Trading strategies that bet on the market’s up or down movement are known as directional trading strategies. A long position will be taken by an investor who thinks the market is rising. Investors can carry out an essential directional exchanging system by taking a long position if the market, or security, is rising, or a short position if the security’s cost is falling. Then again, in the event that a financial backer accepts the costs will drop, they will take a short position. Directional trading strategies can be used in tandem to make volatility bets. This includes strategies like straddles, strangles, and box spreads.

Since many strategies may be used to profit from a move higher or lower in the wider market or a specific stock, directional trading is also synonymous with options trading. The four types of strategies are bull calls, bull puts, bear calls, and bear puts. The strategies reduce option costs, uncertainty, and risk, but they also result in smaller payoffs. While directional trading requires the trader to have a strong conviction about the market, or security’s, near-term direction, the trader also needs to have a risk mitigation strategy in place to protect investment capital if prices move in the direction that is counter to the trader’s view.

Directional trading necessitates a firm belief in the market’s, or security’s, near-term direction, while still being mindful of the risks involved if prices shift the other way. Calls or puts are used in trading strategies. To begin, investors forecast market movement. Then, investors can make spreads by purchasing and selling alternatives at various strike costs. Doing so will help decline the danger and cost.

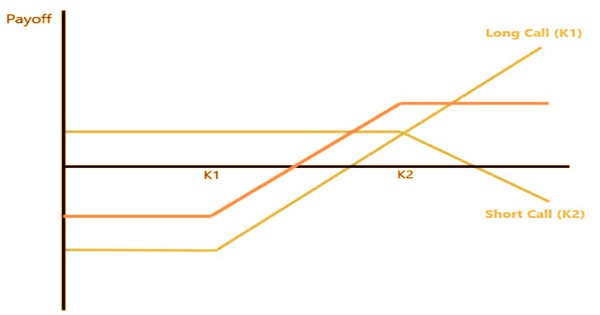

Bull Call: When investors believe the markets are doing well and will rise in value, they issue bull calls. They do this by purchasing a lower strike price call option and selling a higher strike price call option. Investors would have to pay a premium to purchase a call option. The premium is higher for alternatives with a low strike cost since it has more prominent worth. Since purchasing a call choice can be costly, financial backers can decide to offer a call to gather a premium. Thusly, they make a bull call.

A bull call is depicted in the diagram below. The payoff is represented by the vertical axis, which is the profit minus the premium price, and the price is represented by the horizontal axis. The blue lines represent the long and short positions on a call option, while the orange line represents the payoff of a bull call based on the underlying asset’s price. Since a bull call is a risked everything will expand, the result is higher when the cost is high. The graph likewise shows that when the cost is low, the long call has a lower result than the bull call. The long call, on the other hand, has a better chance of paying off because the bull call’s payout is capped until the price reaches the same level as the K2 strike price.

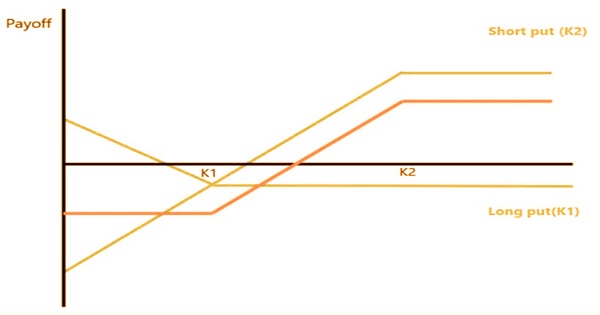

Bull Put: A bull put is a bet that the markets are doing well and that prices will rise. It’s similar to bull calls, but instead of bulls, put choices are used. Buying a lower strike price put and selling a higher strike price put may be used to build bull puts. A bull put will have lower loses in correlation with a since a long time ago put when costs fall. Be that as it may, it additionally covers the income of the choice. Accordingly, the income is less unpredictable.

The diagram below, like the bull call, indicates that the payoff is higher when the price is high. It also demonstrates that when the price is low, a short put has a more drastic negative payoff. The payoff is less drastic if investors buy a long-put option with strike price K1.

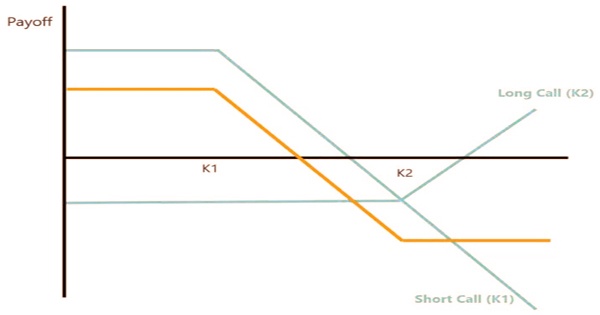

Bear Call: The presumption that stock prices will decline is the basis for a bear call. This is created by selling a low-strike-priced call and buying a high-strike-priced call by investors or traders. The option’s loss and gain are minimal, just like other directional strategies. However, the strategy’s benefit is that it reduces uncertainty. In the event that costs wind up expanding, a financial backer with a bear call will endure less misfortunes than a financial backer with a call choice.

The diagram depicts a higher payout when prices are low, as a bear call is a bet that the price of the underlying asset will fall. It also indicates that the bear call’s loss (orange line) is capped. This eliminates the possibility of a short call, which can result in a loss of any amount depending on how high the price rises.

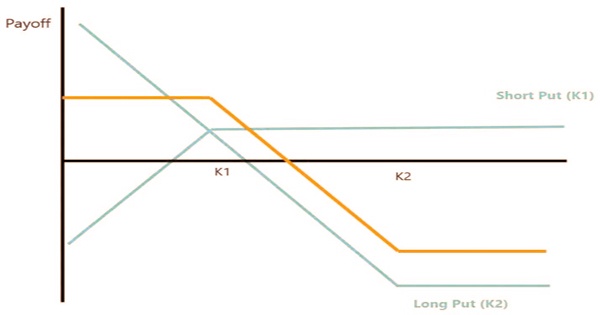

Bear Put: Like bear calls, bear puts make a benefit when the market costs fall. Financial backers make bear puts by selling a put with a low strike cost and purchasing a put with a high strike cost. A bear put is less expensive than simply purchasing a put alternative and diminishes unpredictability. An investor can earn a premium by selling a put option to cover the expense of purchasing a put option with a high strike price. Since a put option allows the buyer to sell the underlying asset at a predetermined strike price, the option with a higher strike price is more attractive because it provides the buyer with more profits.

As demonstrated by the graph beneath, the result is at the most noteworthy before the cost of the basic resource arrives at the strike value K1. This finds a place with the financial backer’s expectation and gives high settlements when the cost is low. The orange line in the diagram also indicates that the bear put’s payoff declines gradually as the price rises. However, it is not as low as just getting a long put option because the short position on another put option pays off.

By and large, alternatives offer a lot more prominent adaptability to structure directional exchanges rather than straight long/short exchanges a stock or file. Directional trading strategies really help financial backers limit their danger, decline costs, and foresee the income with more prominent exactness. Understanding directional strategies additionally assists financial backers with making complex procedures. These systems join bull spreads and call spreads and bet on the instability of the hidden resource.

Information Sources: