Measuring Customer Satisfaction Level of Credit

Cardholders of Southeast Bank Limited

A credit card is alternatively termed as “Plastic Money” which has come from the developed nations to the people of developing countries like Bangladesh in 1995. It was introduced by Standard Chartered Bangladesh as first multinational banking financial institution to initiate the activity and later National Bank came with it as first local private banking financial institution to bring it on. The business of credit card was not widely used and popular to its target customer because people considered it as irrelevant expenditure to living rather than short-term financial need or status symbol. Gradually people, mostly the educated and wealthy persons started to use it but now after the increase in living and lifestyle cost which resulted from recession and inflation; people of varied class, income, education and social status are widely using it. Some users like to think it as an instrument of financial freedom and some think it as a premium status symbol of life. Nowadays, on an average, a person having a net income monthly of BDT 50000 is agreeing to have and maintain a credit card.

The rate of enjoying card has also increased in terms of age, gender, educational qualification and profession. There are many private and foreign banks are operating in the market and offering credit card of various type of features which makes open space for clients to switch to another bank. The market is nearly saturated as the demand if credit card is less than the supply and offerings. At this synopsis of business, SEBL credit card is operating in the market which has some advantages and disadvantages to the market. The performance of SEBL Credit Card is not satisfactory if we consider some important factors. Though are competing in the market, emphasizing on distinct possible variables.

Every product or service has a level of customer satisfaction which is tough to measure as it‟s a subject of psychometric and market synopsis. The satisfaction sense of people is a distinct and independent variable which is not always the accurate measurement of satisfaction. It comes truly when some statistical methods are being applied to prove or express their choices on the scale of measurement. A small but thorough research is being done to measure the customer satisfaction level which describes the status of satisfaction on the basis of specific independent attributes and general posture of the data analysis with supporting schematics.

During my internship, I found many people coming with complain or affairs about credit card so it seemed logical to measure the satisfaction of people for this product which could show and describe some important aspects. Each step of research design and execution are being followed strictly so that the process and result becomes theoretically correct. The research has been conducted in the premise of the branch and its client whose are availing credit card. The population is very low if I consider the branch population of credit card; the credit card is a centralized product of card division and owns the entire share of profit. The branch only works as intermediary to support the product and corresponding services. But for the simplicity and accuracy of research, it is better to concentrate on client whose are coming in the branch, having credit card or dealing with it. The research result is being marked out in an ordinal scale in a descriptive way which shows a neutral position at the central point of customers‟ opinion.

Objectives of the Report: – The report has broad and specific objectives to follow.

a) Broad Objective: – The main or broad objective of the report is to measure and describe the satisfaction level of credit cardholders of SEBL, both specifically and generally so that different mentioned attributes of customer satisfaction in terms of credit card and of related aspects can be detected promptly with effective interpretations.

b) Specific Objectives:- Other than the broad objective, the report has few specific objectives too which are given in following-

- To identify the problem and elements of customer satisfaction in terms of credit card

- To organize and analyze the specific and general factors of customer satisfaction in terms of credit card

- To provide a fruitful analysis findings and effective recommendation so that customer and bank can draw an understanding and decide about future

- To provide an overview of customer demographics and their frequency distribution in particular through the research

Scope of the Report: – The report has covered the direct and indirect attributes of credit card and secondary factors associated with it, both of which are crucial for the understanding of opinion, preference and finally the satisfaction level of credit cardholders onward. The overall representation of research data is backed by comprehensive analysis and description of credit card in detail for the best understanding of the audience or reporting authority in previous chapter so that utmost focus is ensured to the report topic within this chapter. The scope is not limited to overall level of satisfaction but also it encompasses a specific measurement of data and attributes with supporting schematics. The research report also contains the respondent analysis segment, where I have tried to demonstrate the effect of some primary demographics with supporting illustrations so that some demographical representation of data comes and shows the general scenario with connected interpretation.

The research data are being collected from the scope of branch to the highest possible extent. The research result could be used for improvement or customization of credit card and associated services but the purpose is to describe or measure the satisfaction level rather predicting anything, but the authority can use its result if they want on the basis of my findings and recommendations.

Problem Definition and Discussion: – It‟s normal to identify the problem first before designing solution and research of customer satisfaction is all about what the problem is and how I respond to it. The literature is being reviewed on the basis of problem and solution it warrants. I also have tried to justify the reason behind choosing this topic and analyze it statistically.

I was deeply observing the facts and practices of banking operation that where I could find a problem and design a solution through my research. So, I was looking for a topic with patience and took suggestions from many official of my office but they replied for many distinct topics or were not able to give me a solution. Suddenly, when I was posted to the credit operation, I found some customers who are using credit cards of SEBL and they were talking about bill payment of their card. One of them make us surprised when he said something very negative about our product and wanted to pay the last bill to close the credit card. I got excited after hearing such conversations and paid more attention. In fact, I didn‟t know anything about credit card before choosing my internship topic and I would like to thank this program which has made me knowledgeable about many things of banking and credit card. They were mainly complaining about mailing system, interest and complementary services that other banks provide much smoothly. My interest and curiosity get a boost-up after their departure and I asked about their discussion and complain to my officer. The officer showed his congeniality towards my eagerness and described me everything. I had learned many things about credit card on that day and on next following days. After getting some amount of information, I discussed it with my supervisor who suggest to choosing the topic and helped me to outlining and mapping the topic.

The case I described above has credited to choose the topic and finding the problem within the topic. Measuring the satisfaction level of credit cardholders became imperative to analyze as I heard about many demerits and merits of credit card continuously. It became clear that clients are having problem with credit card of SEBL which is now a premium status symbol and financial mobility of life. This product should not be underestimated rather it requires deep attention so that it can satisfy its client and function successfully in the market. The problem with credit card remains baffled if its satisfaction is not measured both specifically and generally with effective statistical tools. Besides, I found it logical to prepare a research report on any problematic issue because research doesn‟t get valuation if it can‟t bring solution or pave the way for solution. I believe that my research with such recommendation will pave the way for final solution and it will help the customer and bank authority to take decision about their choices and policy.

Another reason besides a logical reasoning was to choose the topic which has availability of customer related information. I completed my internship in a branch which is located in one of the prime residential area of Dhaka City- Dhanmondi, where most educated, aristocrat and upper class people lives. They define credit card not as financial need rather as financial mobility product to avoid the risk and hassle of carrying huge amount of cash. They prefer different types and brands of high value credit card and use it regularly so they can tell me about the nook and corner of credit card from varied perspective. On the other hand, people in nearby areas like Mohammadpur and Raierbazar, majority of them are not posh like Dhanmondi customers but they are rich and they see credit card as a status symbol and financial mobility instrument both. By envisaging the geographic location of the bank and its nearby customer base, it seemed logical to choose this topic as it will be easy to know customers expectation and opinion. The branch is the major meeting point of different types of client with varied necessity and queries. I easily have obtained card related information and customers opinion about our SEBL VISA Credit Card.

I searched for the different study material and report, where I can find data and information for conducting this research but I didn‟t find any similar topic that that talks about the credit card or measuring customer satisfaction of nay banking products within my branch. It is true that everybody wants to get some refereeing documents to get an idea about his report. I asked to the officer of my branch and requested for some report. He only managed to give two internship reports previously done by interns, but he didn‟t let me copy or bring that at home. So, I just took a general outline of an internship reports and searched for my topic related tasks that are done before and shared with everyone. I got the idea of preparing a questionnaire with multiple segments from there and I also read some small articles about making survey questionnaire for measuring customer satisfaction level of a product. I don‟t know whether anyone before me did report on the same topic in SEBL but I am the first person who is doing this type of measurement report on customer satisfaction and more specifically measurement of credit cardholders‟ satisfaction level at Sat Masjid Road Branch.

Customer Satisfaction and Discussion: – The extent to which a product‟s perceived performance matches a buyer‟s expectations is called customer satisfaction. Customer satisfaction depends on the products perceived performance relative to buyer‟s expectations. If the performance falls short according to the expectation, then the customers are dissatisfied. If the performance matches with the expectation, the customers are satisfied.

If the performance exceeds expectations, the customers are delighted. Smart companies aim to delight customers by promising only what they can deliver, then delivering more than they promise to entertain the customers more than ever. Building a long term profitable customer relationship plays a vital role in terms of determining superior customer value and satisfaction. Accordingly, it has left an ever lasting effort in terms of attracting, retaining and as well as growing customer base. Usually, the customers buy from a company that offers the highest customer perceived value. Customer value is the customer‟s evaluation of the difference between all the benefits and all the cost of a marketing and product offer, relating to those of competing offers which it is actually the difference between the total customer value and the total customer cost.

Satisfied customers produce several benefits for the company. They are fewer price sensitive and they talk favorably to others about the company and its products and services. They also remain loyal for a longer period. However, the relationship between customer satisfaction and loyalty varies greatly across industries and competitive situations. So, customer satisfaction plays a vital role as well as has left an everlasting impact in terms of the customer loyalty and retention. A slight drop from satisfaction can create enormous drop in loyalty and slight rise ensures customer delight and strengthens the emotional relationship with a product or service.

Building customer relationship and customer equity are also important in this respect. This is the edge of modern science and technology. With the speed of time, energy, money business is running at full speed. Different kinds of marketing strategies have reduced the difference between country to country and the whole world has brought into a single compass. So, in today‟s world, the importance is not only finding the customers but also keeping and growing them as well. Customer relationship management team is oriented towards the long term. Today‟s smart firms not only want to create customers, they want to own them for life, capture their customer lifetime value and build overall customer equity.

Increased competition is forcing businesses to pay much more attention to satisfying customers. Customer satisfaction, a business term, is a measure of how products and services supplied by a company meet or surpass customer expectation. It is seen as a key performance indicator within business in a competitive marketplace where businesses compete for customers; customer satisfaction is seen as a key differentiator and increasingly has become a key element of business strategy.

Customer satisfaction is one of the single strongest predictors of customer retention but while satisfied customers tend to be loyal customers, loyal customers are not always satisfied customers and the impact of customer satisfaction on retention and loyalty is not the same for all industries or for all companies within an industry. Maintaining a consistent level of customer satisfaction is not easy; it means monitoring and controlling multiple objects. At one level, you need to know what expectations your customers have of your services and products. You also need to understand the key elements that most heavily influence retention for your business. At another level, it is imperative that your product and service delivery processes and policies are compatible with your quality standards and delivery systems. It is also essential that your employees are committed to and properly trained to implement quality service.

Measuring Customer Satisfaction and Discussion:- Measuring customer satisfaction provides an indication of how successful the organization is at providing products and services to the marketplace. Customer satisfaction is an ambiguous and abstract concept and the actual manifestation of the state of satisfaction will vary from person to person and from product to product. The state of satisfaction depends on a number of both psychological and physical variables which correlate with satisfaction behaviors such as return and recommend rate. The level of satisfaction can also vary depending on other options the customer may have and other products against which the customer can compare the organization’s products.

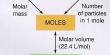

The determinants of customer satisfaction include Quality, Value, Timeliness, Efficiency, Simplicity, Behavior and Commitment to innovation. These factors are emphasized for improvement and organizational change measurement; also to design the change management architecture. The usual measures of customer satisfaction involve a survey with a set of statements using a Likert scale. The customer is asked to evaluate each statement and in term of their perception and expectation; the performance of the product or service being measured.

Unsatisfactory experiences in scale can motivate to complain towards the company and to patronize to other firms. Satisfactory experience can increase the confidence level of company on customer equity, relation and loyalty. The medium or neutral position warns about improvement and enrichment parameters.

You need to know what expectations your customers have on your product and services, the effectiveness of your marketing strategies, the strength of your company’s image as well as the key elements that most heavily influence customer retention for your business.

Data Collection Medium and Procedure: – The primary data is the most significant of all the data that needs to conduct a marketing research. This data is taken mainly from customer or sampling element, which only can duly fulfill the requirement of any researcher. The research topic I have chosen to complete my internship report has high significance of primary data from customer because it‟s them who are the producer of customer satisfaction related direct and indirect factors in terms of Credit Cards. The satisfaction towards the product will be measured on their opinion to the questionnaire statement. The customer satisfaction towards a competitive product can be measured by survey questionnaire. I am now going to explain that how the data has been collected through survey questionnaire and how the questionnaire was formed.

Format of Survey Questionnaire: – The survey questionnaire for my research on measuring customer satisfaction of credit cardholders was formed in a way that constitutes all direct and indirect satisfaction related factors of this competitive and modern product. For this kind of survey, the questionnaire should entail all characteristics of perfection in terms of topic of survey. The idea has been generated in my mind after talking with customers, officer and going through different online related articles. I had paid deeper attention to the reply of credit cardholder and officers towards my question or towards the product. When writing the competitive analysis of different banks credit card with SEBL credit card, I was able to draw a map and prepare a sample in my mind.

The questionnaire has three pages only considering its importance and functionality. It is made of three distinct sections and each of them has logical and functional use. Before going on, I will explain about the introduction and declaration part of mine. On that part, I have mentioned my name, ID, University name, name and place of organization of doing internship which proves my valid identity and so for the paper. Then I have mentioned the topic and purpose of my internship report along with the supervisors‟ name. Again I have briefed about the report topic and objectives so that it makes the credit cardholders abundantly clear about the topic and questionnaire. Eventually, I promised to maintain utmost confidentiality of information and questionnaire. These types of statements are an integral part of research questionnaire. Before rating the statements, I also provided instruction on how to fill it.

The first section contains 18 direct and correlated statements which are very specific on product attributes and major satisfaction related factors. The change in one attribute may have impact on another to some extent. I have tried my best to focus on major and minor but specifically product and its satisfaction related factors which I have obtained from customer and officers in reply. I made such format, considering convenience in specific analysis and presentation of data.

The second section contains only 5 statements which are about overall satisfaction of product and its surrounding services. I intended to make such questionnaire which not only become very specific but also general so that it can help in understating the scenario precisely and provide fruitful indication. I made such format, considering convenience in general analysis and presentation of data.

The third section talks about the identity of respondents participating in my research. The purpose of forming it is to find the customer related general demographic data so that customers of credit card and their behavioral patterns can be separately and precisely explained. It contains the income, sex, age, marital status, education, occupation, using period and magnitude of using credit card. It will be well-described in the findings.

Procedure of Data Collection: – After designing sample and preparing questionnaire, I have been looking for finding a way to collect the data from customers which doesn‟t create any disturbance at the work of customer and branch. I decided to use different desk of the bank like front desk, cash counter, credit desk because they have regular interaction with customers. I got this idea because of likeness the overall branch officials have on me and their support in this regard is unforgettable and I can‟t thank them in word. After having the ratings from 8 branch officials who uses SEBL VISA Credit Card, it became easy for me tocollect the rests. The manager and officers highly praised my work and permitted my request to use the workstation for distributing questionnaire to credit cardholders and fetching their responses. I used the cash counter because credit cardholders came to pay their bill as that was the payment time for interest-free outstanding amount for previous month. Most of the customers pay their bills at the end and I also got the chance to talk with them and get a questionnaire filled up which took maximum 10-15 minutes by average customers. I was always with the customer while he was filling the papers. In the last days of April, I was working at second floor on credit section. So, I had to apply this technique because fewer customers come at second floor. After identifying a credit cardholder, the section officer just called me via intercom or peon so that I can deal with customers. When I found any credit cardholder in my branch, I just followed him when he or she is done with work. I introduced myself and requested to talk with me for a while about the credit card and his satisfaction factor. After judging the impression of element towards the credit card and its attributes, I gave a survey questionnaire to the element with his or her permission. I used my cognitive judgment and intuition to find perfect elements, having eagerness, patience, knowledge and statement to be put in my research.

Scaling Technique:- The scaling technique that has been used in my survey questionnaire is called Likert scale which is one of the most prominent, effective and easy itemized scale of measurement. It has five response categories from “Strongly Disagree” to “Strongly Agree” which requires the respondents to indicate a degree of agreement or disagreement with each of a series of statements related to stimulus objects. It contains the characteristics of both main form of interval and ordinal scale. It possesses the characteristics of description, order and distance. This scale is being widely used in marketing research of customer satisfaction and it is a popular technique for online surveys. Though it‟s time consuming to prepare, administer, answer and evaluate but customer can understand it easily.

Data Analysis: – The analysis of survey data is very difficult and coherent job to do for a researcher. Everything that has been mentioned in the methodology gets application and implementation here. After analyzing the data collected from primary and secondary sources, the result on the topic comes out and represent what is intended to.

It is a quantitative research that mostly has quantitative data with few qualitative data too. The primary data which is the survey data has been put into application by using some descriptive statistical techniques. There are five ways to analyze the primary data. I have preferred to choose the descriptive way here which uses mean/median/mode to find the central limit tendency of data and standard deviation, variance to show the level of dispersion from central limit. As the research have both exploratory and conclusive characteristics in a balance along with interval scale of measurement, it is strongly advisable by theory to use the descriptive way of data analysis with the use of upper mentioned techniques for getting the core output in measuring customer satisfaction. I will also try to use frequency distribution, percentile and tabulation for showing the results schematically which may increase the acceptability, reliability and validity of research finding at higher extent. I will try to use MSExcel for applying the statistical tools though SPSS is better but lack of knowledge, improper training, time limitation and power shortage doesn‟t allow me to use SPSS.

The survey data will be analyzed differently than traditional way. You might have detected that my survey questionnaire for measuring customer satisfaction contains three independent but indirectly related sections like when I am rating a stimuli at the first part; I am also rating the second part and third part. Each part has distinct characteristics and unique functionality though they are parts of same questionnaire and will portray a result in an aggregate. So, I have decided to apply the same statistical tools on first and second section equally but in two patterns. The patterns will be such which will analyze the sections both „Specifically‟ and „Generally‟. The term „Specifically‟ means the statistical tools will be applied- onto 18 direct statements about product-customer satisfaction particularly and also onto 5 indirect or spillover statement of overall satisfaction in particular. The specific measurement will be conducted by counting the response of 20 samples on each stimuli or statement. This will allow the researcher to draw the conclusion on customer satisfaction based on each stimuli or product-customer related statements and make useful recommendations. On the other hand, the second pattern is just similar to first pattern but the difference is the „General‟ analysis of the total scores instead of specific that will be collected from summing up the total scores of first and second section, then applying the statistical tools. This will give an overall and general result of analysis. The researcher can compare easily the results that may have minor or no distance between specific and general results.

Now the third section, that contains the identity of respondents in terms of some major demographic data will show the specific position of customers into this research effort on the basis of income, age, sex, education, occupation, frequency of use, usage period and card type which may definitely infer something very specific and essential about the Credit Cardholders. It is an additional part although but the interpretation on customer is not insignificant. This section will be shown mainly by charts or tables.

Findings

The findings of research titled „Measuring Customer Satisfaction Level of Credit Cardholders of SEBL‟ have finally arrived by using descriptive statistical techniques equally on first and second section of survey data. The mentioned pattern of data analysis has been followed promptly. The findings are presented based on that pattern. Firstly, the research findings of first two sections will be showed specifically with supporting interpretation and illustrations.

Secondly, the research findings of first two sections will be showed generally with supporting interpretation and illustrations. Lastly, the findings from respondent analysis will be portrayed also with supporting illustration and interpretation. At the end, the measurement of customer satisfaction will be provided in an aggregate manner.

Specific Findings of Research: – The specific finding of research has been prepared using arithmetic mean for getting central limit and standard deviation for getting the dispersion from the mean. It will first count the direct customer satisfaction section, then the indirect or overall satisfaction section of survey data.

Specific Findings of First Section: – The specific finding of first section of survey questionnaire is only focused on the direct product related data that has been fetched for measuring customer satisfaction. (PLEASE LOOK AT THE APPENDIX 4.2)

Statement 1: The sample elements have provided rating of 3.35 in an average to the statement that said about the latest and updated features of SEBL VISA Credit Card which means that sample elements have showed neutral position. The standard deviation of this statement is 0.93 which means the mean has medium dispersion in reply of sample size of 20.

Statement 2: The sample elements have provided 3.55 in an average to the statement that said about easy withdrawal and purchase facility by credit card of SEBL which means the respondent are slightly agreeing with it. It has a dispersion of 0.96 which means the mean has medium dispersion in reply of sample size of 20.

Statement 3: The means is 3.85 to the statement that said about easy payment of credit card bills that means the respondents are slightly agreeing and the dispersion is 0.987 that means medium dispersion in response from mean value.

Statement 4: The mean is 4.1 that means respondents are agreeing with statement of receiving bill at right time and their dispersion is 1.165 that indicates high level of dispersion in the rating of this attribute. Some people might have faced problem with collection of bill at right time.

Statement 5: The mean is 2.25 which indicate disagreement with the statement that said the media used for notification are effective. But the dispersion is 1.65 that is quite high. People of different educational and occupational status may have different opinion in this regard. Some may not facing problem with media or may not identify the problem.

Statement 6: The mean of this statement is 3.85 that indicate slight agreeing with the statement of competitive fees and charges of SEBL credit card. As the dispersion is 1.348 which is quite high, means the rating is less uniformed and some people may think about reducing or increasing the fees and charges to make it more competitive.

Statement 7: The mean is 4.15 that mean people are fully agreeing with the statement that said about accurate charging of interest. The dispersion is also low having a value of 0.744 which says people have medium rating at very lower extent in this regard.

Statement 8: The mean of this statement claims that the procedure and time taken for obtaining a credit card is acceptable and rational is 3.45 which mean people have neutral opinion but the dispersion is 1.098 which is neither medium nor higher. Some might think of it as an acceptable or rational procedure or vice versa.

Statement 9: The mean of this statement is 3.85 that indicate people are agreeing with uninterruptable transaction capability of SEBL credit card. The dispersion is also very low, only 0.586 which means the statement is more or less agreed by all samples.

Statement 10: The mean of this statement is 3.5 that indicate people are slightly agreeing with hassle-free enhancement of credit limit but the dispersion is 1.00 which is neither medium nor high, people have something different in their mind.

Statement 11: The mean of this statement is 2.85 that means respondents are disagreeing with this statement that said that the asked collateral for obtaining a SEBL credit card is similar to the market but the dispersion is 1.225 which is very high. Majority might be against the collateral system where some business oriented person may think it rational to some extent.

Statement 12: The average respondents reply on reward and complementary services is 2.1 which means respondents are disagreeing with this statement and their dispersion is medium value of 0.96 which is medium. The similarity in answers was expected here.

Statement 13: The statement talked about the operation and maintenance of credit card where the mean is 2.35, respondents are disagreeing with the statement and the dispersion value is 1.18 which is also high. Knowledge of respondents on technical and technological matter could make the difference.

Statement 14: The statement has been rated by respondents in an average of 3.2; they are neutral on the call center service and efficiency. The dispersion value is 1.105 which is slightly higher as some people might have faced serious problem with call center.

Statement 15: The average number of respondents has put a rating of 3.4 which is neutral on the statement about physical characteristics of credit card. The dispersion is 1.04 which means the dispersion is neither medium nor high. Some people may likes dislikes it or some may not noticed properly.

Statement 16: The statement has a mean of 4.00 which means the respondents are agreeing with easy and fast use of credit card into other banks ATM machine. Their dispersion is relatively lower than other statements which says their together in this regard.

Statement 17: The mean of this statement is 3.5; the respondents are in neutral position in response to the extra benefit gained by them on the basis of their profession or account status. The dispersion value is 0.94 which shows medium spread in rating by respondents.

Statement 18: The mean of this statement is 3.65; the respondents are close to agreeing position in terms of security of credit card. The dispersion is 0.67 which is low that implies respondents opinion is similar. Some people may think that security of card is not so strong.

Specific Findings of Second Section: – The specific finding of second section of survey questionnaire is only focused on indirect or overall customer satisfaction related data that has been fetched for measuring customer satisfaction.

Statement 1: The mean value of the statement is 4.00 which imply that respondents are agreeing with the statement about the support of branch in terms of credit card. The dispersion value is 0.910 which is medium. Some people may not think the same but majority has rated it high.

Statement 2: The means value of the statement is 3.2 which imply that respondents are in a neutral position about the brand value of credit card and the dispersion is less relative to the medium level at 0.83.

Statement 3: The mean value of this statement is 3.8; suggest a relative agreement to the fulfillment of necessity by SEBL Credit Card and the dispersion is 0.82 which is less relative to the medium level.

Statement 4: The mean value of this statement that talks about the promotional activities of SEBL VISA Credit Card has a low rating of 2.25 which means disagreement but the dispersion is 1.10, a bit higher than medium level. The cause could be the peoples less concern and knowledge about commercial promotional.

Statement 5: The last one has a mean value of 3.6 that indicates a bit rise to agreement level from neutral regarding the behaviors of sales executive or dealing persons. It has a dispersion value of 0.98 which is at higher extent within the medium level.

Interpretations: – The mean of each statement has been formed by the response given to the particular statement of analysis by 20 samples. It has measured and described the condition of each statement particularly and precisely. Standard deviation has shown the distance or scattering limit of responses from central point. The dispersion below 0.70 has been considered low, below 1.00 has been considered medium and above 1.1 has been considered higher though it might sound strange but I have decided this scale in considering the importance of research result and the inference it‟s going to provide. It has caused because of random responses given to each statement without much thinking or not having proper sense to understand the statements. Another reason also could be small sample size.

The customer satisfaction on product-satisfaction related direct statements has a cumulative mean of 3.39 which means an average Neutral position within the measurement scale along with dispersion level of 1.02

The customer satisfaction on indirect satisfaction related statements has a cumulative mean of 3.37 that is an average Neutral position within the measurement scale along with dispersion level of 0.928

General Findings of Research: – The general or overall finding of research has been prepared using arithmetic mean, mode, standard deviation, frequency distribution and percentile for getting central limit, dispersion level, highest frequency and corresponding classes and percentage which will represent the findings more precisely so that it can be understood and concluded in a general sense. It will first count the direct customer satisfaction section and then the indirect or overall satisfaction section of survey data.

General Findings of First Section: – The general finding of first section of survey questionnaire is only focused on the direct product related data that has been fetched for measuring customer satisfaction.

- The survey questionnaire has a rating scale that starts from 1 and ends to 5. The first part of the questionnaire has 18 correlated statements which have been filled by 20 samples accordingly. The total; highest possible score could be 90 and lowest possible score could be 18 for one set of questionnaire.

- I have calculated the total of twenty sets of questionnaire particularly and prepared classes of score from 15 to 95 using class interval of 10. After that I placed the scores into their classes and summated the frequencies which are 20. I also converted the frequencies to percentile so that the proportion can be displayed. The highest number of frequency of total score belongs into the class of 55-65 which has a frequency of 10, almost 50% of the total scores lies within the class.

- Then I used the mode to find exactly what point the central limit of the class belong and it is 61.42 with 50% frequency percentile. The average general rating has been brought by dividing the mode with number of statements into the first part because it‟s the number that has prepared the scoring and classes. The cumulative mean of rating score is 3.412 that are indicating the Neutral position of customer satisfaction on direct statements about credit card. It also has a standard deviation of 1.05

General Findings of Second Section: – The general finding of second section of survey questionnaire is only focused on indirect or overall customer satisfaction related data that has been fetched for measuring customer satisfaction.

- The general finding that came out from the scoring of customers to indirect customer satisfaction related data has came out using the same techniques or procedure that has been used getting the result generally from first section.

- Here, only have five indirect statements of measuring customer satisfaction. The higher limit is 25 and lower limit 5, class interval is also 5. So, I got 4 classes in which the highest frequency lies within 15-20. The highest frequency of that class is 11 which 55% of the total scores. By calculating mode, I got the exact number of the class which is 16.92. The cumulative mean of rating score is 3.384 that is indicating the Neutral position of customer satisfaction on indirect statements about credit card. It also has a standard deviation of 0.93

Interpretations: – The objective of this section is to find out customer satisfaction of credit cardholder in term of both specific and general pattern so that no discrepancy exists about the result that I have measured in a descriptive way. This findings show the total highest scores that has been obtained in both section within particular set of questionnaire, filled by samples. It helps to detect the highest class of total score, exact mean number of the class, frequency of that class and finally the rating derived from cumulative average of scores and dispersion. The customer satisfaction on product-satisfaction related direct statements has a cumulative mean of 3.412 which means an average Neutral position within the measurement scale along with dispersion level of 1.05 generally.

The customer satisfaction on indirect satisfaction related statements has a cumulative mean of 3.334 that is an average Neutral position within the measurement scale along with dispersion level of 0.930 generally.

Findings of Respondent Analysis: – The objective of this part is to illustrate and describe the small analysis done with the respondents‟ data that have been collected structurally from the third section of the report. It aims only to provide statistical schematics in pie and bar charts to disclose explicitly the personal information of respondents. It mainly contains major demographic data provided by them though I have high chance of error. It will project the full scenario of credit cardholders who have participated in the research effort and supply demographic inference about SEBL‟s credit cardholder.

Gender Distribution: – Amongst the samples, only 3 elements were female out of 20. The percentage of male and female is 85% and 15% which indicates males are still the giant credit cardholder of the sampling unit and total population in the market. Females are behind in this race because they don‟t have high salaried job, profitable business or established professional standing in volume alike the males.

Age Distribution: – The age of credit cardholders who have been sampled and analyzed has different ages of life. The bar chart in the appendix shows that the classes of age in mentioned in an interval scale. I have started the age limit from 20 to onwards because a person within the age of 20-24 can use a credit card if he or she has enough credentials and financial reputation. It can be seen that person having the age from 30-34 are using the credit cards mostly because they are mostly married, matured, professionally and financially stable, solvent person. They can get one card for their maintaining lifestyle or fulfilling need of money. Besides, the people belong to age group of 25-29 and 35-39 are also using mentionable amount of credit card. In my research these group consists 8 customers. This could happen if the primary group members have new earning life, changing lifestyle, new girl friend of any plan to settle the future now by any means. One of my friends who works in a MNC and earning handsome salary, has recently started using a dual currency credit card even if his job is only three months and his age is 24 only.

Distribution of Marital Status: – Most of the respondents in my research have found married. Amongst 20 samples, only 8 or 40% is single and rests are married. It could be logical because the married people need more money for leveraging their increased cost of living & lifestyle.

Distribution of Educational Qualification: – Sample elements participated in my

research are complete post graduates. 16 of the total sample have masters‟ degree, 3 have bachelor‟s degree and 1 has doctorate degree. This could mean, mostly the highly educated people uses credit card.

Distribution of Occupation: – It‟s found that majority of the credit cardholders who has participated in the research are salaried private service holder and their percentage is 75% and 15 in numbers. Besides, there are 2 independent professional and 3 businessmen. It is indicative strongly that most of the people are private service holder as they earns handsome salary than public service holder and they are most eligible to bank as they have fixed monthly income and salary certification by employer. Though the limit they receive can‟t match with the limit of businessmen or independent professionals.

Distribution of Income: – The income of a person is one of the most important factors when issuing a credit card by the bank. On the basis of income amount, he or she will get proportion of credit limit. In my research, I found three income groups to mention.

They hold significant amount of income level in the research arena. Difference in amount is insignificant between two groups and extremely different with another group. The majority earns between Tk. 30000-50000 per month which has 35% holdings in the chart. The second majority comprises two groups with 20% holdings; one has monthly income of Tk. 50000-70000 and another has Tk. 130000-150000. It can be strongly explained that first group who earns less than the second and third has, high need of money than others for different purposes. The second group is earning higher than first group, may be the married service holders. The third group with highest income may lie under the businessmen or independent professionals group in most cases.

Magnitude of using credit card: – Majority of the credit cardholders of different type, brand and income level uses their credit card on a weekly basis which has a total holding of 60% of the magnitude. It could be the people doing high salaried private job, business or freelancing with responsibility of family. The second highest group uses the credit card on monthly basis that has a holding of 35%. Those who have international credit card can do online transaction or purchase which occurs per week.

Types of credit card used by credit cardholders: – It‟s obvious after conducting the research that people uses the classical VISA credit card most with a holding of 55% to fulfill their need of bearing a credit card. The person who goes frequently outside the country or purchases products and services through online takes international credit card that supports dual currency transaction at market floating rate. It‟s the necessity that determines the function and use of credit card in most cases.

Aggregate Interpretation: – After conducting a marketing research on „Measuring the Customer Satisfaction Level of Credit Cardholders of SEBL‟ in a descriptive way by using survey questionnaire, descriptive statistical techniques and distinct pattern in analyzing survey data, it can be said that the research objective has been fulfilled with proper understanding and conclusion on the topic. The problem can be solved on the basis of findings provided in three patterns within the research. The most important sections of analysis indicate and conclude the status of customer satisfaction of credit cardholders both specifically and generally that the customer satisfaction level of credit cardholders lies at the Neutral position on the scale of measurement. The result that has came after working with the data; retrieved from the extent of Sat Masjid Road Branch can provide appropriate understanding to the topic, can offer directives towards solving the problem and improve the level of satisfaction.

Recommendations

The findings from the research can offer some recommendation or supporting directives whose application or quick implementation will improve the level of credit cardholders‟ satisfaction along with increase in profitability, sustainability and reputation of business. The recommendation is based on the specific scores of different direct and indirect statements about credit cardholders‟ satisfaction.

- The media that are currently being used for sending notification about bill, transaction and information should be modified like using e-mail notification at every phase.

- The operations of issuance, risk measurement and delivery should be re-engineered and decentralized like setting a particular section at each major braches which would be interlinked with main server of card division. It may give relieve from any hassle and time wastage.

- They should try to sale some of their own POS machines to spread their name and rip off some benefit.

- They should disclose the fees and charges related information more elaborately that would build a sustainable market and brand reputation; also would prevent the unfair practice of hidden charges by the industry.

- They should plan and implement the concept of cash reward point and discount at selective merchant points of various category.

- Besides checking statement only, they can improvise a re-engineering process of overall IT operation that should allow online bill payment, transaction, account monitoring and real-time customer service.

- The visual appearance of the card should be recolor means instead of contrasting with bank logo; a more eye-catching, stylish theme can be printed based on the preference of cardholder.

- They could devise a new sales strategy that would target big enterprises with high volume of human resources and would offer benefit packages.

- They should quickly introduce „MasterCard‟ to the market so that it allows capturing the rest of the customers, who likes to think „MasterCard‟ as a premium status symbol than VISA.

- They also could introduce highly secured EVM Chip installed Credit cards.

- They must prepare an organized set of plan regarding the advertising and promotional activities which should include billboards, internet advertising and sponsorship.

- They must design a product or service opinion slip for credit cardholders and distribute it to all major branches that will notify the comments and transcribe the data for periodic survey.

- The sales team and officers should get periodic training on interacting and dealing with different classes of potential and exiting customers.

- For providing service on behalf of card division, the branch should receive a commission which will boost up the motivation level of branch official to a new extent and will bolster the brand positioning.

Conclusion

In conclusion, the research has tried to put strong focus on each integral part proportionately and gained the ability to fulfill the specific and broad objectives. The customer satisfaction and related concepts, attributes, measurement, techniques are described, applied and disseminated in a manner that makes it easily understandable and recommendable to solve the problem. If the decision making authority places little attention to the recommendations that has made by research findings, would pave the way success and satisfaction.