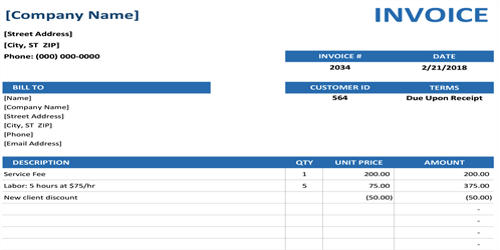

Invoice

An invoice is a document used in trade. It is a commercial document that itemizes and records a transaction between a buyer and a seller. It is a document sent to a buyer that specifies the amount and cost of products or services that have been provided by a seller. Full particulars as to the quality, quantity, and price of the goods; methods of transportation and payment, etc. are set forth in it. Types of invoices may include a receipt, a bill of sale, debit note, or sales invoice. It includes the cost of the products purchased or services rendered to the buyer.

Invoices are a critical element of accounting internal controls and audits. It is a commercial document issued by a seller to a buyer, relating to a sale transaction and indicating the products, quantities, and agreed prices for products or services the seller had provided the buyer. Charges on an invoice must be approved by the responsible management personnel. These generally outline payment terms, unit costs, shipping, handling, and any other terms outlined during the transaction. Companies need to deliver invoices in order to demand payments. Payment terms usually specify the period of time that a buyer has to send payment to the seller for the goods and/or services that they have purchased.

A typical invoice may contain:

- The word invoice (or tax invoice);

- A unique reference number,

- Date of the invoice;

- Credit terms;

- Tax amounts, if relevant (e.g., GST or VAT);

- Name and contact details of the seller;

- Tax or company registration details of the seller,

- Name and contact details of the buyer;

- Date of sending or delivery of the goods or service;

- Purchase-order number;

- Description of the product(s);

- Unit price(s) of the product(s), if relevant;

- The total amount charged with currency;

- Payment terms.

Invoices can also serve as legal records if they contain the names of the seller and client, description and price of goods or services, and the terms of payment. It is a legally binding agreement showing both parties’ consent to the quoted price and payment conditions.

However, there are other benefits to using invoices.

- Maintaining records – This makes it possible to find out when good was sold, who bought it, and who sold it.

- Payment tracking – It helps both the seller and the buyer to keep track of their payments and amounts owed.

- Legal protection – A proper invoice is legal proof of an agreement between the buyer and seller on a set price.

- Easy tax filing – Recording and maintaining all sale invoices helps the company report its income and ensure that it’s paid the proper amount of taxes.

- Business analytics – Analyzing invoices can help businesses gather information from their customers’ buying patterns and identify trends, popular products, peak buying times, and more.