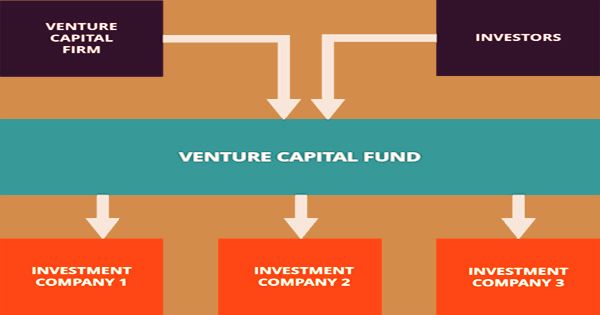

Venture capital funds (also known as VC funds) are pooled investment funds which manage the money of start-up investors and small to medium-sized enterprises with strong growth potential seeking private equity stakes. It is a kind of venture reserve that puts resources into beginning phase new businesses that offer an exceptional yield potential yet in addition accompany a serious level of danger. The fund is operated by a venture capital company, and typically the investors are institutions or individuals with high net worth. In the past, investments in venture capital (VC) were open only to experienced venture capitalists, but now qualified investors have a greater opportunity to engage in venture capital investments. VC funds, however, remain largely outside the control of ordinary investors.

The investors who supply the asset with cash are assigned as restricted accomplices. The individual who deals with the asset is known as the overall accomplice. The overall accomplice chooses which beginning phase organizations the asset will put resources into dependent on rules set up by the asset accomplices. These typically include:

- Growth and liquidity benchmarks

- Strategic measures such as market position and the separateness of the goods or services of a business

- The power and coordination of the management team of the organization

(Venture capital fund structure)

Venture capital funds are investment vehicles for private equity that aim to invest in businesses with high-risk/high-return profiles based on the size, assets, and stage of product development of a business. A venture capital firm plays out a double job in the asset, filling in as both a financial specialist and an asset administrator. As a financial specialist, they as a rule put in 1%-2% of their own cash, which shows to different speculators that they are focused on the accomplishment of the asset. They are responsible, as fund managers, for identifying investment opportunities, new business models, or innovations and for identifying those with the potential to produce a high return on investment for the fund.

Venture capital funds are radically different from mutual funds and hedge funds because they concentrate on a very particular form of early-stage investment. All businesses attracting investments in venture capital have a high potential for success, are risky, and have a long investment period. In a venture capital company, common tasks include:

- General Partners: Responsible for all investment decisions in the fund and generally invests its money in the fund

- Venture Partners: Source opportunities for investment and are paid on the basis of deals that close

- Principals: Mid-level, position-focused on investment. With investment management expertise or other experience relevant to the investment policy of the fund

- Associates: Junior employees with any investment banking or management consultancy expertise

- Entrepreneur-in-Residence: Industry experts who are employed briefly as consultants or mentors to the venture capital company, often to help with due diligence or to pitch new start-up ideas.

Venture capital (VC) funds play a more dynamic job in their ventures by giving direction and frequently holding a board seat. VC finances in this way play a functioning and active part in the administration and tasks of the organizations in their portfolio. Most VC funds usually have a five-year active investment period. After that time, they enter a ‘support period’ of a further five years during which, if they have done well, the general partner will choose to spend capital earned to date from the investments of the fund. This second five-year term may be extended for two or three years if the limited partner’s consent.

Two income sources pay for venture capital firms: management fees and carried interest.

- In order to cover the operating costs, management fees are an annual charge paid by investors to the venture capital company. Usually, the fee is about 2 percent.

- Carried interest is a performance bonus charged to the venture capital company if a profit is realized by the investor, which is usually around 20% of the overall distribution of profit. The sum is then divided among the venture capital firm’s staff, with the bulk going to the general partners.

Venture capital (VC) funds have portfolio restores that will in general look like a hand weight way to deal with contributing. A considerable lot of these assets make little wagers on a wide assortment of youthful new businesses, accepting that at any rate one will accomplish high development and prize the asset with a similarly huge payout toward the end. This helps the fund to mitigate the possibility of folding any investments. Venture capital funds also concentrate on a sector, market segment, process of investment, geography, or any combination of each. The gains are shared among the limited partners at the end of the life of a VC fund. The general partner pays a fee and receives a share of the net gains.

Funds start with a capital-raising period where the investment firm searches out financial specialists for the new asset. Contingent upon the company’s standing, economic situations, and fund strategy, the cycle can require months or even years. The fund is closed to new contributors until the intended funding sum has been met. For all pooled investment funds, prior to making any investments of their own, venture capital funds must raise money from outside investors. A plan is given to likely financial specialists of the asset who at that point submit cash to that store. All potential speculators who make a responsibility are called by the asset’s administrators and individual venture sums are concluded. The average lifecycle of a venture capital fund lasts for about seven to ten years, beginning when the fund is closed and finishing when all deals are exited and any proceeds are redistributed to investors.

Financial specialists of a venture capital (VC) fund make returns when a portfolio organization exits, either in an IPO or consolidation and securing. On the off chance that a benefit is made off the leave, the asset likewise keeps a level of the benefits ordinarily around 20% notwithstanding the yearly administration charge. While the anticipated return varies depending on the sector and risk profile, venture capital funds usually aim for about 30 percent of the gross internal rate of return. Although the returns on venture capital funds can be attractive, each investment entails a substantial amount of risk. Most new companies fall flat and can bring about considerable misfortunes to the asset conceivably, an absolute misfortune. The prior the speculation stage, the more danger is included, as less develop; problematic organizations or innovations are more inclined to disappointment.

Information Sources: