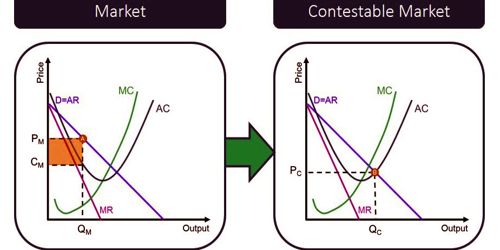

The theory of contestable markets is associated with the American economist William Baumol. In economics, the theory of contestable markets, associated primarily with its 1982 proponent William J. Baumol, held that there are markets served by a small number of firms that are nevertheless characterized by competitive equilibria because of the existence of potential short-term entrants. Contestable in economics means that a company can be challenged or contested by rival companies looking to enter the industry or market.

Contestable markets are an economic concept stating that companies with few rivals behave in a competitive manner when the market they operate in has weak barriers to entry.

William Baumol contributed to The Theory of Contestable Markets. It is said that he was a candidate for the Nobel Prize in Economics.

Application

The contestable market theory assumes that even in a monopoly or oligopoly, dominant companies will act competitively when there is a lack of barriers for competitors. The theory of contestable markets has been used to argue for the weaker application of antitrust laws, as simply observing a monopoly market may not prove that a firm is exploiting its market power to control the price level. Examples of barriers to entry include government regulation or high entry costs. Without these barriers, competitors can enter the market and challenge the existing, well-established companies.

The applicability of the theory to real-world situations may be questioned, however, particularly as there are very few markets that are completely free of sunk costs and entry and exit barriers. This means there are no barriers to entry and no barriers to exit, such as sunk costs and contractual agreements. Low-cost airlines remain a commonly referenced example of a contestable market; entrants have the possibility of leasing aircraft and should be able to respond to high profits by quickly entering and exiting. For a market to be perfectly contestable, relevant industry technology would be readily available to potential entrants.

A contestable market occurs when there is freedom of entry and exit into the market. The contestable risks play on the minds of the executive management teams within the industry. However, it is now generally admitted that Baumol’s judgment that the US airline industry was, therefore, best left deregulated was incorrect since the now duly deregulated industry is “well on its way” to evolving into a concentrated oligopoly. The existence, or absence, of sunk costs and economies of scale, are two significant determinants of contestability. It is important to remember that contestability is not a clear-cut issue, there are degrees of contestability, some markets having more capacity for new firms to enter.