A Currency Transaction Tax (CTT) is a tax on currency transactions that is levied on the buying and selling of currencies. It is a tax levied on the use of currency for various purposes. The tax is typically a small percentage of the transaction value and is intended to discourage short-term speculation in the currency markets. The tax is associated with the financial sector and is a type of financial transaction tax, as opposed to a consumer consumption tax, though the tax may be passed on to the customer by the financial institution.

The idea of a CTT has been around for many years, but it has gained more attention in recent times as a potential tool for raising revenue for governments, as well as for regulating financial markets. Advocates of a CTT argue that it can help to stabilize currency markets by reducing volatility and preventing sudden, large-scale movements in exchange rates.

Opponents of a CTT argue that it could harm economic growth by reducing liquidity in currency markets and increasing transaction costs for businesses. They also argue that it could be difficult to implement and enforce, as currency transactions often take place across borders and between different financial institutions.

Purpose

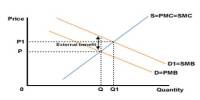

The primary purpose of a CTT is to discourage short-term currency speculation, which can lead to financial instability. Speculators who buy and sell currencies rapidly can create volatile swings in exchange rates, which can be damaging to the real economy. By making such transactions more expensive, a CTT can encourage investors to take a longer-term view of the currency markets, which can lead to greater stability.

Proponents of the CTT argue that it could also generate significant revenue for governments, which could be used to fund important social programs or to reduce other taxes. However, opponents argue that the tax could be difficult to implement and could lead to a decrease in liquidity in the currency markets.

Several countries have implemented some form of currency transaction tax, including France, Italy, and Brazil. However, these taxes are typically focused on specific types of currency transactions, such as high-frequency trading, rather than being a broad-based tax on all currency transactions.

Overall, the idea of a CTT remains controversial, and it has yet to be implemented on a large scale. However, some countries have implemented similar taxes on a smaller scale, and the idea continues to be debated among policymakers and economists.