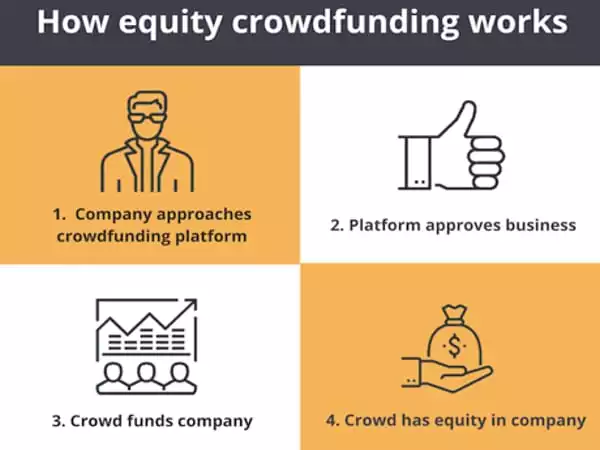

Crowdfunding is the practice of gathering funds from the general public (i.e., the “crowd”), primarily through online forums, social media, and crowdfunding websites, to fund a new project or endeavor. Equity crowdfunding is the online sale of private firm securities to a group of people for investment, and it is thus a component of the capital markets. Equity crowdsourcing is frequently subject to securities and financial regulation because it involves investment in a commercial firm. In exchange for relatively small sums of money, public investors receive a proportionate share of the company’s stock. Crowdfunding for equities is also known as crowd investing, investment crowdfunding, or crowd equity.

Equity crowdfunding is a type of capital-raising strategy utilized by startups and early-stage businesses. In essence, equity crowdfunding distributes the company’s securities to a large number of potential investors in exchange for money. Each investor is entitled to a proportionate share of the company based on their investment. Equity crowdfunding is still a relatively young phenomenon, having emerged only after the turn of the century. As a result, some countries have only recently passed legislation governing such fundraising tactics, while others have only loose, generic regulations in place. Because the fundraising strategy is potentially prone to fraud, one of the primary aims of regulation is to protect investors.

Equity crowdfunding is a system that allows large groups of investors to support fledgling enterprises and small businesses in exchange for stock ownership. Previously, entrepreneurs raised such cash by borrowing from friends and family, applying for a bank loan, or approaching angel investors, private equity firms, or venture capital firms. Investors contribute money to a company in exchange for ownership of a tiny portion of that company. Owners now have an additional choice thanks to crowdsourcing.

Equity crowdfunding is transferring relatively small sums of money in exchange for a proportionate share of the company’s equity. A business that is funded through equity crowdfunding may collapse, commit fraud, or take years to turn a profit. If the company succeeds, its value rises, as does the value of a stake in the company—the inverse is also true. Equity crowdfunding coverage indicates that its potential is greatest with fledgling enterprises seeking smaller investments to establish themselves, while follow-on capital (needed for later expansion) may come from other sources.

Risks of Equity Crowdfunding

- Higher Risk of Failure – A business that has been funded through equity crowdfunding is arguably more likely to fail than one that has been funded through venture capital or other traditional means that provide seasoned personnel to help guide a start-up through early development hurdles.

- Fraud – Because of their broad reach, scalability, accessibility, and ease of recordkeeping, online forums and social media are excellent for equity crowdfunding.

- Years to Materialize – Every investor anticipates some sort of future return. Returns for equity crowdfunded initiatives, on the other hand, may take many years, if at all.