Functional finance is an economic theory proposed by Abba P. Lerner, based on effective demand principles and chartism. It is a heterodox macroeconomic theory developed by Abba Lerner during World War II that seeks to eliminate economic insecurity (i.e., the business cycle) through government intervention in the economy. It states that the government should finance itself to meet explicit goals, such as taming the business cycle, achieving full employment, ensuring growth, and low inflation. It involves making decisions about the deficit and the money supply with regard to their functionality, not some abstract moralistic premise.

Lerner also presents some arguments concerning the effects of taxes which are not part of Functional Finance but are relevant. Functional finance lost favor for a variety of reasons. First, Lerner’s discussion of functional finance did not consider the politics of government finance; it assumed that the government could change taxes and spending according to the needs of the macroeconomy. Lerner believes that there is a multiplier effect from changes in fiscal policy that does not have an offsetting change intended to balance the budget.

Principles

The principal ideas behind functional finance can be summarized as:

- Governments have to intervene in the national and global economy; these economies are not self-regulating.

- It is the role of government to stave off inflation and unemployment by controlling consumer spending through the raising and lowering of taxes.

- The principal economic objective of the state should be to ensure a prosperous economy.

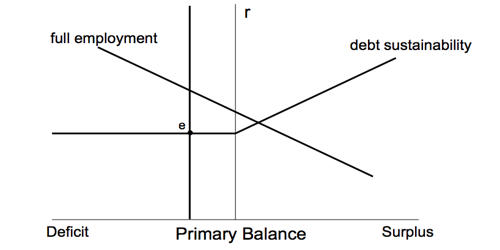

- The purpose of government borrowing and lending is to control interest rates, investment levels, and inflation.

- Money is a creature of the state; it has to be managed.

- The government should print, hoard, or destroy money as it sees fit to achieve these goals.

- The amount and pace of government spending should be set in light of the desired level of activity, and taxes should be levied for their economic impact, rather than to raise revenue.

The principles of ‘sound finance’ apply to individuals. They make sense for individuals, households, businesses, and non-sovereign governments (such as cities and individual US states) but do not apply to the governments of sovereign states, capable of issuing money. The government shall maintain a reasonable level of demand at all times. If there is too little spending and, thus, excessive unemployment, the government shall reduce taxes or increase its own spending. If there is too

much spending, the government shall prevent inflation by reducing its own expenditures or by increasing taxes. Abba Lerner’s Functional Finance generally evokes fear from fiscal conservatives and never was accepted even among Keynesian economists.