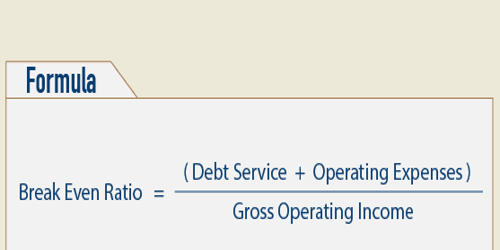

Break-Even Ratio

The break-even ratio for a property is the percentage of its gross operating income that the property needs to break even, i.e. for costs to equal expenses. The Break-even ratio is the percentage of Break-even sales volume to sales volume at budgeted capacity. To calculate the break-even ratio, simply take the debt service + operating expenses – any reserves and divide by the gross operating income. The break-even ratio is important for both investors and lenders. It’s used to know what occupancy level you require in order to still cover your bills. Generally, it is used by lenders to commercial real estate investors. It is an indicator used by lenders when underwriting real estate investment properties, its purpose is to estimate how vulnerable a real estate investment property is to defaulting on its debt should rental income decline

For example, if Break-even sales volume is 50,000 units and sales volume at budgeted capacity is 125,000 units, then break even ration is 40% if the company’s plant capacity is 200,000 units, then break-even sales to capacity is 25% i.e, 50,000 units/200,000 units X 100.

Another example -Let’s say a given property has an annual debt service of $15,000 and it’s annual operating expenses are $12,000. The total yearly expenses for this property are $27,000.

Now, let’s say this property has a gross income of $33,000 (not to be confused with the net operating income).

Total Expenses / Gross Income = Break Even Ratio

= $27,000 / $33,000 = 81.8%.

On the other hand, if the break-even ratio is 75%, an investor or lender would be far more confident in the deal knowing that during the worst-case scenario of a 25% vacancy rate, the property could still cover all of its expenses and obligations. The lower the Break-Even Ratio the better for the real estate investment property;

the Break-Even Ratio typically ranges between 70% and 100%.

Before getting to the formula, we first need to go over the variables that comprise it. Here’s a brief overview of the components that make up the break-even ratio formula:

- The debt service of the property. This refers to the payments that are geared towards reimbursing the interest and principal on a loan. The sum of all periodic payments is called an annual debt service (ADS).

- The operating expenses of the property. These are all the yearly costs that come with managing real estate investment properties. This includes marketing, insurance, taxes, utilities, maintenance and repairs, accounting and legal, and trash collection among many other expenses.

- The gross operating income of the property. The gross operating income is the effective gross income of the property. In other terms, it’s the result of subtracting vacancy loss and credit loss from the gross potential income.