An Automatic Investment Plan (AIP) is an investment program that enables investors, at regular intervals, to add money to an investment account to be invested in a predetermined strategy or portfolio. In investing, there is only one certainty: stock and bond prices can fluctuate. In any case, even the most experienced speculator can’t anticipate precisely when they will rise and when they will fall. Funds may be deducted from the paycheck of an employee automatically or paid out from a personal account. From basic dividend reinvestment strategies to completely automated robo-advisors, individuals may also structure AIPs on their own.

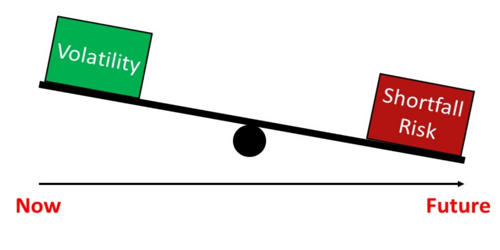

Putting a fixed sum in an asset at normal stretches implies that we will consequently purchase more offers when the cost is low and less offers when the cost is high. This can assist us with decreasing our normal expense per share. When we follow our long-term financial goals, it is also a smart way to handle two critical risks that can get in our way. First, when the market is at its best, it lets us escape the risk of spending all of our assets. Second, and much more significant, it can assist us with keeping away from one of the most exceedingly terrible missteps a financial specialist can make basically not getting around to sufficiently contributing.

(Automatic Investment Plan)

One of the easiest ways to save money is to have an automated investment plan. To help promote automatic investment strategies, various market structures have been devised. Financial specialists can contribute through their boss by planning programmed allowances from their check for interest in manager supported speculation accounts. People can likewise decide to set up programmed withdrawals from an individual record.

For one simple reason, it can be hard to follow a dollar-cost averaging strategy on our own: people are always too busy to remember to write a check, and the strategy relies on daily payments. Participation in the scheme entails continuous investment in the stock, irrespective of the fund’s fluctuating price levels. Along these lines, prior to beginning the arrangement, we ought to consider our monetary capacity to proceed with buys through declining markets and value levels. Investment opportunities help to promote workers’ short-term as well as long-term investment objectives. A 401k is the most prevalent savings vehicle for employer-sponsored automatic investment.

Employees can decide to naturally put a level of their check-in a business supported 401k. Numerous businesses will frequently coordinate a level of their employee’s programmed venture as a feature of their advantages program. Remember that dollar-cost averaging won’t ensure a benefit. No technique or speculation plan can ensure a pick-up or secure us against a misfortune on the off chance that we sell when the estimation of our venture is lower than its expense. Organizations may likewise offer extra alternatives for programmed contributing, for example, organization stock or Z-shares at a common asset organization. These programmed contributing alternatives help to advance faithfulness and long haul residency.

Many investment platforms often offer options for choosing to save automatic investments in a money market account, earning interest before other types of securities are allocated to the money. One type of AIP that develops interests in a solitary stock is a dividend reinvestment plan (DRIP). A DRIP is a program that permits speculators to consequently reinvest their money profits into extra offers or fragmentary portions of the hidden stock on the profit installment date.

For the most part, Robo-advisors automate indexed strategies intended for long time horizons. In order to optimize asset allocation weights to maximize expected return for given risk tolerance and then keep those portfolio weights balanced, they appear to follow passive investment strategies guided by modern portfolio theory (MPT). Speculators making programmed ventures through a business supported advantages program will likewise ordinarily get a good deal on exchange expenses and experience lower charges.

Information Sources: