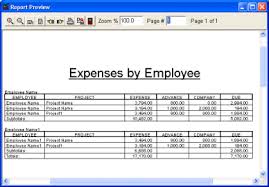

The aim of this article is to explain employee expense reports. The employee expense reports ought to include the signature on the authorized person who may have approved the employee’s visit. Employee expense reports are reimbursed if the expenses are business purposes and only if the employee submits the price report within the specified time. Business-related expenses indicate those expenses that have been incurred while accomplishing employee-related services. Even so, if an employee is now for an entitled pleasure visit, they can submit pertaining to reimbursement.

Employee Expense Reports