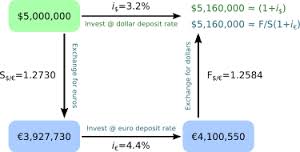

Covered Interest Arbitrage is a strategy in that an investor relies on a forward contract in order to hedge against trade rate risk. Covered interest rate arbitrageis the practice of using favorable rate of interest differentials to buy a higher-yielding forex, and hedging the exchange risk by way of a forward currency deal. Covered interest arbitrage is merely possible if the money necessary for hedging the trade risk is less than the additional give back generated by purchasing a higher-yielding currency.

Covered Interest Arbitrage