The debt service coverage ratio (DSCR), also referred to as the Debt Coverage Ratio (DCR), tests a company’s ability to use its operating profits to repay all of its debt obligations, including repayment of principal and interest on both short-term and long-term debt. The DSCR tells investors whether a business has sufficient profits to pay off its debts. With regard to government funds, the DSCR is the measure of fare income required by a nation to meet yearly intrigue and head installments on its outer obligation. It is a famous benchmark utilized in the estimation of a substance’s (individual or company) capacity to deliver enough money to cover its obligation (counting lease) installments.

When a company has some debt on its balance sheets, such as bonds, debt, or lines of credit, DSCR is sometimes used. In a leveraged buyout deal, it is also a widely used ratio to assess the target company’s debt ability along with other credit metrics, such as multiple gross debt / EBITDA, multiple net debts / EBITDA, interest coverage ratio, and fixed charge coverage ratio. With regard to individual money, it is a proportion utilized by bank credit officials to decide salary property advances. Incorporate money, DSCR alludes to the measure of income accessible to meet the yearly premium and head installments on obligation, including sinking reserve installments. In close to home money, DSCR alludes to a proportion utilized by bank credit officials in deciding obligation overhauling capacity.

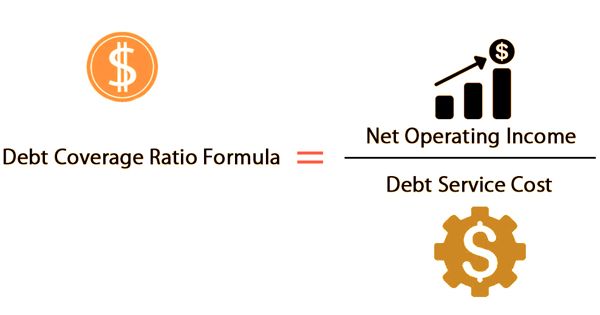

Formula of DSCR

Net operating income and overall debt servicing of the company are required in the formula for the debt-service coverage ratio. Net operating income, not counting taxation and interest costs, is the revenue of a corporation minus its operating expenses. The equivalent of earnings before interest and tax (EBIT) is also considered.

DSCR = Net Operating Income / Total Debt Service

Where:

Net Operating Income = Revenue − COE

COE = certain operating expenses

Total Debt Service = Current debt obligations

Debt Service is financing-related charges and payments. The actual costs arising from taking loans or borrowing properties are interest and lease payments. As a lender or creditor comparing the credit-worthiness of different companies or a manager comparing various years or quarters, when measuring DSCR, it is necessary to apply clear criteria. As a borrower, understand that loan specialists may ascertain DSCR in marginally various manners. Settling the rule of an advance doesn’t change the net value/liquidation estimation of a substance; notwithstanding, it lessens the money an element measures (in return of diminishing credit risk or expanding value in a benefit).

Example of Debt Service Coverage Ratio (DSCR)

Complete debt service applies to existing debt commitments, implying all interest payments due in the coming year, principal, sinking fund, and lease payments. This will include short-term debt and the existing component of long-term debt on the balance sheet. Usually, most commercial banks need a 1.15-1.35-fold ratio (net operating income or NOI / annual debt service) to ensure that adequate cash flow is available on an ongoing basis to meet loan payments. Since interest payments are tax-deductible, income taxes complicate DSCR figures, while principal repayments are not. Therefore, a more reliable way of estimating total debt service is to measure the following:

TDS = (Interest × (1 − Tax Rate)) + Principal

Where:

TDS = Total debt service

While DSCR is, in principle, the ratio of the cash flow available for debt service to the debt service requested, in fact, since interest is a tax-deductible cost and principal, there is no single number reflecting the amount of cash generated from transactions that are both entirely available for debt service and the only cash available for debt service. The base DSCR a loan specialist will request can rely upon macroeconomic conditions. In the event that the economy is developing, credit is all the more promptly accessible, and loan specialists might be all the more sympathetic of lower ratios.

Information Sources: