3.CREDIT POLICY & GENERAL GUIDELINES

3.1TYPES OF CREDITS

CREDIT CATEGORIES BY TENURE

Loans and advances may primarily be divided into two groups:

a)Fixed term loan: These are the advances made by the Bank with fixed repayment schedules. The term of loan are defined as follows:

Short Term : Up to 12 months

Medium Term : More than 12 and up to 36 months

Long Term : More than 36 months

b)Continuing Credits: Theses are the advances having no fixed repayment schedule, but have an expiry date at which is renewable on satisfactory performance.

3.1 AGRICULTURE CREDIT

Credit facilities to the agricultural sector fall under this category. It is subdivided into two major heads:

a) Loans to Primary Producers: This sector of agricultural financing refers to the credit facilities allowed to production units engaged in farming, fishing, forestry or livestock but does not endued traders of agricultural products.

b)Loans to Input Dealers/Distributors: It refers to the financing allowed to input dealers and/or distributors in the agricultural sectors. Until the Bank mobilizes enough funds and extends its outreach to rural areas, there would not be much scope for disbursement of loans to primary products.

3.1.2 TERM LOAN FOR LARGE & MEDIUM SCALE INDUSTRY

This category of advances accommodate the medium and long term financing for capital machinery and equipment of new industries and BMRE of the existing units who are engaged in manufacturing of goods and services.

Term financing to tea gardens is also included in this category depending on the nature and size of investment requires.

3.1.3 TERM LOANS FOR SMALL & COTTAGE INDUSTRIES

These are the medium and long term loans allowed to small & cottage manufacturing industries. Small industry is presently defined as those establishments whose total investment in fixed capital such as land, building, machinery and equipment (excluding taxes and duties) does riot exceed Tk. 30 million (cottage industries also fall within this definition).

Bangladesh Bank sometimes provides interest subsidy at varying rates to the banks on loans extended under this category.

3.1.4 WORKING CAPITAL

Loans allowed to the manufacturing units to meet their working capital requirements, irrespective of their size (big, medium or small) fall under the category. These are usually continuing credits and as such fall under the category of continuing credits.

3.1.5 EXPORT CREDIT

Credit facilities allowed to finance exports against Letter of Credit and/or confirmed export orders fall under this category. It is accommodated under the heads Export Cash Credit (ECC), Packing Credit (PC), Foreign Documentary Bills Purchased (FDBP), Local Export Bills Purchased etc.

3.1.6 COMMERCIAL LENDING

Short term loans and continuing credits allowed for commercial purposes other than exports fall under this category. It includes import financing, financing for internal trade, service establishment, etc. No medium and long term loans are accommodated here. This category of advances are allowed in the form of Loan against Imported Merchandise (LIM), Loan against Trust Receipt (LTR), Payment Against Documents (PAD), Secured Overdrafts (SOD), Cash Credit (CC), Loan (General), etc. for commercial purposes.

3.1.7 LOANS UNDER SPECIAL CREDIT SCHEME

a) Consumers Credit Scheme

b) Rural Credit Scheme for poverty alleviation

c) Monthly Income Scheme

d) Monthly Saving Scheme

e) Education Saving Scheme

f) Students Micro Credit Program for higher education

g) Other such schemes as and when introduced by the Bank.

3.1.8 OTHER CREDITS

Any loan that does not fall under any of the above categories is considered under the category “Others” It includes loan to transport equipments, construction works including housing

(commercial/residential), work order finance, personal loans, etc.

3.2 LENDING PRINCIPLES

For sound lending interalia, the following points should be kept in view:

- Judicious selection of customers

- Purpose

- Safety

- Security

- Liquidity

- Adequate return (Profitability)

- Supervision

- National/social interest

- Credit Control Policy of Bangladesh Bank

It is to be always remembered that the Bank is the custodian of public money and as such the credit officers must be judicious, careful and selective while lending out the depositors’ money to ensure timely recovery. The deciding factors to recovery loans are- selection of right type of borrowers, end-use of credits, effective follow-up and proper supervision.

4.CREDIT ANALYSIS

Credit analysis is an integral part of the lending process in The Premier Bank Limited. Credit analysis is of utmost importance for the lending process to be successful. Proper credit analysis helps avoid risks in the lending process and brings transparency. The analysis of financial statements of the prospective borrower(s) carried on for the purpose of determining the past financial health of the borrowing unit and judging whether any future loan commitment to the unit is secured or not is known as credit analysis. Credit analysis is generally done at the branch level of lending process and the results and findings are evaluated in the head office.

4.1EVALUATION OF CIB REPORT

Bangladesh Bank provides Credit Information Bureau (CIB) Report to banks and other financial institutions. This report is about borrowers having outstanding loan balance of Tk. 1.00 ac and above with scheduled banks and non-bank financial institutions. It contains the following information:

- Debtor/borrower information (outstanding loan balance and loan classification status) Owner information

- Group/related business information

- Credit Exposure Matrix/financial information

4.2 ANALYSIS OF PROJECT FEASIBILITY

In order to obtain a credit, the prospective borrower has to apply through a request for credit limit form in the format provided by Premier Bank. This form, in effect, serves as a project feasibility report. The given information is analyzed in detail by the bank to measure the viability of the project. It covers the following aspects of the project:

i.Identification of the Project and the Promoters:

- Name and brief introduction of the project

- Name, address, background, educational qualification, technical qualification (if any), and business experience of project promoters/sponsors

- Asset-liability position of promoters and of sister concerns

ii. Project Organization and Management:

- Legal form of project organization

- Organizational structure and management set-up

- Authority distribution and reporting relationships

- Shareholding distribution among promoters/sponsors

- Memorandum of Association and Articles of Association of the project

iii. Technical Aspects of the Project:

- Land and location of the project

- Building, structures, and fixture requirement

- Machinery, equipment, and vehicles requirement

- Raw materials and other inputs requirement

iv. Marketing Aspects of the Project:

- Proposed product mix

- Pricing strategy

- Mode/Channels of distribution

- Promotional strategy

- Local and global market outlook

Project costs and Financial Aspects of the Project:

- Detailed break-up of project costs: fixed, variable, and semi-variable

- Working capital needs

- Proposed debt-equity structure of the project

- Proposed sources of financing

- Proposed primary and collateral securities for loan with valuation

- Proposed loan repayment schedule with desired moratorium period

Socio-economic Aspects of the Project:

- Employment generation

- Use of advanced technology

- Contribution to GDP

- Foreign exchange savings

4.3 LENDING RISK ANALYSIS

Lending Risk Analysis (LRA) is basically a risk rating method to show the level of risk that the bank may not be able to fully recover a loan from a particular borrower. This lending risk is to be primarily calculated from two angles namely Business risk and Security risk. Business risk would be ultimately shown through six types of risks namely, Supply, Sales, Performance, Resilience, Management Competence and Management Integrity risks.

4.3.1 BUSINESS RISK

Business Risk is concerned with whether the borrowing company would fail to generate sufficient cash out of business to repay the loan. Business Risk consists of the Industry Risk and the Company Risk.

INDUSTRY RISK

Due to some external reasons a business may fail and the risk, which arises from external factors of the business, is called Industry Risk. It consists of Supply Risk and Sales Risk.

SUPPLY RISK: Supply Risk is the risk that the business suffers from external disruptions to the supply of inputs. Inputs include all the items that the firm needs to run its business, e.g., labor, power, machinery, factory equipment, raw materials, etc. The price, quality or quantity of supplies may be disrupted. Supply risk is assessed in the following steps:

- First, a cost breakdown is obtained.

- Second, the disruption risk of each item is assessed.

- Third, the significant risks of supply disruption are identified,

- Finally, the risk that the company will be affected by disruptions to its supplies is assessed.

SALES RISK: Sales Risk is the risk that the business suffers from external disruptions to sales. Sales may be disrupted by changes to market size, increase in competition, changes in regulations, or the loss of a single large customer. Sales risk is assessed in the following steps:

- First, industry turnover is taken into account.

- Second, the competitive pressure is assessed by analyzing two major competitors.

- Third, the ease of entry into the industry by new competitors is assessed.

- Fourth, the risk of regulatory changes affecting sales is considered.

- Fifth, the risk of a single large customer switching to a competitor is assessed.

- Finally, an overall assessment of sales risk is made.

COMPANY RISK

Company Risk is concerned with some internal factors of the business. It has two components and four sub-components as follows:

COMPANY POSITION RISK: Each and every company holds a position within its industry. This position has to be competitive. Due to weakness in the company’s position in its industry, a company may fail and this risk of failure is called company position risk. It is again sub-divided into Performance Risk and Resilience Risk.

Performance Risk: Performance Risk is the risk that implies that the company’s position is so weak that it will be unable to repay the loan, even under expected external conditions. Assessment of performance risk involves validating the company’s performance expectations. Performance risk is assessed in the following steps:

- First, recent performance history of the company is analyzed.

- Second, the company’s competitive position is analyzed.

- Third, the company’s strategies are evaluated and its cash flow forecasts are analyzed.

- Finally, overall assessment of performance risk is made.

Resilience Risk: Resilience Risk is the risk of failure of the company due to lack of resilience in the face of unexpected external conditions. The resilience of a company depends on its leverage, liquidity, and the strength of its connections. Resilience risk is assessed in the following steps:

- First, financial measures of leverage are analyzed.

- Second, the degree of readiness of the shareholders to lend is measured. Third, the company’s resilience to bankruptcy is evaluated.

- Fourth, significant findings from ratio analysis are taken into account.

- Fifth, variability of costs of the company and its overall resilience to lack of liquidity is assessed.

- Finally, the company’s resilience to adverse political changes is assessed.

MANAGEMENT RISK: If the management of a company is unable to exploit its position effectively, the company may fail and this risk of failure is called management risk. It is again sub-divided into management competence risk and management integrity risk.

Management Competence Risk: It is the risk of company failure because of lack of managerial expertise and professionalism. The competence of the managers depends on education, experience, and also the level of teamwork. Managerial competence is measured in the following steps:

First, the ability of the owners and board members is considered.

- Second, the ability of the managers responsible for finance and operations is assessed. Finally, the strengths and weaknesses of other key personnel are judged and an overall assessment of management ability is made.

- To assess the level of managerial teamwork:

- First, the organizational structure of the company is analyzed.

- Second, the degree of collaboration and coordination among management team members is evaluated.

- Finally, an overall judgment of management competence of the company is made.

Management Integrity Risk: It is the risk of failure of the company to repay its loan due to the lack of managerial ethics. Management integrity is a combination of honesty and trustworthiness. Management integrity is measured in the following steps:

- First, management honesty is assessed by evaluating the reliability of information supplied by management.

- Then, management reliability or dependability is assessed and an overall appraisal of management integrity is made.

4.3.2 SECURITY RISK

Security risk is the risk that the realized value of the security does not fully cover the exposure of a loan. Here, exposure means outstanding amount of the loan (principal and interest). There are two main components of security risk as described below:

Security Control Risk: It is the risk that the bank fails to realize the security because of lack of bank’s control over the security offered by the borrowers. The risk of failing to realize the security depends on the difficulty with which the bank can obtain a favorable judgment and take possession.

To assess security control risk:

- First, an analysis is made about the ease with which the bank can obtain a favorable judgment regarding the securities offered.

- Then, the ease of taking possession of securities by the bank is taken into account.

4.3.3 OVERALL LENDING RISK AND DECISION MAKING

Overall lending risk is derived from the different types of risks that the bank has assessed so far and it selects a risk rating from the following matrix.

| Lending Risk

| Risk Level | Score | |||||||||||||||||||||

Low | Average | High | Excessive | |||||||||||||||||||||

Business Risk | ||||||||||||||||||||||||

| Supply riskWhat is the risk of failure due to disruption in the supply of inputs? | Score | |||||||||||||||||||||||

1.5 | 3 | 4.5 | 12 | |||||||||||||||||||||

Industry risk | ||||||||||||||||||||||||

| Sales RiskWhat is the risk of failure due to disruption of sales? | ||||||||||||||||||||||||

Score | 1.5 | 3 | 4.5 | 12 | ||||||||||||||||||||

Company risk | ||||||||||||||||||||||||

| Performance riskWhat is the risk that the company’s position is so weak that it cannot perform well enough to repay the loan, given expected external conditions? | ||||||||||||||||||||||||

Score | 2 | 4 | 6 | 16 | ||||||||||||||||||||

Company Position risk | ||||||||||||||||||||||||

| Resilience riskWhat is risk of failure due to lack of resilience to unexpected external conditions? | ||||||||||||||||||||||||

Score | 2 | 4 | 6 | 16 | ||||||||||||||||||||

Management risk | ||||||||||||||||||||||||

| Management competence riskWhat is the risk of failure due to lack of management competence? | ||||||||||||||||||||||||

Score | 3 | 6 | 9 | 28 | ||||||||||||||||||||

| Management integrity riskWhat is the risk of failure due to lack of management integrity? | ||||||||||||||||||||||||

Score | 3 | 6 | 18 | 34 | ||||||||||||||||||||

| Total Business risk score | ||||||||||||||||||||||||

Security risk | ||||||||||||||||||||||||

| Security control riskWhat is the risk that the Bank fails to realize the security? | ||||||||||||||||||||||||

Score | -10 | -5 | +5 | +10 | ||||||||||||||||||||

| Security cover riskWhat is the risk that the realized security value is less than exposure | ||||||||||||||||||||||||

Score | -10 | -5 | +5 | +10 | ||||||||||||||||||||

| Total security risk score | ||||||||||||||||||||||||

Good Risk | Acceptable Risk | Marginal Risk | Poor Risk | ||||||||

13-19 | 20-26 | 27-34 | Over 34 | ||||||||

Business Risk | 1 | 2 | 3 | 4 | |||||||

(-20) –(-15) | (-14) -0 | 0-10 | |||||||||

Security Risk | A | B | C | D | |||||||

Select Overall Risk from Matrix

1 | 2 | 3 | 4 |

A | A | A | A |

B | B | B | B |

C | C | C | C |

D | D | D | D |

Good | Acceptable | Marginal | Poor |

Figure 4.1: Lending Risk Analysis Matrix

The interpretation is as follows:

- If it is found from the matrix that the business and security risk is 1A, 16, 1C, or 10, then the loan proposal is considered to be in the Good Risk category.

- If it is found from the matrix that the business and security risk is 2A, 26, or 2C, then the loan proposal is considered to be in the Acceptable Risk category.

- If it is found from the matrix that the business and security risk is 20, 3A, or 38, then the loan proposal is considered to be in the Marginal Risk category.

- If it is found from the matrix that the business and security risk is 3C, 3D, 4A, 46, 4C, or 40, then the loan proposal is considered to be in the Poor Risk category.

4.4 FINANCIAL SPREADSHEET ANALYSIS

This is a computer-based credit risk analysis technique. It uses a number of financial ratios to arrive at two different scores, namely: the ‘2-score, and the “V-score Then, these two scores are used to indicate levels of risks associated with lending to a particular business organization. Both these scores, in terms of their application, calculation methods, and interpretations, are discussed below:

4.4.1 “Z”-SCORE

The “Z”-score is generally applied to the large manufacturing companies. The formula to calculate the “7-score is as follows:

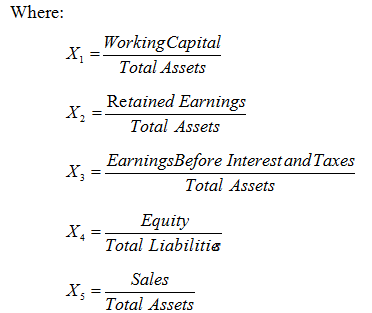

Z = 1.2 X1 + 1.4 X2 + 3.3 X3 + 0.6 X4 + 0.999 X5

The interpretations of “Z” –score are as follows:

- A score higher than 3 indicates a Low Risk.

- A score under 3 indicates further investigation is necessary.

- A score under 1.81 implies an inherent weakness and the probability of company failure within 2 years.

- A consistent downward trend requires investigation even when the score is satisfactory.

4.4.2 “Y” –Score

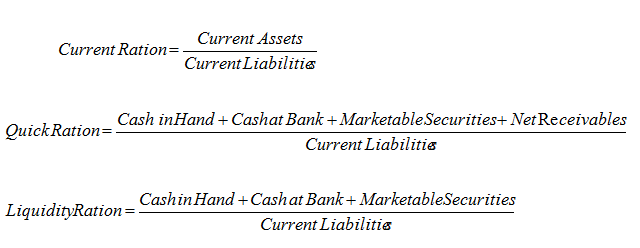

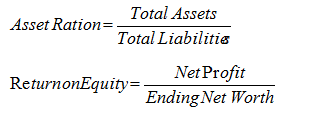

The “Y” –Score is applied to all trading companies and also small manufacturing companies. For determination of the total score, it is necessary to calculate different ratios. After calculation of ratios, the points are determined from the “Y” –score table. The 5 ratios are as follow:

“Y” –Score table is as Follows:

Points per Ratio | Current Ratio | Quick Ratio | Liquidity Ratio | Asset Ratio | Return on Equity |

0 | Below-1 | Below 0.25 | Below 0.10 | Below 0.33 | Below 0.05 |

1 | 1-1.32 | 0.25-0.49 | 0.10-0.19 | 1.33-1.66 | 0.025-0.049 |

2 | 1.33-1.66 | 0.50-0.74 | 0.20-0.29 | 1.67-1.99 | 0.05-0.074 |

3 | 1.67-1.99 | 0.75-0.99 | 0.30-0.39 | 2-2.74 | 0.075-0.099 |

4 | 2 and above | 1 and above | 0.40 and above | 2.75 and above | 0.01 and above |

Table: 4.1: “Y” Credit Score Table

The interpretations of “Y” –Score are as follow:

- A total score of less than 12 indicates an unusual degree of risk and a strong reliance security is suggested for the lender.

- The formula is very much dependent on liquidity ratio. Low scores require a close review of the components of working capita, i.e., current assets less current liabilities. Inventory is likely to from a high percentage of current assets.

- Again, the trend is as important as the actual score.

Having obtained both “Y” –Score and “Z” –Score, the lender has to compare these two scores with the following interpretations:

- If result of the two scores appears contradictory, the component ratios of the lower scores will have to be reviewed to identify the weak ratios and explanation to be sought.

- If the “Z” –Score is satisfactory, and the “Y” –Score is not, then the Sales to Total Assets ratio is to be reviewed. If this ratio and the Sales to Working Capital ratio are high, then the company is probably a safe borrower.

More parts of this post-

Credit Management Of Premier Bank (Part-1)

Credit Management Of Premier Bank (Part-2)