Executive Summary

This Internship report will give a clear idea about the activities and operational strategies of PBL. Especially this report focuses on the, “A study on the foreign exchange transaction on import & export of Pubali Bank Ltd.”.

Pubali Bank Limited introduces a deep line of retail products that starts with household durables and end with non-resident credit. This report critically endeavors to highlight the overall banking business-General Banking, Loans and Advances and International Trade and thereof contribution to the economy considering PBL’s performance.

Though at time PBL was a problem bank, it has shown surprising growth and performance in the last decade after the journey as a private commercial Bank, which is of course a positive sign for our economy that is why I have chosen this sector for my internship project writing. the overall mechanism & activities of general banking, international trade, and loans and advances have been discussed covering the maintenance of accounts, issuance of cheque books, online money transfer, remittance of funds, operation relating to clearing, management of deposit, credit policy, credit principles, classification of loan , import business, export business and foreign remittance which comes from different foreign countries mainly Middle Eastern countries through different Exchange Companies correspondence maintaining with PBL and total business volume of Import-Export, & Foreign Remittance of PBL. Findings have been enumerated covering general information about the activities of PBL. Finally, I have recommended the PBL to provide special care by launching projects and special strategies to its future growth.

Project Background

The internship project is the fulfillment of an active part of the internship program as per requirements for completing the BBA program. As an intern attach with Pubali Bank Limited, naturally the selected project will be related to the area by which the organization can be influenced. Pubali Bank Limited is the largest private scheduled Bank of the country. It is significant part of the Banking and financing sectors of Bangladesh, which is always playing an important role to improve the banking and financing in this country.

Bangladesh is one of the developing countries in the world. The economy of the country has a lot left to be desired and there are lots of scopes for massive improvement. In an economy like this, banking sector can play a vital role to improve the overall social-economic condition of the country. The banks by playing the role of an intermediary can mobilize the excess fund of surplus sectors to provide necessary finance, to those sectors, which are needed to promote for the sound development of the country. In this regard Pubali Bank Limited by dint of rendering the overall banking services has been playing active role in the development of our economy.

This report is an attempt to reflect the position of Pubali Bank Limited in the banking industry of the country in respect of its activities in the arena of overall banking services- General Banking, International Trade and Local Financing.

Rationale of the study

There are three types of schedule commercial banks are in our country. They are Nationalized Commercial Banks, Local Private Commercial banks and Foreign Private Commercial banks. Pubali Bank Limited has discovered a new horizon in the field of banking area, which offers General Banking, Investment and Foreign Exchange banking system.

So I have decided to study on the topic “An study on Foreign Exchange transaction on export and import of Pubali Bank Limited”.

Because the BBA program is an integrated, practical and theoretical method of learning, the students of this program are required to have practical exposure in any kind of business organization last term of this course. This report on practical orientation has been oriented above thinking. The BBA program conducted by BIU was introduced in order to provide a number of graduates in business sector; this program has been designed to facilitate the students and to provide basic theoretical knowledge and practical in the job activities in the context of Bangladesh. Students are required to work on a specific topic based on their theoretical and practical knowledge acquires during the period of Dissertation Program and then submits it to the teacher. That is why I prepared this report.

Origin of the Report

This internship report is generated under the supervision of Mr. Shajedul Alam, senior lecturer of USB Department of University of Liberal Arts Bangladesh. It is required to fulfill the BBA. The topic of this report is “A study on the foreign exchange transaction on import & export of Pubali Bank Ltd.”.

To prepare this report I have selected and got opportunity to work as an interne at Pubali Bank Limited, Foreign Exchange Corporate Branch, under the supervision of Ferdousi Jahan, Deputy General Manager, in charge of the Branch. My supervisor duly approved the topic, which was decided for doing the report. The report will definitely increase the knowledge of other students to know the financing institutions i.e. Banking Industry of Bangladesh, and the various services PBL is providing to develop this industry.

Objective of the Study

The main objective of my study is to gather practical knowledge regarding banking system and operation.

The specific objectives of this study are as follows:

- To acquire some practical experience that will be helpful in the near future.

- To find out the overall picture of Foreign Exchange Business of Pubali Bank Limited.

- To gather knowledge the function and transactions of different type of Foreign Exchange business of Pubali Bank Limited and comparison of practice based on theory.

- To identify the problems related of Foreign Exchange business faced by Pubali Bank Limited.

- To demonstrate their Strength, Weakness, Opportunities and Threats.

- To find out the reasons why people go to Pubali Bank Limited.

SCOPE of the Study

The report has been prepared from every day working experience, extensive. Discussion with the concern dealing officer of PBL, Foreign Exchange Branch, Dhaka, and the theoretical learning that I have achieved from library, journal and circular of Bangladesh Bank . It is not possible to pinpoint the each and every aspects of overall banking transaction due to this short span of time.

Methodology of the study

The study is qualitative in nature. In depth interview of the company personnel, various official documents, study case, circulars were used as instruments to collect information.

Several group discussions arranged with the concern official of the different wing of department of PBL, Foreign Exchange Branch. The study contains a huge amount of data and information. In preparing this report, I had to follow some methods to collect information:

Sources of Data

I collect my information through face to face interview and discussion with the officers of different wings of PBL, Foreign Exchange Branch. I have gone through different types of publications. I had also used published data. These are:

- Various publications of PBL.

- Annual report.

- Various reports were collected from internal bodies and library.

- Main papers and documents were collected from different wings and desks.

Procedure Of Data Analysis

For the data analysis the following steps are followed:

- Software: Computer software (e.g. Microsoft Excel) is used, which has helped to make the analysis of data collected during the research proposal easier, more efficient, and more effective.

- Tables: Frequency table, data analysis, etc have been used to describe the findings.

- Graphics: Chart wizard, graph different types of figures have been used to represent the findings from the survey.

Limitation of the Study

There were some problems efforts was applied to conduct the orientation program. A wholehearted effort was applied to conduct the orientation program and to bring a reliable and fruitful result.

In spite of having the wholehearted effort, there exit some limitation, which acted a barrier to conduct the program.

The study has suffered following limitations:

- Respondents were reluctant to fill the questionnaire, which has impeded the preparation of the study.

- Validity of the study is subject to the reply of the respondent.

- Because of the resource constraint survey as per the sample size was not possible which has restricted the accuracy of the result.

- All the concerned personnel of the bank have not been interviewed.

- Lack of in-depth knowledge and analytical ability for writing such study.

Profile of the Organization

Banking Sector in Bangladesh

In 1971, Bangladesh, was East Pakistan, emerged as an independent country. In immediately nationalized the entire Banks expanding 3 Foreign Banks, six Nationalize Banks were thus formed. In 1983 a new policy was implemented allowing private sector participation in the industrialization. As a part of this process, two national commercial Banks were against denationalization and a number of Private Commercial Banks were allowed to operate. Among these Pubali Bank and Uttara Bank were the first to be decentralized.

Pubali Bank limited is the largest Commercial Bank in Private sector. The Bank was incorporated in the year 1959 under the name and style of Eastern Mercantile Bank limited under company Act 1913. After liberation of the country in 1971, the Bank was nationalize as per policy of the Government of the People’s Republic of Bangladesh under the Bangladesh Bank (Nationalization) order 1972(PO No 26 of 1972) and was renamed as Pubali Bank. Subsequently, the Bank was denationalization in the year 1983 and was again incorporated in Bangladesh under the name and styles of Pubali Bank Limited in that year 1984 on May 20 under the license no Bl/DA/1/84. The Government of the People’s Republic of Bangladesh transferred the entire undertaking of Pubali Bank Limited, which took over the same as a going concern. It is listed in the Stock Exchanges at Dhaka and Chittagong as publicly traded company for its general class of shares. In 1983 PBL started their new journey with the deposit of Tk. 645.14 Crore and they sold 16 Lac shares in the market. It has a large asset position comprising of Tk.130, 121.42 million in March 2011. The Bank employs largest in private sector, which stood almost 5600 personnel in March 2011. Presently it has 400 branches in operations Principal branch is one of the big and important branches of PBL.

PBL intendeds to ensure the trust and confidence of the customers through focused customer’s orientation qualities of services and state of art technology. The company philosophy-A Bank for the 21st century has been precisely the essence of the legend of the Bank success.

Mission of PBL

- To get recognition as a dynamic, innovative and customer supportive Bank.

- To maintain continuous & steady growth with utmost transparency and to diversify development of resources.

- To enhance continuous development of information & technology to meet the demand and challenges of the time.

Vision of PBL

To hold the position of best private commercial bank in Bangladesh with adherence to meticulous compliance of rules and regulation and strong commitment to social responsibility.

Objectives of PBL

The objectives of the bank are to promote private sponsors to establish joint venture banks, financial companies, branches and affiliates abroad to satisfy their customers. It conveys its objective via their motto:

- Be one of the best bank in Bangladesh

- To establish, maintain, carry on, transact, undertake and conduct all types of banking, financial,

- investment and trust-business in Bangladesh and abroad

- To form, promote, organize, assist, participate or aid in forming, promoting or organizing any company, bank, syndicate, consortium, and institute or any holding or subsidiary company in Bangladesh or abroad for the purpose of undertaking any banking, financial, investment or trust business.

- To encourage, sponsor and facilitate participation of private capital in financial, industrial or commercial investments, shares and securities and in particular by providing finance in the form of long, medium or short term loans or share participation by way of subscription to the promoter shares or underwriting support or bridge finance loans and/or by any manner.

Management and organization Structure

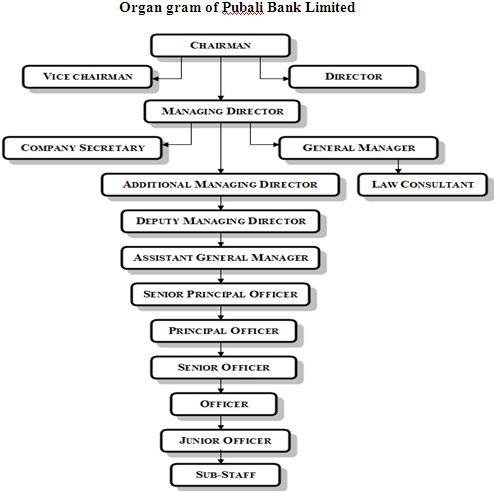

The Bank was established primarily as Private Bank. After liberation it was nationalized and it remained so for quite a long period. The Board of Directors being at the highest level of organizational structure plays an important role on the policy formulation. The Board of Directors is not directly concern with day-to-day operation of Bank. They had delegated their authority to the Managing Director who is assist by Additional Managing Director (AMD), Deputy Managing Directors (DMD) and General Managers (GM) to look after the day-to-day affairs of the Bank. The Bank is running by an excellent management team under the direct supervision of a competent Board of Directors. The Board of Directors comprises total fourteen members headed by the Chairman. Mr. Hafiz Ahmed Mazumder is the present Chairman of the Board. The Managing Director (MD) heads management team. Under him a AMD, four DMDs, a GM heads each department of the Bank. Mr. Helal Ahmed Chowdhury is the present Managing Director of PBL. The management hierarchy of Pubali Bank Limited is given below:

Credit Division

All activities related to the loans and advances are directed and controlled by this division. This division is presently headed by a General Manager. The credit deals with different types of credit, like, Commercial credit (e.g., Secured overdraft, cash credit, etc.), Industrial credit. For monitoring, follow-up, supervision of the functions and to gather market information, there is a cell in this division.

Human Resources Division

This department is assigned to do the activity related to general administration and development of human resource of the bank.

Central Accounts Division

This division maintains all sort of accounts of the bank, performs fund management, management information system, expenditure control, budgeting, etc. This department is presently headed by a Chief Financial Officer and General Manager.

International Division

International division of Pubali Bank Ltd. performs the responsibilities of foreign trade and foreign exchange and foreign remittance on behalf of the branches. The division deals with the issues regarding opening, lodgment, and payment of import of Credit, PAD, LIM, LTR, etc. This division also relates to export such as advising, negotiating, export documents, etc.

Audit Division

This division is headed by a General Manager and works directly under the control of the managing director. The division is responsible to arrange periodical internal audit, conduct special audit, follow-up and monitor the bank’s overall activities.

Consumer Credit Division

This division sanctions the loans related to household goods, car, flat purchase, educational loans etc. and makes periodical on site and off site supervision and initiate step to recover the loans. Presently the division is headed by a General Manager.

Lease Financing Division

This division is assigned to perform the task to invest in Lease asset-Equipments, Machineries, Pick up Van and son. The division promulgates policies related to Lease Finance and takes all types of supervisory steps together with the Branch.

Credit Monitoring & Recovery Division

This division is headed by a General Manager and works directly under the control of the managing director. The division is responsible to follow-up and monitor the credit at the post sanction stage and to arrange all types of procedures to recover the bad loans.

LAW DIVISION

This division is responsible for all types of legal aspects. This division is headed by a General Manager and he must be a legal representative.

General Services and Development Division

This division is headed by a General Manager and works directly under the control of the managing director. The division is responsible to arrange the bank’s overall development activities such as opening new branch and so on.

Research and development Division

This division is headed by a General Manager and works directly under the control of the managing director. The division is responsible to arrange the bank’s overall research and

Development activities such as designing product policy program, controlling product quality, creating new brand product and so on.PBL is the largest commercial Bank in private sector of Bangladesh. The Bank within stipulation lay down by the Bank Company Act 1991 and directives as received from Bangladesh Bank from time to time provide all types of commercial Banking services. It has 400 branches all over the country and among them 205 Branches is online.

The risk management of the bank covers six core risk areas of banking I.e.

- Credit risk

- Asset Liability risk

- Foreign Exchange risk

- Internal Control & Compliance risk

- Money Laundering risk, and

- Information technology risk

Business Activities Of PBL

The bank management is well conscious about its responsibilities and always uses to take calculative business risk with a view to safeguard the bank’s capital, its financial resources and profitability. The bank follows the guidelines of Bangladesh bank and other regulatory authorities in respect of risk management. As per as direction of Bangladesh bank a separate risk management unit has already been formed in the bank headed by deputy managing director (admin), deputy managing director (operation), deputy managing director (general) and all the divisional heads are the members of the unit.

The principal activities of the bank are banking and banking related business. The banking business included deposits taking, extending credit to corporate organization, retail and small & medium enterprises, trade financing, project financing, etc. Some of which are mentioned below with a brief overview of the major business activities:

Retail Banking: As part of risk diversification strategy PBL has expanded the lending activities in this sector since 2003. The loan schemes offered by the bank include Flat Loan, Household Loan, Car Loan, Education Loan, Retired Primary Teacher Loan, Loan against Salary, and Loan against Medical Equipments and so on.

SME Lending: Job creation is essential and it must come from Small and Medium Enterprise that will ultimately dominate the private sector. During 2010 bank’s Strategy was focused on customer convenience.

Corporate Credit: PBL’s strategy is to provide comprehensive service to the clients of this segment who are large and medium size corporate customers with experience in trade finance and related services.

Islamic Banking: for the development of Islamic Banking Business, in 2010 PBL had entered into the vein of Islamic Banking Business. Islamic Banking operation of the bank has been separated from the operation of conventional banking.

Correspondent Relationship or Foreign Exchange Business: Over the years, foreign trade operations of the bank played a pivotal role in the overall business development of the bank The bank has established correspondent relationships with a number of foreign banks, namely American express Bank, Bank of Tokyo, Standard Chartered Bank, Mashreq Bank, Hong Kong Shanghai Corporation, CITI Bank NA-New York And Arab-Bangladesh Bank Ltd. The bank is maintaining foreign exchange accounts in New York, Tokyo, Calcutta, and London. The bank set up letter of credit on behalf of its valued customers using its correspondents as advising and reimbursing banks. The banks maintain a need based correspondent relationship policy, which is gradually expanding.

Merchant Banking: The Bank’s operation in this sector was limited Underwriting, Portfolio Management and Banker to the Issue functions. At present this merchant banking is separated from core banking and it is regarded as the sister concerns of PBL.

Information Technology in Automation and Online Banking: All the 400 branches have been computerized and running successfully with the in-house developed software, PIBS (Pubali Integrated Banking System). Pubali Bank limited has implemented Centralized online Banking system in the year 2008 through its in-house developed software. In the mean time all branches in Dhaka, Chittagong and Sylhet have been brought under online banking system. At present 301 branches are online and it will be increased branches in the upcoming year. The rmaining branches will brought under online banking system gradually. The bank will also extend services to its customers through internet Banking and mobile phone bank phase wise shortly. The bank has developed Islamic Banking Software and 2 (two) Islamic banking wings in Dhaka and Sylhet. The bank has entered into the internet world through its website www.pubalibangla.com and has also been operating Automated Trailer Machine (ATM) and Point of sale (POS) services to meet the demand at the time. PBL also has entered into the payment system of Bangladesh Electronic Fund Transfer (BEFTN) in 2011.

Pubali Exchange and Pubali Money Payment Business: PBL has started the business of Pubali Exchange and Pubali Money Payment to facilitate the process of remittances. PBL in this regard has established 2 Exchange in London and Malaysia and will also establish another one in Italy very soon. Gradually Pubali Exchange will be established all over the world.

Products And Services Of PBL

Pubali Bank Limited offers various kinds of deposit products and loan schemes. The Bank also has highly qualified professional staff members who have the capability to manage and meet all the requirements of the bank. Every account is assigned to an account manager who personally takes care of it and is available for discussion and inquiries, whether one writes, telephones or calls. The products and services are given below:

Deposit Services:

Foreign Currency Account | Miscellaneous Services:

|

Loans & Lease Services:

| Remittance Services:

|

Last three Years At A Glance Of PBL

| SL. | Particulars | 2008 | 2009 | 2010 |

| 1 | Authorized Capital | 5,000.00 | 5,000.00 | 10,000.00

|

| 2 | Paid-up capital | 2,940.00 | 3,822.00 | 4,968.00 |

| 3 | Reserve fund | 4,606.82 | 5,687.25 | 9,411.27 |

| 4 | Total Deposits | 73,016.51 | 88,466.46 | 98,850.50 |

| 5 | Total Advance | 61,788.15 | 74,203.33 | 89,106.21 |

| 6 | Total Investment | 8,375.59 | 12,168.65 | 16,516.39 |

| 7 | Import Business | 58,009.10 | 60,493.85 | 85,683.53 |

| 8 | Export Business | 24,795.65 | 24,739.65 | 33,909.78 |

| 9 | Bridge Finance | 6.89 | 6.89 | 6.89 |

| 10 | Total Income | 9009.25 | 10,663.81 | 12,828.53 |

| 11 | Total Expenditure | 5563.39 | 6824.34 | 7343.48 |

| 12 | Pre-Tax Profit | 3445.86 | 3839.47 | 5485.05 |

| 13 | Net Profit | 1515.23 | 2092.23 | 3233.09 |

| 14 | Total Assets | 89,884.70 | 107,579.60 | 128,462.65 |

| 15 | Fixed Assets | 1383.36 | 1443.50 | 3330.32 |

| Other Information | ||||

| 16 | Number of Employees | 5321 | 5375 | 5534 |

| 17 | Number of Shareholder | 24,153 | 30,899 | 86,200 |

| 18 | Number of Branches | 371 | 386 | 399 |

| 19 | Earning Per Share(absolute EPS for tk. 10 face value) | 5.15 | 5.47 | 6.51 |

Role Of Foreign Exchange In International Trade

Since the early days of civilization, nations have engaged in trading. At the same time each nation has developed its own currency. Internationalism of trade and nationalization of currencies are two divergent phenomena, as mentioned by the French economist. As the world, by the grace of modern technology, is getting smaller day by day, the need for foreign exchange has become a part of everyday life. Globalization of the world economy for goods and services makes foreign exchange necessary for almost every citizen across the country.

Foreign exchange has a price in relation to local currency in the same way as rice, jute or any other tradable goods has a price in terms of taka and the price will vary. Foreign currencies from our point of view can very well be equated to commodities.

Local Rules and Regulation

Our foreign exchange transactions are being controlled by the following local regulations:

Foreign Exchange Regulations Act: Foreign Exchange Regulations

(FER) Act 1947 enacted on 11th March 1947 in the British India,

Provides the local basis for regulating the foreign exchange . This act

was adapted in Pakistan and lastly in Bangladesh.

Guideline for Foreign Exchange Transaction: This publication issued

By Bangladesh Bank in the year 1996 in two volumes. This is compilation

Of the instructions to be followed by the authorized Dea/Crs in transaction

Relating to foreign exchange .

F.E. Circular: Bangladesh Bank issues F.E circular from time to time control the export business and remittance to control the foreign exchange. It has one kind of supplementary and complementary action to the guideline for foreign exchange transaction.

Import-Export policy: Ministry of commerce issues Export policy and Import policy giving basis formalities and instructions for Import and Export business.

Public Notice: Sometimes Chief Controller of Import and Export issue public notice for any kind of change in foreign exchange transactions.

Instructions from Different Ministry: Different ministry of government sometimes instruct the authorized dealer directly or through Bangladesh Bank to follow something required for the government.

International Regulation For Foreign Exchange

There are some international organizations influencing the foreign exchange transactions. Few of them are discussed below:

International Chamber of Commerce: ICC is a worldwide non-governmental organization of thousands of companies. It was founded in 1919. Its headquarters is in Paris. For managing and controlling the international trade ICC issues some publications which are being followed by the all member countries. It has also a International Court of Arbitration to solve the international business dispute. The major publications of ICC are:

- Uniform Customs and Practice for Documentary Credit (UCPDC).

- Uniform Rules for Collection.

- Uniform Rules for Reimbursement.

- International Standard for Banking Practice.

World Trade Organization (WTO): WTO is another international trade organization established in 1995. This organization has vital role in international trade through its 124 member countries.

Exchange Rate

The rate of exchange is the price of one currency, in terms of another currency or in the other words, the number of units of one currency which exchange for a given number of units of another currency.

Theories of Determination of Exchange Rate

There are mainly 4 theories explaining the determination of exchange rate. Such as:

- a. Mint Parity Theory

- b. IMF Par Value Theory

- c. Purchasing Power Party Theory

- d. Demand and Supply Theory.

Analysis and Findings

Import Performance Of PBL

During the year the bank handled import business worth tk. 85683.53million. During the previous year the amount was tk. 60493.85million. The amount of import business handled by the bank increased by tk. 25189.68million during the year which was 41.64% higher than that of the previous year

Key Performance of Import

| Year | 2006 | 2007 | 2008 | 2009 | 2010 |

| BDT in Million | 37316.50 | 48345.41 | 58009.10 | 60493.85 | 85683.53 |

Table 4.1: Key Performance of Import

Registration of L/C

A credit officer scrutinizes this application and accordingly prepares a proposal (CLP) and forwards it to the head office credit committee (HOCC). The committee, if satisfied, sanctions the limit and returns back to the branch. Thus the importer is entitled for the limit.

The letter of credit (L/C) registration function shall allow the user to register a new L/C upon receipt of an application for issuance / opening of L/C.

It shall provide the followings:

- Able to automatically generate and assign a unique reference number for each new L/C according to the bank pre- defined format. The system assigned number will be the L/C reference number and shall be used for all future transactions on the L/C.

- Able support and indicate the following types of L/C:

- Normal L/C

- Revolving L/C

- Transferable L/C

- Restricted L/C

- Back to back L/C

- Red clause L/C

- Capture brief information on L/C, such as type of L/C, customer, application date, date of receipt of application, currency and amount of L/C.

- Book/earmark on the customer’s L/C credit line, using L/C amount in local equivalent / currency of facility, computed using prevailing counter mid rate exchange rate.

- To log the name of user who perform the registration and the date of registration in the registration record.

- Allow user to “cancel/delete” the registration record 9marked unused) with reason, should the bank decide not to proceed with the issuance transaction. Reference numbers that are’ deleted, cannot be re used.

Precaution To Open A L/C:

Before Opening a L/C, the issuing bank must check the following:

- L/C application properly stamped, signature verified and margin approved and properly retained.

- Indent/ proforma/ sales contract invoice signed by the importer and indenter / supplier.

- Ensure that the relevant particulars of L/C application correspond with those stipulated in indenter / Proforma invoice.

- Validity of LCA entitlement of goods, amount etc. conforms to the L/C application.

- Conversion and rate of exchange correctly applied.

- Charges like commission, FCC, Postage, telex, SWIFT charge, if any recovered.

- Insurance cover note- in the name of issuing bank- A/C importer covering required risk and voyage route.

- Incorporation of instruction for negotiating Bank as per banks existing arrangement.

- Reimbursement instructions for reimbursing bank.

- If foreign bank confirmation is required, necessary permission should be obtained and accordingly advising bank is advised as per banks existing arrangement.

- If add confirmation is required on account of the applicant charges should be

- Recovered from the applicant

Opening Process of A L/C

In foreign exchange banking Letter of credit (L/C) opening is an important part. L/C opening is a set of procedure which every importer needs to follow to import their products. At first importer need to contact with Exporter and with their understanding exporter prepare pro forma invoice and sent it to the importer.

After received the pro forma invoice importer present it to their bank that is known as issuing bank that prepare L/C on behalf of importer. After preparing L/C proposal need to send Head office of issuing bank for approval. After approval, issuing bank open L/C on behalf of importer, signed it by proper authority of bank officer, and send it their authorized export country bank for authentication. The process is done through SWIFT/ Telex. The bank that provides authentication then it called advising bank. After given the authentication seal- advising bank send it to the exporter bank as per requirement of invoice.

Charges of L/C opening : To open local L/C:

- Commission-

- SWIFT charge

- Stamp-

- Service charge-

- VAT

To open foreign L/C:

- Commission-

- SWIFT charge

- Stamp-

- Service charge-

- VAT

Documentation check list for L/C: To open L/C the following documents are required-

- Application of the client

- Acceptance of the terms and conditions of sanctions advice on duplicate copy.

- Copy to municipal trade license.

- IRC TIN of importer and valid registration certificate of indenter.

- Copy of registered partnership deed duly certified as true copy (in case of partnership firm)

- Copy of resolution of the partners for taking financial facilities and authorizing partner(S) for execution of documents and operation of the account (in case of partnership firm).

- Copy of memorandum and article of association of the company including certificate of incorporation duly certified by RJSC and attested by the managing director accompanied by an up- to –date list of director ( in case of limited company) in case of public limited certificate of commitment of business is to be obtained.

- Copy of board resolution of the company for taking financial facilities and authorizing directors for execution of documents and operation of the account (in case of limited company)

- An undertaking not to change the management of the company and the memorandum and the articles of

- Association of the company without prior written permission of the bank (in case of the limited company).

- Copy of the audited balance sheet for last three years(In case of limited company).

- L/C application (Stamped).

- D.P note single / joint stamped.

- Letter of arrangement.

- Letter of continuity (Stamped)

- Letter of disbursement.

- Letter of authority.

- Agreement of pledge.

- Undertaking from the client that import documents will be retired by them on the first presentation (In case no post import facility is extended)

- Marine insurance policy.

- Declaration from the importer to barer the exchange rate fluctuation.

- Letter of guarantee (stamped) of all the partners in their individual capacity (In case of a partnership firm)

- Letter of guarantee (stamped) of all the directors in their individual capacity (In case of a limited company)

- Comparative guarantee from legal entity on TK- 150 non judicial stamp if required in Head office sanction advice.

- Supplier satisfactory credit report in all cases where the amount of letter of credit exceeds TK 200000 against the proforma invoice issued directly by foreign supplier and TK 500000 against indent issued by local agent of the suppliers.

- Partnership inspection certificate if required in H.O sanction advice.

- Lien and physical possession of valid irrevocable Export L/C of the foreign buyers in favor of the client advice through our bank or any other scheduled bank of the

- Undertaking of the client that in case of failure to export the goods as per terms of export L/C they will make payment of relative import bills at maturity date from WES fund from their own sources (In case of back to back L/C

EXPORT Formalities

- Procedure for registration of Exporter.

- Book and resister ledger required for export;

- Export L/C checking and advising;

- Formalities of back to back L/C opening;

- Accounting of back to back L/C;

- B.B bill checking / Lodgment;

- Mechanism of acceptance;

- Pre-shipment financing;

- Export document checking and negotiation under reserve/ collection basis;

- Calculation of offering sheet for fund disbursement system;

- Proceeds realization correspondents;

- Formalities of back to back payments system;

- Substitute benefits realization / collection system;

- EXP from reporting to Bangladesh bank;

- Disposal of EXP form;

- Export incentives;

- Disputes and settlement of export claim.

Preparation Of Export Documents

For obtaining export registration certificate (ERC) from the CCI & E, the following documents are required:

- Application form

- Nationality certificate

- Partnership deed (registered)

- Memorandum & Articles of association and incorporation certificate.

- Bank corticated.

- Income tax certificate

- Valid trade license

BACK to Back L/C

- Back – to –back L/C is a secondary L/C opened by the advising bank in favor of domestic / foreign supplier on the basis of an export L/C. Back – to – back L/C opened for procurement of raw materials / finished goods for execution of shipment order. The beneficiary of back – to –back L/C is generally paid on negotiation of the final documents submitted by the exporter.

- Although BB L/C is normally opened at nil margin but Brach may ask for margin and collateral security or new clients or special cases.

- The following points will be considered for allowing BB L/C-

- Only recognized units of readymade garments, specialized Textiles under bonded warehouse system will be extended BBLC facility. Therefore Branch must satisfy that the client has a valid bonded warehouse license.

- The genuineness of the export L/C must be valid with the advising bank.

- The validity of the export L/C will be for a reasonable time so that after receiving of goods under BB L/C may be processed / manufacture red comfortably keeping in view the validity of shipments period of muster L/C and production capacity of the factory.

- The value addition by the exporter will be at least 80% of the net FOB value of the export L/C (in some cases 75% are also allowed, subject to Bangladesh bank restrictions). FOB value is calculated by deducting freight charges, insurance, commission involved in shipment of the merchandise under the export L/C.

- The import L/C will be opened on usence basis covering usence of not more than 180 days or as prescribe by Bangladesh bank from time to time.

- Interest on essence period shall not exceed LIBOR or the prevailing rate of interest of supplier’s country or as may be prescribed by Bangladesh Bank from time to time.

- All amendments of the export L/C should be noted down carefully to rule out the change of excess L/C obligation under import L/C.

- Opening of import L/C against export L/C under Barter should not be allowed without prior permission of Head Office.

- In cases, where pre- shipment inspection certificate is required international recognized agencies should be nominated by name to carry out the pre- shipment inspection and the same should be stipulated in the L/C, as on clause of the L/C.

Foreign Remittance

Convertibility of Taka in current account transactions symbolized a turning point in the country’s exchange management and exchange rate system. Now the operation of foreign currency accounts has been more liberalized. Funds from these accounts are freely remittable to any country according to the needs of A/c holders.

Authorized Dealer remittance means purchase and sale of freely convertible Foreign Currencies as permissible by the rules and regulations of Exchange Control Authority of Bangladesh Bank.

Remittance takes place in two types:

i) Inward remittance

ii) Outward remittance

FDBC (Foreign Documents Bills For Collection)

The term “Inward Remittance” includes not only remittances by TT, MT, Draft etc. but also purchases of bills and traveler’s cheques.

Generally, Inward remittance comprises:

a) Remittance received by Drafts

b) Remittance received by mail transfer

c) Remittance received by telegraphic transfer

d) Purchase of bills & travelers cheques

Remittance equivalent to USD 2,000 and above should be reported on “Form – C” therefore, after receipt of Inward remittance of USD 2,000 or above or equivalent, the A/D Branches, before

disbursement of the same shall obtain declaration from the beneficiary in a prescribed form “Form C”.

But declaration in “Form-C” will not be required by the beneficiary against any remittance sent by Bangladesh national working abroad which meant for family maintenance. “Form-C” is required when remittance comes from abroad in the name of Firms, Companies, and NGO’s etc.

Remittance received against export should be certified and reported on EXP Forms, In case of remittance received in advance for exports, the A/D should obtain a signed declaration from the beneficiary on the back of the Advance Receipt Voucher certifying the purpose of remittance.

It may be mentioned here that Inward Remittance received through DD/MT/TT/TC should be reported on “Form-C”. Remittance received against exports should be certified and reported on EXP Form.

There are three types of such accounts:

a) FC accounts

b) Resident Foreign Currency Deposit Account

c) Non-resident Foreign Currency Deposit Account

The Bangladesh Nations working abroad may maintain F.C. Account & brought Foreign Currency at the time of their return to Bangladesh. These accounts are termed as Resident Foreign Currency Deposits A/c. One person can bring into Bangladesh for USD 3,000/- or above has been duly declared by them to the custom on Form FMJ at the time of arrival can be credited to F.C A/c or be encased in Bangladesh Taka within 30 days of arrival ( F.E. circular No.05 dated 04.02

Outward Remittance

Remittance from our country to foreign countries is called outward foreign remittance. The Authorized Dealer on behalf of Bangladesh Bank approves outward remittance. Only a few remittances of special nature require Bangladesh Bank’s prior approval. Any person who wishes to purchase foreign exchange must lodge an application for the purpose on a prescribed Form with the authorized Dealer Branch. There are two types of application forms for outward remittances – “IMP Form” and “T/M Form”.

a) The IMP form is designed to cover remittances for payment of import obligation.

b) T/M form is designed to cover all other types of remittances other than Imports.

Outward remittance may be made for following purposes:

a) Travel

b) Medical Treatment

c) Educational purpose

d) Attending seminar etc.

e) Balance amount of F,C. A/c

f) Profit of foreign companies

g) Technical assistance

h) New exporters up to USD 6,000/- for business promotion

I) F.C. remittance can be made for fare, exhibition from Export Retention Quota.

Outward remittance in favor of beneficiaries outside Bangladesh may be made in any of the following manners:

a) By issuing Demand Draft

b) By issuing Mail Transfer

c) By issuing Telegraphic Transfer

Excluding payment of import obligation some commercial remittances may take place in the form or DD/MT/TT for under noted cases:

I) Remittance or Dividend to non-resident shareholders

ii) Remittance of profit of foreign firms and companies.

iii) Remittance for import of Books and Journals

iv) Remittance of pre-shipment inspection fees etc.

Conclusion

It can be conclude that, since 1983, the Government of Peoples Republic of Bangladesh started taking ownership reform measures in financial sector. Two out of six NCBs were denationalized and a number of private commercial Banks (PCBs) were allowed to operate by the government. It results competition and improves the level of customer services operation efficiency of the Banking sector. As a result of this competition peoples are favoring a lot, Banking services are improved, employments are generated and public money earns more and more securities and benefits which ultimately developing economy as a whole.

It is also to be stated that this competition is not confined within the country. Due to high fuel cost and relatively lowers technological use made us competitive in the world economy. But we are in a state of consistent in economic sector maintaining on an average five (05%) percent of GDP growth. This constant growth results in high-tech introduction and positive competitive environment in financial sector especially within financial intermediaries (Banks). Introduction of high-tech services can ensure growth towards first generation Bank like Pubali Bank Ltd.

Bank always contributes towards the economic development of a country. PBL, compared with other banks are contributing more by investing most of their funds in fruitful projects leading to increase in production. It is obvious that right thinking of this bank including establishing a successful network over the country and increasing resources, will be able to play a considerable role in the portfolio of development financing in the developing country like ours.

PBL continues to play its’ leading role in socio-economic development of the country as a companion of Independent Bangladesh. Besides its’ traditional function such as deposit mobilization, deployment of fund in trade, commerce, industry, agriculture, import & export business, outward and inward remittance, as an agent of Bangladesh Bank, PBL has emerged as the pioneer of playing key role in the country.

Pubali bank limited, considering the environment, though far behind from other banks, the bank is in a state of steady growth. The top management of PBL is always trying their best to improve their service quality to the customers and enhance the reputation in the Banking business in our country as well as abroad. PBL recruits a good number of fresh talents every year and invests handsome money for necessary training purposes to ensure the fulfillment of better service. Now, the slogan of PBL is “Think Bank, Lead Bank”.

Above all, bank is a risky industry with many diversified and complex inputs and outputs. Asset liability management has vast and difficult areas to manage. A bank only can minimize its risks and maximize profit by managing its balance efficiently. The manual is a guiding assistance for the purpose and not the whole thing of asset liability management. The issues contained in this manual may enrich one’s skill for better performance in the field.

Suggestion And Recommendation

In order to get competitive advantage & to deliver quality service, top management should try to modify the services. For the improvement of the service the following measures should be taken:

- Customer’s Convenience: For customer’s convenience, PBL should provide more personnel to deliver faster services to their honorable customer.

- Human Development: Development of human resources should be ensured to increase efficiency in work.

- Communication System: Ensure proper communication system and maintenance of files & machineries should modernize.

- Interest: More interest should be paid on deposit account so that customers are convinced to deposit their money in bank.

- R & D: Research & Development wing must be more extensive & rich.

- Strategy: Effective strategies must be undertaken against defaulter.

- Project Management: ‘Project Management’ must be practiced in case of investing in the project. Feasibility study of the project, project planning, monitoring & evaluation should be undertaken.

- Managerial Function: PBL must have to follow the management functions (from planning to control) strictly in all of their business activities and also operation the bank.

- Financial Analysis: Branch should have a separate section to analyze the financial statement for fining its liquidity, profitability & ownership ratios.

- Strict Rules for arrival and departure for the employee: Management should strict about the arrival and departure time for the employees.

- Job Rotation: In PBL job rotation is fully absent job rotation is very important to make the entire employee efficient for all departments.

Some other important factor that should be focused on the development process:

- Time consumed at service level should be minimized at optimum level.

- Evaluate customer’s needs from their perspective and explain logically the shortcomings.

- Improve office atmosphere to give customers better feeling.

- Use of effective MIS (Management information system).

- To deliver quality service top management should try to mitigate the gap between customer’s expectation & employee’s perception.

- If management does not emphasis on the asset- liability management of bank then it will fall into great losses in near future.