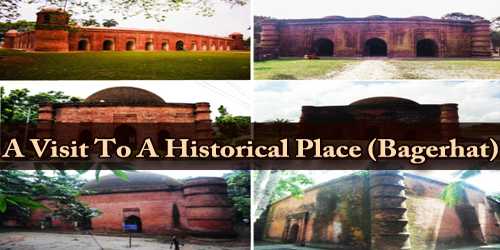

Ancient Money

In order to better understand what money is and what role it plays in our lives, we should begin by defining what we mean by the word ‘money’. Simply put, money is nothing more than what is offered or received for the purchase or sale of goods and services. The earliest money came in many forms–cattle, salt, grain, tobacco, whiskey and stones, to name a few. In Southeast Asia, the use of cowry shells (bia) dates back to pre-history.

Traders realised that it was easier to assess the quality and weight of metals than other commodities. References to the use of gold and silver as money can be found in 3000 year old Hindu epics. During the Srivichai period from 850 to 1450 (1400 – 2000 BE) each region in what is today Thailand had its own distinct form of money. In the South, the ‘namo’, a coffee bean shaped silver piece stamped with a Sanskrit letter, was introduced via Indian traders. Silver bracelet money (‘gamlai meu’), droplet money (‘ngoen tork’) and Chinese money were all commonly used in the Lanna kingdom in the north; while, in the Northeast, merchants under the influence of the Lan Chang empire, used bar-shaped ingots made of various metals, known as ‘hang’, ‘tu’, ‘hoy’, and ‘lat’.

With the emergence of Siam as a modern state, the use of bullet money (‘ngoen paduang’), became more widespread. The bullet money, 89 to 95% silver and marked with the stamps of the King, the government and the smith, was known to villagers as ‘bent leg’ money (‘ngoen ka ngor’) or ‘coiled pupa’ money (‘ngoen kad duang’) due to its appearance. Initially, bullet money was produced by both government and private silversmiths; while the bullet money of the government was supposed to be uniform, the bullet money of the silversmiths varied greatly in size, weight and composition. Various attempts were made to restrict the production of bullet money to government-sanctioned smiths.

After the Bowring Treaty in 1855 (2398 BE), foreign coins began to enter Siam along with the flow of trade. During this period, Mexican, Peruvian, Dutch, Chinese and Indian coins were commonly used. The Royal Minting Department produced the first Siamese coins, known as ‘pae’ in 1860 (2403 BE). Along with increased usage of coins came the discovery, as had been made in Europe, that by slightly altering the coins–lowering the precious metal content slightly or shaving a little bit off the edge of the coin–enormous profits could be had. Eventually, the Siamese government was forced to re-stamp all foreign coins coming into the country in order to assure Siamese citizens that they were genuine. The use of bullet money was finally outlawed in 1904 (2447 BE) by Rama IV–silver artisans could simply not produce enough bullet money to meet the increasing demands of foreign trade. This coincided with the introduction of both coin presses and foreign-made paper notes to the Siamese Kingdom.

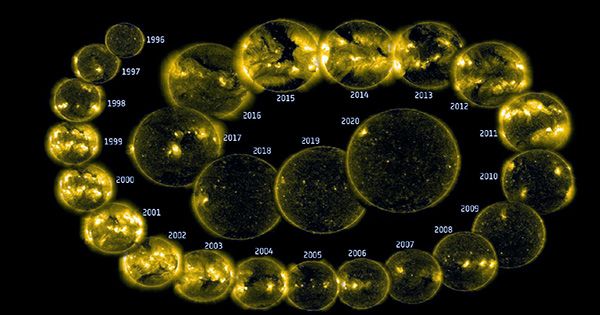

A Comparative Chronology of Money

A detailed chronology of money in its social and political context from the very earliest times onwards. Around the next corner there may be lying in wait apparently quite novel monetary problems which in all probability bear a basic similarity to those that have already been tackled with varying degrees of success or failure in other times and places. The chronology is split into sections by period to provide faster access.

Inflation and the Pendulum Metatheory of Money

Keynesianism and monetarism have many precursors. Why does a monetary theory enjoy a vogue then give way to an opposing theory which in turn is displaced by a theory similar to its predecessor? There is a perpetual conflict between the interests of debtors, who seek to enlarge the quantity of money and creditors, who seek to maintain or increase the value of money by limiting its supply. Military expenditure and population pressures affect this conflict of interest. Furthermore money is fungible by nature and always attracts substitutes.

Origins of Money and of Banking

The use of money evolved out of deeply rooted customs as is shown by the study of primitive forms of money, e.g. cattle, cowrie shells, whales teeth and manillas (ornamental jewellery). The clumsiness of barter was merely one factor in the development of money, and not the most important one. Banking was invented before coins and reached a high level of sophistication in the Egypt of the Ptolomies. Military conquests, such as those of Alexander the Great, spread the use of coins which became the most convenient means of payment.

Warfare and Financial History

From blood money payments in primitive societies to the military-industrial complex of the present day developments in warfare and finance have, unfortunately, been closely connected. Even the word to pay comes from a Latin word meaning to pacify. This essay covers conflicts from the wars between Ancient Greece and Persia to World War II. Warfare played an important part in the spread of the use of coinage and the invention of the national debt, while the adoption of paper money in the West was both a cause of the American Revolution and a means of financing it.

The Significance of Celtic Coinage

The Celts on the Continent and in parts of Britain produced large numbers of coins before the Roman conquest. The Anglo-Saxon invasions put an end to minting in Britain almost completely for nearly two hundred years and in Wales production of coins did not become common until after the English conquest.

The Vikings and Money in England

Paying through the nose! The impact of Danegeld – history’s best-known protection racket! In an age when a penny was a substantial sum of money literally millions of silver pennies were minted in England to buy off the Viking invaders. (This essay is also available on originally the Viking Network for Schools, for which it was originally written).

Money in North American History

The British colonies in North America were chronically short of coins and were forced to use various substitutes including wampum, like the native inhabitants, and tobacco. The enthusiastic adoption of paper money and its suppression by the British was a factor in provoking the American revolution, which was financed by hyperinflation. Ever since independence banking has been the subject of political controversy and although the US emerged from the two World Wars as the dominant superpower the US financial system may be in relative decline.

The Origins of the term Dollar and the Dollar Sign

The word “dollar” was used by Shakespeare and derives from “thaler” the name of a European coin. An outline of the convoluted history of central European thalers, Scandinavian dalers, the Spanish peso, the American dollar, and dollars used in Britain and the British Empire, and in China.

Britain and European Monetary Union

Why is Britain sceptical? The pound Sterling has a very different history from continental currencies. Other European countries have more experience with currency unions, e.g. the Latin Monetary Union of 1861-1920, the Scandinavian Monetary Union which lasted until 1924, and the Zollverein of 1834 which led to political union between the German states. Furthermore the history of the pound sterling goes back 1,300 years whereas most European currencies date back only to the end of the Second World War since that conflict led to the destruction and reform of their previous currencies. Consequently a change of currency would arouse more suspicion in Britain than on the Continent.

Democracy and Government Control of the Money Supply

When coins were the predominant form of payment governments controlled minting. The development of modern banking and paper money broke the government monopoly of money creation and fostered the growth of democracy. Will the advent of electronic money have a similar significance?

Third World Money and Debt in the Twentieth Century

The pressure of a rapidly expanding world population on finite resources is a virtually silent explosion as far as monetarist literature is concerned. The task of enabling millions of the world’s poorest men and women to earn a decent living for themselves is the greatest problem facing mankind. Re-anchoring the runaway inflation-ridden currencies of many Third World countries is a prerequisite for successful development.

Monetary Innovation in Historical Perspective

Why Revolution always Boils Down to Evolution. A review of the major innovations, both in technology and in accounting, over the last three thousand years. This is the text of a keynote address given by Glyn Davies at a conference on e-money with the theme “Digital Money: New Era or Business as Usual?”

Money Through Revolution and War

It has been argued that the American, French, Russian and Chinese revolutions were fought on the back of paper money printed by their respective governments. The economic base and political will simply did not exist to raise the necessary funds from taxation. Moreover, no banker in their right mind would lend such enormous amounts when there was little or no intention to repay. In fact, the inflation which resulted from increases in government-issued money was far less damaging for the domestic political agenda than enormous interest payments to foreign creditors would have been. However, there is one very powerful group whose interests are negatively affected by such inflation–banks.

Post World War Two: The Bretton Woods Agreements

At the end of the Second World War, 730 policy makers from 44 countries attended the Bretton Woods conference in a small resort town of the same name in New Hampshire. While Thailand was not an original signatory to the Bretton Woods treaties, she did agree to join the gold standard in January, 1946, and eventually joined the IMF and World Bank in May, 1949. The primary objective of the Bretton Woods agreement was to attempt to reinstate the gold standard–once again–in order to facilitate international trade and protect creditors from any potential currency devaluations.

The Last Thirty Years

Like the three previous attempts at establishing a universal currency standard, the Bretton Woods agreements soon collapsed. While other nations, particularly Germany and Japan, had reinvested in more efficient industrial production after the Second World War, the US continued with obsolete manufacturing methods; this, combined with the drain of the Vietnam War meant that, as long as the US adhered to fixed exchange rates, international investors would buy in cheap markets overseas and sell in the relatively over-priced American market. By the late sixties, rumours abound that the US dollar was over-valued. Piles of US dollars sitting in European banks, accumulated from the sales of European corporations in the US, were turned into gold. For over twenty years, US dollars had been a safe bet–now it was better to put your money in gold, Deutschemarks or Swiss Francs.

By 1971, the once massive inflow of gold to the US had become an equally alarming outflow, causing President Richard Nixon to rescind his promise to pay the international holders of US dollars in gold. In an attempt to put a brave face on the unilateral violation of an international agreement, the US came up with the term ‘floating exchange rate’ to describe the ensuing devaluation of the US dollar under the Smithsonian Agreements. A similar play on words was given by Thai Prime Minister, Chavalit Yongchaiyudh, to explain his backpedalling on a promise not to devalue the baht in 1997.

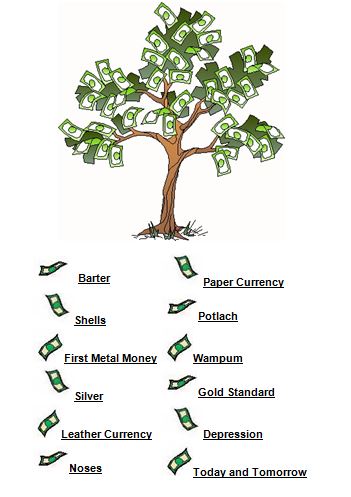

Barter

The first people didn’t buy goods from other people with money. They used barter. Barter is the exchange of personal possessions of value for other goods that you want. This kind of exchange started at the beginning of humankind and is still used today. From 9,000-6,000 B.C., livestock was often used as a unit of exchange. Later, as agriculture developed, people used crops for barter. For example, I could ask another farmer to trade a pound of apples for a pound of bananas.

Shells

At about 1200 B.C. in China, cowry shells became the first medium of exchange, or money. The cowry has served as money throughout history even to the middle of this century.

First Metal Money

China, in 1,000 B.C., produced mock cowry shells at the end of the Stone Age. They can be thought of as the original development of metal currency. In addition, tools made of metal, like knives and spades, were also used in China as money. From these models, we developed today’s round coins that we use daily. The Chinese coins were usually made out of base metals which had holes in them so that you could put the coins together to make a chain.

Silver

At about 500 B.C., pieces of silver were the earliest coins. Eventually in time they took the appearance of today and were imprinted with numerous gods and emperors to mark their value. These coins were first shown in Lydia, or Turkey, during this time, but the methods were used over and over again, and further improved upon by the Greek, Persian, Macedonian, and Roman empires. Not like Chinese coins, which relied on base metals, these new coins were composed from scarce metals such as bronze, gold, and silver, which had a lot of intrinsic value.

Leather Currency

In 118 B.C., banknotes in the form of leather money were used in China. One-foot square pieces of white deerskin edged in vivid colors were exchanged for goods. This is believed to be the beginning of a kind of paper money.

Noses

During the ninth century A.D., the Danes in Ireland had an expression “To pay through the nose.” It comes from the practice of cutting the noses of those who were careless in paying the Danish poll tax.

Paper Currency

From the ninth century to the fifteenth century A.D., in China, the first actual paper currency was used as money. Through this period the amount of currency skyrocketed causing severe inflation. Unfortunately, in 1455 the use of the currency vanished from China. European civilization still would not have paper currency for many years.

Potlach

In 1500, North American Indians engaged in potlach, a term that describes the exchange of gifts at banquets, dances, and various rituals. Since the trading of gifts was so important in figuring the leaders’ community status, potlach went out of control as the gifts became more extravagant in an effort to surpass others’ gifts.

Wampum

In 1535, though likely well before this earliest recorded date, strings of beads made from clam shells, called wampum, are used by North American Indians as money. Wampum means white, the color of the clam shells and the beads.

Gold Standard

In 1816, England made gold a benchmark of value. This meant that the value of currency was pegged to a certain number of ounces of gold. This would help to prevent inflation of currency. The U.S. went on the gold standard in 1900.

Depression

Because of the depression of the 1930’s, the U.S. began a world wide movement to end tying currency to gold. Today, few nations tie the value of their currency to the price of gold. Other government and financial institutions now try to control inflation.

Today

At present, nations continue to change their currencies. For example, the U.S. has already changed its $100 and $20 banknotes. More changes are in the works.

Tomorrow

Tomorrow is already here. Electronic money (or digital cash) is already being exchanged over the Internet.

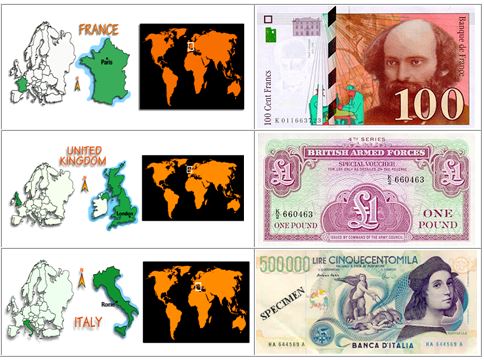

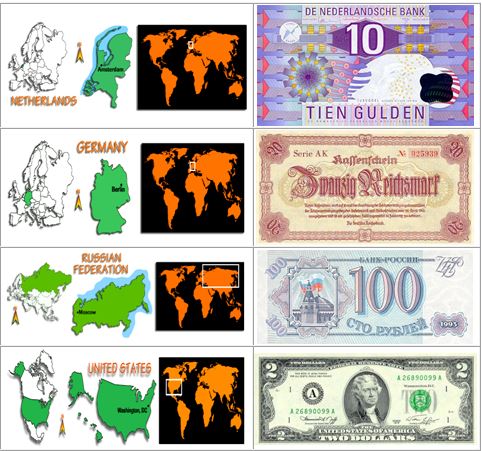

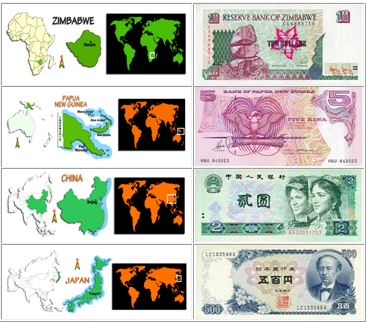

Pictures of World Paper Currencies

Article Writing by : Asad Saimon