The beta coefficient, often known as the beta (β) or market beta, is a measure of a security’s or portfolio’s volatility or systematic risk in comparison to the market as a whole. When a modest amount of an asset is added to a market portfolio, beta becomes a useful indicator of its contribution to the risk of the portfolio. The capital asset pricing model (CAPM) uses beta to characterize the connection between systematic risk and asset anticipated return (usually stocks).

By comparing the returns of an individual security/portfolio to the returns of the broader market, we may develop a statistical measure of risk and determine the fraction of risk that can be ascribed to the market. As a result, beta is also known as the non-diversifiable risk, systematic risk, market risk, or hedging ratio of an asset. The beta coefficient is used in the Capital Asset Pricing Model (CAPM) to calculate the rate of return of a portfolio or stock. CAPM is a commonly used approach for pricing hazardous securities and producing estimates of projected returns on assets, taking into account both asset risk and capital costs.

The value-weighted average of all market-betas of all investable assets in relation to the value-weighted market index is 1, according to the definition. The product of a stock’s beta coefficient and the market risk premium, which is the difference between the broad market return and the risk-free interest rate, is the equity risk premium. Beta statistics for a single stock can only provide an investor a rough idea of how much risk the stock will bring to a (supposedly) well-diversified portfolio.

The underlying risk that impacts the entire market is known as systematic risk. Large changes in macroeconomic factors like interest rates, inflation, GDP, or foreign currency affect the whole market and cannot be prevented by diversification. Beta is a type of regression analysis since it generally reflects the slope of the security’s characteristic line, which is a straight line that depicts the link between a stock’s rate of return and the market’s rate of return.

If an asset’s beta is greater than (less than) 1, it means that its return moves more (less) than 1-to-1 with the market-return portfolio’s on average. By comparing the rate of change between “general-market” and “stock-specific” returns, the Beta coefficient links “general-market” systematic risk to “stock-specific” unsystematic risk. In fact, only a few equities have negative betas (those that tend to rise as the market falls); most stocks have betas of 0 to 3.

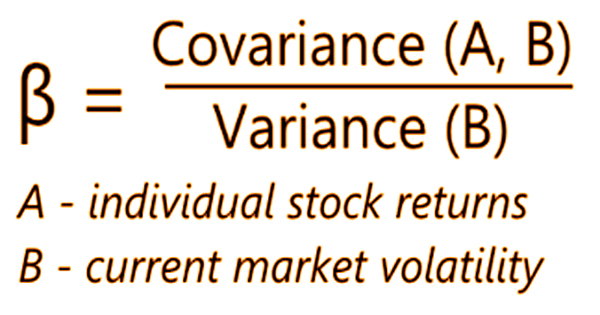

Individual stock returns are described as a function of the broader market’s returns in the Capital Asset Pricing Model (or CAPM). The activity of a security’s returns as they respond to market fluctuations is adequately described by beta. The beta of a security is determined by multiplying the product of the security’s covariance and the market’s returns by the variance of the market’s returns over a certain time. That is just a depiction of the probability of a change in a stock’s or security’s rate of return as a result of a change in market returns.

Divide the covariance of a stock’s return with market returns by the variance of market return to get the beta coefficient.

β = Covariance of Market Return with Stock Return / Variance of Market Return

The product of the standard deviation of stock returns, the standard deviation of market returns, and their correlation coefficient is covariance. We may get another calculation for the beta coefficient by multiplying the correlation coefficient by the standard deviation of stock returns divided by the standard deviation of market returns using this connection.

β = Correlation Coefficient × Standard Deviation of Stock Returns / Standard Deviation of Market Returns

The beta calculation is used by investors to determine if a stock moves in lockstep with the rest of the market. It also tells you how volatile or hazardous a stock is in comparison to the rest of the market. The hedging ratio of investment in relation to the stock market is known as beta. The market that is utilized as a benchmark must be connected to the stock in order for beta to give any helpful information.

As a result, beta assesses how much an individual investment contributes to the risk of a market portfolio that hasn’t been mitigated by diversification. When an investment is held on its own, it does not measure the risk. One of the most common applications of Beta is in valuation models to determine the cost of equity (Re).

The CAPM calculates an asset’s Beta based on a single factor: the market’s systematic risk. The CAPM’s cost of equity reflects the reality that most investors have well-diversified portfolios with unsystematic risk successfully diversified out. Finally, beta is used by investors to determine how much risk a stock adds to its portfolio. While a stock that follows the market very closely does not add much risk to a portfolio, it also does not improve the possibility for higher gains.

A beta coefficient of less than one indicates that the stock has a systematic risk lower than the market and, as a result, would provide a lower-than-market return; a beta coefficient greater than one indicates that the stock has an above-average risk and, as a result, would have to provide a higher-than-market return. The unpredictability connected with a single stock or industry is known as unsystematic risk, also known as diversifiable risk. In general, the CAPM and Beta provide a simple computation technique for standardizing a risk measure across a wide range of firms with different capital structures and fundamentals.

It’s worth noting that the majority of utilities stocks have a beta of less than one. On the other hand, most technological trades, such as Nasdaq listings, have a coefficient larger than 1, indicating a higher probability of higher rewards with higher risks. The most significant disadvantage of utilizing Beta is that it is based only on previous results and does not take into consideration fresh information that may have an influence on future returns. Furthermore, when more return data is accumulated over time, the measure of Beta changes, and the cost of equity changes as well.

Information Sources: