An exponential moving average (EMA), also referred to as an exponentially weighted moving average (EWMA), is a type of moving average (MA) that gives the most recent data points more weight and significance. Every older datum’s weighting decreases exponentially, never reaching zero. It is a technical indicator utilized in exchanging rehearses that shows how the cost of a resource or security changes throughout a specific timeframe. A simple moving average (SMA), which gives equal weight to all observations in the period, reacts less strongly to recent price changes than an exponentially weighted moving average (EWMA).

The point of all moving midpoints is to set up the bearing in which the cost of security is moving dependent on past costs. Like every moving normal, this technical indicator (EMA) is utilized to create purchase and sell signals dependent on hybrids and divergences from the verifiable normal. Traders often use a variety of EMA lengths, including 10-day, 50-day, and 200-day moving averages. Exponential moving averages are also latency measures. They do not forecast future values; rather, they illustrate the stock price’s current trend.

The exponential moving average (EMA) is a weighted moving normal determined by taking the normal cost for a specific market throughout a characterized timeframe and changing this figure to expand the heaviness of ongoing value information. The formula below simplifies the equation by breaking it down into its component sections, making it easier to imagine and compute.

EMA = Price (t) × k + EMA (y) × (1 – k)

Where:

t = today

y = yesterday

N = number of days in EMA

K = 2 ÷ (N + 1)

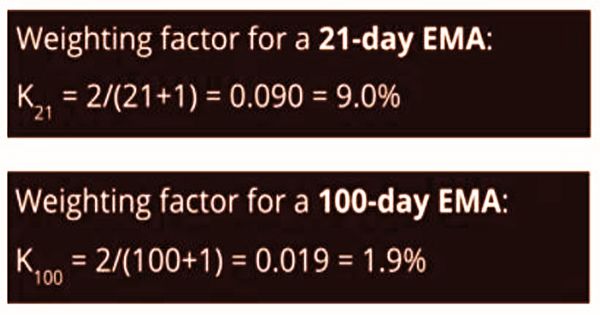

The weightage of EMAs measured over a smaller number of periods (i.e., based on more recent prices) is higher than that of EMAs calculated over longer periods. Calculating the value of “K” over two separate time spans illustrates this:

The most recent price is given a 9.0 percent weight by the 21-day EMA, but just 1.9 percent by the 100-day EMA. As a result, EMAs calculated over shorter time intervals are more sensitive to price adjustments than EMAs calculated over longer time intervals.

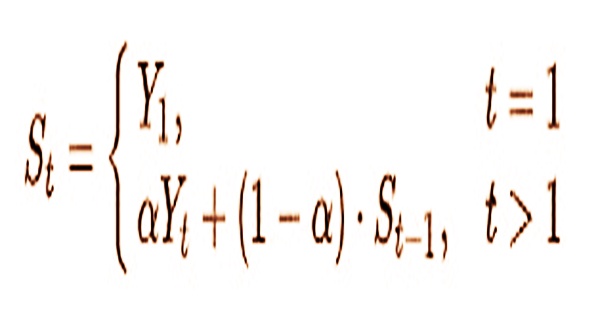

The EMA for a series Y may be calculated recursively:

Where:

- The coefficient is a constant smoothing factor between 0 and 1 that reflects the degree of weighting reduction. With higher, older findings are discounted more quickly.

- Yt is the value at a time period t.

- St is the value of the EMA at any time period t.

S1 can be initialized in a variety of ways, the most common of which is to set it to Y1 as seen above, but other methods exist, such as setting it to the average of the first 4 or 5 observations. The effect of S1 initializations on the resulting moving average is dependent on; smaller values make S1 selection more important than larger values since a higher discount older observation faster. Whatever is done for S1, it is fundamentally incorrect since it assumes values prior to the available data.

The EMA exchanging technique can be utilized in a similar way as the SMA (simple moving average). At the point when the more limited term EMA crosses over the more drawn-out term EMA, this signals a purchase signal. At the point when the more limited term EMA crosses underneath the more drawn-out term EMA, merchants hope to enter short positions. The EMA values are entirely at the discretion of the trader. The EMA gives recent prices more weight, while the SMA gives all values equal weight. For a shorter-period EMA, the weighting given to the most recent price is greater than for a longer-period EMA. For a 10-period EMA, for example, an 18.18 percent multiplier is applied to the most recent price data, while the weight for a 20-period EMA is just 9.52 percent.

Applications of the Exponential Moving Average (EMA):

- Highlighting trends: One of the most critical roles of an EMA is to highlight and identify price trends. A rising EMA suggests an upward trend in prices, and vice versa. When the price is above the EMA line, it is expected to rise; when it is below, it is expected to fall. By recognizing value headings, the EMA permits financial backers and merchants to spot purchasing and selling signals dependent on their exchanging procedure.

- Support and Resistance bands: The EMA, as well as other forms of moving averages, act as price support and resistance levels. Support thresholds, also known as “floors,” serve as a cap on how much prices can fall during uptrends. Resistance thresholds, on the other hand, serve as “ceilings,” with prices not expected to rise above them during downtrends.

The 12-and 26-day exponential moving averages (EMAs) are frequently the most cited and dissected momentary midpoints. The 12-and 26-day are utilized to make markers like the moving average convergence divergence (MACD) and the percentage price oscillator (PPO). The EMA indicator is easy to use and a perfect way for new traders to learn about technical analysis and how to spot patterns and entry opportunities. The EMA is often used in conjunction with other resources by more experienced traders, but this does not make it any less efficient. By and large, the 50-and 200-day EMAs are utilized as pointers for long haul patterns. At the point when a stock value crosses its 200-day moving normal, it is a specialized sign that an inversion has happened.

Both the exponential moving average (EMA) and the simple moving average (SMA) are technical indicators that use historical data to create a smooth trend line for a security’s price. EMAs, like all other moving average measures, work best in trending markets. At the point when the market is in a solid and supported upturn, the EMA marker line will likewise show an upswing and the other way around for a downtrend. The distinction between the two moving averages is that the EMA gives more weight to recent prices than the SMA does to all data points, which is why the EMA line moves faster than the SMA line.

The key distinction between an EMA and a SMA is their sensitivity to changes in the data used to measure them. It’s debatable whether the most recent days of the time span should be given more weight. Many traders conclude that new data more accurately represents the security’s current trend. In any case, note that none of the moving midpoints is a preferred marker over one another. An EMA, for example, is a more reliable reflection of recent market changes and can help detect patterns faster than a SMA, but it also experiences more short-term volatility. The best moving average for analysis is calculated by the trading strategy.

Information Sources: