Business Overview and Job Experiences Premier Bank Limited

The Premier Bank Limited (PBL) is the leading private bank in Bangladesh. It is a scheduled bank, which is incorporated in Bangladesh as banking company on June 10, 1999 under Companies Act.1994. It has created a new way of its own banking area of Bangladesh in terms of providing service to customer and value addition to its stakeholders. Bangladesh Bank, the central bank of Bangladesh, issued banking license on June 17, 1999 under Banking Companies Act.1991. The Head Office of the Premier Bank Limited is located at Banani. Within short period of time, the bank has been successful in positioning itself as progressive and dynamic financial institution in our country. The bank is now widely operated by the business community from small entrepreneurs to big merchant and multinational because of modern and innovative ideas and financial solution. Now it has opened 65 branches in different areas of the country.

Company overview:

The Premier Bank Limited is managed by a group of dynamic Board of Directors drawn from different disciplines. They hold very respectable positions in the society and are from highly successful group of Businesses and Industries in Bangladesh. The Bank has a very competent Management Team who have long experience in domestic and international Banking. The Bank upholds and strictly abides by good corporate governance practices and is subject to the regulatory supervision of Bangladesh Bank.

- Authorised Capital: BDT 6000.00 Million

- Paid up Capital: BDT 3818.61 Million

Vision

The bank has a clear vision towards its ultimate destiny – “To be the best amongst the top financial institutions.”

Mission

- To be the most caring and customer friendly provider of financial services, creating opportunities for more people in more places.

- To ensure stability and sound growth while enhancing the value of shareholders investment.

- To aggressively adopt technology at all levels of operation to improve efficiency and reduce cost per transaction.

- To ensure a high level of transparency and ethical standards in all business transacted by the bank.

- To provide congenial atmosphere this will attract competent work force.

- To be socially responsible and strive to uplift the quality of the life by making effective contribution to national development.

Values:

- Service first

- Easier banking

- Better relationship

- Assured confidentiality

- Good corporate governance

- Corporate citizenship

Objective

- To encourage and motivate new entrepreneur to establish industries and business in line with development of the national economy.

- To boost up investment in private sector by financing independently or under syndication arrangement.

- To financing foreign trade of the country both in export and import.

- To enhance savings tendency of the people by offering attractive and lucrative new savings scheme.

- To develop the standard of living of the limited income group by offering consumer credit scheme.

- To boost up mobilization of savings both from urban and rural areas.

- To develop the model of participatory banking.

- To develop competitive, most modern scientific and social welfare oriented banking institution on the country.

- To finance the industry, trade and commerce through conventional way as well as by offering various customers friendly credit products.

Strategy of the Premier Bank Limited

Be Pro-active

We make conscious endeavor to elevate our life and activities. There is no place for fun in ‘Reactive Management’. We learn to anticipate and act.

Begin With the End in Mind

Our every action corresponds to our goal. We set our goal from what lies behind and beyond us. We begin in earnest to finish in time to pursuing that goal.

Put First Things First

We make a choice for things that make an upbeat difference. Things that matter most are not put at the mercy of things that matter least.

Think Win-win

Win-win is a frame of mind and heart that constantly seeks mutual benefit an all human interactions. In our philosophy, we want to see all parties an optimistic winner. A forward looking planning helps us engage in a win-win relationship.

Seek first to understand and then be understood

We prize our ability to communicate over all other values. Most of the time, we patiently hear people more than we are heard. We seek first to understand how we are expectedthen we position ourselves as befittingly as we can.

Synergy

The effect of a combined whole is always greater than the sum of individual parts. The relationship which the parts have to each other is a part in itself. We believe, every part is important and each can contribute. We work together with others to build a team work those results in a better success.

Care and Share Alike for the Society

We care for the feelings, needs and experience of the society and share our interests equally. We try hard to provide for the less privileged and have-nots to ensure a better society and a more prosperous Bangladesh. It is an honor, our duty and privilege, to be able to serve the nation in more ways than just providing banking services.

Functions of the Bank:

The Bank offers:

- Commercial banking service including collection of deposit, short term trade finance, working capital finance in processing and manufacturing units and financing and facilitating trade

- Term loans and working capital loans to industries.

- Loans to Small and Medium Enterprises (SMEs).

Business philosophy of the bank:

The philosophy of PBL is to develop the Bank as an ideal and unique banking institution such as providing “service first”. The bank is quite different from other privately owned one-managed commercial bank operating in Bangladesh. PBL is to grow as a leader in the industry rather than a follower. The leadership will be in the area of service constant effort being made to add new dimension so that clients can get additional value in the matter of services to match with the needs and requirements of the country’s growing society and developing economy.

Board of Directors:

The Board of PBL consists of 15 Directors. Out of 15 members, one is from Taiwan. The members of the Board of Directors of the Bank hold very respectable positions in the society. They are from highly successful group of Business and Industries in Bangladesh. Each member of the Board of Directors plays a significant role in the socio-economic domain of the country.

Division of PBL:

The MD is the head of the operational area, of the bank and its chief executive. The MD is appointed by the board of directors with prior permission of Bangladesh bank. All policy formulation and subsequent executions are done in the Head office. It comprises the following divisions. Financial Administration Division (FAD), GSD, ID, ITD, Establishment, Accounts.

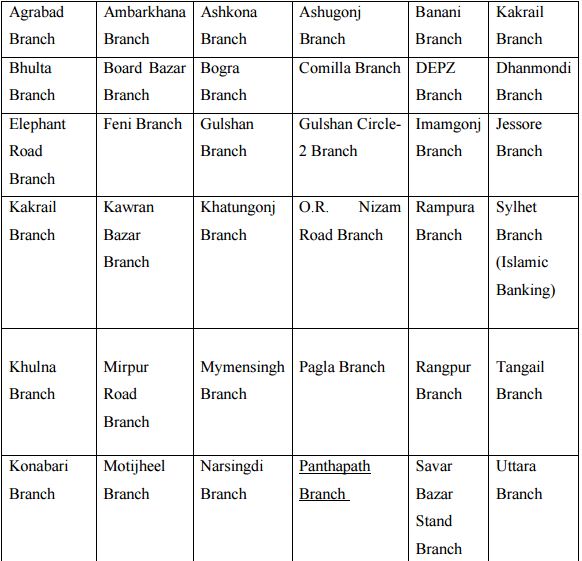

District-wise Branch distribution of Premier bank Limited:

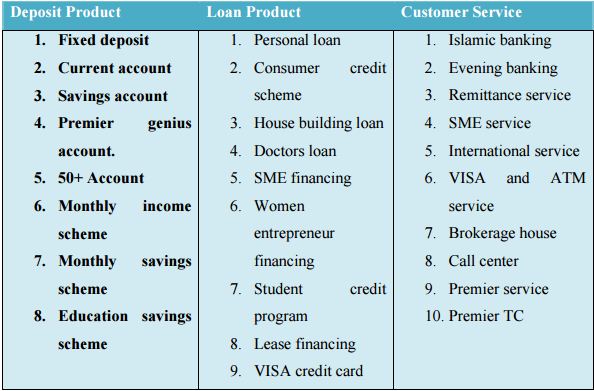

Products and Services of the bank:

Premier Bank is always conscious of the changing needs of the customers and strive to develop new and improved services for its valued customers. Bank offers various Deposits and Lending Products & Services to meet all kinds of financial needs of our customers.

Product of Premier Bank Limited:

Deposit Products:

- Monthly Savings Scheme (MSS)

- Monthly Income Scheme (MIS)

- Education Savings Scheme (ESS)

- Special Deposit Scheme (SDS)

- Fixed Deposit (FD)

- Saving Account (SB)

- Current Account (CD)

- Corporate Savings Account (SB)

- Short Term Deposit Account (STD)

- RFCD/ NFCD Account

Premier Bank is paying interest on daily balance of the Savings & Corporate Savings Accounts.

Lending Products:

- Consumer Credit Scheme

- Rural Credit Scheme

- Student Credit Programme

- Special Credit Scheme on RMG

- Doctor’s Loan

- Lease Finance

- SME Finance

- Hire Purchase

- Trade Finance

- Working Capital Finance

- Project Finance

- Finance for Agroprocessing Industry

Other Commercial Lending such as: Cash Credit, PAD, LIM, LTR

Islamic Baking Operation:

In order to serve those Customers who neither receive or Pay Interest, we have decided to open separate branches based on SHARIAH PRINCIPLES. The activities & book keeping will be kept separate from the Conventional Branch Operations.

Islamic Banking service is now available at MOHAKHALI BRANCH and SYLHET BRANCH. These two branches are run under Islamic Shariah Principles. Chairman of Islami Bank Limited, former secretary of Government of Bangladesh and former Deputy Governor of Bangladesh Bank – Mr. Shah Abdul Hannan is also the chairman of Islamic Shariah Council of Premier Bank. The council also consists of renowned Islamic scholars like Dr. A.R.M. Ali Haider, Professor of Department of Islamic Studies, University of Dhaka, Moulana Ruhul Amin Khan, Executive Director of the Daily Inqilab and others who determine the guiding principles for operation of our Islamic Branches. The performance of our Islamic banking branches during the year 2011 is Deposits 6750.22, Investments 3572.03, Profit 294.97 (Taka in Million).

Services of the Bank:

Locker Service:

For safekeeping of customers’ valuables like important documents and goods like jewelries and gold ornaments, Premier Locker Service is available in most of the Branches in urban areas.

Online any Branch Banking:

We have set up Wide Area Network using Radio, Fibre-Optics & other available communication systems to provide any branch banking to our customers. Customer of one branch is now able to deposit and withdraw money at any of our branches except Barishal Branch. Our Barishal Branch will be included in our Wide Area Network shortly. No TT/DD or cash carrying will be necessary.

Online branch banking service is designed to serve its valued clients. Under this system, you shall be able to do the following type of transactions. Cash withdrawal from your account at any branch of the Bank. Deposit in your account at any Branch of the Bank.

Transfer of money from your account to any other account with any Branch of the Bank. Transaction Limit – Unlimited transaction.

Online Transaction Membership Fee – No Membership fee is required.

Charges for Online Transaction – No charges for online transaction.

ATM:

We have four ATM booths. But the bank are planning to install more ATMs around the country to enable our Account Holders & Card Members to draw cash, do fund transfer, payments and balance inquiry on line.

Banking Software:

A Robust banking software which will integrate the Total Banking Operation and provide total solutions to customer needs is under selection. Implementation is expected soon.

Swift:

Premier Bank Limited is one of the first few Bangladeshi Banks who have become member of SWIFT (Society for Worldwide Inter-bank Financial Telecommunication) in 2002. SWIFT is members owned co-operative, which provides a fast and accurate communication network for financial transactions such as Letters of Credit, Fund transfer etc. By becoming a member of SWIFT, the bank has opened up possibilities for uninterrupted connectivity with over 5,700 user institutions in 150 countries around the world.

SWIFT No.: PRMRBDDH

Credit Card:

Premier Bank holds the principle member License from VISA International to issue & acquire the world’s most widely used Credit Card. Premier Bank is the first local private bank to offer VISA International credit card in the country. The Bank is offering both Local International Cards.

My Job Part:

In this internship Program, I have played the role of service intern. As a service intern, I have introduced with the banking system of premier bank. First two month, I have met and greet with the customer. I have talked with them and tried to find out their expectation toward the bank and find out the solution how it could be solved. Then I have asked them the question and recorded the answer to my note book.

In the mean time, from the general banking department, I have learnt how to open a bank account such as current account, savings account, MSS, FDR etc. I have leant about how to issue cheque book and sometimes by using other user id I gave different types of posting such as cheque book posting.

I can give solvency certificate to the customer and bank account statement to the customer. For that it has procedure. But I have leant it and could easily do the work. Along with, I have started to move each and every desk and tried to learn about the activities of other desk. But from the third month I have started to work in loan and

Credit department. From the loan department, I have learnt about how to prepare bank guarantee and the process of sanctioning bank guarantee.

Then I have leant about how to prepare Credit Information Bureau (CIB) report and I have prepared about 7 or 8 CIB Report of the borrower and bank guarantor of Kakrail Branch.

I have also leant about how to make credit or loan proposal. By the short time, as intern I have made 2 loan proposals. I am happy by giving that service to the bank. And I hope my senior’s are also happy with the performance of me comparing to the other intern of the branch.

Findings and analysis:

PBL Kakrail branch has not adequate number of skilled manpower in branch. PBL has only 64 branches throughout the country, and most of the branches are in Dhaka city. So the service coverage of PBL is very narrow.

- PBL has maintained lengthy process in maintaining record for any type’s of data sending and receiving such as issuing debit card and cheque book. Sometime its good as it become secured and sometime it has negative effect that the customer become bored and it takes more time to maintain the process.

- PBL has very small operational network. So it cannot do remittance business extensively.

- The branch does not do any treasury function. It is rather done by Head Office.

- PBL has introduced Visa Debit Card first time ever done by a Local Bank in Bangladesh.

- PBL has also introduced SMS Banking for its valued clients. The customers can check their account balance, send request for bank statement, and other features are added in this SMS banking service. But not broadly.

- Branches maintain systematic records of transactions with the customers in hard discs with backups so that these can be retrieved when necessary.

- The Bank has adopted online banking. It provides all the modern services with latest technology.

- The Bank uses “Ultimus” software.

- The branch frequently face network problem but there are no netwok operator in the branch. Every time the branch has to call network operator from Head Office, which cause loss of many valuable time.

- The communication network used for online banking by the bank often goes down, which cause many problems to the clients to make or get payments or balance transfer and hamper their business.

Conclusion

Success in the banking business largely depends on effective lending. Less the amount of loan losses, the more the income will be from lending operations. The more the income from lending operations the more will be the profit of the bank

Overall of my investigation I can say that Products and services are satisfactory and continuously meet the challenges of developing new products and services to match the specific requirements of customers.

Over the years Premier Bank Ltd. had shown commendable improvement. But as discussed earlier, the world will not compromise for PBL, for that matter, neither local competitors nor the multinational ones. In this era, when only the fittest survives, PBL wrap a long yard behind from that fitness. This is the crucial time for PBL to consolidate the success they have achieved, and go on with its mission. Otherwise ‘A Bank with Vision’ will only be an illusion to them.