An evergreen loan, also known as a revolving loan, revolving credit facility, or standing loan, is a form of loan in which the borrower receives a principal sum from the lender with a contract interest rate and duration, and the borrower may repay or retake the loan at any point during the term of the contract. The borrower makes installments on the advance equilibrium, in view of the advance’s terms. As the chief equilibrium on the credit is paid off, it would then be able to be acquired once more. Evergreen loans/advances are normally a credit extension that is consistently settled, leaving the borrower with accessible assets for credit buys. There is a caveat, that on an annual basis, the lender must review an evergreen loan to decide whether the applicant meets the loan renewal qualifications. Instead of being bound by a contractual payment plan, the borrower can take money out and pay it back as many times as he or she likes.

Notwithstanding reliably taking care of the evergreen loan, the person’s budget summaries should be analyzed to guarantee adequate pay and, if insurance is on the table, the insurance should be sufficiently significant to get the advance. Most evergreen loans are credit lines that are permanently extended in the short term, with the principal remaining outstanding for the long term. The creditor pays back, and uses it again and again, before the bank or debtor wishes to cancel it, practically indefinitely. The most widely recognized sorts of evergreen advances are rotating advances; notwithstanding, evergreen letters (or notes) of credit are likewise famous.

Evergreen loans come in a range of shapes and sizes, and they’re available across a variety of banking items. The two most popular evergreen loan products provided by credit issuers are credit cards and checking account overdraft lines of credit. In Evergreen loans, the moneylender endorses the chief measure of the credit to the borrower with an agreement period which characterizes the legitimacy of the agreement giving the loan cost as well. These loans are useful because they revolve, which means that users do not have to reapply for a new loan any time they need funds. Both customers and companies will benefit from them.

Again, for the renewal of an evergreen loan, a borrower must fulfill the annual conditions to be approved. Several considerations a lender considers are listed below:

- Financial statements: Lenders look at the financial statements of a borrower first. Its primary aim is to ensure that the creditor is able to pay back his or her debt (or the balance of the loan). When reviewing the financial statements, the lender’s aim is to search at any other past and current debts owed by the borrower, how they were repaid, and if the borrower’s income is adequate to continue making loan payments.

- Collateral/Need for collateral: There might be a need for collateral for some borrowers to receive an evergreen loan. It depends on a variety of factors, but it is particularly relevant for low-income borrowers. The objective for the moneylender is to decide whether the borrower’s security holds sufficient incentive to fence the credit if the borrower defaults. To recoup the loan balance, the lender must raise the collateral and sell it. Generally, creditors with sound finances do not have to provide any collateral.

- Consistency of payments: Finally, one of the most important factors tested by a lender is how well the borrower has paid off the loan over the course of the year (and maybe previous years, depending on whether the loan has been extended in the past). The condition is fulfilled as long as the borrower has regularly paid off the loan.

Evergreen credits are famous for individuals associated with land improvements. The advance is utilized to begin, it is reimbursed as individuals begin getting tied up with the task, and afterward cash is taken out again to fund further development. At the end of the deal, the borrower must pay off the interest rate as well as the principal amount, but the gain falls to the borrower during the contract period where the borrower can withdraw any amount and repay the amount according to his advantage. And the borrower can do this for any number of times during the contract period.

Rotating credit offers the upside of an open credit extension that borrowers can draw from over their whole life, as long as they stay on favorable terms with the backer. It might likewise offer the upside of lower regularly scheduled installments than non-spinning credit. With revolving credit, issuers give a monthly statement and minimum monthly payment to borrowers that they have to make to keep their account up to date. Banking firms offer various revolving credit products depending on the application submitted by the borrower. When the application is affirmed and the advance sum is additionally endorsed, the moneylender (banks, and so on) gives the chief add up to the candidate (borrower) which is likewise bound with a greatest credit sum limit. The borrower can utilize this sum according to his attentiveness.

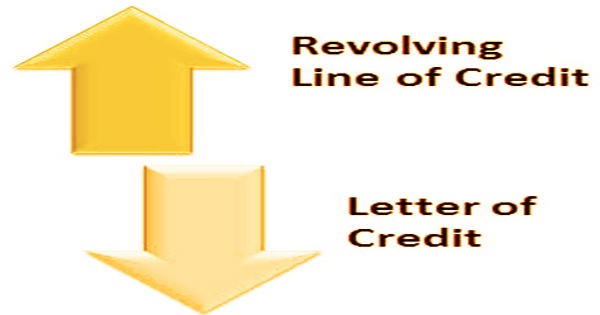

A revolving line of credit (LOC) given to the borrower is one of the most common forms of evergreen loans, provided the borrower meets the different conditions to secure the loan. By far, a revolving LOC is provided mainly to businesses that need money, or more precisely, working capital. When the application is affirmed and the advance sum is additionally endorsed, the moneylender (banks, and so on) gives the chief add-up to the candidate (borrower) which is likewise bound with the greatest credit sum limit. The borrower can utilize this sum according to his attentiveness.

A letter of credit is a special promise given by a bank to a third party working on behalf of a client that the bank will pay the obligation if the client fails to do so. The bank issues the letter of credit with a predetermined credit cap, up to which it will approve the financial guarantee. The customer during going into the exchange may give a letter of credit to the next gathering for the installment of the thought of the exchange or agreement. Like the credit, the letter can be uncertainly restored up until the borrower at this point don’t needs it.

Evergreen loans are widely used as credit cards and bank overdrafts. If the borrower reaches (maxes out) the credit cap, in order to withdraw more money, he or she will have to repay part of the loan. They are valuable forms of personal credit for borrowers because they do not have to reapply for a new loan any time, they need to use it. They may likewise be given by different organizations with which the purchaser doesn’t have extra-record connections. The evergreen credit is really given by a bank or other monetary organization to an organization, government, or person who applies for such. The lender approves the loan amount upon verification of the history and financial status of the borrower.

Information Sources: