A Financial Transaction Tax (FTT) is a tax levied on various financial transactions, such as buying or selling stocks, bonds, and derivatives. It is a tax levied on a specific type of financial transaction to be used for a specific purpose. The idea behind an FTT is to raise revenue for governments while also discouraging speculative trading that can contribute to market instability. For transactions involving intangible property rather than real property, the tax has been most commonly associated with the financial sector. It is not usually thought to include consumer consumption taxes.

A transaction tax is levied on specific taxable transactions rather than on any other characteristics of financial institutions. No transaction tax will be levied on an institution if it is never a party to a taxable transaction. If an institution conducts only one such transaction, the tax will be levied on that single transaction. This tax narrower in scope than a financial activities tax (FAT), and is not directly an industry or sector tax like a Financial stability contribution (FSC), or “bank tax”, for example.

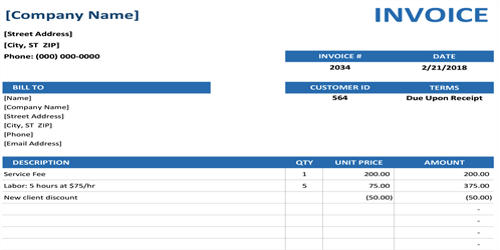

FTTs can take different forms and rates, depending on the country and the type of financial transaction. For example, some FTTs are designed to be small but apply to a wide range of transactions, while others are higher but only apply to certain types of transactions. FTTs can be structured in different ways, but typically they are imposed as a small percentage of the value of the transaction. For example, a 0.1% FTT on a $10,000 stock trade would amount to a $10 tax. FTTs can be applied to transactions in a particular country, region, or globally.

There has been much debate about the effectiveness and feasibility of FTTs. Supporters argue that FTTs can generate significant revenue for governments, discourage high-frequency trading, and reduce market volatility. Critics, however, argue that FTTs can discourage investment and harm the economy, especially if they are not implemented uniformly across countries.

Several countries have already implemented some form of FTT, including France, Italy, and Sweden. In the European Union, there have been discussions about implementing an EU-wide FTT, but progress has been slow due to disagreements among member states.

Financial transaction taxes are classified into several types. Each serves a distinct function. Some have been implemented, while others are just ideas. Concepts can be found in a variety of organizations and regions all over the world. Some are domestic and intended for use within a single country, while others are multinational. In 2011, 40 countries used FTT, raising a total of $38 billion (€29 billion).

Several countries and regions have implemented or proposed FTTs, including France, Germany, Italy, and the European Union. However, the implementation of FTTs can be challenging, as they can be subject to evasion and can drive trading to other jurisdictions with lower taxes.