Executive Summary

Banking system of Bangladesh has gone through three phase of development nationalization. Privatization and Financial Sector reform. Export Import Bank of Bangladesh Limited, one of the leading private commercial banks, is promoted by a group of renowned Bangladeshi entrepreneurs, and started its banking operation on 3rd August 1999. All branches are situated in the highly demanded areas.

Export Import Bank believes in moral and material development at the same time. Interest or Usury has not been appreciated and accepted by the “Quaran” Export Import Bank Limited avoids “interest” in all its transactions and provides all available modern banking services to its clients and want to contribute in both moral and material development of human being. The bank provides a broad range of financial services to its customer and corporate clients.

As a new bank, Export Import Bank Limited has been competing with other private banks where all the banks are adopting different incentive programs to attract the customers. Accordingly, EXIM Bank is offering different type of deposit schemes bearing highest rate of return.

The whole working process of EXIM Bank Ltd. Panchaboti branch is divided into three sectors- a) General Banking Section. b) Foreign Exchange Section. c) Credit / Investment section.

General Banking is the starting point of all the banking operations. It is the department, which provides day to day services to the customers. It involves with accounts opening section, cash section, and remittance section and clearing section. It open new account, remit funds, issued bank draft, pay order etc. Provide customer through quick and sincere service is the goal of general banking section.

During making of this report I have made an in- depth interview about the customer satisfaction and their impression about the banks products and services. Here, I got experience of different taste and got some learning.

From that interview I collect as many information, which is helpful for the bank. The concept of Banking has changed and people now think about modern Banking and wants to have sophisticated products and services. Now a day’s customer of the bank supposed to get the availability of information related to products and services. The management of the bank need to ensure so many things like quick service, friendly environment, fully automated services, available ATM booth, set up customer service center, reliable interest rate, more branches in suitable location, launching of on line banking through all over the branch etc. Now measure of service depends on the extent of customer satisfaction about the product and service they are receiving. So the bank must ensure customers are satisfied to their services they are delivering. For this they may engage some experts for ensuring this. The internship topic may be related to this, the intern may help to collect related information through some exploratory work.

EXIM Bank has a history of its own. It has huge client’s lists with 62 branches network in the country, through it is lacking so many things. But I believe solving of the arising problems and implementing the facilities of modern Banking and technology it could reach in higher position.

Lastly one major thing about my internship, which gave me an opportunity to work in banking sector with major responsibility, and the experience I got will be a memorable part of my life.

Background of the Study

Knowledge and learning become perfect when it is associated with theory and practice. Theoretical knowledge gets perfection with practical application. As the parties, educational institution and the organization substantially benefit from such a program “INTERNSHIP”. That is, students can train and prepare themselves for the job market. So I choose EXIM BANK BANGLADESH LTD to get experience as an internee and developed a positive attitude toward job. Because this is a well reported service providing organization of Bangladesh. EXIM Bank also practices Islamic banking system. I am very curious about Islamic Banking.

Scope of the study

EXIM Bank Bangladesh limited is now well growing and it’s containing sixty two branches in all over Bangladesh. The scope of the study will be different banking operation and the “Identify the customer expectation for satisfying their need” EXIM Bank, Panchaboti Branch. For the purpose of my internship program, I am working in the panchaboti Branch at EXIM and this provides me the way to get myself familiarized with banking environment. I have an opportunity to gather experience by working in different departments of the branch.

Objective of the study

There have two types of objective.

Broad objectives

Specific objectives.

The broad objectives of the study are:

The broad objectives of this study are the “Identify the customer expectation for satisfying their need” EXIM Bank, Panchaboti Branch.

The specific objectives of the study are:

The specific objective of this research is to “Identify the customer expectation for satisfying their need” EXIM Bank, Panchaboti Branch.

Methodology of the study

This research is an exploratory research. The primary source of the research is in depth interview of different customer of EXIM Bank, panchaboti Branch. The secondary source is the brochure, wed site of Bank. In sampling process random sampling is used. Sample size is 30. The question is open ended. With the help of content analysis I analyzed the data. The data for the intended research will be gathered through the questionnaire formulating open ended structured questionnaire.

Due to time and other restrictions, the in-depth interview was restricted into a small amount of client of EXIM Bank, panchaboti Branch.

There are huge numbers account holders EXIM Bank, Panchaboti Branch. It is quite impossible to conduct the in-depth interview with all of those. So, I had decided to use the random sampling method.

Data gathering method

Structured open ended questions are used to collect data from the respondents. Seven hypotheses had been constructed to develop attributes that are expected to have strong impact. The constructs and operational definition of each hypothesis is given to this report. Some demographic questions were also asked for more in-depth interpretation of the respondents.

Pre-testing

The originally developed questionnaire will be pre tested with some dummy respondents to ensure the quality of the questionnaire in terms of preciseness, conciseness, objectivity, and understand ability of the questions.

Limitations of the study

In spite of the best effort we could not collect some of the information required at the time of report.

Due to lack of experience, we faced many problems during the report. In many cases we failed to obtain accurate information, which is perhaps due to lack of the experience in data collection and report writing.

The magnitude of the report was critical so the allocated time for preparing the report was not adequate. Due to lack of time we could not collect details information about related areas.

Back ground of the organization

“Export Import Bank of Bangladesh Limited” (EXIM Bank Limited) was named before Bengali “Bengal Export Import Bank Limited” being newly formed commercial bank of the country with a distinctive identity was opened in 3rd August 1999. With the permission of “Bangladesh Bank” under banking companies Act-1991. The bank received the certificate of incorporation #C-37884 (2164)/ 99 under the company Act of 1994.

EXIM Bank Ltd. Was established in 1999 under the leadership of Late Mr. Shahjahan Kabir founder chairman who had a long dream of floating a commercial bank which would contribute to the socio – economic development of our country. Mr. Nazrul Islam Majumder became the honorable founder chairman respectively.

The Bank has migrated all of its conventional banking operation into Shariah Based Islamic Banking since July 2004.

Organization Offer

The organization offers total banking support for all the Bangladeshi citizens with some of their distinctive features by their many branches throughout the country. All customers get general banking support, gets loan and gets the facility to transfer and receive many around the world for their personal or business need.

Local and International Competitors

After considering some critical reason like Deposit accounts, Investment accounts, Authorized capital, paid capital, Reserve position, Scope of providing services, work forces, total income, Expenditure, EAT, Dividend per share, Total asset and fixed asset it has been found that the bank is in a very good position.

It is a local bank and following Islamic Banking system. So from this point of view the local other Islamic banks are the main competitor of this bank and same of those competitors are the Islamic Bank of Bangladesh, Shahjalal Islamic Bank of Bangladesh, Al- Arafah Islamic Bank Ltd. etc.

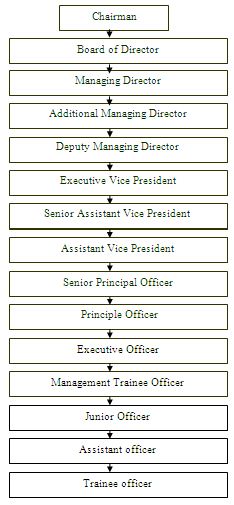

Organizational Structure

Corporate Culture

EXIM Bank is one of the most disciplined banks with a distinctive corporate culture. The bank believes in shared meanings. Shared understanding and shared sense making. Banks people can see and understand events, activities, objectives and situation in a distinctive way. They mould their manners and etiquette, character individually to suit the purpose of the bank and the needs of the customers who are of permanent important for the bank. The people in the bank see themselves as a tight knit team or as family that they believe in working tighter for growth. The corporate culture they belong has not been imposed; it has rather been achieved through their corporate conduct.

Legal Status

It is a private limited company and its total name is Export Import Bank of Bangladesh Ltd. But EXIM Bank wants to make a substantive contribution to the society where it operates.

Vision and Mission

Vision

The slogan of Export Import Bank of Bangladesh Limited “Together Towards Tomorrow” expresses most of the vision of EXIM Bank, which is leading the banking sector with the blessing of satisfied customers.

Mission

Every financial institution want earn at least a reasonable profit for its long term survival and also want to obtain a sustainable position in the banking sector in the country.

In keeping this in mind, EXIM Bank’s corporate missions are-

- To provide high quality financial service in export and import trade.

- To provide efficient customer service.

- Maintain corporate and business ethics.

- To become trusted repository of customers money and their financial adviser.

- To make its products superior and rewarding to the customers.

- To display team spirit and professionalism.

- To have a sound capital base.

- To enhancement of shareholders wealth.

- To fulfill its social commitments by expanding its chair table and humanitarian activities.

Decision making process

Usually top management that means the manager or the 2nd manager usually makes all the decisions. They also create pressure to subordinate to execute those decisions. Top management always links with the other officers, executive and staffs as well as with clients to maintain daily banking activities. They don’t maintain any specific uniform to separate boss and subordinate or workers.

Decision about the investment and loans are mainly taken by the managers and the executives working on this section. Other decisions about general banking are usually taken by the officers. But if they faces any problem then they takes help or suggestions from the top level executives or from the 2nd manager or from the manager.

Other internal banking decisions also taken by the manager but most of the time the manager took into consideration the opinion of other officials before taken a major decision.

Management Style

The administration management style is classical management style. Classic management style is a method for efficiency and facilitating planning, organizing and controlling. Classic management style is effective for EXIM Bank Ltd. Because by using this style the organization progress the efficiency of their employed.

Maintenance department policies/Training program/Expectation

Maintenance department policies and procedures were not clearly presented. There has an effective training program for all level of the employees.

Approximately eighty percent of expectation was fulfilled expect some critical ego tie matters. They even wasn’t concern about to serve us a cup of tea in a whole day but each of the officers were taking it 3-4 times.

Communication rate between managers, assistant or the work team

Communication rate between the manager, assistant and work team is moderately high. For achieving any kind of organizational goal most of the time they frequently communicate with each other. This is a modern bank and to survive in this era of high competition, they are bound to maintain frequent relationship with each other.

Daily work plan

Daily working hour of this organization is 8 hours, from 9 A.M. to 5 P.M. five days a week, except Friday and Saturday. But sometimes it needs 2 or 3 hours more to compete the works. Lunch hour is not fixed, whenever who feels less pressure he takes his or her lunch. They are very much conscious about them daily routine assignments and attendance.

SWOT Analysis

The Bank’s strength and competitive capabilities can be shown by the SWOT analysis. The SWOT analysis is grounded in the basic principal that strategy – making efforts must aim at producing a good fit between a company’s resources capability and its external situation. The SWOT analysis of EXIM Bank Limited is as follows:

Strength

- Reputation of the Bank: The banks have provided services successfully and have achieved goodwill among the Shariah Based Banks.

- B. Sponsor: EXIM Bank has sponsors from various sectors of Bangladesh. The most successful entrepreneurs from various sectors started this company. As a result there was a combination of different thoughts and skills in the management of the bank, which is very much essential for success in today’s competitive market.

- C. Top management: EXIM Bank has a very competent and experienced top management.

- D. Shariah Based Banking: EXIM Bank is operating based on Islamic Shariah. As Bangladesh is a Muslim country, the shariah banking has been able to attract customers.

- E. Branches: EXIM Bank is operating their business all over the country with 62 branches and still planning to expand their business by opening new branches in the country. It has strengthened the distribution of the bank’s services

Weakness

Promotion: The bank does not have any formal promotional activity. They do not give any sort of advertisement or do not have any marketing activity. They do not even too bill boards. This is why they are far behind the competitive in the private banking. Even some people do not know that EXIM Bank is operated according to shariah. Some people think EXIM Bank is responsible for Import and Export only.

Opportunity

A. Consumer Banking: EXIM bank is operating corporate banking. In our country there is a huge opportunity of customer banking. So EXIM bank a reposition their branding and introduce consumer banking with corporate banking.

B. ATM: The banking sector of the country is becoming modernized in the country. People like to draw money any time from anywhere. So ATM card is getting popularized in the country. EXIM Bank can introduce ATM system in their bank. More over, Shariah Based banks are not providing ATM cards. So those who want ATM card but do not like interest, they can be attractive by ATM card issued by a Shariah based Bank.C. More Branches: The economy of the country is expanding. The business outside Dhaka is also expanding. As a result, the demand for banking service is increasing day by day. So EXIM bank can open more banks in the country and can expand their business.

D. Shariah Based Banking: In our country people are religious. Most of the people are Muslim. They are becoming educated and know the bad impact of interest. So they are moving towards Shariah based banking. EXIM Bank takes this opportunity.

E. New products: The intention of the people has been changing. They now want to save more. They also want some benefit on their saving. So EXIM bank can introduce more products and schemes.

Threat

A. Competitions: In Bangladesh, after economic reform, more private bank has started their operation in the country. They are coming with different types of attracting products. This has increased the completion among the private banks.

B. Devaluation of local currency: The value of local currency is decreasing. So investment in local banking is decreasing. More over the inflation is increasing in the country. So people want to save money but in a, any cases they cannot. As a result, the banks are getting less deposit.

C. Bank default: There is a tendency of the people of the country to become bankrupt. Few days ago oriental bank has a great suffering. In our country, the receivable from top 20 bankrupt companies stood 88.36 billion. This is discouraging banks to make new investment.

Major learning’s from organization

I have learned many things while I was working in the bank as an internee. I already mention I worked in the general banking departments many section. I have learned there the works in accounts opening, FDR, closing account, cheque book issue, bills collection, transferring.

My expectation of working in a bank truly met up. Because I wanted to work in an environment where I will have friendly generous environment, where I would able to learn new things, where I would have scope to serve clients directly, where I could have opportunity to understand people about their need and demand, where different segments of customer and their characteristics, demographic profit I could able to know under one roof.

My interest during my internship period was to learn about banking system and the ways of doing the banking activities. Truly speaking it’s not possible for one to learn all the and out of banking system within three month.

I have initiated for doing new think one after another, I worked in General Banking department except in the cash counter. I have moved and learn many sections work. I took the initiative for learning about foreign exchange department.

My major field was marketing. The internship program relates to the marketing field in the following way like I able to learn about different market segments, their geographic and demographic and demographic location, competitive factors, problem identification and its solution, I relate it to the terms of customer satisfaction and improvement of product and services of the bank.

Recommendation

After completing my internship program I have made an in depth interview of the customers of EXIM bank mirpur branch on customer satisfaction. Through this in depth interview I have asked several questions related to the Banking service and their expectation about it.

I have gathered the following information which is helpful for management of the EXIM bank. For the probable solutions of the identified problems to ensure better progress to EXIM bank in future, some necessary steps are bellow on the basis of collected data, observation expert staffs’ opinion and my knowledge and judgment.

- For improving customer satisfaction the information related to customer should be available to branch.

- For the customer satisfaction service delivery should be given within 10-15 minutes.

- While delivering of services friendly behaviors should be ensured by the employees because it became a necessity of customers.

- Offices should be decorated with the help of interior design companies. Because the better interior and nice location of the branch could be an incentive for customer satisfaction.

- Available sitting arrangement for customers in the bank could be a good sign for satisfaction of customers.

- Customers are the heart of the organization. They should provide more space in the office and if possible they should have some entertainment facilities.

- The bank sanction loan to corporate client only but it should provide loan in SME sector in order to develop the socio-economic condition of the country.

- The product and services of the bank should be new and competitive.

- Definitely to be competitive and ensuring of fastest services for customers satisfaction online banking system should start over the branches as fast as possible.

- Online banking service should be introduces by all over the branches as soon as possible.

- Banking services may be given 24 hours on the main branches if possible.

- ATM booth should be available especially in the major areas. Like city and commercial areas.

- Interest rate should be flexible and if possible it could bring down fewer than 10%.

- Token system can be introduced in case of service providing in the Bank.

- Number of branches should be more and in the suburban areas.

- Product and services should be according to customer’s satisfaction and new one.

The Bank may use the intern students in research work of customer satisfaction, product and service demand and current market situation of their bank besides the daily work.

Conclusion

EXIM bank ltd. is a third generation bank. It is committed to provide high quality financial services to contribute to the growth of G.D.P of the country through stimulating trade and commerce, accelerating the pace of industrialization, boosting up export, creating employment opportunity for the educated people, poverty alleviation, raising standard of living of limited income group and overall sustainable socio- economic development of the country. The is not so far when it will be in a position to overcome the existing constraints and it may be expected that by establishing a network over the country and by increasing resources this bank will be able to play a considerable role in the portfolio of development of financing.

Banks always contribute towards the economic development of a country. Compared with others bank EXIM Banks is contributing more by investing most of its fund in fruitful projects leading to increase production of the country. It is obvious that right channel of banking establish a successful network over the country and increase resources. It is rendering its banking services with the needs of the nation to cope with the demands of the people in the country. More over it is shariah based bank, which does not provides any interest. They just provide a portion of profit to his account holder.

Management of EXIM Bank should think of providing sophisticated services and a comprehensive study of the branch performances, employees and customer relations, should focus on customer satisfaction on priority basis. The use of modern technology and fully automated services to be ensured by the management, there should be a scope to invest in small and cottage industry and ensuring loan fir these sectors.

By stepping into new and aggressive strategy EXIM Bank can make a difference in Bangladeshi’s banking sector. By constantly reviewing its systems, policies, process and prices of its products and services, ensuring various facilities, use of modern technology and establishing a bond with the customers it could reach in leading position. By ensuring customer satisfaction and meet up the market demand it could be the pioneer in the banking sector.

From the discussion it can be concluded that EXIM Bank playing an important role in the economic development of the country and it has prospect future to have a very good position in the banking sector. To do this it should increase promotional activities to reach to the people easily. From the learning and experience point of view I can say that I really enjoyed my internship at EXIM Bank Ltd. from the very first day. I am confident that this three month internship program at EXIM Bank Ltd. will definitely help me to realize my further carrier in the job market.