Preparation of Cost Reconciliation Statement

A statement that is prepared for reconciling the profit between financial and cost accounts is known’s as a cost reconciliation statement. If there is a difference in the results shown by the cost accounts and financial accounts, then only a cost reconciliation statement is prepared to reconcile their results by removing their differences. So, It is a statement recording the profit or losses shown by the cost accounts and financial account.

A cost reconciliation statement is prepared on the same footing on which a bank reconciliation statement is prepared. It is a statement where the causes for the difference in net profit or net loss between cost and financial accounts are established and suitable adjustments are made to remove them. The preparation of cost reconciliation statement involves the following steps:

Step 1: Start with profit or loss shown by any one set of accounts ( profit or loss as per cost accounts or financial accounts) as the base

Step 2: Find out the reason of the difference of profit between cost and financial account (You are requested to refer above post ‘Causes or reasons for difference in profits’)

Step 3: Determine the addition or subtract (less) items

Step 4: Prepare cost reconciliation statement

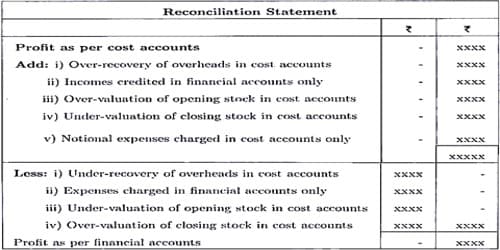

Specimen of Cost Reconciliation Statement

Taking the profit as per cost account or loss of financial account –

Particulars……………………………………………………………………………….Amount

Profit as per cost account or loss as per financial account……………….XXX

Add:

- Overcharge of expenses in cost account……………………………………XXX

- Items of expenses recorded only in cost account………………………..XXX

- Items of income recorded only in financial account……………………XXX

- Amount of understated income in cost account………………………….XXX

- Over-valuation of opening stock in cost account…………………………XXX

- Undervaluation of closing stock in cost account…………………………XXX

Less:

- Under the charge of expenses in cost account………………………………….(XXX)

- Items of expenses recorded only in financial account………………….(XXX)

- Income is shown in cost account, but not in financial account…………(XXX)

- Amount of income overstates in cost account……………………………..(XXX)

- Undervaluation of opening stock in cost account………………………..(XXX)

- Overvaluation of closing stock in cost account……………………………(XXX)

Profit as per financial account or loss as per cost account……………………..XXX

Information Source: