Convergence generally means coming together, while divergence generally means moving apart. The idea of convergence in economics (also sometimes known as the catch-up effect) is the hypothesis that poorer economies’ per capita incomes will tend to grow at faster rates than richer economies. Most traders prefer to convergence when describing the price action of a futures contract. As a result, all economies should eventually converge in terms of per capita income. In other words, the poorer economies will literally “catch-up” to the more robust economies

Convergence happens because, theoretically, an efficient market will not allow something to trade for two prices at the same time.

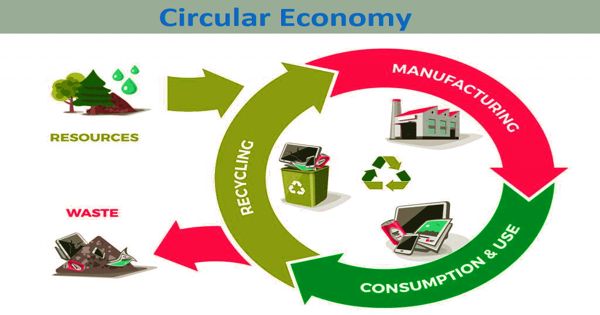

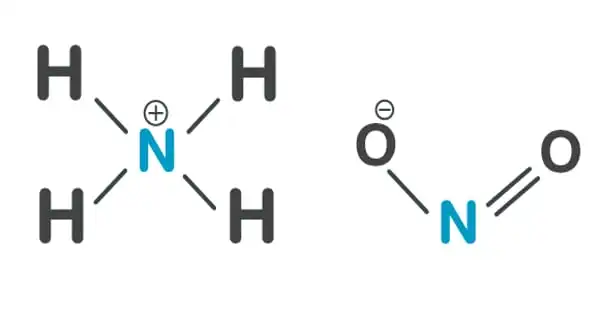

In economic growth literature, the term “convergence” can have two meanings. The first kind (sometimes called “sigma-convergence”) refers to a reduction in the dispersion of levels of income across economies. The catch-up effect refers to a theory speculating that poorer economies will grow more rapidly than wealthier economies, leading to a convergence in terms of per capita income. “Beta-convergence” on the other hand, occurs when poor economies grow faster than rich ones. Poorer countries are also at an advantage because they can replicate the production methods, technologies, and institutions of developed countries. The most common explanation for convergence is the constantly increasing speed at which new technologies spread across international borders.

Convergence happens because, theoretically, an efficient market will not allow something to trade for two prices at the same time. Developing countries have the potential to grow at a faster rate than developed countries because diminishing returns (in particular, to capital) are not as strong as in capital-rich countries. The actual market value of a futures contract is lower than the contract price at issue because traders have to factor for the time value of the security. Furthermore, poorer countries can replicate the production methods, technologies, and institutions of developed countries. This convergence signifies that all industrialized nations are approaching a common level of prosperity.

The world economy entered a new age of convergence around 1990 when average per capita incomes in emerging markets and developing economies taken as a whole began to grow much faster than in advanced economies. Economists say that there is “conditional beta-convergence” when economies experience “beta-convergence” but conditional on other variables (namely the investment rate and the population growth rate) being held constant. They say that “unconditional beta-convergence” or “absolute beta-convergence” exists when the growth rate of an economy declines as it approaches its steady state. For the past two decades, however, per capita income in emerging and developing economies taken as a whole has grown almost three times as fast as in advanced economies, despite the 1997–98 Asian crisis.