Asset prices experience a sharp decline in value during a financial crisis, businesses and consumers are unable to pay their debts, and financial institutions face a shortage of liquidity. During a panic or bank run, investors sell off their assets or withdraw cash from savings accounts out of fear that their value will decline if they keep them in a financial institution. This is a common feature of financial crises.

The phrase “Financial Crisis” typically refers to a serious upheaval in the financial markets and institutions that has had devastating effects on the economy. The Global Financial Crisis (GFC) of 2007–2008 was one of the most notable financial crises in recent memory. The GFC’s root causes, which included a number of important factors, were intricate and interconnected.

(a) Housing Bubble and Subprime Mortgages: The housing bubble, which had been fueled by lax lending standards and easy credit for several years, was what started the crisis. Subprime mortgages, which were home loans given to borrowers with poor credit histories, were made available by numerous financial institutions.

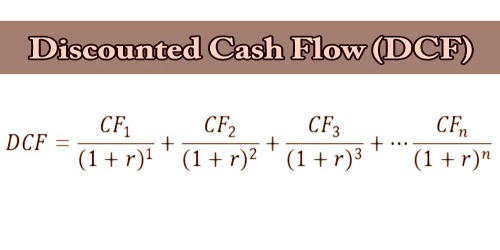

(b) Securitization and Financial Innovations: Banks sold these complex financial products known as mortgage-backed securities (MBS) and collateralized debt obligations (CDOs) by bundling these subprime mortgages with other loan types. Credit rating agencies frequently gave these products high ratings, giving consumers a false sense of security.

(c) Risky Financial Practices: Some financial institutions used risky strategies like leveraging, which increases both potential profits and losses by taking out large loans to invest in securities. This made these institutions more susceptible to changes in the market.

(d) Deterioration of Underwriting Standards: The underwriting requirements of lenders had been significantly loosened, enabling borrowers with weak ability to repay their loans to obtain mortgages. When interest rates started to rise and housing prices started to decline, this resulted in a large number of defaults.

(e) Lack of Transparency: Many financial institutions did not fully understand the risks associated with the complex financial products they were dealing with. Additionally, the lack of transparency in these products made it difficult for investors to accurately assess their risks.

(f) Interconnectedness of Financial Institutions: The global financial system had become highly interconnected through various financial instruments and derivatives. When the housing market started to decline and defaults on mortgages increased, the impact spread through the system, leading to a crisis of confidence and liquidity.

(g) Government Policies and Regulatory Failures: Regulatory agencies failed to effectively monitor and regulate the financial industry. Additionally, government policies promoting homeownership and low interest rates played a role in fueling the housing bubble.

(h) Lack of Risk Management: Many financial institutions did not adequately manage their risks. They often assumed that housing prices would continue to rise and did not prepare for the possibility of a market downturn.

Due to the interconnectedness of the world financial system, the crisis quickly spread to international financial markets, resulting in widespread panic and financial instability.

These elements came together to form a “perfect storm” that brought about the demise of significant financial institutions, a credit freeze, and a serious global economic downturn. The crisis led to the implementation of reforms by governments and regulatory bodies all over the world, including the Dodd-Frank Wall Street Reform and Consumer Protection Act in the United States.