Preferred shares are securities that represent ownership in a corporation, and that have a priority claim over common shares on the company’s assets and earnings. The preferred shareholders enjoy a fixed dividend whereas common shareholders are not guaranteed a fixed dividend. It is often considered a hybrid security as it offers features of both bonds and common stock. These shares are one important source of hybrid financing because it has some features of equity shares and some features of debentures.

Features of Preferred Shares

Preferred shares have a special combination of features that differentiate them from debt or common equity. Although the terms may vary, the following features are common:

- Preference in assets upon liquidation:

The shares provide their holders with priority over common stockholders to claim the company’s assets upon liquidation. When the company is liquidated, preference shareholders are paid and the residue is available to the equity shareholders. So, preference shareholders have a prior right to that of the equity shareholders.

- Dividend payments:

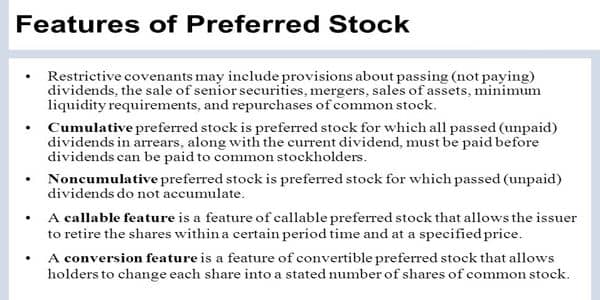

Preferred shares pay dividends annually which are a fixed percentage of stock’s purchase price. The shares provide dividend payments to shareholders. The payments can be fixed or floating, based on an interest rate benchmark such as LIBOR. However, if the company does not have any earnings then it is not applicable to pay dividends to anyone.

- Preference in dividends:

Preferred shareholders have a priority in dividend payments over the holders of the common stock. Normally, the firm must pay these unpaid dividends prior to the payment of dividends on the common stock.

- Non-voting:

Generally, the shares do not assign voting rights to their holders. The basis for not allowing the preference shareholder to vote is that the preference shareholder is in a relatively secure position and, therefore, should have no right to vote except in the special circumstances. However, some preferred shares allow its holders to vote on extraordinary events.

- Convertibility to common stock:

Preferred shares may be converted to a predetermined number of common shares. In these terms, the conversion ratio and conversion prices are included. Some preferred shares specify the date at which the shares can be converted, while others require approval from the board of directors for the conversion. Conversion ratio includes the number of the common stocks the preferred stockholders will get for exchanging each preferred stock.

- Callability:

The issuer has the right to call in the shares at par value after a set date. The shares can be repurchased by the issuer at specified dates. New preferred shares can be issued at a current lower price after excluding the old high rates.

- Hybrid security of preference shares

The preference share is a hybrid stock between a bond and a common stock. A preference share partakes the characteristics of both the shares and the bonds. Like a bond, it has a claim on the assets of the company.

Information Source: