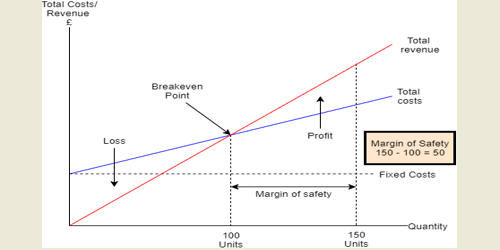

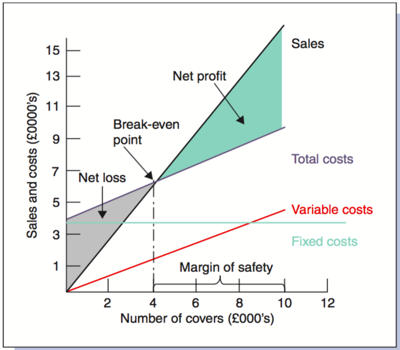

Concept of the Margin of Safety

The margin of safety (M/S) is the excess of budgeted (or actual) sales over the break-even sales. In accounting, the safety margin is built into break-even forecasts to allow for some leeway in those estimates. The margin of safety states where losses begin if the sales drop. It is the difference between the amount of expected profitability and the break-even point. It is a principle of investing in which an investor only purchases securities when their market price is significantly below their intrinsic value. For example, if actual sales for the month of January 2020 are $250,000 and the break-even sales are $150,000, the difference of $100,000 is the margin of safety.

The margin of safety formula is equal to current sales minus the breakeven point, divided by current sales. It indicates the amount by which a company’s sales could decrease before the company will have no profit. It is the number of sales a company can lose before it actually starts to lose money or stops making a profit. It is a financial ratio that measures the number of sales that exceed the break-even point. It’s called the safety margin because it’s kind of like a buffer. This is the number of sales that the company or department can lose before it starts losing money.

The margin of safety = Budgeted sales- Break-even sales. The higher the margin of safety, the safer the position of the business.

A margin of safety ratio is the percentage of the margin of safety to the budgeted sales.

Margin of safety ratio(in %) = (Budgeted sales – Break-even sales)/Budgeted sales

Break-even ratio = 100% – Margin of safety ratio

There exists a close relationship between the margin of safety and net profits.

Net profits before tax = (Budgeted sales – Break-even sales) X P/V ratio

= Margin of safety X P/V ratio

Therefore, P/V ratio = Net profits before tax/Margin of safety.

The margin of safety formula can also be expressed in dollar amounts or number of units:

- The margin of safety in dollars = Current sales – Breakeven sales

- Margin of safety in units = Current sales units – Breakeven point

There are two applications to define the margin of safety:

- Budgeting

In budgeting and break-even analysis, the margin of safety is the gap between the estimated sales output and the level by which a company’s sales could decrease before the company will become unprofitable.

- Investing

In the principle of investing, the margin of safety is the difference between the intrinsic value of a stock against its prevailing market price.