Executive Summary:

Banks mobilize money from the public in the form of deposits as well as borrow funds from the banking system with a view to providing credit in the economy. Besides these core activities, banks are performing other roles in the economy. History shows that a modern bank is offering a wide array of financial services and the bank’s service menu is growing rapidly.

This report is prepared on the basis of three months practical experience at International Financial Investment & Commerce (IFIC) Bank Limited. This internship program helped me a lot to learn about the practical situation of a financial institution especially about the internal control systems over cash and to implement my theoretical knowledge in practical and realistic work atmosphere.

IFIC Bank of Bangladesh Limited is one of the leading commercial banks in the country with commendable operating performance. It is directed by the mission to provide prompt and efficient services to clients. It provides a wide range of commercial banking services to its customers.

This internship Report is aimed at providing a comprehensive picture to the areas of internal control system over cash receipts and cash payments of IFIC Bank. The Report has been divided into eight parts. These are: 1) Introduction, 2) Overview of the company, 3) Theoretical Background, 4) Policies and procedures, 5) Analysis of internal control system veer cash receipts and cash payments, 6) Findings, 7) Recommendation, and Conclusion, 8) Bibliography & annexure.

I mentioned the performance of IFIC bank in internal control system over cash receipts and cash payments. Besides findings of my report and description of recommendation to overcome the limitation added dimension.

I have taken all the reasonable care to ensure the accuracy and quality to make the report standard. And I believe that it has included all the necessary information to be relevant, reliable, and useful.

Introduction:

Background of the Report:

As a pre requisite for completing the Bachelor of Business Administration graduation of The Bangladesh University of Business and Technology (BUBT), I was required to complete internship program in a suitable financial organization and submit a report of my findings.

I was selected to work as an internee in International Finance Investment & Commerce Bank Limited for a period of three months from March 13th, 2011 to June 12th, 2011.It is a four credit hour program of the BBA Program.

In fact, Internal Control and Compliance System provide a descriptive framework of Internal Control as well as management under the regulation provided by Bangladesh Bank. This report treats internal control & management system as an essential learning in Bank management. Here is my report topic is “An analysis of internal control systems over cash receipts and cash payments in IFIC Bank Ltd. Internal control is a process, effected by an entity’s board of directors, management and other personnel, designed to provide reasonable assurance regarding the achievement of objective in the effectiveness and efficiency of operations, reliability of financial reporting, and compliance with applicable laws and regulations.

This report has been prepared under the supervision of Ms. Kanij Fahmida, Assistant Professor & Chairman, Department of Accounting, Bangladesh University of Business and Technology (BUBT).

Justification of the report:

As my major subject is accounting, I have chosen the topic titled “An analysis of internal control systems over cash receipts and cash payments in IFIC Bank Limited. This topic has a great importance as the internal control is very much essential to run an institution smoothly and effectively as well as to achieve the goal, even the cash related activities are the most sensitive factors for any kind of institution. I have chosen this topic because; it will let me have a practical knowledge on this important area. This report is suitable for the people who are engaged in financial institutions or wants to be a banker or high official in the financial institutions. It is strongly believed that this study will be used as comprehensive & informative one.

Scope of the report:

During this three months internship program in International Finance Investment and Commerce Bank Limited almost all the departments have been observed. It was not an easy task to collect all the information relevant to my report topic. I had been focused on the Internal Control Systems over the cash receipts and cash payments in IFIC Bank Limited. The area of my study has been encompassed the operation area of IFIC Bank, Pallabi Branch, for a period of three months from March 13, 2011 to June 12, 2011.

Objectives of the report:

Broad objective

The broad objective of the report is to analyze the Internal Control Systems over the Cash receipts and Cash payments in IFIC Bank Limited.

Specific Objectives

- To identify and understand the related policies and procedures for cash receipts in IFIC Bank.

- To identify and understand the related policies and procedures for cash payments in IFIC Bank.

- To identify the problems of internal control systems over the cash receipts and cash payments exist in IFIC Bank

- To recommend some guidelines to improve the effectiveness of the internal control systems over the cash receipts and cash payments.

Methodology

Types of Research :

In this study, descriptive research has been undertaken to gain insights and understanding about the internal control systems over the cash receipts and cash payments.

Research Design:

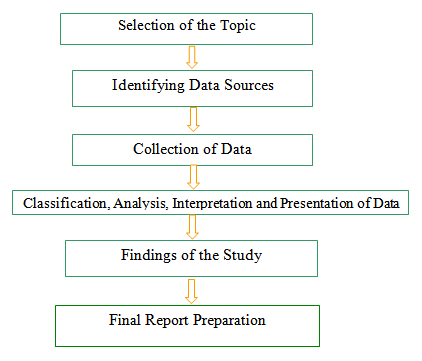

The report is descriptive in nature. To perform the study data sources were identified and collected. The collection were classified, analyzed, interpreted and presented in a systematic manner and key points were found out. The overall process of methodology is given below in the form of flowchart. Figure-1: Research design

Figure-1: Research design

Sources of Data

Both primary and secondary data sources are used to collect the information to complete the report in good health:

Primary

- Face to face conversation with the head of the branch.

- Observation.

Secondary

- Annual report of the IFIC Bank.

- Relevant documents provided by the bank officers.

- Web site of IFIC Bank.

- Text books.

- Wed site search.

Data collection procedure

Primary data collection:

- Formal face to face conversation: I have collected primary data through face to face conversation with the branch manager & other officers by using a questionnaire.

- Observation of their daily activities: I have also collected some data by observing the activities performed by the staffs of the bank.

Secondary data collection:

I have collected the secondary data from the annual report of the bank, relevant documents provided by the bank, web site search, text book as well as web site of IFIC Bank Ltd.

Duration:

weeks within the period of three months internship program.

Sample size

Randomly three people were selected for the analysis purpose. The way in which sampling is conducted is only a part of the total design of an analysis process.

Limitation of the study:

Every organization has some own secrecy, which cannot be & should not be disclosing to an outsider. So I had some limitations to enter in to the affairs of the bank in depth. Moreover, the employees of the organization had their own routine duties. In spite of their full cooperation I failed to discuss about every intended aspects in details.

- Only three month is not enough time for this kind of study. So, it is very much tough to prepare the report in good health.

- As a student, I am not experienced about this type of task. Due to lack of experience, it is very much tough for me to prepare the report properly.

Overview of the company or company profile

Background:

International Finance Investment and Commerce Bank Limited (IFIC Bank) is banking company incorporated in the People’s Republic of Bangladesh with limited liability. It was set up at the instance of the Government in 1976 as a joint venture between the Government of Bangladesh and sponsors in the private sector with the goal of working as a finance company within the country and setting up joint venture banks/financial institutions aboard. In 1983 when the Government allowed banks in the private sector, IFIC was converted into a full fledged commercial bank. Government then held 49 percent shares while the sponsors and general public held the rest. The Government of the People’s Republic of Bangladesh now holds 32.75% of the share capital of the Bank. Directors and Sponsors having vast experience in the field of trade and commerce own 8.62% of the share capital and the rest is held by the general public.

The objectives of the finance company were to establish venture banks, finance companies and affiliates abroad and to carry out normal functions o finance company at home.

When the government decides to open up banking in the private sector in 1983 the finance company was converted into a full-fledged commercial Bank. Along with this, the government also allowed four other commercial banks in the private sector. Subsequently, the governments denationalized two banks, which were, then fully government owned.

While in all these banks government was holding nominal 5 percent shares, an exception was made in the case of the IFIC Bank. The government retained 40 percent shares of the bank.

The decision by the government to retain 40 percent shares in IFIC Bank was in pursuance of the original objectives, namely promotion of the participation of the government and private sponsors to establish joint venture banks, financial companies, branches and affiliate abroad.

All types of commercial banking services are provided by the bank within the stipulations laid down bank Company Act, 1991 and directives issued by Bangladesh Bank from time to time. Branches of the Bank at the end of 2010 stood at 87. The bank is listed with Dhaka and Chittagong Stock Exchange Limited as a publicly quoted company for its “A Class” ordinary shares.

Mission:

- Our Mission is to provide service to our clients with the help of a skilled and dedicated workforce whose creative talents, innovative actions and competitive edge make our position unique in giving quality service to all institutions and individuals that we care for.

- We are committed to the welfare and economic prosperity of the people and the community, for we drive from them our inspiration and drive for onward progress to prosperity.

- We want to be the leader among banks in Bangladesh and make our indelible mark as an active partner in regional banking operating beyond the national boundary.

- In an intensely competitive and complex financial and business environment, we particularly focus on growth and profitability of all concerned.

Goal

The goals of the bank are to promote joint participation of Government and private sponsors to establish joint venture banks, financial companies, branches and affiliate abroad to satisfy their customers.

It coveys its goal via their motto: “Your satisfaction first”

To establish, maintain, carry on, transact, undertake and conduct all types of banking, financial, investment and trust – business in Bangladesh and abroad.

To form, establish and organize any bank, company, institution or organization, singly and/or joint – collaboration for partnership with the individual, company, financial institution, bank organization, or any government and/or any agency for – the purpose of carrying on banking, financial, investment and trust business.

To carry on any business relating to wage earner’s scheme as may be allowed by Bangladesh Bank from time to time including maintaining of Foreign Currency Accounts any other matter related thereto.

To contract or negotiate all kinds of loan, and or assistance, private or public, from any source, local or foreign, and to take all such steps as may be required to complete such deals.

To form, promote organize, assist, participate or aid in forming or organizing any company, bank, syndicate, consortium, and institute or any holding or subsidiary company in Bangladesh.

To take part in the formation, management, supervision or control of the business or operations of any company.

To purchase, or otherwise acquire, undertake the whole or any part of or any interest in the business, goodwill, property, contract agreement.

To encourage, sponsor and facilitate participation of private capital in financial, industrial or commercial investments.

Hierarchy of the Management of IFIC Bank Ltd.

Managing Director (MD) |

Deputy Managing Director |

Senior Executive Vice President |

Executive Vice president |

Senior Vice President |

First Vice President |

Vice President |

Senior Assistant Vice President |

First Assistant Vice president |

Assistant Vice president |

Senior Executive Officer |

Senior Officer |

Office Grade – I |

Probationary Officer |

Office Grade – II |

Assistant Officer |

Office Assistant |

Driver |

Security Staff |

Office Attendant |

Table-1: Hierarchy of the Management of IFIC Bank Ltd.

The thirteen members of the Board of Directors are responsible for the strategic planning and overall policy guidelines of the Bank. Further, there is an Executive Committee of the Board to dispose of urgent business proposals.

Besides, there is an audit committee in the board to oversee compliance of major regulatory and operational issues.

The CEO and Managing Director, Deputy Managing Director and Head of Divisions are responsible for achieving business goals and overseeing the day to day operation.

The CEO and Managing Director is assisted by a Senior Management Group consisting of Deputy Managing Director and Head of Divisions who supervise operation of various divisions centrally and co – ordinates operation of branches.

Key issues are managed by a Management Committee headed by the CEO and managing director. This facilitates rapid decisions.

There is an Asset Liability Committee comprising member of the senior executives headed by CEO and Managing Director to look into all operational functions and Risk Management of the Bank.

Ownership structure:

The sponsors hold ownership of the Bank in the private sector and Government of the People Republic of Bangladesh. Sponsors and individuals now own a little more than 67% and the government owns 32.75 percent share capital of the Bank.

Capital and reserves:

The Bank started with an authorized capital of TK. 100 million in 1983 and paid up capital at that time stood at TK 71.50 million only. Now, IFIC Bank Limited is a strongly capitalized bank. Its authorized is TK.5350.00 million while its paid up capital is TK. 1743.86 million as on31st December, 2009. The total share holder’s equity reached TK. 4197.56 million and total capital stood at TK.4928.76 million as on 31st December 2009.

Capital management framework of the IFIC Bank is designed to ensure that the bank maintains sufficient capital consistent with the Bank’s risk profile, applicable regulatory requirements and credit rating consideration.

The reserves of IFIC Bank stood at TK. 2453.60million in 2009 against TK1855.29 million in 2008. The bank mobilized total deposits of Tk50,017.96 million as of December 31,2009 as against TK.36092.17 million as of December 31, 2008 that is an increase of 38.58% during the year.

Branch expansion:

During the year 2009, IFIC Bank Limited opened five urban branches and three rural branches & three SME Service Centers at different geographical location to provide banking service to its customers. Total number of branches of the Bank at the end of 2009 stands at 82 and five SME service centers. In 2010 the bank expanded its branch at 87, even all 87 branches & SME service centers of IFIC Bank is operating under state –of – art world class real time on line banking solution.

Operation Abroad

Joint Venture:

Bank of Maldives – In 1983, IFIC Bank set up joint venture bank in Maldives known as Bank of Maldives Limited (BML). It is the first bank of Maldives. In 1992, as per contract, IFIC Bank handed over the management of BML to Maldives.

Oman – Bangladesh – Exchange – To facilitate remittance by Bangladeshi in Omen, IFIC Bank set up a money exchange company as a joint venture, named Oman Bangladesh Exchange.

Branch abroad:

Pakistan Branch – IFIC Bank opened its first overseas branch in Karachi, Pakistan. It opened its second branch at Lahore in Pakistan.

Nepal Bangladesh Limited – In December 1993, the Bank got permission to establish a joint venture bank with 50 percent equity capital in Nepal. The bank known as Nepal Bangladesh Ltd. It came into operation in June 1994.

Human Resource Development:

The Bank has a Human Resource Development & Research Development to develop human resources internally. The academy is equipped with professional library, modern training aids professional faculty and other facility. It is now under personnel & Human Resource Division. The academy conducts regularly foundation courses, specialize courses and seminars on different areas of banking to take care of the professional needs.

Milestones in the development of IFIC BANK

| 1976 | – | Established as an Investment & Finance Company under arrangement of joint venture with the govt. of Bangladesh. |

| 1980 | – | Commenced operation in Foreign Exchange Business in a limited scale. |

| 1982 | – | Obtained permission from the Govt. to operate as a commercial bank. |

| – | Set up a its first overseas joint venture (Bank of Maldives Limited) in the Republic of Maldives (IFIC’s share in Bank of Maldives Limited was subsequently sold to Maldives Govt. in 1992) | |

| 1983 | – | Commenced operation as a full-fledged commercial bank in Bangladesh. |

| 1985 | – | Set up a joint venture Exchange Company in the Sultanate of Oman, titled Oman Bangladesh Exchange Company (subsequently renamed as Oman International Exchange, LLC). |

| 1987 | – | Set up its first overseas branch in Pakistan at Karachi. |

| 1993 | – | Set up its second overseas branch in Pakistan at Lahore. |

| 1994 | – | Set up its first joint venture in Nepal for banking operation, titled Nepal Bangladesh Bank Ltd. |

| 1999 | – | Set up its second joint venture in Nepal for lease financing, titled Nepal Bangladesh Finance & leasing Co. Ltd. (which was merged with NBBL in 2007) |

| 2003 | – | Overseas Branches in Pakistan amalgamated with NDLC, to establish a joint venture bank: NDLC-IFIC Bank Ltd., subsequently renamed as NIB Bank Ltd. |

| 2005 | – | Acquired MISYS solution for real time on-line banking application. |

| – | Core Risk Management implemented. | |

| 2006 | – | Corporate Branding introduced. |

| – | Visa Principal and Plus (Issuer and Require) Program Participant Membership obtained. | |

| 2008 | – | Observing 25th Anniversary of Customer Satisfaction. |

| 2009 | – | 64 Branches offering Real Time On-line banking facility. |

| 2010 | – | All 87 Branches & SME Service Centers of IFIC Bank is operating under state-of-art world class Real Time On-line Banking Solution. |

Financial Highlights of 2009

| Particulars | Million in Tk. | In % |

| Operating Income | 3180.00 | – |

| Profit after Tax | 657.00 | – |

| Shareholders’ Equity | 3197.00 | – |

| Return On Asset | – | 1.44 |

| ROI | – | 13.59 |

| Stock Dividend | – | 30 |

| Earnings per Share | TK49.00 | |

| Authorized Capital | 1600.00 | |

| Paid up Capital | 1341.00 |

Table-2: Financial Highlights of 2009

Source: Annual Report, IFIC Bank Ltd. 2009

Financial Position of 2009 of IFIC Bank Ltd. at a Glance

| Sl |

noParticularsTaka in Million

Paid-up Capital1341.43

Total Capital3793.04

Capital Surplus733.30

Total Assets45729.47

Total Deposit36092.17

Total Loan & Advances33018.39

Total Contingent Liabilities & Commitments20536.26

Credit Deposit Ratio91.48%

Percentage of classified Loan Against total Loans & Advances5.92%

Profit after Tax & Provision657.31

Amount of classified Loans During the year1953.07

Provision kept against classified Loans651.85

Provision Surplus / Deficit30.20

Cost of Fund6.12%

Interest Earning Assets39806.29

Non-interest Earning Assets5931.20

Return on Investment (ROI)13.59%

Return on Assets (ROA)1.44%

Income from Investment691.44

Earnings Per Share49.00

Income Per Share411.98

Price Earnings Ratio (Times)24.26

Table-3: Financial Position of 2009 of IFIC Bank Ltd. at a Glance.

Theoretical Background:

Internal Control:

In accounting and auditing, internal control is defined as a process, effected by an organization’s structure, work and authority flows, people and management information systems, designed to help the organization accomplish specific goals or objectives. It is a means by which an organization’s resources are directed, monitored, and measured. It plays an important role in preventing and detecting fraud and protecting the organization’s resources, both physical (e.g., machinery and property) and intangible (e.g., reputation or intellectual property such as trademarks). At the organizational level, internal control objectives relate to the reliability of financial reporting, timely feedback on the achievement of operational or strategic goals, and compliance with laws and regulations. At the specific transaction level, internal control refers to the actions taken to achieve a specific objective (e.g., how to ensure the organization’s payments to third parties are for valid services rendered.) Internal control procedures reduce process variation, leading to more predictable outcomes.

Evaluating internal controls is one of internal auditor’s primary responsibilities. The Institute of Internal Auditors (IIA) defines control and control processes as follows:

A control is any action taken by management, the board, and other parties to manage risk and increase the likelihood that established objectives and goals will be achieved. Management plans, organizes, and directs the performance of sufficient actions to provide reasonable assurance that objectives and goals will be achieved.

Control processes are the policies, procedures, and activities that are part of a control framework, designed to ensure that risks are contained within the risk tolerances established by the risk management process. Risk management is a process to identify, assess, manage, and control potential events or situations to provide reasonable assurance regarding the achievement of the organization’s objectives.

Major Components of Internal Control:

- Control environment: Factors that set the tone of the organization, influencing the control consciousness of its people. The seven factors are (ICHAMPBO):

I – Integrity and ethical values,

C – Commitment to competence,

H – Human resource policies and practices,

A – Assignment of authority and responsibility,

M – Management’s philosophy and operating style,

B – Board of Director’s or Audit Committee participation, and

O – Organizational structure.

- Risk Assessment: Risks that may affect an entity’s ability to properly record, process, summarize and report financial data.

Risk assessment is the evaluation to determine the areas and functions within the organization and each department that have risk of errors, noncompliance, and fraud.

Controls may then be put in place to help mitigate the risks identified during risk assessment

Changes in the Operating Environment (e.g. Increased Competition)

- New Personnel

- New Information Systems

- Rapid Growth

- New Technology

- New Lines, Products, or Activities

- Corporate Restructuring

- Foreign Operations

- Accounting Pronouncements

- Control Activities: Various policies and procedures that help ensure those necessary actions are taken to address risks affecting achievement of entity’s objectives (PIPS):

– Performance reviews (review of actual against budgets, forecasts)

– Information processing (checks for accuracy, completeness, authorization)

– Physical controls (physical security)

– Segregation of duties

- Information and communication: Methods and records established to record, process, summarize, and report transactions and to maintain accountability of related assets and liabilities. Must accomplish:

a. Identify and record all valid transactions.

b. Describe on a timely basis.

c. Measure the value properly.

d. Record in the proper time period.

e. Properly present and disclose.

f Communicate responsibilities to employees.

- Monitoring: Assessment of the quality of internal control performance over time.

Principles of Internal Control:

To safeguard assets and enhance the accuracy and reliability of accounting records, companies follow specific control principles. This measure varies with the size and nature of the business and with management’s control philosophy. There are six principles of internal control, given by Weygandt, Kieso, & Kimmel those are explained below:

i. ESTABLISHMENT OF RESPONSIBILITY: An essential principle of internal control is to assign responsibility to specific employees. Control is most effective when only one person is responsible for a given task. Establishing responsibility includes authorization an approval of transaction.

ii. SEGREGATON OF DUTIES: Segregation of duties is indispensible in an internal control system. There are two common application of this principle:

Different individuals should be responsible for related activities.

The responsibility for record keeping for an asset should be separate from the physical custody of that asset.

iii. DOCUMENTATION PROCEDURES: Documents provide evidence the transactions and events have occurred. Companies should establish procedures for documents. First, whenever possible, Companies should use pre-numbered documents, and all documents should be accounted for. Second, the control system should require that employees promptly forward source documents for accounting entries to the accounting department. This control measure helps to ensure timely recording of the transaction and contributes directly to accuracy and reliability of the accounting records.

iv. PHYSICAL, MECHANICAL AND ELECTRONIC CONTROLS: Use of physical, mechanical, and electronic controls is essential. Physical controls relate to the safeguarding of assets. Mechanical and electronic controls also safeguard assets and enhance the accuracy and reliability of the accounting records.

v. INDEPENDENT INTERNAL VERIFICATION: Most internal control systems provide for independent internal verification. This principle involves the review of data prepared by employees. To obtain maximum benefits from independent internal verification :

Companies should verify records periodically or on a surprise basis.

An employee who is independent of the personnel responsible for the information should make the verification.

Discrepancies and exceptions should be reported to a management level that can take appropriate corrective action.

Independent internal control is especially useful in comparing recorded accountability with existing assets.

vi. OTHER CONTROLS

Other control measures include the following:

a) Bond employees who handle cash: Bonding involves obtaining insurance protection against misappropriation of assets by employees. It contributes to the safeguarding of cash in two ways:

- First, the insurance company carefully screens all individuals before adding them to the policy and may reject risky application.

- Second, bonded employees know that the insurance company will vigorously prosecute all offenders.

b) Rotate employees’ duties and require employees to take vacations: These measures deter employees from attempting thefts since they will not be able to permanently conceal their improper actions.

c) Conduct through background checks: Many believe that the most important and inexpensive measure any business can take to reduce employee theft and fraud is for the human resources department to conduct through background checks.

POLICIES AND PROCEDURE INTRODUCTION :

Good controls encourage efficiency, compliance with laws and regulations, sound information and help to eliminate fraud and abuse. Internal Control refers to mechanism in place on a permanent basis to control the activities in a bank both at central and at departmental level. It requires the operation of a solid accounting and information system i.e. maintain transparency and accountability of activities.

The objective of putting in place and effective Internal Control System in IFIC Bank is to enable the bank to utilize its resources in a more productive and effective manner as well as to manage and control the cash related particular risk or risks – to which the company is exposed – adopt measures to mitigate these risks. Through an effective internal control system can identify weakness and take appropriate measures to overcome the situation.

STRUCTURE FOR INTERNAL CONTROL SYSTEM

Organizational structure plays a vital role in establishing effective internal control system. The essence of the ideal organizational structure that will facilitate effectiveness of the internal control system is the segregation of duties. The IFIC Bank Limited, depending on the structure, size, and location of its branches and strength of its manpower try to establish an organizational structure which allows segregation of duties among its key functions such as marketing, operations, credit, financial administration etc.

In cases where such segregation is not possible, there must be certain monitoring mechanism which should be independently reviewed to ensure all policies and procedures are followed at the branch level.

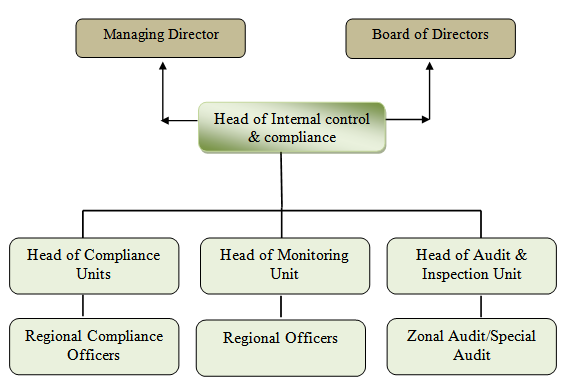

INTERNAL CONTROL & COMPLIANCE DIVISION (ICCD) OF IFIC Bank Limited:

The ICC division is consisting of 29 members’ team headed by a Senior Vice President. The head of ICC is responsible for compliance and control related tasks which include compliance with laws and regulations, audit and inspection, monitoring activities and risk assessment.

Organ Gram of Internal Control & Compliance Division (ICCD)

Figure 2: Organ gram of Internal Control & Compliance Division (ICCD)

The ICC division is split into three units-

I) Compliance Unit

II) Monitoring Unit &

III) Audit and Inspection Unit

I) Compliance Unit:

The compliance unit is responsible to ensure that the bank complies with all the policies and procedures of the bank as well as all regulatory requirements while conducting its business. It will also maintain liaison with the regulators or policy maker at all level and notify the other units regarding regulatory or procedural changes.

II) Monitoring Unit:

Monitoring unit is responsible to monitor the operational performance of various branches. This unit also collect relevant data and analyze those to assess the risk of individual units. In case it finds major deviation it recommend to the Internal Control Head for sending audit and inspection team for review.

III) Audit & Inspection Unit:

This unit performs periodic and special Inspection by its inspection team. It may have different section within this team responsible only for credit inspection or special investigation.

They also perform the IT (Information Technology) audit. This Audit is aimed at ensuring an acceptable standard for security on all The IFIC Bank Limited’s Servers, Workstations, Routers, Switches, Network, Core Banking system and other IT systems.

INTERNAL CONTROL PROCEDURES AND CONTROL ACTIVITIES IN IFIC BAMK LTD:

Control procedures and control activities mean those policies and procedures in addition to the control environment, which are established by the management to achieve the IFIC Bank’s specific objectives.

Control Procedures: It covers two broad areas i.e. Accounting Control and Administrative Control.

a) Accounting Control: It comprises primarily the plan of organization and the procedures and records that are concerned with the safeguarding of assets, prevention and detection of fraud and error, accuracy and completeness of accounting records and timely preparation of reliable financial information.

b) Administrative Controls: It includes all other managerial controls concerned with the decision making process.

Control Activities: An appropriate control structure is set up with control activities defined at every business level, i.e. top level review; appropriate activity controls for different divisions; physical controls; checks for compliance with exposure limits and follow-up on non-compliance; a system for approvals and authorizations and system of verification and reconciliation. Senior management ensures that adequate control activities are an integral part of the daily functions of all relevant personnel; this enables quick response to changing conditions and avoids unnecessary costs.

Control activities are involved into two steps, i.e. –

I) The establishment of control policies and procedures and

II) Verification that the control policies and procedures are being complied with.

Management of Cash in IFIC Bank Ltd.

Cash Management System

Cash handling is a very sensitive area of banking since there is a possibility of theft, robbery, forgery, money laundering and many other mishaps. As such, Cash Management should be done in a very systematic manner, and in a secured environment. The work should also entrusted to tested and honest people. Usually in a Branch Cash is managed by a Cash Incharge with the assistance of a few Receiving and Paying cashiers or cash officers. Besides security aspects customer service also needs to be closely looked into.

Receipt of Cash

Cash Receipt during Banking Hours

- Deposit slip/ voucher

Deposit slip or credit voucher duly filled in are submitted along with the cash at the cash counter for depositing cash.

- Check title of account, number & amount in figure & words

Cash receiving officer shall check the title of account, its number, amount in words and figures in the deposit slip or credit voucher and also the signature and name of the depositor.

- Receipt of cash deposited by customer

The cash receiving officer will receive the cash at the counter. He or she will first count the bundles and loose cash, preferably, with the help of the counting machine. Thereafter, if there is no difference he or she will write the denominations on the reverse of the deposit slip.

- Entry in cash receipt register

After receiving the cash, receiving cash officer will enter the particulars of the deposit slip/ voucher in the cash receipt register under progressive serial number. He/ she will put his/ her signature both in the counter foil and deposit slip/ voucher and he/ she will pass on the same along with the register to the authorized officer for his/ her signature.

- Counter signature by authorized officer

Authorized officer will affix the ‘Cash received’ seal on the deposit slip/ voucher and detach deposit slip from the counterfoil and return it along with the register to receiving cash officer and retain the deposit slip/ credit voucher. Authorized officer will send the deposit slip to the deposit department and credit vouchers to the respective departments to witch those relate.

- Cash received seal

Cash received seal supplied by head office with security elements is only allowed to be used.

Balancing of cash receipt register:

Receiving cash officer totals the amounts entered in the cash receipt register at the close of business which must agree with the total of actual cash received.

Cash receipt after banking hours/ evening banking shift:

- Cash received in late or evening shift is taken in the next day’s date.

- Procedure for receipt is same as explained in the foregoing paragraphs.

- Cash so received and balanced are put separately in the safe in the strong room.

Payment of Cash:

Payment of cash within Banking Hours:

- Cheques, Demand Drafts, Payment orders, SDRs, FDRs and deposit cash vouchers etc, are received from the customers and various departments for payment in cash.

- The instrument is checked for any apparent discrepancy, posting marks and cancellation etc.

- Signature of cancellation officer and officer(s) passing the voucher should be made available with the paying officer.

- Other then in cheques, signature of the recipient will be obtained on the reverse side of the instrument such as DD, PO, SDR and cash debit voucher which will be verified by the incharge from where the instrument or voucher organized or sent for payment. The instrument or voucher will be sent to the paying officer with a register where particulars of the instrument are recorded by the respective department with initials of incharge. The paying officer will receive the instrument/ voucher with an initial against the entry in the register. He or she will obtain another signature of the recipient on the reverse side of the instrument or voucher and make payment when signature has agreed with the signature obtained earlier.

- Cash is counted and the denominations of notes are written down on the reverse of the instrument.

- Cash Paid’ seal is affixed on the face of the instrument and signed by the paying cash officer

- Particulars of the instruments are entered in cash payment register.

- Signature of the bearer is obtained on the reverse of the cheque in cash of cheque payable to bearer and cash is paid to him or her after verifying with the signature earlier given.

- Paid instruments are kept with the paying cash officer till handling over cash to cash-in –charge.

Balancing of cash payment register:

- i. At the close of business, the amounts entered in the cash payment register are totaled. The total is agreed with the total amount paid.

- ii. The total is written in words and figures.

- iii. The officer incharge of deposit department checks the entries and instruments to ascertain that the payment has been correctly made and releases the instruments from the cash payment register by his or her initial against each entry.

- iv. The officer – in – charge also checks and signs the cash payment register.

Disposal of paid instrument:

After the cash is paid the instruments are sent to the Accounts Department as the cash may be cheques and other instruments are received by the accounts incharge.

Disposal of unpaid instruments:

- Instruments presented in the cash counter and returned unpaid by various departments are received by paying cash officer attached with Memorandum duly entered in the register.

- The particulars of the instruments are compared with those in the register and memorandum.

- Entries in the register are initialed by the officer and the register is returned to the department concerned.

- The instrument is returned to the bearer of the instruments.

Payment of cash after banking hours:

- The practice of payment of instruments after banking hours is to be exercised very sparingly and only in case of very good customers.

- The instrument is posted in the next day’s date and canceled as usual, before payment is made.

- When payment is made after baking hours the p0ayment is made only to the drawer in case of cheque of the 1st payee in case of demand draft , etc, upon proper verification.

Balancing, checking and safe custody of cash

Balancing of cash:

At the close of business when cash receipt and cash payment registers are balanced, the cash balance book is written and agreed with the cash in hand. The book is checked and signed by the authorized officer.

Cash position memo:

- After cash balance book is written, the cash position memo written in duplicate. The memo is checked and signed by the cash incharge.

- The cash position memo is, thereafter, sent to accounts department for tallying with clean cash book and preserving with vouchers.

- The signature of the receiver is obtained on the duplicate copy of the memo and filed in the ‘Cash position memo file’.

Checking of cash:

- i. When the cash balance book is balanced, the manager or second officer, whoever is assigned for checking of cash, is informed to check the cash.

- ii. The cash is counted by the checking officer and verified with the entries of cash balance book.

- iii. The cash balance is checked with the closing figures of the preceding day of the book and closing of cash receipt and cash payment registers.

- iv. The entries of denomination of notes and coins in the cash balance book is compared with the denomination of notes and coins counted and recorded on the face of cash denomination slip.

- v. If found in order, the checking officer signs the cash balance book, cash receipt register and cash payment register.

- vi. The cash position memo is checked and counter signed by the checking officer.

Entry in vault register:

While keeping cash in safe and withdrawing cash from safe during the day, each time entry will be made in the vault register and initialed by the cash incharge and joint custodian of cash.

Safe custody of cash:

- i. In the presence of cash officer and the officer who has counted the cash and signed the book, the cash is kept in the safe.

- ii. The safe is locked under joint operation and thereafter the strong room door is similarly locked and kept locked overnight and holidays.

Petty cash

Receipt of cash:

- i. Petty cash is drawn to the debit of ‘Suspense account – advanced against petty cash’ on debit cash voucher according to the limit.

- ii. The amount is kept by the cash department.

- iii. The account is maintained by the cash department in petty cash register.

- iv. The amount received is entered in the relative column of the petty cash register

Payment against petty cash:

- i. Payment are made by cashier on receipt of petty cash voucher signed by the manager/ authorized officer. The voucher is signed on the reverse by the recipient.

- ii. Entries are made by the cashier in the cashier in the respective columns of the petty cash form and register

Adjustment of entries against petty cash:

- i. The amount of petty cash consumed is reimbursed to the debit of those expenditure accounts on which petty cash has been spent. The entry is passed on debit cash voucher.

- ii. On the last day of the month the entry is reversed as follows:

- The amount spent is reimbursed as explained in preceding para.

- The cash held is deposited to the credit o f ‘Suspense Account – advance against petty cash.

ANALYSIS OF INTERNAL CONTROL SYSTEM OF IFIC BANK:

Banking is a diversified and complex financial activity involving high risk. Effective management and control of such risk is largely dependent on efficient and sound Internal Control System for establishing corporate governance, transparency and accountability. IFIC Bank has a well defined Internal Control System that is applied to all its departments and divisions. Risk Based Internal Audit (RBIA) is used for branches of IFIC Bank Limited.

The scope of the report is limited to the branch operations due to the authorization by The IFIC Bank Limited. This part of the report will explore an overview of Internal Control System of IFIC Bank in case of branch operations. Pallabi branch is complied with the policies and procedures made by the Internal Control and Compliance System Division ( ICCD) of IFIC Bank for cash receipts and cash payments.

Cash:

Cash, the most liquid of assets, is the standard medium of exchange and the basis for measuring and accounting for all other items. It is generally classified as a current asset. To be reported as cash, it must be readily available for the payment of current obligations, and it must be free from any contractual restriction that limits its use is satisfying debts.

Cash includes:

- Coin;

- Petty cash;

- Currency ; and

- Available funds on deposit at the bank.

Negotiable instruments such as money orders, certified checks, cashier’s checks, personal checks, and bank drafts are also viewed as cash. Savings accounts are usually classified as cash, although the bank has the legal right to demand notice before withdrawal. But, because prior is rarely demanded by banks, savings accounts are considered as cash.

Internal control system over cash receipts

Establishment of responsibility and segregation of duties:

One of the most important steps can be taken to protect cash is to separate cash handling duties among different people. With proper separation of duties, no single person has control over the entire cash process. In IFIC Bank, the duties relating to receipts are so allocated that no single person has exclusive control over an entire transaction, to establish the responsibility and adequately segregate the duties following steps are taken:

Separation of the custody of cash from accounting

Separation of the authorization of transaction from the custody of related cash

Separation of operational responsibility from record keeping responsibility

Best practice is to have different people:

- Receive and deposit cash

- Record cash payments to receivable records

- Reconcile cash receipts to deposits and the general ledger

- Bill for goods and services

- Follow up on collection of returned checks

- Distribute payroll or other checks

The key to effective cash control while separating duties is to minimize the number of people who actually handle cash before it’s deposited.

Authorization and approval:

Every transaction must be properly authorized if controls are to be satisfactory. Authorization can be general or specific. General authorization means that management establishes policies for the organization to follow. Specific authorization applies to individual transaction. Authorization is a policy decision for either a general class of transactions or specific transactions. Approval is the implementation of management’s general authorizations decision. In IFIC Bank Cash, cheques, and related documents are received only by persons authorized to do so. There is a system of ensuring that cash cheques, etc, collected by the authorized representatives of the bank are recorded, deposited and reconciled promptly.

Every single transaction made in the branch is firstly posted by an authorized employee and then verified by an authorized officer to detect the errors and fraudulent activity.

For example, the steps in issuing a cheque book to the customer are-

First, the account holder fills the requisition slip that contains his/her two specimen signature, date and address and submit it to the responsible officer.

Second, this requisition information is sent to the Head Office using MISYS.

Third, the cheque book is sent by the Head Office to the branch within 7 days.

Fourth, the authorized officer posting the cheque book’s serial number to the special software.

Fifth, any customer service officer match the account holder’s specimen signature on the requisition slip with the signature recorded in the MISYS.

Sixth, matching the signature, the cheque book is given to the customer by taking one more specimen signature of the account holder in the cheque book issue register. It is to be noted that cheque books are given to the customers maintaining the serial numbers to utilize the resource and to have a proper record of cheque books.

Finally, the posted serial numbers are verified by the Operational Manager of the branch.

Documentation procedures:

Documents are the physical objects upon which transactions are entered and summarized IFIC Bank Limited maintains all kinds of documents necessary to provide evidence and to minimize fraud and errors, regarding cash receipts.

This is to be remembered that Pallabi branch provides Retail Banking, Corporate and Investment Banking, and SME Banking Services to its customers. It is fully on line banking, means fully computerized. As a result, all transactions made immediately input in the MISYS (software of online banking by IFIC Bank Ltd) and accounting procedures automatically done by the software. So there is no need to provide the documents for accounting entry as it is done by MISYS automatically. Moreover, in IFIC bank ltd the receipts (deposit book) are pre – numbered. All receipts are entered in the cash book whenever it is occurred or at the same day. In IFIC Bank cash book is maintained along with the printed copy from the computer.

Physical, mechanical & electronic control:

The IFIC Bank Limited has a proper and adequate physical, mechanical and electronic control to prevent fraud and errors over cash receipts. IFIC Bank does not keep the unused receipts books in safe custody under the charge of a senior official and does not issue after verifying that the previous receipt books has been fully accounted for. There is a system of reconciliation of bank accounts at regular intervals. There is also a regular reconciliation of cash in hand as per the books of account and the physical balance in hand.

To ensure physical controls over cash, the bank has –

- Vaults for cash and business papers

- Safety Deposit boxes for cash and other business papers

To ensure mechanical & electronic controls, pallabi branch has –

Alarms to prevent break-ins

Close Circuit Camera to deter theft.

There is no system of sending monthly, but, there is a system of sending half yearly statements of account to customers and other parties from whom cash, cheques or drafts are received on a regular basis and asking them to confirm the correctness of the statements.

Independent internal verification:

In many banks internal control is identified with internal audit; the scope of internal control is not limited to audit work. It is an integral part of the daily activity of a bank, which on its own merit identifies the risk associated with the process and adopts a measure to mitigate the risk. Internal audit on the other hand is a part of internal control system which reinforces the control system through regular review.

Risk Based Internal Audit (RBIA) refers, to selective transaction testing, an evaluation of the risk management systems and control procedures prevailing in various areas of bank’s operations.

The implementation of Risk Based Internal Audit means that greater emphasis is placed on the internal auditors’ role in mitigating risks.

The following four –step approach to internal control evaluation, referred to as the risk based audit approach, provides a logical framework for carrying out an audit:

- i. Determine the threats (errors and irregularities) facing the Accounting Information System.

- ii. Identify the control procedure implemented to minimize each threat by preventing or detecting the errors and irregularities.

- iii. Evaluate the control procedures. Reviewing system documentation and interviewing appropriate personnel to determine if the necessary procedures are in place is called a systems review.

- iv. Evaluate weaknesses to determine their effect on the nature, timing, or extent of auditing procedures and client suggestions. This step focuses on the control risks and if the control system as a whole adequately addresses them.

The risk – based approach to auditing provides auditors with a clear understanding of the errors and irregularities that can occur and the related risks and exposures.

At pallabi branch of IFIC Bank Ltd, the supervisor independently checks the cash books or cash prints everyday to ensure up to date recording. At the branch, the surprise count of cash balance is carried out periodically by the internal auditor or by another independent official who does not have any duties relating to handling cash or accounting for it. The internal audit of receipts is conducted regularly.

Bonding employees who handle cash:

Bonding involves obtaining insurance protection against misappropriation of assets by employees. It contributes to the safeguarding of cash in two ways:

- First, the insurance company carefully screens all individuals before adding them to the policy and may reject risky application.

- Second, bonded employees know that the insurance company will vigorously prosecute all offenders.

In IFIC bank, there is adequate insurance against theft, misappropriation of cash etc.

Rotating employees’ duties:

These measures deter employees from attempting thefts since they will not to be able to permanently conceal their improper actions. That’s why the duties of the various people specially relating to cash (receipts) are rotated periodically.

Others control for the receipt of cash:

The following controls are incorporated in IFIC Bank over miscellaneous receipts like sale of scrap/IPO shares:

- Checking number of application equivalent with the receipt cash amount from the customers;

- Checking forgery of notes;

- Carefully scroll numbering so that no mismatch is occurred.

The controls which are executed for over the counter receipts of cash are given bellow:

- Carefully matching the name and A/C number of customers;

- Checking whether the amount in figure is equivalent with amount in words;

- Checking the forgery of notes;

Internal control system over the cash payments

Establishment of responsibility and segregation of duties:

An essential principles of internal control it assign responsibility to specific employees. Control is most effective when only one person is responsible for a given task as well as the different individuals are responsible for related activities. At the pallabi branch, the duties relating to payments are so allocated that no single person has exclusive control over an entire transaction.

Documentation procedure:

Documents provide evidence the transactions and events have occurred. Companies should establish procedures for documents. Documents should be –

Pre – numbered consecutively to facilitate control over missing documents;

Prepared at the time a transaction takes place, or as soon as possible thereafter;

Sufficiently simple to ensure they are clearly understood;

Constructed in a manner that encourages correct preparation.

In IFIC Bank the payments are recorded promptly in the cash book along with printed copy, so that they can make adequate control to ensure no payment is made twice against the same bill, they also mark the payment voucher as “paid” once the payment has been made. In order to ensure effective internal control all cheques are pre – numbered.

Physical, mechanical, and electronic controls:

To maintain adequate internal control, it is essential to protect assets and records. Physical controls relate to the safeguarding of assets. Mechanical and electronic controls also safeguard assets and enhance the accuracy and reliability of the accounting records. In IFIC Bank branch, there are adequate controls for safe custody of cheque books.

In IFIC bank there is no system of sending monthly, but, there is a system of sending half yearly statements of account to customers to whom payments are made on a regular basis and asking them to confirm the correctness of the statements. They also check out arithmetical accuracy of payment documents before approving a payment.

- Best practices by the IFIC Bank:

- Compare payments to payment records.

- Record cash payments when paid.

- Perform periodic surprise cash counts.

Independent internal verification:

In IFIC Bank Ltd, an independent audit & inspection mechanism is working to review the effectiveness of internal control at branches/divisions. Internal control unit has also been set – up at all branches with the existing manpower to minimize irregularities or lapses, to prevent frauds/forgeries and to control risk at the operational level. The audit committee of the board constantly monitors the function of internal control and compliance division and reports to the Board of Directors on quarterly basis. IFIC Bank pallabi branch, regularly conduct internal audit of payment to protect their cash effectively and efficiently.

Rotating employees’ duties:

At the pallabi branch, the duties of the employees, especially who are authorized for cash counter (For Payment or receive) rotted periodically to deter whether the employees are comply with rules and regulations or not, whether they attempting any fraudulent activities, any misrepresentation or not.

Other controls for the payment of cash:

For cash disbursements under voucher system the authorized officer’s sign as well as the manager’s sign is mandatory.

Controls for the petty cash fund system:

In IFIC Bank, for the petty cash fund system they follow a strict rule, to assure the effective internal control. Vouchers must have to be signed by authorized officers even those to be signed by branch manager to end petty cash fund system.

Controls for the electronic fund transfer (EFT) system:

The term electronic fund transfer (EFT) refers to making cash payments electronically rather than by check. EFT is usually accomplished through the banking systems automated clearing house (ACH) network. The following control procedures are adopted for the electronic fund transfer (EFT) system:

- Providing individual card with password for making transaction.

- Card blocking system for more than three time of falsie password pressing.

- Using Close – circuit camera.

Liquidity controls of the IFIF Bank Ltd, Pallabi Branch:

One of the important ingredients of a good Bank Management is to maintain “Liquidity”. To control and to safeguard this liquidity factor, there are two types of limits for cash money that is insured against any accident. These are –

- Counter Limit: The counter limit for cash money is TK.10, 00,000. This amount is fully insured by the bank. If this amount is exceeded then it is sent to the vault to maintain the counter limit and to safeguard the money by insurance.

- Vault Limit: The vault limit for cash money is TK. 50, 00,000. This amount is fully insured by the bank. If this amount is exceeded then it is sent to the Head Office to maintain the vault limit and to safeguard the money by insurance.

Problems in implementing internal control system in IFIC Bank:

The officers are yet to be habituated with the new ideas of Internal Control and Compliance Division (ICCD).

Some of officials think that compliance of ICC is rather important, than actual work.

Even well designed internal controls can break down. Employees sometimes misunderstand instructions or simply make mistakes. Errors may also result from new technology and the complexity of computerized information systems.

High level personnel may be able to override prescribed policies and procedures for personal gain or advantage.

Control systems can be circumvented by employee collusion. Individuals acting collectively can alter financial data or other management information in a manner that cannot be identified by control systems, etc.

Findings

From the analysis of Internal Control & Compliance System over cash receipts and cash payments in IFIC Bank Ltd, I have found the following major issues:

The bank applies the Risk Based Internal Audit (RBIA) in conducting the audit activities.

Duties relating to both, cash receipts and cash payments are effectively allocated, so that, no one has an exclusive control over the ransactions.

The policies, procedures and principles of Internal Control System of IFIC bank are not elaborately and logically explained in the “Internal Control and Compliance Manual”

The unused receipt books and cheque books are not kept in safe custody under the charge of a senior officials and issue without verifying that the previous receipt books have been fully accounted for.

There is a system of insuring that cash, cheques, etc collected by the authorized representative of the bank, are recorded, deposited and reconciled promptly.

In IFIC Bank, there is no system of sending monthly, but, there is a system of sending half yearly statements of account to customers and requesting them to confirm the correctness of the statements.

There is adequate insurance against theft, fraud, misappropriation o f cash etc.

There is a system of regular reconciliation of cash in hand as per the books of account and the physical balance in hand.

The bank regularly conducts an internal audit of receipts as well as the payments.

The bank maintains the cash book along with the printed copy from the computer.

In IFIC Bank Ltd, there is a system of surprise count of cash balance carried out periodically by the internal auditor or by the independent official who does not have any duties relating to handling cash or accounted for it.

The duties of the employees, related to cash are rotated periodically.

Internal controls can be broken down. Because, employees sometimes misunderstand instruction or simply make mistakes.

Control systems can be circumvented by employee collusion.

In IFIC Bank Ltd, officers are yet to be habituated with the new ideas of Internal Control and Compliance Division (ICCD).

Some of officials think that compliance of ICC is rather important, than actual work.

RECOMMENDATIONS & CONCLUSION

Recommendations:

Though IFIC Bank Ltd has a strong internal control system but nothing is perfect in this world. So, in order to ensure better internal control system over cash receipts and cash disbursements IFIC Bank should take deep attention on the followings:

- The policies, procedures and principles of Internal Control System of IFIC bank should be more elaborately and logically explained in the “Internal Control & Compliance Manual” in accordance with its banking activities and accounting standards.

- The bank should keep the unused receipt books and cheque books in safe custody under the charge of a senior officials and issue only after verifying that the previous receipt books have been fully accounted for.

- The IFIC Bank should send monthly statements of account to customers and requesting them to confirm the correctness of the statements.

- IFIC Bank should take necessary steps to make habituated the officers with internal control and compliance activities.

- Officials’ should give equal importance on compliance of ICC and actual work.

- The bank should take appropriate corrective action to avoid employees’ misunderstanding.

- IFIC Bank should take preventive action to avoid employee collusion.

Conclusion:

The IFIC Bank Limited is one of the top banks in Bangladesh. This organization is much more structured compare to any other bank operating in Bangladesh. Especially, in retail, and SME banking, the bank is showing an excellent performance. The bank aims to be the first in retail banking within the next 2 years and how it is performing, it shows that the day is not so far when it will reach to its destination.

Duration of three month internship, I have attempted to analysis the Internal Control System of IFIC Bank over the cash receipts and cash payments. In spite of the time and information I have known that the IFIC Bank has an effective Internal Control System operated by its ICC department over the cash receipts and cash payments. This Internal Control System of IFIC has several policies, procedures and guidelines comply with the Bangladesh bank’s rules and regulation and consistent with the bank’s banking activities. After analyzing the primary and secondary data I realize that the Internal Control System of IFIC Bank Ltd, helps the organization to manage its cash department in an efficient manner.

The Internal Control System of IFIC Bank Ltd ensures the accountability, reliability, completeness, and timeliness of financial or cash related information. It also ensures that all personnel in cash section complying with applicable laws and regulation. All these activities of the Internal Control System continuously help the International Finance Investment and Commerce Bank Limited to achieve its goals and objectives in time.

Bibliography:

- Weygant Jerry J, Kieso Donald E, Kimmel Pual D. Accounting Principles, (8th edition) 2008.

- Arens Alvin A. & Loebbecke James K. AUDITING (An integrated approach) (8th edition) 2009-2010.

- Annual Report 2009

- Manual of internal control system.