Cobweb Model

Cobweb model or Cobweb theory is the idea that price fluctuations can lead to fluctuations in supply which cause a cycle of rising and falling prices. It describes cyclical supply and demand in a market where the amount produced must be chosen before prices are observed. Producers’ expectations about prices are assumed to be based on observations of previous prices. Nicholas Kaldor analyzed the model in 1934, coining the term “cobweb theorem” (see Kaldor, 1938 and Pashigian, 2008), citing previous analyses in German by Henry Schultz and Umberto Ricci (it).

The Cobweb Model is the classic demonstration that dynamic behavior by economic agents might not converge to a stable equilibrium with supply equal to demand. Agricultural markets are a context where the cobweb model might apply since there is a lag between planting and harvesting (Kaldor, 1934, p. 133-134 gives two agricultural examples: rubber and corn).

The cobweb theorem is an economic model used to explain how small economic shocks can become amplified by the behavior of producers.

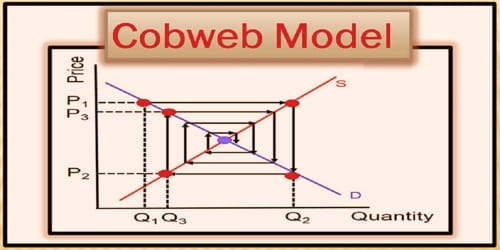

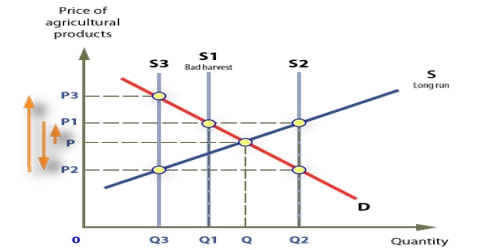

The equilibrium price is at the intersection of the supply and demand curves. A poor harvest in period 1 means supply falls to Q1 so that prices rise to P1. If producers plan their period 2 production under the expectation that this high price will continue, then the period 2 supply will be higher, at Q2. Prices, therefore, fall to P2 when they try to sell all their output. As this process repeats itself, oscillating between periods of low supply with high prices and then high supply with low prices, the price and quantity trace out a spiral. They may spiral inwards, as in the top figure, in which case the economy converges to the equilibrium where supply and demand cross; or they may spiral outwards, with the fluctuations increasing in magnitude.

The Inventory-Based Pricing Model relaxes the assumption that supply must equal demand to consider how maintaining an inventory might moderate the possible instability. Retail stores, for example, very often buy an inventory, set a price, and then wait to see what demand might be.

The Inventory-Based Pricing Model illustrates that the Cobweb Model might or might not be a realistic challenge to supply and demand equilibrium. Introducing an inventory buffering the difference between supply and demand and letting prices respond to the level of the inventory can be sufficient to eliminate the instability observed for the basic Cobweb Model.

Limitations of Cobweb Theory –

Rational expectations. The model assumes farmers base next years supply purely on the previous price and assume that next year’s price will be the same as last year (adaptive expectations). However, that rarely applies in the real world. Farmers are more likely to see it as a ‘good’ year or ‘bad year and learn from price volatility.

Price divergence is unrealistic and not empirically seen. The idea that farmers only base supply on last year’s price means, in theory, prices could increasingly diverge, but farmers would learn from this and pre-empt changes in price.

It may not be easy or desirable to switch supply. A potato grower may concentrate on potatoes because that is his specialty. It is not easy to give up potatoes and take to aubergines.

Other factors affecting the price. There are many other factors affecting price than a farmers decision to supply. In global markets, supply fluctuations will be minimized by the role of importing from abroad. Also, demand may vary. Also, supply can vary due to weather factors.

Buffer stock schemes. Governments or producers could band together to limit price volatility by buying surplus.

Information Source: