Equity share is the foundation of the company as it raises funds. Since equity shares are non-redeemable, they serve as a long-term source of finance for companies. Preference shares are the shares that promise the holder a preference over the equity shares. These can be converted to equity shares. Equity shares come with voting rights, and its holders are also entitled to receive surplus and claim company assets.

Commonly, preference shares are issued to institutional investors such as banks, NBFCs and the like, and not to retail investors. Preference shares are issued when a company is required to raise capital from the market but doesn’t want a loan.

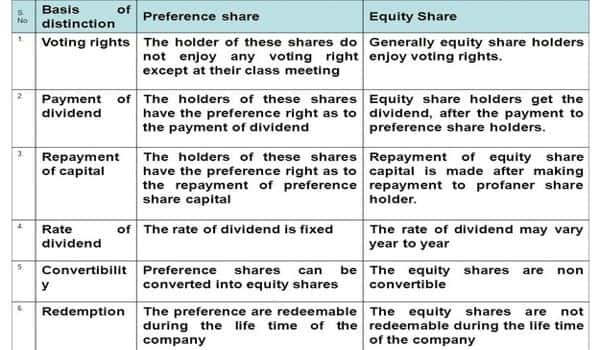

The main differences between equity shares and preference shares are as follows:

(1) Rate of Dividend

- Equity shares do not have right to receive dividend. The rate of dividend on equity shares may vary from year to year depending upon the availability of profit. Under this the rate of dividend is fluctuating.

- Under preference shares, based on time, cumulative or non-cumulative are entitled for the dividend. Preference share holders are paid dividend at a fixed rate. Here, the rate of dividend is fixed.

(2) Arrears of Dividend

- Equity shareholders cannot get the arrears of past dividend. Shareholders are not entitled to avail arrears of dividends.

- Cumulative preference share holders can get the arrears of past dividend. Shareholders are likely to avail arrears of dividend along with current year’s dividend.

(3) Redemption

- Equity shares can not be redeemed except, under a scheme involving reduction of capital.

- Preference shares can be redeemed as provided by the articles and terms of issue.

(4) Voting

- Equity shareholders enjoy voting rights.

- Preference shareholders do not have the right to participate in the management of the company.

(5) Payment of Dividend

- Payment of dividend to equity share is made only after paying to preference shares. These are considered as ordinary shares and thus they do not have any types.

- Preference shares have a preferential right to receive dividend before equity shares. These come in various types like: Convertible and non-convertible, Cumulative and non cumulative, Non participatory, etc.

(6) Role in management

- Equity share comes with the power to participate in the company’s management.

- Preference share does not extend management rights.

Based on the difference between equity share and preference share, it can be said that both shareholders benefit in different ways. While equity shareholders enjoy voting right and can partake in company-oriented decisions, preference shareholders have an upper-hand at the distribution of dividends.

Information Source: