The way banks respond to climate risks and uncertainty may have an impact on financial stability as well as the global transition to a low-carbon economy. Researchers from IIASA and the Vienna University of Economics and Business conducted a new study to investigate the role that banks’ expectations about climate-related risks will play in fostering or impeding an orderly low-carbon transition.

According to a study published in the Journal of Financial Stability’s special issue on climate risks and financial stability, banks and their expectations about climate-related risks – particularly climate transition risk resulting from a disorderly implementation of climate policies – play an important role in the successful transition to a low-carbon economy, as lower credit costs could make the transition easier.

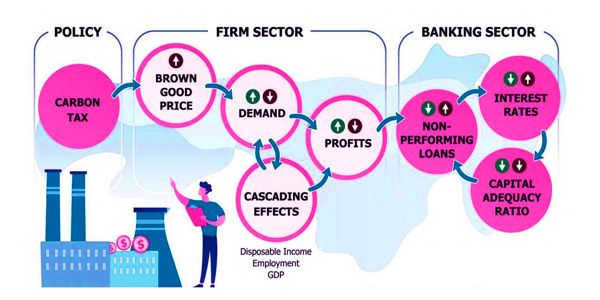

Climate policies, depending on the timing and structure of implementation, may reduce the profitability of brown (carbon-intensive) firms, leading to unanticipated loan defaults by such firms. This could pose a credit risk for banks and investors, potentially jeopardizing financial stability and leading to a credit crunch that would also harm green firms, jeopardizing the success of a smooth low-carbon transition.

The way in which banks react to climate risks and uncertainty could impact financial stability as well as the world’s transition to a low-carbon economy. A new study explored the role that banks’ expectations about climate-related risks will play in fostering or hindering an orderly low-carbon transition.

The authors explain that they set out to assess the role of banks’ expectations about climate-related risks – climate sentiments – in fostering or hindering the low-carbon transition.

“We wanted to know under what conditions a carbon tax or other green supporting factor can encourage green loans and investments in the economy, as well as what conditions would be conducive to the onset of credit market instability, with a focus on loan contracts. Furthermore, we wanted to see what role, if any, the banking sector’s climate sentiments might play in fostering or hindering the expected effect of climate policies on the green economy and financial stability “Asjad Naqvi, an IIASA researcher, and study author, says.

The researchers developed a Stock-Flow Consistent model to analyze the macro-financial implications and feedback effects of climate fiscal and macro-prudential policies. This model takes a forward-looking approach to the pricing of climate risks in banks’ lending contracts and credit risk borne by firms. The researchers used this newly developed model and its innovative features to assess the transmission channels of two major policies and regulations, namely a carbon tax and a green supporting factor, on the credit market as well as on macroeconomic performance and stability.

“A carbon tax would tax carbon-intensive production, making low-carbon production and investment in such facilities more appealing. To avoid unintended consequences, the implementation of a carbon tax should be accompanied by distributive welfare measures. A green supporting factor, on the other hand, would reduce the capital requirements for loans made by banks for green investments, making green lending more appealing to banks and potentially leading to better credit conditions for green investment projects “Irene Monasterolo, a researcher at the Vienna University of Economics and Business, is the study’s author.

The authors argue that the effects of banks’ climate sentiments highlight the critical role of timely and credible climate policy strategies in signaling the market and allowing for an orderly low-carbon transition. Their research could assist financial regulators and central banks in identifying the financial instability implications of credit risk, as well as banks in managing their loan portfolios in the face of climate transition shocks, thereby avoiding the risk of losses caused by non-performing loans.

“Climate sentiments could be pivotal in facilitating a smooth low-carbon transition. Policy credibility is critical for establishing trust in the banking sector, which determines successful policy implementation and mitigates the negative effects of economic and financial instability through lending conditions. A single policy may not be enough to accelerate the low-carbon transition. In this regard, the conditions for synergies between various climate policies and green investment policies, such as the so-called European Green Deal, should be investigated further “Nepomuk Dunz, study author and IIASA researcher, concludes.