A follow-on public offering (FPO) facilitates the promoters of a company already listed through an exchange-based bidding platform to sell or dilute their existing shares. It is the issuance of additional shares after an initial public offering (IPO) by a company. Often known as secondary offerings are follow-on offerings. For example, Google’s initial public offering (IPO) included both a primary offering (issuance of Google stock by Google) and a secondary offering (sale of Google stock held by shareholders, including the founders). An offer of shares by a shareholder of a company following the initial public offering of the company is often considered the second-best offer by the FPO.

In this type of offering, a current proprietor of the business offers back portions of their value to the individual or gathering that makes the offer. On account of the dilutive contribution, the organization’s directorate consents to expand the offer buoy to sell greater value in the organization. This new cash inflow could be used to pay off some debt or used for the necessary expansion of the company. The number of shares outstanding increases as new shares are generated and then sold by the company, and this creates earnings dilution on a per-share basis. It varies from an immediate offer on the grounds that there is no requirement for endorsement by investors. Holders of the offers will possibly get the full estimation of their speculation when the business gets productive.

Example of Follow-on Public Offer (FPO)

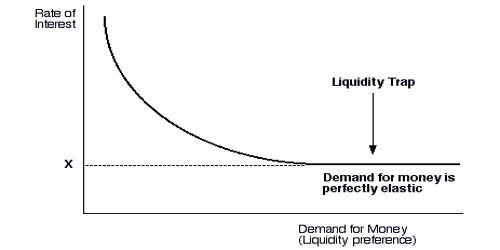

An at-the-market offering (ATM) is a form of FPO in which a business may sell secondary public shares to raise capital on any given day, usually depending on the prevailing market price. The profit from the cash inflow from the sale is generally strategic and is considered beneficial for the company and its shareholders’ longer-term objectives. A few proprietors of the stock anyway may not view the occasion as well over an all the more transient valuation skyline. As the price paid to buy the shares is not fixed in stone, this form of bid varies from a pure buying option. It is necessary, therefore, to carefully consider potential options.

FPOs have a price band in which buyers must bid for the shares or simply give their consent at the cut-off price to purchase the shares. Via a bid paper, public companies may also take advantage of an FPO. FPOs ought not to be mistaken for IPOs, the first sale of stock of value to general society. FPOs are extra issues made after an organization is set up on a trade. Financial specialists are not needed to pay any sort of charges far beyond the fixed cost in an FPO.

Two key forms of follow-on public offerings are available. The first is dilutive for investors, as the Board of Directors of the company decides to raise the float level of stock or the number of available shares. This kind of follow-on public offering looks to fund-raise to pay off past commitments or extend the business, bringing about an expansion in the quantity of offers remarkable.

The other form of public bid for follow-on is non-dilutive. When directors or significant shareholders sell-off privately held shares, this strategy is useful.

The investor must use sophisticated financial modeling and analytical instruments in order to determine the best trading scenario in order to make a successful offer. It needs considerable effort to decide when the best time to purchase is and how much the shares should be paid by the buyer. It additionally considers the danger factor of speculation since it speaks to an expected weakening of value. One illustration of a sort of follow-on contribution is an at-the-market offering (ATM offering), which is in some cases called a controlled value appropriation.

In an ATM offering, exchange-listed companies sell newly issued securities incrementally to the secondary trading market at prevailing market rates through a licensed broker-dealer. The issuing company can, on an as-needed basis, raise capital with the option to refrain from offering shares if, on a particular day, it is not satisfied with the available price. Diluted follow-on offerings happen when an organization gives extra offers to rise to subsidize and offer those offers to the public market. As the quantity of offers increment, the earnings per share (EPS) decline. Most commonly, the funds collected through an FPO are allocated to minimize debt or alter the capital structure of a company. The influx of cash is beneficial for the company’s long-term prospects and is also good for its shares as well.

When privately owned shares are offered for sale by company directors or other insiders (such as venture capitalists) who may be looking to diversify their assets, the non-dilutive form of follow-on offering is. Money continues from non-weakened deals go straightforwardly to the investors putting the stock out of the dark market. As a rule, these investors are organization originators, individuals from the directorate, or pre-IPO speculators. As new shares are not issued, the EPS of the company remains unchanged. Secondary business offers are also called non-diluted follow-on offerings.

In the event that offers or protections are recorded, repurchase will be as per the guidelines made by the Securities and Exchange Board for this benefit, and the repurchase in regard of unlisted offers or other indicated protections is in understanding Share Capital and Debenture Rules 2014. As with an IPO, the selling company will also propose the use of a greenshoe or over-allotment option to the investment banks that act as underwriters of the follow-on offering. In the investment world, follow-on offers are popular. They provide businesses with a simple way of raising equity that can be used for general purposes. Companies or organizations declaring optional contributions may see their offer value fall subsequently. Investors frequently respond contrarily to optional contributions since they weaken existing offers and many are presented beneath market costs.

Information Sources: