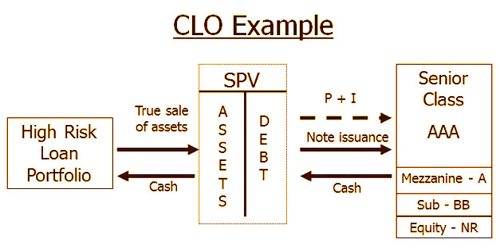

Securities that are secured by a pool of loans are collateralized loan obligations (CLO). Securitization is called the method of pooling assets into marketable security. CLOs are, in other words, repackaged loans that are sold to investors. A CLO is a form of debt obligation that is collateralized. CLOs are mostly funded by low credit rating corporate loans or loans taken out to execute leveraged buyouts by private equity companies. They are equivalent to a collateralized mortgage obligation (CMO), except that loans instead of mortgages are the underlying instruments.

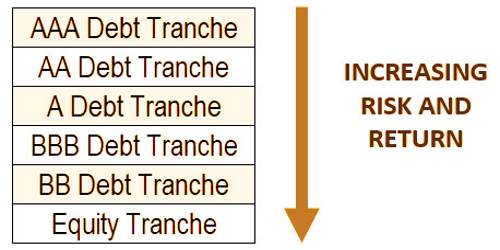

With a CLO, from the underlying loans, the lender collects scheduled debt payments, bearing much of the risk in the event that borrowers default. Debt payments from the underlying loans are pooled together with a collateralized loan commitment and allocated to holders of the different tranches of the CLO. The investor is given greater diversity and the opportunity for higher-than-average returns in exchange for taking on the default risk. In a CLO, there are several tranches, as illustrated below:

Loans typically first-lien bank credits to organizations that are positioned beneath venture grade are at first offered to a CLO supervisor who packages different (for the most part 100 to 225) advances together and deals with the unions, effectively purchasing and selling loans. The lead bank retains a minority amount of the loan while normally retaining “agent” responsibilities representing the interests of the CLOs syndicate as well as servicing the syndicate loan payments; although the lead bank may appoint another bank to assume the position of the agent bank upon closing of the syndication. Speculators can decide to put resources into whichever tranche meets their danger/bring profile back. The higher evaluated the tranche, the safer and lower the return.

Each tranche is a piece of the CLO, and when the underlying loan payments are made, it decides who will be paid out first. A CLO’s underlying loans are composed mainly of first-lien senior-secured bank loans. Second-lien and unsecured loans are other forms of lending that can be found in a CLO. The explanation for the production of CLOs was to build the gracefully of willing business moneylenders, in order to bring down the value (premium expenses) of credits to organizations and to permit banks all the more regularly to quickly offer advances to outer financial specialist/loan specialists to encourage the loaning of cash to business customers and acquire charges with next to zero danger to themselves.

Example of Collateralized Loan Obligation (CLO)

Investors who are first paid out have lower average risk, but, as a result, earn lower interest payments. Last payments can be made to investors who are in later tranches, but interest payments are higher to compensate for the risk. Debt payments made on the underlying loans are pooled together and spread from the top of the tranche to the bottom to investors. Value tranches don’t have FICO assessments and are paid out after all obligation tranches. Value tranches are seldom paid an income however offer proprietorship in the CLO itself in case of a deal.

A leveraged loan will usually have an interest rate set to float above the three-month LIBOR (London Inter-bank Offered Rate), but perhaps only a certain lender will feel secure with a single, financially leveraged borrower’s risk of losses. The investors at the bottom of the tranche will be the first to incur losses if creditors in a collateralized loan obligation default and are unable to meet their debt payments. A higher return is offered to investors at the bottom of the tranche to compensate for such risks.

A CLO is an effectively overseen instrument: chiefs can and do purchase and sell singular bank advances in the hidden security pool with an end goal to score gains and limit misfortunes. Enterprises with great FICO assessments were at that point ready to acquire inexpensively with bonds, however those that couldn’t need to get from banks at greater expenses. The CLO provided a way to borrow from entities other than banks from companies with lower credit scores, minimizing the total cost of money to them. Moreover, much of the debt of a CLO is protected by high-quality collateral, rendering liquidation less likely and making it better positioned to withstand market fluctuations.

Information Sources: