EXECUTIVE SUMMARY

The Internship Report Excellence in Customer Service: A Case Study of IFIC Bank Limited is originated as a partial requirement of BBA Program, Department of Business Administration, International Islamic University Chittagong, Dhaka Campus.

This report focuses 12 weeks working experiences in International Finance Investment and Commerce Bank Ltd. This report will give a clear idea/concept that how IFIC bank can provide excellence in customer service by their whole banking service. This report contains five parts

The first chapter is focused on the Introduction, objectives, scope, limitations, methodology, data collection & processing method for the study.

The second chapter is focused on the overview of the IFIC Bank Limited. It contains short profile of the Organization, The Organization’s History and activities.

The Third chapter is focused on the Excellence in customer of IFIC Bank Limited. It contains different aspects of customer excellence in customer service of IFIC Bank Ltd. Bank has categorized various types Banking Service for their excellence customer such as: Retail Banking Service, Corporate banking Service, SME Banking Service, Agriculture credit Service, Internet Banking Service/ E-Banking, Foreign Exchange service, Common Services for all customer. Among these banking they are provide their customer service and prove that their Excellency.

The fourth chapter of this report contains the Statistical Data Analysis, Findings on the basis of data collected through questionnaire.

The fifth part contains recommendation and conclusion of this report.

A sample of questionnaire which is used in the report and references also have been attached with this report under The Six chapter.

INTRODUCTION

Back Ground of the Report

A bank is a financial organization which provides different types of services to its customers benefit. It deals with deposits and advances and other related services. The main objective of a bank is to mobilize the fund of its customers. It receives money from those who want to save in the form of deposits and it lends money to those who really need it in emergency. In the process of taking of deposits and Stipulation of loan, bank generates money. This distinctive characteristic places bank separately from other financial institutions. Banks accumulate deposit at the lowest possible cost and make available loans and advances at higher cost. The difference between these is the profit for the Bank.

Over the years the banking industry in Bangladesh has flourished. Now the time is very much competitive for every industry as well as in banking industry. To keep the strong position in this competitive industry banks are frequently looking for ways to offer superior customer service which will facilitate them to prevail and keep customers.

IFIC bank limited is not out of this. To maintain its strong position in this competitive world they are also providing different types of services to its customers and trying a lot to keep their customers satisfied.

But it needs to be highlights here that different services to the customers are not up to the mark. Therefore, it is very much essential to take in-depth studies on excellence in customer services of IFIC Bank Ltd.

Objectives of the Report

Broad Objective

The main Objective of the Study is to assess the Excellence in Customer Service of IFIC Bank Ltd.

Specific objective

To achieve the main objective, this study highlights some specific objectives that are as follows:

To give a brief overview of IFIC banks Ltd.

To highlights different aspects of customer excellence in customer service of IFIC Bank Ltd.

To analysis the opinions related to different level of customer service.

To suggest some recommendations to improve the total customer service level of the bank.

Methodology

The methodology includes the methods, procedures, and techniques used to collect and analyze information. To prepare this report I have used two methods. And those methods were effective in preparing this report.

Primary Data:

Many of the data and information were collected from my practical experience and queries from the executives while doing my internship at IFIC Bank Ltd. Besides that most of the necessary information has been collected by face to face interview with the major clients of the bank and people working in different department, personal investigation with bankers, circular sent by Head Office and maintaining daily diary which contains all the activities that has been observe and done in the bank

The primary sources are:

Practical observation.

Face to face conversation with branch manager, officers and executives of the bank.

Face to face conversation with the existing and new customers of IFIC.

Relevant document’s studies as provided by the officers concerned.

Personal diary (That contains every day experience in bank while undergoing

practical orientation).

Secondary Data:

Annual Report of IFIC Bank Ltd.

Gather knowledge about the bank from their banking website.(www.ificbank.bd.com)

Publications obtained from different libraries and from internet

Population size:

All officers and clients of IFIC Bank Ltd

Sample Design:

I have considered the different section of people who have an account of this bank. The judgmental sampling procedure was used to select the sample units from different customers of different department of the bank who were willing to respond to the questionnaire. From the bank I was taken 50 customers for my sample of the survey that was given actual result about customer service level from different service department of the bank. As the sample of customer of the bank, 30 customers are female and 20 customers are male.

Scope of the study

The scope of this report is limited to the IFIC Bank Ltd. The scope of the report is also limited by the information given by the bank. As the report is mainly based on practical observation, the scope was limited to the related department of this report, there was no scope of going outside the range and also the scope has narrowed to the branch operation and practices.

Limitations of the Study

Some restraints at the time of preparing the report are appended below:

IFIC Bank Ltd. maintains strict confidentiality about provide their financial information; therefore, it was quite difficult to obtain all the necessary data that was required to complete the report. In some cases assumption had to be use for some particular figures. Thus in those cases there could be a certain level of inaccuracy.

Major part of this report is based on the face to face interviews, which consists of view and opinion of those people. In some cases some of them were not able to provide concrete facts or figures. In these cases as well some assumption had to be made.

Since banks personals were very busy they could provide me very little time.

Due to time limitations many of the aspects could not be discussed in the present report

The nature of information of the project part is somewhat critical to analyze. It was quite difficult to have the sufficient knowledge and understanding in that particular field, in a short period of internship program.

Overview of the IFIC Bank

Profile of IFIC Bank Limited

International Finance Investment and Commerce Bank Limited (IFIC Bank) is banking company incorporated in the People’s Republic of Bangladesh with limited liability. It was set up at the instance of the Government in 1976 as a joint venture between the Government of Bangladesh and sponsors in the private sector with the objective of working as a finance company within the country and setting up joint venture banks/financial institutions aboard. In 1983 when the Government allowed banks in the private sector, IFIC was converted into a full-fledged commercial bank. The Government of the People’s Republic of Bangladesh now holds 32.75% of the share capital of the Bank. Directors and Sponsors having vast experience in the field of trade and commerce own 8.62% of the share capital and the rest is held by the general public.

IFIC Bank is providing a wide range of financial services, offering specialist advice and products to corporate clients to meet diverse demands of changing market scenario. We have expertise to customize products & services to meet specific requirements of our clients. We are committed to serve our customer with extensive branch network all over the country to expedite our client’s business growth. We facilitate your business to face the challenges and realize opportunities, now and in the future. Bank’s main focus is relationship based banking and understanding corporate & institutional business environments in Bangladesh

Bank Mission

Our Mission is to provide service to our clients with the help of a skilled and dedicated workforce whose creative talents, innovative actions and competitive edge make our position unique in giving quality service to all institutions and individuals that we care for.

We are committed to the welfare and economic prosperity of the people and the community, for we derive from them our inspiration and drive for onward progress to prosperity.

Bank Vision

We want to be the leader among banks in Bangladesh and make our indelible mark as an active partner in regional banking operating beyond the national boundary.

Bank Slogan: Your Satisfaction First

Objective of IFIC Bank Ltd

Maximization of profit through customer satisfaction is the main objective of the Bank in addition. The others relevant objectives are:

- To be market leaders in high quality banking products and services.

- Active excellence in customer service through providing the most modern and Advance state of art technology in the different spheres of banking.

- To participate in the industrial development of the country to encourage the new and educated young entrepreneurs to undertake productive venture and demonstrate their Creativity and there by participate in the national development.

- To provide credit facilities to the small and medium size entrepreneur located in urban and sub urban area and easily accessible by our branches.

- To reduce dependence of moneylender.

- To make the small and medium enterprise self -reliant.

- To develop saving attitude and making acquaintance with banking facilities.

- To inspire for undertaking small projects for creation employment through income.

- To ensure the high return on investment

- To strive for profit and sound growth.

- To play a significant role in the economic development of the country.

- To protect money laundering.

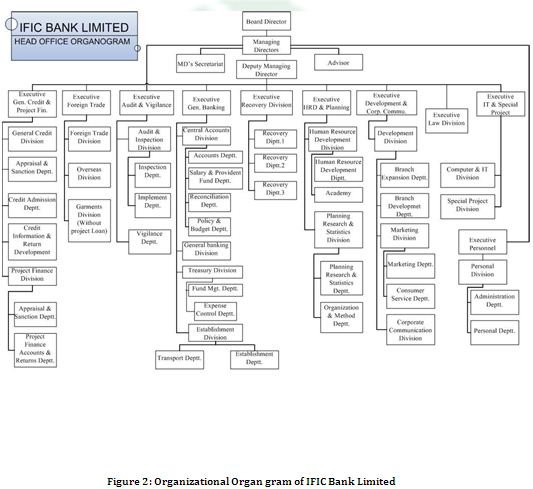

Organ gram of IFIC Bank Ltd

Customer Service:

Customer service is the set of behaviors that a business undertakes during its interaction with its customers. It can also refer to a specific person or desk which is set up to provide general assistance to customers.

CRM is a system with which to identify and track customers’ needs. Four basic steps will help to ensure a greater effectiveness in your CRM system:

- Establish clear and specific objectives regarding the CRM needs you wish to fulfill

- Plan a realistic strategy to accomplish the set objectives

- Identify a CRM software that matches up with set goals

- Evaluate on a regular basis to train and adapt your strategy to your progressive experience

Customer Satisfaction:

It refers to the satisfaction of customers in terms of how they are satisfied with the politeness, knowledge and promptness of employees in handling busy customers. It also takes into consideration the perception of the customers as to whether the product or service is worth what they are paying for it.

Customers of IFIC Bank Limited have a good perception about the quality of service provided by them. From our survey we found that customers are satisfied with the overall service of IFIC Bank. All the offers provided by IFIC Bank are very beneficial for the customers. But in case of service benefit is not the alone factor that determines the level of satisfaction. There are many other things that take control over the overall satisfaction. For instance, service having attractive offers may fail only because of rude behavior or carelessness of the provider. So it is very important to ensure other factors that are related with the success of the service.

The Five Factors to customer Satisfaction

There are five major factors identified by the experts that are essential to assure the quality of better service that will lift the level of satisfaction. They are reliability, responsiveness, assurance, empathy and tangibles. These five factors determines the quality of interaction between customer and provider, the quality of Physical environment quality and outcome quality of the service which leads the overall service to the position of excellence of quality. From our survey we found that how these factors affect their satisfaction level.

Reliability:

It means ability to perform the promised service accurately. In case of banking reliability is very important. Because if the client pretends that the company is not able to continue its service proper in the future they will not interested to banking with IFIC Bank. From our survey we see that most of the customers chose IFIC Bank because they think it is reliable compare to others in case of providing various unique features .On the whole customers have a perception that IFIC Bank is capable to provide all the services they offered.

Responsiveness:

It is another vital factor that controls customers’ perception about quality of service. It means willingness of the employees to help the customers. According to the perception of customers responsiveness is very important to increase the quality of the service. Even the customers ranked the importance of responsiveness in banking 7 out of 9. If employees do not response immediately to the need of the customers, valuable time of the customers will be spent unnecessarily. Even the customer may become frustrated whether he will get the service or not. The customers of IFIC Bank replied that IFIC Bank responses promptly.

Assurance:

It means the knowledge and ability of the employees to develop trust in the mind of the clients about the completion of the task properly and on time. Customers have a great perception about IFIC Bank that they perform according to their promise. Assurance has a great impact on the quality of the service because if promises are not kept customers may switch to other bank.

Empathy

To ensure better service it is very important for the employees to have empathy. Empathy means giving individual attention and taking extra care of the customer. IFIC Bank has young and energetic employs that interact with customers nicely and they continuously ask about their satisfaction and dissatisfaction of every individual.

Tangibles

Tangibles are very important factor because it directs the customer mind about the quality of the service. Tangibles are physical facilities, equipment etc used in the context of service company. Interior decoration, sitting arrangements, temperature of the room, cleanness odor everything controls the perception of customers about the quality of the service. IFIC Bank has confirmed well interior decoration in all their branches and they try keep the standard of their services cape same all over the world. They use all the elements Used in there company like chairs, carpet etc imported from abord and all of them are same for all branches.

Excellence in Customer Service provide by IFIC Bank Ltd

International Finance Investment and Commerce Bank Ltd is one of the leading financial institutions. It expressed its eagerness to offer new services to its valued customer and reward their loyalty and support with innovative service offers. IFIC Bank Bangladesh focused and committed to bringing in distinctive and world class products and services while maintaining service levels and customer satisfaction at the highest standards. The following Product& Services offered by IFIC Bank, Bangladesh, which come with a range of attractive benefits for the customers that maximize value to the customers and differentiate it from its competitor.

Here I have categorized various types Banking Service. These are

- Retail Banking Service,

- Corporate banking Service,

- SME Banking Service,

- Agriculture credit Service,

- Foreign Exchange service

- Internet Banking Service/ E-Banking

- Common Services offered to all Customers

From this banking service they provide there Excellency to the customer and achieve customer satisfaction. Given below Product and Service offered by IFIC Bank Ltd.

Retail Banking Service

Retail Banking is mass- banking facility for individual customers to avail banking services directly from our wide branch net work all over the country. We provide one-stop financial services to all individual customers through our innovative products & services to cater their need. With a view to provide faster and more convenient centralized online banking services, most of our branches have been brought under the real time online banking system.

IFIC Bank offers a wide variety of deposit products, loan product & value added services to suit your banking requirements. Products and services for individual customer include: Consumer Finance, Deposit Product, Card, NRB Account, Student File, SMS Banking etc.

Corporate Banking Service

IFIC Bank is providing a wide range of financial services, offering specialist advice and products to corporate clients to meet diverse demands of changing market scenario. We have expertise to customize products & services to meet specific requirements of our clients. We are committed to serve our customer with extensive branch net work all over the country to expedite our client’s business growth. We facilitate your business to face the challenges and realize opportunities, now and in the future. Our main focus is relationship based banking and understanding corporate & institutional business environments. Our experienced Relationship Managers & their team can respond to and anticipate your needs and give you competitive business advantages. Products and services for commercial and business customers include: Working Capital Finance, Project Finance, Term Finance, Trade Finance, Lease Finance, Syndication Loan etc.

i. Working Capital Finance

Business Enterprises engaged in manufacturing/ trading/ service business are eligible to avail Working Capital Loan to meet day to day expenses for processing of manufacturing and selling product & services.

It includes both fund and non-fund based products. Fund-based working capital products include secured over draft cash credit, packing credit, short-term loans payable on demand. Non-fund based products include bank guarantee performance guarantees and bid bonds are also supporting the business of our customers.

ii. Project Finance

IFIC Bank provides project loan to set up /BMRE of long-term infrastructure and industrial projects service unit on the basis of debt and equity.

The Bank has been financing Term Loan (Industrial) facility for establishing new project and/or BMRE of various projects in the sectors viz. textile, garments, power, steel, telecom, pharmaceuticals, packaging, consume Product health, CNG refueling, Real-estate.

iii. Term Finance

IFIC Bank is offering short term & mid-term finance to meet emergency financial needs of the project/business

iv. Trade Finance

a) Import

- Letter of Credit

- Loan against Imported Merchandize (LIM)

- Loan against Trust Receipt (LTR)

b) Export

- Pre-shipment finance

- Post-shipment finance

v. Lease Financing

For individual and small enterprise besides medium and large enterprises; Can enjoy tax benefit. IFIC offers financing vehicles/ CNG conversion/ refueling plant/ sea or river transport, Capital machinery/plat/ equipment/lift / generator/boiler, construction equipment/ computer for IT education center, medical equipment etc.

vi. Syndication Finance

IFIC Bank along with other commercial banks has been financing large scale projects under syndication arrangement to raise and meet huge credit need of a company

SME Banking Service

The growth of Small and Medium enterprises (SMEs) in terms of size and number has multiple effects on the national economy, specifically on employment generation, GDP growth, and poverty alleviation in Bangladesh. At present, Small & Medium Enterprise sector is playing a vital role in creation of new generation entrepreneurs and ‘Entrepreneurs Culture’ in the country. Experience shows that borrowers of small enterprise sector prefers collateral free loan since normally they cannot offer high value security to cover the exposure. To facilitate SME sector of the country, IFIC Bank provides collateral free credit facilities to the small & medium entrepreneurs across the country whose access to traditional credit facilities are very limited. We are offering 15 different products for selected target groups, such as – Easy Commercial Loan, Retailers Loan, Muldhan Loan, Women Entrepreneur’s Loan (Protyasha), Transport Loan, Working Capital Loan, Project Loan, letter of Contractor’s Loan, Bidder’s Loan, Working Capital Loan, Project Loan, Letter of Guarantee, Letter of Credit Loan against Imported Merchandize (LIM), Loan against Trust Receipt etc.

Major Findings

This is the most important part of my report titled Excellence in Customer service of IFIC Bank Limited. In findings part I am interpreting the results of my survey on 50 sample customers. The results of this study are stated below in points:

Most of the peoples have Savings account.

Most of the customers choose this bank because of the bank location.

Most of the customers are satisfied with the service charge of the bank

The customers are satisfied with the account opening procedure of the bank.

Most of the respondents are receive Cheque against a requisition within 10-15 minutes.

The customers are satisfied with the service provided by the bank.

The customers are satisfied with the behavior of the employees.

The customers who have the account in the bank they can apply for the card and most of them have card. But this is not enough for the bank.

The customers are not satisfied with the number of ATM booths.

The customers are not satisfied with the system of issue a card.

The customers are satisfied with the IFIC Bank employees because they can expertly solve the banking problem.

The customers are satisfied inquiring over telephone.

The customers are satisfied about the delivery process of customer service.

All employees of SBL are efficient and responsive.

Branch environment of IFIC Bank is very pleasant.

IFIC Bank is very much committed to their clients.

RECOMMENDATION:

IFIC Bank Limited has an efficient and excellent management team and performing with a great expertise and care. The limitations can be overcome by some measures to make the performance outstanding. I have some suggestions for The IFIC Bank Limited derived from my observations out of my survey on 50 customers. Those are given below:

Bank should give importance on other accounts.

Bank should improve the size, location and personal relationship.

Number of the branch should be increased. In the rural area bank can be open their branch.

The account opening procedure should be more easier.

The procedure should be short and the employees must be efficient to deliver the service.

To hold the level of customer satisfaction bank should offer new product and provide better service depends on customers’ needs.

Employees of the bank should be more efficient to provide the service to the customer to reach the 100% satisfaction level of customers.

To increase the number of card holder’s bank should advertise of it properly and influence the account holders to take the debit or credit cards.

I think the number of ATM booths must be increased.

Bank should make the procedure short of issuing card and try to issue the card quickly.

I think the technology of ATM must be improved.

Bank should give emphasis on training program to make them more experts.

Employees of the bank should be more aware to answer over the telephone.

Here, bank should ignore the lengthy delivery process of customer service.

The IFIC Bank Limited should maintain good relationship with the customers by providing qualitative products and services.

The employees must be smart and energetic to serve the customers efficiently.

Complain/ suggestions box for the customers may be arranged.

The IFIC Bank Limited should arrange the time-to-time promotion system for the employees to increase their effectiveness/ efficiency/ motivation level.

Monthly providing of account statements may increase customer’s loyalty to the bank.

The bank should concentrate on interest rate according to the expectation of the customers

CONCLUSION

IFIC Bank has started its banking activities much earlier comparing to the other banks and due to that, it has gained a lot of banking experience, which has been proved very worthy for them. But that is a part of their job because our countries economic condition is yet to progress a lot. Time to time they are offering different attractive packages of program for customer like different types of account such as Current Deposit Account, Savings Accounting and Fixed Deposit Account etc from the given charts and tables we can see the various range of their deposits and other offers, which remains on changing time to time. They also have adequate planning for compensation in various sectors like-they have a wide range of bonus- branch bonus, sales bonus as the percentage of individual performance etc. They also have some special incentives for specified performance, which is encouraging for the employees. But at the same time they have some drawbacks like- they do focus mainly on financial incentives and benefits and not on non-financial ones. But it is not wise on their part. So they need to consider the non-financial incentives a little bit seriously for the customers as well as for the employees also. They also need to increase the range of attractive offers with the increasing business. Another thing is, according to my perception, they require a much prompt guideline to operate their activities.

To summarize the whole situation, I would like to say that, this organization is giving a wonderful service to the people in general and at the same time they are also trying to educate our people about the world class banking procedures which is, according to my concept, a very worthy step and we should cooperate with them in this matter for our own benefit. The IFIC Bank Ltd is trying to manage the overall banking activities program and they will definitely progress with the modernization of business environment.