribed) period to receive the passport.

PURPOSE | VERY URGENT | URGENT | NORMAL |

| International Passport (48 pages) | TK 5000 | TK 3000 | TK 2000 |

| International Passport (64 pages) | TK 6000 | TK 3500 | TK 2500 |

| Special Passport (Indian) | TK 2500 | TK 2000 | TK 1000 |

| Renewal (International Passport) | TK 2500 | TK 1500 |

|

| Renewal ( Special Passport) | TK 2000 | TK 1000 |

|

| International Passport Endorsement | TK 500 | TK 300 | |

| Special Passport Endorsement | TK 300 | TK 200 | |

| TIME DURATION | 3 working days + 1 day = Total 4 days | 21 working days + 1day= Total 22 days | 30 working days + 1 day = Total 31 days |

2.18 Locker Service

Trust Bank Limited provides locker facilities to the public at selected branches where people can keep their valuable things. The banks for this purpose have strong rooms which are equipped with safe deposits lockers. There is different size of lockers available in the selected branch of bank e.g. big, medium and small. The charges vary for different types of locker. The charge is higher for big locker and lower for small one. Bank has no liabilities. If any thing loss, bank will not be responsible for that. As Bank and the party jointly operate it, no single party can operate it. No party is allowed to keep any illegal product

Different sizes of locker rent:

In The Trust Bank Limited, Mirpur Branch, there is different size of locker. The rent of the locker depends on the size of the locker. Different sizes of locker rent are as follows:

Size Size Rent (yearly)

Small 21.5” x 7”x 5” Tk. 1000/-

Medium 21.5” x 14.5”x 5” Tk. 1500/-

Large 2105”x14.5”x 9.75” Tk. 2000/-

Rules and regulation for hire a locker in the Bank:

Any person can take or hire a locker from the bank. However, bank insists him or her to be a customer by opening on account.

The person who takes a locker on rent has to fill up a proper lease document which contains the terms and conditions of hiring locker.

The bank maintains a locker register in which all transactions relating to each of the rent out lockers are recorded on a separate

Two keys are used for opening the lockers, of which one kept by the hirer in his/her possession while the other i.e. the master key retained by the banker himself.

The contents of the locker are not known to the bank.

The master key should remain in the custody of the manager or any other authorized officer during the days.

Refundable caution fee is taken for allowing locker facility.

Duplicate key can be issued after paying duplicate key charges.

2.19 SMS Banking:

Trust Bank offers another time saving service: SMS Banking. This automated SMS Banking can be reached 24 hours a day, 7 days a week. This service performs balance query and mini statement through SMS via affixed mobile number given by client. Mini statement contains last five debit and credit transaction including balances. SMS banking services will cost Tk 3 plus VAT for each SMS. This service will soon include utility bill and fund transfer facilities

2.20 Internet Banking:

Trust bank Limited has introduced internet banking in order to provide better customer service. In this case any body from any where by their unique ID and password can access their account from specific website (www. trust bank.com.bd) to know about their account. Here user can see balance and mini statement of their account. They can print out any transaction by giving data range in the specific field and also preserve it as a document. That mini statement needs not any signature verification as that will be auto generated statement.

2.21 Tele Banking

The Trust Bank Limited, Mirpur Branch is now providing the Tele Banking Service. For Tele Banking Service at Mirpur Branch, the person do not need to visit the branch, sitting at the home through the telephone they can gather information. They will have the convenience of requesting the services mentioned below-

Tele

Banking

Services | Balance Inquiry

Exchange Rate Inquiry

Request for Statements

Information about interest on different types of deposits.

Balance of the account

Other Banking Information |

2.22 International banking:

The Trust Bank Limited, with its wide corresponding relationship with major banks on the world is fully capable to meet the client’s need of foreign currency transaction and foreign trade services. Clients can open and maintain accounts in foreign currencies such as US Dollar, Pound Sterling and Japanese Yen and even in Euro with them. With its own Dealing Room, TBL is able to offer client competitive exchange rate for all major currencies of the world.

2.23 Debit Card:

Trust Visa Electron (Debit Card) provides a lot of facilities. This card accepted to all ATM with Visa sign. This card can use nationwide. Transaction account is debited directly from customers account. Cash can be withdrawal limit Tk 20,000.00/- to 40,000.00/- by maximum four transactions a day. Single snap cash withdrawal limit is maximum 20000.00/- a day. Personal Identification Number (PIN) can be change more than two times a day for security measure. ATM will retract the card for three time wrong PIN entry during transactions for security purposes. In case of retraction, customer nearest branch or card division must be contracted Annual fee is Tk 300 and Annual interest rate is 15%.

| Particulars | Amount (Taka) |

| Issuing fee | 500 |

| Renewal fee | 500 |

| Card replacement fee | 500 |

| Pin re-issue fee | 300 |

| Transaction fee(Trust bank card use Trust Bank ATMs) | Free |

| Transaction fee)Trust bank card use other Q-cash network ATMs) | 10 |

2.24 Credit Card:

Visa Gold Local:

Unsecured credit line.

Operable only within Bangladesh.

Credit line up to BDT 100,000.00/-.

Visa Classic Local:

Operable only within Bangladesh.

Cash withdrawal facility up to 50% of total credit limit.

Up to 45 days interest free credit facility.

Interest rate @ 24% per annum i.e. 2% per month (subject to change).

Visa Classic International

Operable only outside Bangladesh.

Cash withdrawal facility up to 50% of total credit limit.

Up to 45 days interest free credit facility.

Interest rate @ 24% per annum i.e. 2% per month (subject to change).

Visa Gold International

Operable only outside Bangladesh.

World wide acceptance.

Cash withdrawal facility up to 50% of total credit limit.

Up to 45 days interest free credit facility.

Interest rate @ 24% per annum i.e. 2% per month (subject to change).

Visa Dual Card

Operable both inside and outside Bangladesh.

Credit line in both currencies.

World wide acceptance

2.25 Current Business performance:

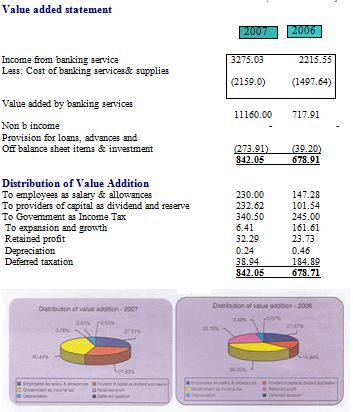

Consolidation of business profit & loss:

Banks overall profit grew significantly in 2007 over that of 2006. Despite of the bank increased by around 42.75 % and stood at Tk. 27,102 million at the end of 2007. Loans and advance increased by 41.66% and stood at Tk18, 682 million at the end of year. Import business increased by 54% while export by 46%. Both local and foreign remittances grew significantly. Increase in all business parameters resulted in higher operating profit, which increased by 56.10%.

Achievement against business plan

(Figures in million Taka)

Particulars Budget Achievement % of Achievement

Deposit 22,500 27,102 120%

Loans and advances 16,500 18,682 113%

Import- Local 3,621 4,405 122%

Import- Foreign 13,592 17.683 130%

Export- Local 2,840 4,114 145%

Export – Foreign 3,374 4,225 125%

Remittance- Local 12,975 17,535 135%

Remittance- Foreign 1,102 2,612 318%

Guarantee 889 1,114 125%

Operating profit 700 854 122%

Branch Expansion:

In line with their 5 year branch expansion plan, 5 new branches were opened in 2007, namely Mirpur and Kawran Bazar Branches at Dhaka, Naval Base Branch at Chittagong Feni Branch and Joyapra Branch. The Board of directors has planned to open 9 more Branches in 2008. In 2009 total numbers of branches is 40. Recently Trust Bank has opened their new branch at Shena Kalyan Bhaban, KDA Avenue, Khulna. Since the bank is passing through high growth period, the board of director has decided to open as many branches as possible during this high growth period. Increase in number of branches will increase market share in terns of deposit and loans which will ultimately enhance its profit.

Retail Banking Product:

Retail banking has enormous potential in Bangladesh. Visualizing a tremendous prospect, the Bank introduce 11 retail banking products, viz, home loan, any purpose loan, advance against salary, education loan, doctor’s loan, marriage loan, travel loan,CNG conversion loan, car loan, hospitalization loan and household durables loan. Out of 11products, home loan, car loan, any purpose loan and household durables comprise respectively 35%, 30%, and 20% and 11% of the total loan portfolio. In order to give easy access to its products and provide best possible service at the customer’s doorsteps, the bank introduced direct selling services by recruiting qualified and customer focused professionals. Retail loan portfolio at the end of the year stood at Tk 416 million.

SME Lending:

SME sector has provided to be an effective vehicle for creating employment opportunity, reducing poverty and accelerate in overall economic growth. With a view to ensuring balance industrial development of the country, Bangladesh Bank has instructed to allocate ten percent of the total fund of Small and Medium (SMEs) for women entrepreneurs which will provide them the opportunity of easy access to the institution credit facility under the comfortable terms and condition. Visualizing the prospect of SME, the bank has introduced seven SME products – Women Entrepreneur loan, Poultry Farm Loan, Loan for Light Engineering, Entrepreneur Development Loan for Retires and Peak Seasons Loan. SME loan portfolio at the end of the year stood at Tk.500 million.

Remittance Arrangement:

During the year bank signed money Transfer agreement with 5 oversee exchange companies; As a result, remittance flow has increased significantly. Total remittance flow was Tk. 2,612 million in 2007, as against Tk765 million in 2006 registering an increase of 241.43 percent. But they have no room for compliancy. They need more inward foreign remittance to bridge the gap between import and export. Bank Management is continuously in touch with oversees exchange companies for remittance arrangement and getting good response.

Online Banking:

TBL has achieved note worthy progress in the field of information technology during the year review. In January 2007, the bank successfully launched online banking service, which facilitates any branch banking, ATM banking, phone banking, SMS banking and internet banking. All branches are currently using centralize banking software for their data transaction processing and routine reporting. The bank has subscribed to ATM VISA Debit and Credit cards which is an important milestone in automation of the banking services. Beside services like phone banking, SMS banking and internet banking have considerably reduced customers’ pressure on the cash counters.

ATM and Debit Card

The bank has subscribed to VISA Electron (Debit Card), which enable the customer to withdraw money from their account through ATM without turning to cash counter. The bank is a member of Q-Cash ATM network which is a consortium of 14 member banks. At present, Q-Cash has 84 ATMs and 250 POS terminals throughout the country out of which 8 ATMs are attached with the branches of Bank. Besides, the bank has established itself as the settlement bank for the entire Q-cash network

Interface with other ATM networks:

Being the settlement bank for Q-Cash network, the Bank has played a lead role for expansion and sharing of ATM network with different banks at a competitive rate. For instance, Q-cash has recently signed quadr-party agreement with Dutch –Bangla, Trust and Mercantile Bank to create a common transaction routing platform. Dutch – Bangla Bank has 151 ATMS and 700POS terminals nationwide. Besides, in November 2007 Q-Cash signed a similar agreement with BRAC Bank, which has a network of 64 ATMs and 500POS terminals. Signing of these agreements will make 24 – hour banking transactions flexible for the customer of all banks involved in this expansion network. By sharing the network, participants banks will be able to eliminate per transaction toll charge by VISA , since shared network of Q-Cash , Dutch – Bangla and BRAC Bank will be consider as a big network and transactions within this network will be settled locally.

Introduction of VISA Credit Card:

For a bright prospect, the Bank has successfully launched VISA Credit Card to serve its existing and potential customers, although a very stiff competition is prevailing in the market. Presently, they are marketing five types of credit card – VISA Classic Local, VISA Classic International, VISA Gold Local, VISA Gold International and VISA Dual Card. The Bank expects that sizable revenue will flow from credit cards.

Summary of Financial Performance:

Deposit:

In the year 2007 the deposit of the bank shot up to Tk. 27,102 million from TK 18986 million as recorded in the year 2006. The increase in deposits during the period as recorded as 42.75%.The combination of competitive interest rates, depositors’ trust in the bank and mobilization efforts of the Bank management resulted in this growth of deposits. But these is no room for complacency, they have still a long way to go.

Loans & Advances

Total loan and advances of the bank as on 31 December 2007 was Tk. 18,682 million as against Tk. 13,188 million in the 2006, showing an increase by 41.66% over the preceding year. The credit portfolio of the Bank is a mix of scheme loans namely- renovation and reconstruction of scheme loan (RRDH) Loan, Car Loan , Consumer Durable Scheme Loan (CDS), Marriage loan, House Building Finance (HBF) Loan, Commercial Loan. Commercial loan comprise Trade financing in the form of working capital and industrial loan (both large and medium scale industries) with both funded & non- funded credit facilities The portfolio was further devised to avoid risk of single industry concentration and remains in the line with the Bank’s credit norms relating to risk quality. The classified loans & advances accounted for 2.71% of the total loans & advances against industry average of 5.50%.

Total Assets:

Total asset of the Bank stood at Tk.30, 382 million in 2007 as against Tk.21.061 million in 2006 registering a growth of customer deposits. The growth of deposits was used for funding growth in credit and investment.

Investments:

The investment grew by Tk.662 million during the year and stood at Tk.3, 785 million at the end of 2007 as against Tk. 3,123million in 2006. The Bank purchased government treasury bills to cover the increased SLR requirement .Out of the total investment. Tk. 309 million was invested in listed and unlisted shares of different companies.

Borrowings from Other Banks, Financial Institution:

Consolidated balance stood at Tk. 244 million at the end of the year, which represents Tk.230 million call loans from other banks and Tk.14 million refinance loans from Bangladesh Bank. The consolidated balance is much lower than that of 2006, which was Tk.426 million.

Liabilities:

Consolidated liabilities of the Bank stood at Tk. 28228 million at the end of 2007 as against Tk.19, 906 million in 2006, registering a growing 41.81 %. Increase in liabilities was mainly due to about 42.75% increase in deposit over the corresponding year.

Capital Maintenance:

The amount of minimum capital that should be maintained by Bank against its risk weight asset is capital adequacy ratio laid down by Basel Capital Accord. Capital adequacy is measured by the ratio of Bank’s capital to risk weighted asset both in balance sheet and off balance sheet transactions. All assets have been assigned weights from 0 -100%. Off balance sheet are included in the computation by converting them into balance sheet equivalents before a risk weight is allocated. Bank’s capital has two components, Tier I (core capital) and Tier II (supplementary capital)

Core capital (Tier l):

The core capital ratio was 10.69% of total risk weighted assets against the standard of 5%. Core capital represent the paid up of ordinary share capital, share premium, statutory reserve and retained earnings. As on 31 December 2007, Bank’s Core Capital stood at Tk. 2,093 million against Tk. 1,155million in 2006

Supplementary Capital (Tier ll):

Supplementary capital represent asset revaluation reserve, general provision for loans and advances, preference share capital and other subordinated debt. At the close of business on 31 December 2007, Bank’s supplementary capital stood at Tk. 328million.

Total Capital:

Therefore the total capital of the bank stood at Tk.2, 421 million against Tk.1, 311 million in 2006 and maintained a ratio of 12.37% of total risk weighted asses against a standard of 10%. At the end of 2007, statutory Reserve of the Bank stood at Tk. 331 million as against Tk. 215 million in 2006.

Shareholders’ Equity:

Total shareholders’ equity is increased by 86.49% and stood at Tk.2, 154 million at the end of year as against TK. 1,155 million in 2006. the increase was due to conversion of sponsors’ share money deposit into paid up capital amounting Tk.200million , issue of primary share to the public amounting Tk. 700 million (including premium) and increase in statutory reserve. Statutory reserve increased by Tk. 116 million.

Statutory reserve:

In accordance with the provision of Bank Companies Act, 20% of operating profit required to be transferred to Statutory Reserve. As much an amount of Tk. 116 million has been transferred to Statutory Reserve during the year and the balance of the reserve stood at Tk. 3331 million at the end of the year.

(Taka in million)

Particulars 2007 2006

Income per employee 3.89 4.36

Cost per employee 2.88 3.28

Profit and operating result:

The bank earned operating profit of Tk. 854 million during 2007 as compared to Tk. 547 million in the immediate preceding year, registering a growth of 56.10%. after keeping Tk.162 million as provision against classified loans a& advances, Tk. 63 million as provision against unclassified loans (1-5%) and Tk. 5 million as provision against special mention account (SMA). Pre -tax profit stood at Tk.580 million. After keeping Income Tax provision of Tk. 341 million, net profit stood at Tk.239 million. Earning per share was Yk.28.28.Accumulated retained earnings stood at TK 362 million at the end of 2007.

Net Interest Income:

Net interest income registering a significant growth by 66.95% over the last year‘s figure. Interest from loans & advances remained the principal component of interest income and interest paid on deposit was the main component of interest expenses

Investment Income:

Investment income represents interest earned on treasury bills & bonds, dividend income and capital gain from sale of listed securities. Income from investment grew significantly over that of corresponding year; by 75.33 % and the principal contribution came from capital gain of sale of shares.

Total Operating Expanses:

Total operating expenses increased by 59.55% during the year mainly due to increase in number of employees and number of branches. In number of branches result in increase in business volume and increase in profit .Additional human resources had to be hired to support business growth.

Information Technology (IT) and Automation:

All the branches of the TBL arc fully computerized. New software is now in use to provide faster, accurate and efficient services to the clients. The bank is continuously striving for ensuring better services through extensive automation of its branches. The bank has connected its all branches through On-line banking system. The bank has set up a full-fledged IT division to keep abreast of the latest development of IT for ensuring better service in the days to come. Moreover ATM Booths are going to be established over the country.

Human Resources Development (HRD):

The bank’s work force is composed of personnel having sound academic backgrounds with vast experience in banking. Human resources development creates an environment by dynamic, enthusiastic and vigorous participation of all individuals. With opening new branches the total head count would increase in the year 2008. To make the personnel of the bank knowledgeable and truly professional, it arranges training for them at Head office of the bank, BIBM and other institutions. The management of the bank sits with the branch managers and departmental heads in regular meetings that provide scopes for open discussions, which help in formulating new strategies for achieving ‘targets’ of the bank. The bank also gives due emphasizes on the motivational side of the employees by providing them competitive salary/pay packages well as by creating pro-active job environment in the bank.

Foreign Correspondents:

Foreign correspondent relationship facilitates foreign trade operations of the bank, mainly in respect of export, import and foreign remittances. The number of Foreign Correspondents and Agents of the bank covers important business and trade centers of the world to ensure better and hassle free services to its import, export and remittances oriented clienteles.

Web Site:

The introduction of Internet has changed the traditional concept of world trade and commerce. Trust Bank Limited has its own IT team who has developed a web site to provide up-to- date information on the bank at fingertips to the trade and business communities of the world. It can be accessed to under the domain: www.trustbanklimited.com.

Social Commitment and Future Prospect:

This bank has stepped into 10th year of its banking operations so still at its infantile stage but within a short span of time, consolidated its position with all its inherent strength and weakness. This bank would continue to keep its commitment towards societal progress by participating in such programs in future. It would stand by the people through philanthropic activities whenever any crisis and disaster confront them. It will be diversified in the days ahead of the management as they are planning to award students of exceptional academic performance with scholarships in different educational institutions. The management of Trust Bank Limited expects to launch soon school banking by ending their services, which would encourage parsimony in the students.. The management is optimistic that the volume of business would continue to increase in the coming years through their pragmatic and customer friendly policies in line with their attempt to open some more branches in the commercially important places of the country.

Credit Rating:

Credit Rating Information and Services Limited (CRISL) upgraded its rating of the Bank for long term to A (pronounced as single A) in 2007 from A- (pronounced as single A minus) in 2006. CRISL also upgraded short term rating of the Bank to ST-2 in 2007 from ST-3 in 2006. The up gradation was done due to Bank’s good fundamental and involvement in the areas of capital adequacy, market share, liquidity, leverage and loan loss provisioning, financial institution are rated in this category are adjudged to offer adequate safety for timely repayment of financial obligation. This level of safety indicates a Bank entity adequate credit profile. Risk factors are more variable and greater in period of economic stress than those rated in higher category. The shorter rating indicates high certainty of timely repayment. Liquidity factors are strong and supported by good fundamental protection factors. Risk factors are very small.

Dividend

The accompanying profit and loss account depicts the operating result of the bank for the year 2007. The Government has , in the mean time , amended that the Bank Companies Act, 1991 requiring, among other thing, minimum capital plus statutory reserve of Tk.2,000 million for the Banks. Bangladesh Bank issued a circular on 5 November 2007 asking the banks to raise 50% of the shortfall by June 2008 and the remaining 50% by June 2009. Besides Bangladesh Bank has imposed restriction on payment of cash capital until the required capital plus statutory reserve is met. Paid up capital along with statutory reserve of the Bank stood at Tk.1, 497 million as on 31 December 2007 and hence there remains a gap of Tk. 503 million. In order to bridge the gap, the Board of Directors has recommended for issuance of 10% bonus shares (i.e. one bonus share for every five shares held) from the profit of 2007.The board of Director has also recommended for issuance of 20% right shares (i.e. one right share for every five shares held), subject to approval of Securities and Exchange Commission (SEC).

Part – 03

Learning Part

Products of Trust Bank Limited, Mirpur Branch, consists of deposit products and loan products. In learning part I have discussed about deposit products of Trust Bank Limited.

Deposit Products

There are different types of deposit product in Trust Bank Limited.

Types of Account provided by

Trust Bank Limited 1. Savings Deposit Account

2. Short Term Deposit (STD) Account

3. Current Deposit Account

4. Fixed Deposit Receipt Account

Primarily the following four products were launched in January, 2006:

Trust Smart Savers Scheme (TSS).

Trust Money Double Scheme (TMDS).

Trust Money Making Scheme (TMMS)

Trust Educare Scheme (TES).

Later on, in 2007, the following three products were also introduced:

Monthly Benefit Deposit Scheme (MBDS).

Lakhopati Savings Scheme (LSS).

Interest First Fixed Deposit Scheme (IFFDS).

Trust bank also introduce some Islamic deposit products

Mudaraba Term Deposit.

Al- Wadiah Term Deposit (ATD)

3.1. Savings Account:

Savings deposit is popular account maintained in banks. Savings account is opened by individuals for savings purposes and amount deposited over a period of time. This account earns interest at a prescribe rate. Interest on saving account shall be calculated monthly on the basis of guidelines issued by Head office from time to time and credited to the account half yearly in June and December each year. The savings account allows one to have interest income on his/her deposit while the account can be used for transaction purposes. Withdrawal of deposit can be made twice in a week in case of this account. Exceeding this number will forfeit the interest for the month. The TBL offers 7% interest rate on the account. Interest is applied to the account on half-yearly basis. Savings account also offers: statement of account at desired frequency, Tele-banking, Inter branch – banking facilities etc.

General Characteristics:

As per BB instruction 90% of SB deposits are treated as time liability and 10% of it as demand liability

Tk 1000 is required as initial deposit to open this account.

Interest is paid on this account. TBL offers 7% rate of interest for SB A/C.

Withdrawal can not be more than 25% of the balance available, subject to maximum Tk 25000.

The number of withdrawals over period of time is limited. Only two withdrawals are permitted per week. If there are more than two withdrawals are made in a week, no interest will be paid for that month.

Generally householders, individuals and other small-scale savers are the clients of this account.

Minimum Balance of Tk 2,000 is to be maintained.

Interest is credited to the account in June and December.

There is no service charge for savings account.

Rules of Savings Account:

Any Person/ Persons of the age of majority and sound mind can open account singly or jointly. The balance shall be payable to him/her/them or the survivor of the joint account. A guardian can open such account on behalf of a minor.

Clubs, Societies and other similar organizations can open such account on production of their Bye-Laws, Articles of Association, and resolution thereof.

Introduction is mandatory when opening Saving Account.

No one shall be allowed to open more than one Savings Bank Account in the same name in a particular branch.

Every Savings Bank Account shall have a separate account number.

Withdrawal of money shall be only through the leave of the cheque book supplied by the Bank.

A minimum initial deposit of Tk. 1000/- shall be required for opening Savings Bank Account

A Depositor shall not be allowed to withdrawal more than twice a week and shall be allowed to draw 25% of the balance subject to maximum Tk. 25,000/- per week or else the depositor shall be required to serve 7 day’s notice in advance.

Interest payable on minimum balance will be in June and December every year.

The Bank will, as per Govt. directives, realize all taxes/charges/levies at fixed rate annually or otherwise decided by the Govt.

Signature of the client on cheques for withdrawal of money must be similar with the specimen signature recorded with the Bank.

In case of closure of any account within 6 (Six) months from the date of opening of the same, the Bank shall deduct Tk. 100/- from the account as closing charge.

The Bank reserves the absolute right to alter/amend these rules of Savings Bank Account as well rate of interest from time to time.

3.2 Current Deposit Account:

These types of account are opened by both individuals and business concern including non profit making organizations. . These accounts can be of five types. They are:

Frequent transaction both deposit and withdrawals are allowed in this account. This account holder can draw cheques on his/ her account for any amounts and for any number of times in a day if the balance permits. Generally no interest is allowed in this account. Statement of account is required to be dispatched to the A/C holder on monthly basis or as may be requested by the customer.

General Characteristics:

Bank does not pay any interest to CD Account holders.

There is no restriction on the number and the amount of withdrawals from a current account.

Service charge and incidental charges are recovered from the depositors since the bank make payments and collect the bills, drafts, cheques, for any number of times daily.

Businessmen and companies are the main customers of this product.

The Banks through current accounts grant the loans and advances

In practice of TBL, a minimum balance of TK.5000 has to be maintained.

Rules of Current Account:

A Minimum initial deposit of Tk. 5000/- shall be required for opening a Current Deposit Account.

Withdrawal of money by the customer from the account shall be allowed only through the leaves of the cheque book issued by the Bank.

Signature of the customer on the cheque leaf for withdrawal of money shall have to be matched with the specimen signature recorded with the bank.

Bank shall take maximum care and remain alert to record exactly all the transactions of both credit & debit in the ledger with no fault.

Bank shall charge incidental expenses and recover the same from the account once after every 6 (Six) months for maintenance of the account.

Any change/alternation of address/constitution of the customer must be informed to the Bank immediately.

Bank shall reserve absolute right to alter/amend its own rules, regulations as well as rate of interest.

Bank shall reserve the right to close down any account, if the operation of the same appears to be unsatisfactory.

Procedures of opening an account:

For opening an account, at first the prospective account holder will apply for opening an account by filling up account opening form. Account opening form consists of the name of the branch, type of account, name of applicant(s), present address, permanent address, passport number if any, date of birth, nationality, occupation, nominee(s) information, special instruction (if any), initial deposits, specimen signature(s) of the applicants introducer’s information etc.

The prospective customer can be properly introduced by the followings:

An existing customer of the bank.

Officials of the bank not below the rank of Assistant Officer.

A respectable person of the locality who is well known to the manager or authorized officer.

Requirements for opening an account are

Two copies of passport size photograph duly attested by the introducer.

Signature of the prospective account holder in the account opening form and on the specimen signature card duly attested by the introducer.

The concerned authority will allocate a number for the new account. The customer then deposit the “initial deposit” by filling up a deposit slips. Initial deposit to open a current account in TBL isTK.5000.00 and savings account is TK 1000.00.For defense person the amount of initial deposit is flexible. After depositing the initial deposit, the account is considered to be opened. After depositing the initial deposit, TBL records it in the computer by giving new account number then it issues cheque book requisition slip to the customer. Then they distribute all relevant papers to respective department.

The particulars of the application form for opening Current or Saving Account are as follows

Type of the account

Name of the applicant(s)

Father’/Mother’s name

Present address

Permanent address

Passport no (If any)

Date of birth

Nationality

Occupation

Telephone/Mobile/E-mail

Nominee(s)

Special instruction for operation of the A/C

Initial deposit

Specimen signature of the applicant

Introducer’s information.

Name.

Account number

In case of joint account, the following additional headings are in the form:

Operational instruction of the A/C and signatures

In case of partnership account the following additional headings must be added:

Partner’s name and signature.

The person who wants to open an account has to fill a transaction profile-

Example of Transaction Profile (TP)

Bank Products Required | No. of Transaction (Monthly) | Maximum Size (Per transaction) | Total Value (Monthly) |

| Outgoing FCY Transfers | |||

| Outgoing LCY Transfers | |||

| Drafts/Travelers Checks | |||

| Cash withdrawals | |||

| Check Payment | |||

| Pay Link Payments | |||

| FX products | |||

| MM Products (Deposits) | |||

| Letter of credit/Guarantee | |||

| Loan Facilities | |||

| Investment Transactions | |||

| Payroll Cards | |||

| Others (Specify) | |||

| Expected Sources of Fund | |||

| Incoming FCY Transfer | |||

| Incoming LCY Transfer | |||

| Cash Deposits | |||

| Check Deposits | |||

| Cash Collection | |||

| Other station Cash Collections | |||

| Other station Check Collections | |||

| FCY Check Collections | |||

| Export Proceeds | |||

| Other (Specify) |

Note: Please use Additional sheets if required.

I/We, the undersigned, hereby confirm that this: Transaction Profile truly represents the transactions arising out of the normal course of business of our organization. I/We also confirm to inform you any revision in the “Transaction Profile”, if necessary, from time to time.

01. SIGNATURE: 02. SIGNATURE:

NAME: NAME:

3.3 Short Term Deposit Account (STD):

Trust Bank offers 4% interest on Short Term Deposit account, which is less than that of savings deposit. Normally various big companies, organizations, government departments keep money in Short Term Deposit account. In Trust Bank Ltd., Mirpur branch private organizations are Short Term Deposit account holder. For this type of account frequent withdrawal is discouraged. Deposit should be kept for at least seven days to get interest. Prior notice varying from 3 to 29 days or more is required for the withdrawal of money from Short Term Deposit account. The account holder must give notice seven days before the withdrawal that is why Short Term Deposit is called “Seven-Day-Notice” Current Account. The rules of Short Term Deposit (STD) Account are same as the rules of Current Account

General Characteristics:

Customers deposit money for a shorter period of time.

STD account is treated as semi-term deposit

In practice, TBL offers 4.0% rate of interest (half yearly compounding) for STD account on daily minimum balance.

Volume of STD A/C is generally high. In TBL, various big companies, organizations, Government Departments keep money in STD accounts.

Frequent withdrawal is discouraged and requires prior notice.

3.4 Fixed Deposit Account:

Fixed Deposit is very popular types of deposit of the bank and in fact these deposits constitute a sizeable amount of the deposit of the banking sector. Fixed deposit receipts are neither transferable nor negotiable. These are categorized as time liabilities of a bank. Banks pay higher interest on such deposits because depositors part with liquidity for a definite period. . There are different types of interest on the amount. The interest rate depends on the time schedule. Fixed period is specified in advance. Normally the money on a fixed deposit is not payable before the maturity date of a fixed period. At the time of opening the deposit account the banker issues a receipt acknowledging the receipt of money on deposit account. It is popularly known as FDR.

General Characteristics:

Popularly, it is known as Fixed Deposit Receipt (FDR). Term deposits are made with the bank for a fixed period of time.

The trust Bank ltd issues FDR for different periods with different rate of interest.

The bank offers high rate of interest on such deposits.

Fixed deposit receipts are neither transferable nor negotiable.

Opening of FDR Account:

Fixed deposit may be opened by one individual or two or more persons in joint names. For opening a fixed deposit account a depositors or depositors has/have to apply in a printed form supplied by a bank where he/ they is/ are to deposit cash or give cheque to debit his/their account maintained at the branch. Depositor(s) has/ have also to give his their specimen signature in the specimen signature card.

FDR may also be opened in the name of a minor. However, it should be jointly done along with guardian.

Necessary documents for opening a FDR in are as follow.

FDR Form

FDR Card

Before opening a Fixed Deposit Account a customer has to fill up an application form, which contains the following.

Amount in figures

Beneficiaries name and Address

Rate of interest

Information about nominees

Date of maturity

FDR number

Amount in words

Time period

Date of issue

Special Instruction

Any one can operate

To be renewed for another time as per prevailing interest rate

To be transferred in the A/C No-

Specimen signature.

After fill up the FDR form the party deposits the amount. The party can pay the amount in two ways-

a) By Cash-

When the party pays the money in cash then the FDR is issued immediately.

b) By Cheque-

When a party gives the cheque then at first the cheque is send to the clearing house then when the cheque comes from the clearing house successfully then the FDR is issued.

After fulfilling the FDR Form and depositing the amount, FDR Account is opened and FDR receipt is issued and it is recorded in the FDR Register. The FDR Register contains the following information:

FDR Account Number

Fixed Deposit Receipt Number.

Maturity period.

Interest rate.

Name of the FDR holder with address.

In case of Fixed Deposit Account, the bank need not hold a cash reserve to repay money to the customer. The payment will be made after completion of a certain period of time.

Duration|:

Fixed deposits are of various durations. Depending on the liquidity requirement and convenience, a depositor can open a fixed deposit account of any duration along with interest rates applicable to different duration of such deposits.

Payment of interest:

Through interest is payable at the stipulated rate at maturity of FDR. Banks may also pay interest at regular interval at the request of the depositors. Interest may be paid in cash or may be credited to client’s account, if any maintained at the branch. Withdrawals of interest or principal can not made by cheques.

Interest payment procedure:

For 01 months –

If a person opens a FDR account for 01 (one) month then the interest will be charged on simple basis. That is if the person makes a FDR on 01/08/04 for one month then the FDR will be mature on 01/09/04. At the end of the maturity if the person does not withdraw the interest and give the instruction “To be renewed automatically” then after the end of another month the person will get interest on principal only. It means the interest will be charge on the principal balance.

For 3 months or 6 months-

If a person opens a FDR account for 03 (three) months or 06 (six) months then the interest will be charged on compound basis. That is if the person makes a FDR on 01/08/04 for three months then the FDR will be mature on 01/11/04. At the end of the maturity if the person does not withdraw the interest and give the instruction “To be renewed automatically” then after the end of another three months or six months the person will get interest on “Principal + Interest”. It means the interest will be charged on the current balance.

For 01 year & above-

Under these FDR, interest is charged on compound basis. If a person make a FDR for 01 year and at the end of the 01 year if the person does not withdraw the interest amount then after the end of another 01 year he/she will get interest on the “principal amount + interest” as like 03 months or 06 months

Interest on Over Due Deposit:

Legally interest ceases to accrue on fixed deposit after the expiry of the fixed period. But banks at their discretion, may allow interest thereafter if it is renewed.

Payment of fixed deposit:

For payment of fixed deposit, demand by the depositor is essential. On the date of maturity the depositor should present the FDR duly discharge on its back for payment or renewal.

Premature Encashment of FDR:

Trust bank Ltd. allows premature encashment of FDR having post approval from the head office. In this case, interest is given at savings bank account rate, which is usually lower than the FDR rate. A closing charge of amount Tk 50 is realized from the FDR A/C.

Renewal of FDR:

FDR holder can renew his/her FDR after maturity with interest or without interest at his/her discretion. He can renew it for the same period or any other period. FDR is automatically renewed after the date of its maturity if the holder doesn’t encash the same .In case of auto renewal, maturity period remains same.

Payment of jointly FDR before maturity:

If the payment of FDR in the name of two or more person is demanded before maturity by one of the joint depositors , a banker should do so only after obtaining the consent of the other depositors, because one depositor has no right for payment before maturity even if it is a marked to either or survival. The authorization that it is payable to either or survivor is intended to be made at the time of the deposit, till then it remains a joint debt of the bank which may be withdrawn only with the consent of all the depositors.

Request for duplicate FDR

Some times request for duplicate FDR is made by a depositor. If such request for duplicate FDR is made by one depositor from among two or more depositor, then before issuance of duplicate FDR, request letter from all the depositors must be obtained.

Loss of Fixed Deposit Receipt

Sometimes, the depositors report to the bank the loss or theft of a Fixed Deposit Receipt and request it to issue a duplicate one. .A FDR is neither transferable nor negotiable. Any other person therefore cannot claim payment of the amount covered by the receipt. However customer requests the banker for the issue of duplicate one because banker stipulates that the receipt duly discharged must be surrender for its payment. A banker should take the following steps in this regard:

a) A letter signed by the depositor/depositors informing the banker about the loss of the receipt and requesting it to issue a duplicate one, should be obtained.

b) A duly stamped letter of indemnity must be obtained from the depositor/depositors to safe guard it own interest, in case the original receipt is also presented for repayment.

c) A note to this effect should be made in the fixed deposit ledger for future guidance.

Current rate of interest of FDR in TBL

The interest rate offered by the Trust Bank Limited for Fixed Deposit Account is as follows:

| Fixed Deposit | Time Period | Rate of Interest |

| Fixed Deposit | 01 month | 8.00% p.a |

| Fixed Deposit | 03 months | 9.50%p.a. |

| Fixed Deposit | 06 months | 9.50%p.a |

| Fixed Deposit | 01 year & above | 9.50%p.a |

Normally a customer is not allowed to withdraw money before the maturity of the fixed period in case of Fixed Deposit account. If any customer withdraws money before maturity date, the customers will not get any interest.

Excise Duty:

The excise duty for FDR is different for different amount of FDR. These are as follows-

EXCISE DUTY

EXCISE DUTY | |

Amount (Tk.) | Change (Tk.) |

| Tk. 10,000/- to Tk. 1,00,000/- | 120 |

| Tk. 1,00,001 to Tk. 1,00,00,000 | 250 |

| Tk. 1,00,00,001 to Tk. 10,00,00,000 | 550 |

| Above Tk. 10,00,00,000 | 2500 |

Encashment procedure of FDR:

When the party wants to encash the FDR then the FDR slip have to be submitted. Then a credit voucher is made-

Amount of interest paid to Mr. X against FDR no……………………. Cr.

Calculation of broken Days Interest:

For 03 (Three) months/06 (Six) months/01(One) year:

Principal X Savings Rate (7%) X Broken Days

360

Some other important factors of FDR Account are as follow:

FDR is not a negotiable Instrument.

The legal position of a banker regarding a fixed deposit is that of a debtor which bound to repay the money only after the maturity of the fixed period.

Cheque books are not issued for Fixed Deposit Account.

3.5 Trust Smart Savers Scheme (TSS):

The name of the scheme is Trust Smart Savers Scheme (TSS) and an account holder subscribing to this scheme will be called TSS Account holder. An applicant can open TSS account in his name, in his /her spouse name or in the name of his/her children operated by the guardian. The maximum number of TSS account from a single family can not exceed five. Under this scheme, a depositor deposits certain in every month for a period for 3/5/7/10 years and on maturity the depositor gets back the deposited amount and accumulated interest for the saving period. However customer can directly deposit the amount in the TSS account also.

Under the TSS, the following category of deposit and maturity payment has been declared:

| Monthly Deposit | Amount Payable at Maturity (3 years) | Amount Payable at Maturity (5 years) | Amount Payable at Maturity (7 years) | Amount Payable at Maturity (10 years) |

| 500 | 20,897 | 38,514 | 59,801 | 1,00,000 |

| 1,000 | 41,794 | 77,027 | 1,19,601 | 2,00,000 |

| 2,000 | 83,588 | 1,54,055 | 2,39,202 | 4,00,000 |

| 3,000 | 1,25,380 | 2,31,100 | 3,58,800 | 6,00,000 |

| 4,000 | 1,67,170 | 3,08,100 | 4,78,400 | 8,00,000 |

| 5,000 | 2,08,970 | 3,85,100 | 5,98,000 | 10,00,000 |

Terms and Conditions

The first installment may be deposited at any date of the month but subsequent installments have to be deposited on 10th day (in case of holiday next working day) of every month. Advance payment of any number of installments is acceptable.

A passport size photograph is required to open an account.

A passport size photograph of TSS account holder must be attached with the application form.

Signature can be given by the depositor(s) under the scheme to the branch concern to pay regular installment from his/her CD/SB account maintained with the branch.

In case of death of the applicant the relevant account will be closed. Nominee/Nominees will receive the proceeds of the account(s).If the nominee is a minor the proceeds of the account will go to legal guardian of the minor.

Any benefit from Trust Smart Savers Scheme may come under purview of Income Tax or any other levy as decided by the government.

Monthly installment will be automatically realized from the applicant’s account Saving Account linked with TSS Account or directly deposit in the account.

In the event of failure to pay any monthly installment, it will be sole responsibility of TSS account holder to settle the arrear installment(s) before or along with the next due though a written instruct to the bank. In such case there will be a penalty of TK 50.00 for per installment amount to be paid with subsequent installment.

If any monthly installment remains unpaid for six consecutive month , the account will be closed automatically and the account will be settled as per following :

a) If the premature encashment occurred within one year, in that case interest will be allowed.

b) If the premature encashment occurred after one year, in that case he/she will charge as closing charge.

In case of immature closing of the account TK 100.00 will be charged as closing charge.

If there is any overdue/ classified loan in name of account holder with “Trust Bank” then ‘Trust Bank” shall have the right to adjust the loan amount, from the deposit which has been deposited by account holder under the scheme of “TSS”

These terms and condition shall be governed by and construed in accordance with the laws of Bangladesh.

No cheque book will be issued to the client under this scheme.

Loan may be allowed up to 80% of the deposited amount but not below Tk.1,00,000.00 against lien of the same account.

Any account can be transferred from any branch; in that case TK 25 will be charged as Account Transfer Fee.

The bank reserve the right to make changes/alteration/amendments/modification etc. to the scheme and in absence of nominee, to the legal heirs of the deceased will be given the amount due from the scheme on production of succession certificate.

3.6 Trust Money Making Scheme (TMMS):

Under the Scheme, the client has to pay a down payment of Tk 7,500.00 or multiple thereof and the bank contributes Tk 42,500.00 or multiple thereof to form a fixed deposit of Tk 50,000.00 or multiple thereof with the bank. The client is allowed an interest rate of 10.00% on that deposit. The client has to pay the amount due to the bank through monthly equal installment of Tk 855.00 or multiple thereof in 6 years. The client is entitled to get the interest on Account.

The scheme at a Glance:

| Client’s Own Deposit | Tk 7,500.00 or multiple thereof |

| Bank’s Contribution | Tk 42,500.00 or multiple thereof |

| Account Value | Tk 50,000.00 or multiple thereof |

| Tenor | 6 years |

| Installment Size | Tk 855.00 or multiple thereof |

| Interest Size | 10.00% |

Terms and Conditions:

An applicant can open TMMS Account in his her name , in his /her spouse name or in the name of children operated by the guardian

A FDR for the value combining clients own deposit and banks contribution will be issued for three years at 10.00% which will be automatically renewed for further one term of three years.

In case of death of depositor (s), the amount will be payable to Nominee/Nominees or in the absence of nomination, to the legal heirs of the depositor on production of succession certificate.

After deposit made by the client, FDR for the respective amount with three year maturity at10.00% interest will be issued.

Penalty for overdue installment is monthly TK 50.00 only to be paid along with the subsequent installment

If the client fails to deposit three successive installment , the account will be closed automatically and the account will be settled as per following :

| Different duration Treatment | Applied Benefit |

| Less than 06(six )months | No interest |

| More than 06 (six) months but less than 3 years | Prevailing interest on saving account |

| More than 03 years but less than 06 years | Client own deposit + interest on deposit for 3 years and interest at prevailing saving rate for the rest period which shall be more than six months |

In the event of discontinue of the scheme, the deposit will be en-cashed and the proceeds of which if any after adjustment of outstanding loan with up to date interest will be paid to the client.

Installment will be stated from the following month and deadline of each installment is 10th of every month..

Any account can be transferred from any branch; in that case TK 25 will be charged as Account Transfer Fee

The scheme is not encouraging for those who are not able to continue it for at least 3 (three) years.

No loan facility will be allowed against the deposited amount.

3.7 Trust Money Double Scheme (TMDS):

The name of this scheme is Trust Money Double Scheme (TMDS) and an account holder subscribing to this scheme will be called TMDS account holder. Under the scheme, the amount deposited at the very inception is doubled in 6 years. The basic structure of this scheme is as follows:

Deposit Value | Matured Value | Year |

| 10,000.00 or multiple thereof | 20000.00 (Double of the deposited amount) | 7.5 years |

Terms and conditions:

An applicant can open TMDS Account in his her name , in his /her spouse name or in the name of children operated by the guardian

The maximum number of TMDS accounts from a family cannot exceed five.

An order instrument mentioning the amount payable after maturity shall be issued favoring the depositor(s)

In case of discontinuation of the scheme , account will be settled as per following :-

I. If the premature encashment occurred within one year, in that case interest will be allowed.