The primary concern of neoclassical economics is the efficient allocation of limited productive resources. It also considers long-term resource growth, which will allow for increased production of goods and services. The cost of production theory from classical economics is combined with the concepts of utility maximization and marginalism in neoclassical economics.

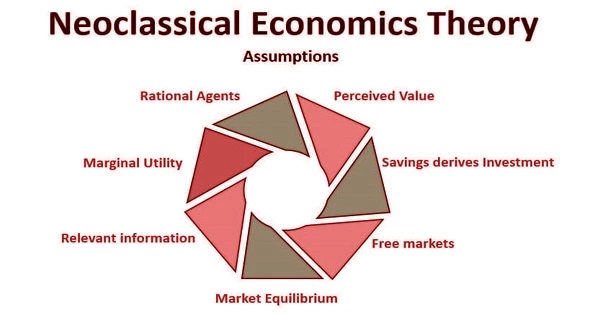

Assumptions of Neoclassical Economics

- Free Markets

According to Neoclassical economics, markets should be free of government intervention; a market with minimal government intervention will adjust itself automatically according to the laws of demand and supply. Free markets also give consumers more options. Markets should be free, which means that the government should not impose too many rules and regulations. People may have a higher standard of living if government intervention is limited. They may, for example, have higher wages and a longer average life expectancy.

- Savings leads to Investments

Neoclassicals believe that a high interest rate encourages savings, which leads to increased investment. When consumers are offered a higher rate of return on investment, they will be more willing to invest their savings. Savings influence investment, but not the other way around. For example, if you have enough money saved up for a car over a period of time, you might consider such an investment.

- Consumers are Rational Agents

A rational person chooses products and services based on their utility. Furthermore, people make decisions that provide the greatest level of satisfaction, advantage, and outcome. According to Neoclassicals, consumers are rational agents who purchase products based on their utility. Before making the decision to purchase a specific product, consumers consider a variety of factors such as price, usefulness, and satisfaction.

- Perceived Value of Goods and Services

Neoclassicals believe that consumers have a perception of the value of a particular product or service. According to them, consumers form their own opinions about a product or service. The perception of a consumer usually trumps the actual value of a product.

Neoclassical economists believe that consumers have a perceived value of goods and services more than input costs. For example, classical economics believes that a product’s value is derived from the cost of materials plus labor. In contrast, neoclassical experts say that an individual perceives a product’s value, influencing its price and demand. They further believe that the price of a product is not dependent upon its cost of production but rather on its “perceived value”.

- The Law of Diminishing Marginal Utility

Individuals make decisions on the basis of marginal utility. The utility of any good or service that increases with its specific use and gradually decreases as the usage ceases is referred to as marginal utility. According to the Law of Diminishing Marginal Utility, increasing the number of units consumed reduces consumer satisfaction. For example, if a consumer is extremely thirsty and buys his first bottle of water to quench his thirst, his satisfaction will be at its peak.

Additional bottles of water will provide him with satisfaction, but it will be less satisfying than the satisfaction derived from the first bottle of water. Prior to producing goods, the producer calculates the marginal cost.

- Market Equilibrium

Neoclassicals believe that market equilibrium will be reached when both consumers and producers have met their respective objectives. The market will be in equilibrium when sellers sell their goods at the price they are willing to sell them at and consumers purchase products at the price that is appropriate for them. When individuals and businesses have achieved their respective objectives, market equilibrium is reached. Within an economy, competition leads to the efficient allocation of resources, which aids in the achievement of market equilibrium between supply and demand.