Banks play an important role in the economy of the country. After liberation except the foreign banks all banks were nationalized. These banks were merged and grouped into six commercial banks. Of the total six commercial banks Uttara and Pubali were transferred to private sector from 1985. In my research paper I mainly focus on financial position of The City Bank Ltd. The City Bank Limited (CBL) is the first private sector Bank in Bangladesh. The Bank has been operating since 1983 with an authorized capital of Tk. 1.75 Billion under the entrepreneurship of twelve prominent & leading businessman of the country.

The noble intention behind starting this Bank was to bring about qualitative changes in the area of Banking and Financial management. To determine the overall performance of the bank I have made a research on the service quality if the City Bank ltd. Because measuring service quality is the best way to evaluate any service sector. There are four measures of service quality- SERVQUAL, importance weighted SERVQUAL, SERVPERF, and importance weighted SERVPERF.

Introduction

Banks play an important role in the economy of the country. To make the economy of a country performed well, it is important to evaluate the bank continuously. The City Bank Limited (CBL) is the first private sector Bank in Bangladesh. Today, The City Bank serves it’s customers at home & abroad with 83 branches spread over the country & about three hundred oversea correspondences covering all the major cities and business center of the world.

Evaluating service area like bank is slightly different from the manufacturing area. Service quality is extremely important to an organization or a bank, but the dilemma seems to be how to accurately and reliably accomplish such

measurement. To know the customer view point about the CBL the evaluation of the service of the bank is much more needed. And that is why my focus was the service quality of the City Bank Ltd. And my topic is titled as “An Assessment of Service Quality in the Banking Sector: A Case Study on The City Bank Ltd”.

Company Background

City Bank is one of the first generation private Commercial Banks operating in Bangladesh. It is a top bank among the oldest Commercial Banks in the country which started their operations in 1983. The Bank started its journey on 27th March 1983 through opening its first branch at B. B. Avenue Branch in the capital, Dhaka city. It was the visionary entrepreneurship of around 13 local businessmen who braved the immense uncertainties and risks with courage and zeal that made the establishment & forward march of the bank possible. Those sponsor directors commenced the journey with only Taka 3.4 crore worth of Capital, which now is a respectable Taka 330.77 crore as capital & reserve.

City Bank is among the very few local banks which do not follow the traditional, decentralized, geographically managed, branch based business or profit model. Instead the bank manages its business and operation vertically from the head office through 4 distinct business divisions namely:

I. Corporate & Investment Banking;

II. Retail Banking (including Cards);

III. SME Banking; &

IV. Treasury & Market Risks.

Under a real-time online banking platform, these 4 business divisions are supported at the back by a robust service delivery or operations setup and also a smart IT Backbone. Such centralized business segment based business & operating model ensure specialized treatment and services to the bank’s different customer segments. The bank currently has 90 online branches and 10 SME service centers and 2 SME/Agri branch spread across the length & breadth of the country that include a fully fledged Islami Banking branch. Besides these traditional delivery points, the bank is also very active in the alternative delivery area. It currently has 122 ATMs of its own; and ATM sharing arrangement with a partner bank that has more than 550 ATMs in place; SMS Banking; Interest Banking and so on. It already started its Customer Call Center operation. The bank has a plan to end the current year with 200 own ATMs. City Bank is the first bank in Bangladesh to have issued Dual Currency Credit Card. The bank is a principal member of VISA international and it issues both Local Currency (Taka) & Foreign Currency (US Dollar) card limits in a single plastic. VISA Debit Card is another popular product which the bank is pushing hard in order to ease out

the queues at the branch created by its astounding base of some 400,000 retail customers.

The launch of VISA Prepaid Card for the travel sector is currently underway. City Bank has launched American Express Credit Card and American Express Gold Credit card in November 2009. City Bank is the local caretaker of the brand and is responsible for all operations supporting the issuing of the new credit cards, including billing and

accounting, customer service, credit management and charge authorizations, as well as marketing the cards in Bangladesh. Both cards are international cards and accepted by the millions of merchants operating on the American Express global merchant network in over 200 countries and territories including Bangladesh. City Bank also introduced exclusive privileges for the card members under the American Express Selects program in Bangladesh. This will entitled any American Express card members to enjoy fantastic savings on retail and dining at some of the finest establishment in Bangladesh. It also provides incredible privileges all over the globe with more than 13,000 offers at over 10,000 merchants in 75 countries. City Bank prides itself in offering a very personalized and friendly customer service. It has in place a customized service excellence model called CRP. CRP focuses on ensuring happy customer through setting benchmarks for attitude, behavior, readiness level, accuracy and timeliness of the service quality. City Bank is one of the largest corporate banks in the country with a current business model that heavily encourages and supports the growth of the bank in Retail and SME Banking. The bank is very much on its way to opening many independent SME centers across the country within a short time. The bank is also very active in the workers’ foreign remittance business. It has strong tie-ups with major exchange companies in the Middle East, Europe, Far East & USA, from where thousands of individual remittances come to the country every month for disbursements through the bank’s large network of 99 online branches and SME service centers.

The current senior management leaders of the bank consist of mostly people from the multinational banks with superior management skills and knowledge in their respective “specialized” areas. The newly launched logo and the pay-off line of the bank are just one initial step towards reaching that point.

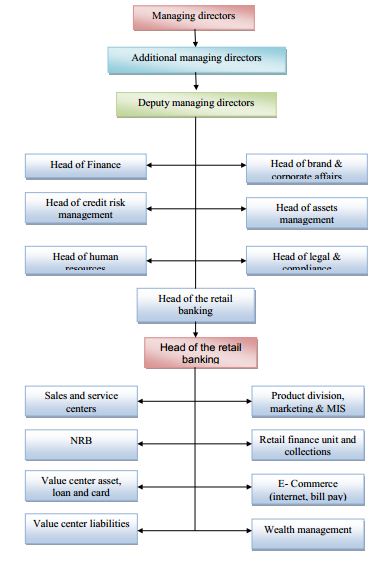

Organogram of City Bank Limited (CBL)

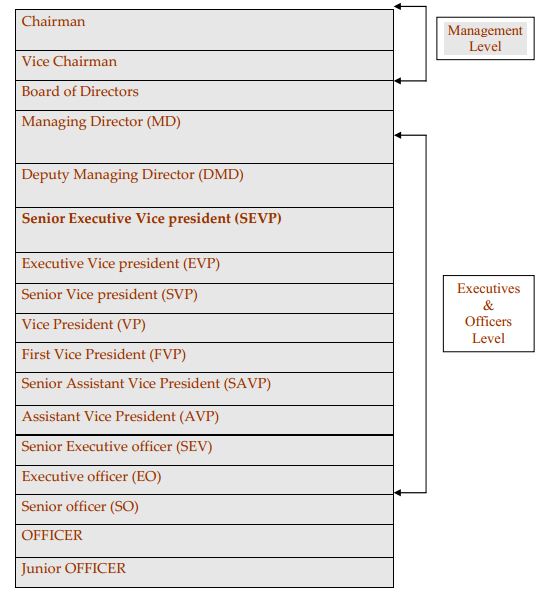

Management Hierarchy of The City Bank Limited

Services:

The city bank limited offers full range of banking services for personal and corporate customers, covering all segments of society within the framework of banking company act and rules and regulations laid down by our central bank. Diversification of products and services include retail banking and customer banking right from industry to

agriculture, real estate to software and it is backed by the latest technology.

All branches of the city bank are fully computerized having online banking facilities for the clients. City bank expresses “making sense of money”. The services of the city bank limited are:

- Online services

- Automated account

- Integrated system

- Signature verification

- Any branch banking

- ATM services

- Mobile banking system

- SMS push pull services

Departments of the City Bank Limited:

- Corporate Banking

- Retail Banking

- SME Banking

- Treasury

Departments in individual branch:

- Customer Service Department

- Cash Department

- Investment Department

- Foreign Exchange Department

- Clearing Department

- Remittance Department

- Operation Department

Objective of the Study

Primary Objective

This report has been prepared as a requirement of the internship program. The report is based upon the organization named “The City Bank Ltd”.

Secondary Objective

- To identify the customers’ perception at the time of receiving service.

- To identify the level of customers expectation from the bank. It will help the bank to provide the services according to their customer.

- To identify what are the factors that are related with the services of the city bank.

- To identify at which factors bank is doing good job. So it can continuouslyfulfilling customers expectation.

- To identify where the bank is not fulfilling the customers’ expectation. It can help the bank for further improvement.

- To see the customer satisfaction level of the customer in CBL.

Methodology

The type of research that is in the report is a descriptive research. It is conducting a probable perception of the customers in terms of service they are having in the city bank new market branch. The research will help to describe the service quality of the branch.

The target population in this following research is defined as follows:

- Elements – male or female respondent client or customer of the bank

- Sampling units- client of bank

- Extent- The City Bank, New Market Branch, Dhaka

- Time -1st July to 25 to August 2012

Considering factor analysis application the sample size should be at least four or five times as many as there are variables. In this research the variables are 12 and therefore the sample size should be 60 but for on the basis of availability the survey made on 50. In this research, through the convenience sampling sample was chosen. Convenience sampling attempts to obtain a sample of convenient element. The selection of sampling units is left primarily to the interviewer. Often, respondents are selected because they happen to be in the right place at the right time. Convenience sampling unit are accessible, easy to measure, and cooperative. And moreover it is also least expensive and least time consuming of all sampling technique.

As a survey method personal mall or intercept survey has been uses in the research. Respondent were intercepted while they were getting service from the bank. The statistical techniques that are used in this are as follow:

Factor Analysis: Factor analysis is a general name denoting a class of procedures used for data reduction and summarization. In marketing research, there may be large number of variables but most of which are correlated and which must be reduced to a manageable level. Relationships among sets of many interrelated variables are examined and represented in terms if a few underlying factors.

T- test: The most popular parametric test is the t test, conducted for examining hypotheses about means. The t test could be conducted on the mean of one sample or two samples of observations. In the case of two samples the sample could be independent or paired.

Chi-square Test: Chi-square is used to test the statistical significance of the observed association in a cross-tabulation. In the factor analysis the Bartlett’s test of sphericity is used to test the null hypothesis that the variables are uncorrelated. The test statistics of sphericity is based on chi-square transformation of determination of hypothesis.

In conducting the statistical techniques 17.0 version SPSS software has been used.

Relationship between Customer Satisfactions and Service Quality in Service Product

The principal study by Zeithaml, et al (1985) fostered a direct relationship between customer satisfaction and service quality and broadened the unique characteristics of service products. They explained that service in its production sense and consumption occur simultaneously. Production and consumption of service products cannot exist in

isolation, requiring them to be simultaneously produced and consumed. Additionally, they suggest that service production and consumption is by its own nature heterogeneous.

Their research was significant in that it highlighted the differences between manufactured products and service products, and it introduced the interrelationships between customer service and customer satisfaction through the measurement of gaps.

Customer Satisfaction

A key aspect in customer satisfaction is the way a customer can attain satisfaction or dissatisfaction with a company’s service. If a company wants to satisfy its customers the first question it needs to answer is what is it that satisfies customers and, equally important, what is it that makes customers dissatisfied with the company and its products

and services. Satisfying customers depends on the balance between customers’ expectations and customers’ experiences with the products and services (Zeithaml et al., 1990). When a company is able to lift a customer’s experience to a level that exceeds that customer’s expectations, then that customer will be satisfied. Because customers have ever increasing expectations it is necessary for companies continuously to improve their quality and hence customers’ experiences with the company. The issue is what should be improved to keep the customers satisfied. What customers experience is not just one simple aspect of a company, but a whole range of aspects. Some of these aspects are concerned with the way customers experience the company itself, some are concerned

with the way customers experience the physical product and, finally, some are concerned with the way customers experience the service the company offers.

Comparing customers’ expectations and their perceptions of actual performance can be done by making use of the SERVQUAL scale of Berry, Parasuraman and Zeithaml (Zeithaml et al., 1990).

Service Quality

Recent debates in the marketing literature regarding the service quality concept have raised important issues for both academics and practitioners. Leading researchers in this area, including Parasuraman, Zeithaml, and Berry (1994), Cronin and Taylor (1992, 1994) and Teas (1994), have provided significant but sometimes conflicting insights into related conceptual, methodological, analytical, and practical issues. Although marketing scholars have proposed additional research on many of these issues, there has been little research on the generalizability of such findings across countries, especially those with developing economies. The four alternative measures of service quality (SERVQUAL, importance weighted SERVQUAL, SERVPERF, and importance weighted SERVPERF) were tested by taking the 22 expectation and performance measures from the SERVQUAL scale (Parasuraman, Zeithaml, and Berry 1988) and adapting the importance weights used by Cronin and Taylor (1992). These 22 expectation and

performance items measure perceptions regarding five factors believed important in service quality: reliability, responsiveness, empathy, assurance, and tangibles.

The Importance of Service Quality Measurement in Banks

While there has been considerable research in the area of service quality, there are a number of fields in which a thorough examination of the service gaps has not been conducted, such as the subject study that will address this important measure from the standpoint of empirical studies of perceptions versus expectations. Banking in a Developing or Developed country is one of those areas in which a thorough examination of gaps between customers’

expectations and bankers’ perceptions of what the customer expects have not been thoroughly examined. Additionally, gaps between customers’ expectations and actual services delivered are an area ripe for study. Why is service such an issue in banking? Berry, et al (1988) noted that most financial institutions are alike in the services provided to their customers. Likewise, he noted that their prices are generally comparable, and in fact might look similar in design, but where they differed was in the level of service provided to their customers. As financial institutions grow, there is a tendency for service to give way to volume delivery to enhance profitability. These large banks appear to have mistakenly concluded that quality service caused profits to erode. It would appear that service quality could make a difference according to Lewis (1993), who noted that service quality leads to reduced costs, increased profitability, and other beneficial elements. In answer to critics, she noted that there was often an initial cost to implement quality service, but the resultant benefit and subsequent increase in profits offset those start-up costs.

Acquiring customers and having them leave is not only disconcerting, it is counterproductive and a profit drain on the organization. One of the principal reasons for customers to leave an organization is poor service delivery. Avkiran (1994) indicated that a telephone study in the Australian state of Victoria revealed poor service to the customer as the most likely reason for customers to consider moving their banking relationships. He observed that service

basically had two levels. The first level was desired service, which the customer desires, and the second level is known as adequate service, which is the minimum level the customer will accept. His research led to concluding that developing a “true customer franchise” requires firms to exceed both levels of desired service and acceptable service. Coyne (1989) takes the opposite stance on service quality, which he states as follows:

“There appear to be thresholds of service for affecting customer behavior… When satisfaction rose above a certain threshold, repurchase loyalty climbed rapidly. In contrast, when satisfaction fell below a different threshold, customer loyalty declined equally rapidly. However, between these thresholds, loyalty was relatively flat. I believe this twin threshold framework applies to a wide variety of service situations. “ (Coyne. 1989: page 70).

While Coyne makes an interesting case for a lack of loyalty other than the extreme limits of service quality, his arguments are easily refuted as it relates to American banks by Finch and Helms (1996) who noted that the delivery of superior service is the best means for satisfying and consequently retaining customers. Further, a two nation study of banking services by Witkowski and Keliner (1996) noted that American bank customers rank their American

banks’ services higher than German bank customers rank German banks’ services, but they also noted that service expectations by the customers is considerably greater in American banks.

In a slightly different approach, but equally as compelling, Beckett, et al (2000) noted that consumers change their buying habits more frequently due to the rigid structure of many financial institutions today at the expense of service to the customer. It was noted by Bahia and Nantel (2000) that there are no publicly available standard scales for measuring perceived quality in banks. It seems apparent from the studies that service quality is extremely important to an organization or a bank, but the dilemma seems to be how to accurately and reliably accomplish such measurement. The primary focus of this study is to seek such a means to measure service quality.

Factor Analysis

Factor analysis is an appropriate technique

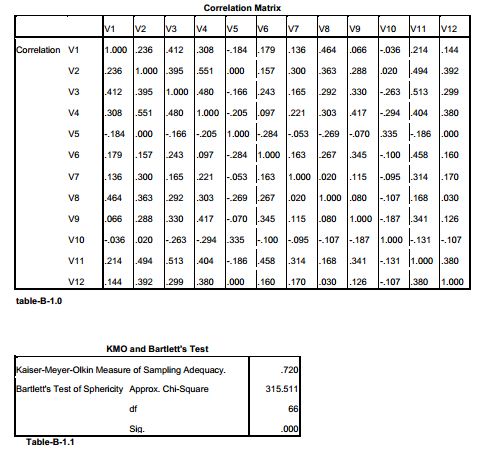

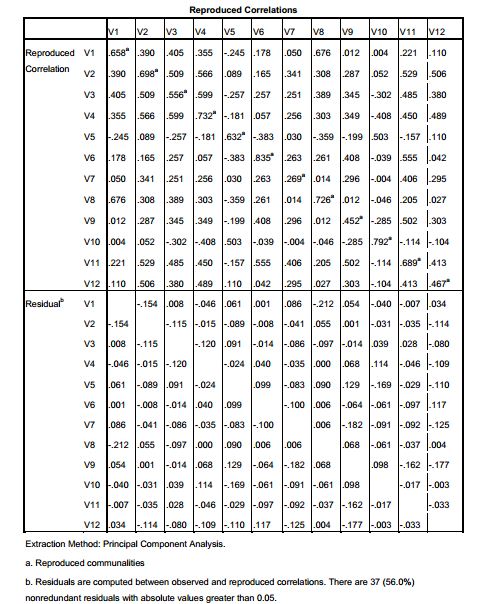

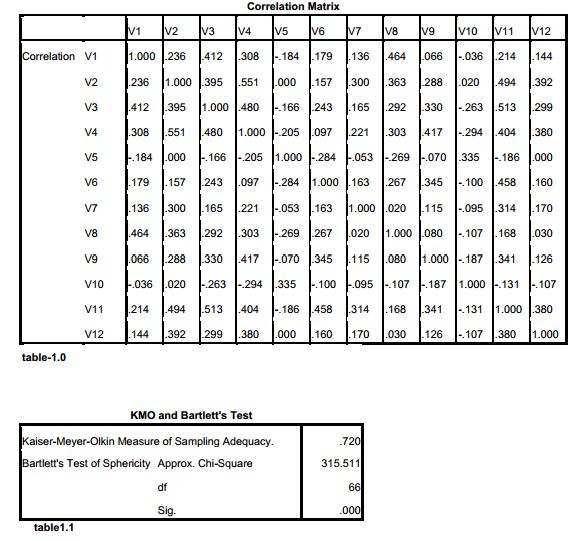

For the factor analysis to be appropriate, the variables must be correlated. So this is the first condition that must be assured. In that case the null (Ho) hypothesis is that the variables are uncorrelated. In other words the population correlation matrix is an identity matrix. In an identity matrix, all the diagonal terms are 1, and all the offdiagonal

terms are 0.

Ho: The variables are uncorrelated in the population

From the results of Factor Analysis that are given in the table 1.0 we find the approximate chi-square is 315.511 with66 degrees of freedom, which is significant (0.000) at the 0.05 level. It means the null hypothesis, that the population correlation matrix is an identity matrix, is rejected by the Barlett’s test of sphercity.

Again the value of KMO statistic (0..720) which is also large (>0.5). Thus factor analysis may be considered an appropriate technique for analyzing the correlation matrix of the given table 1.1.

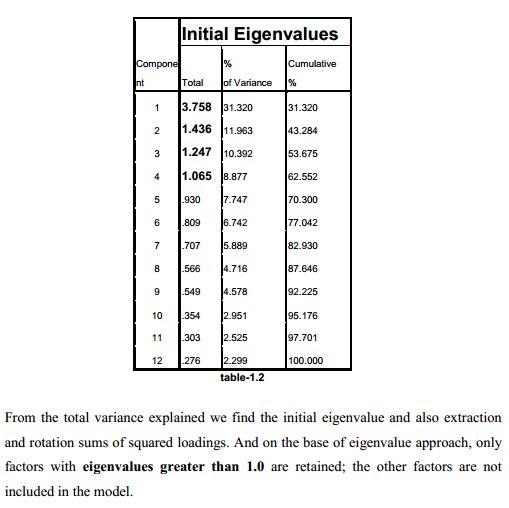

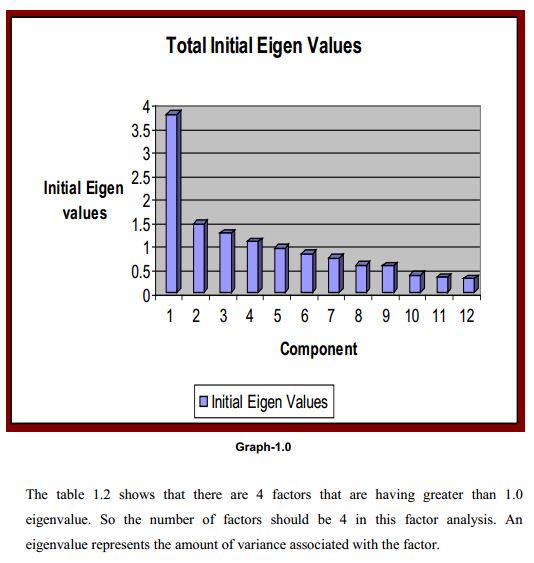

Determining Factors Based on Eigenvalues

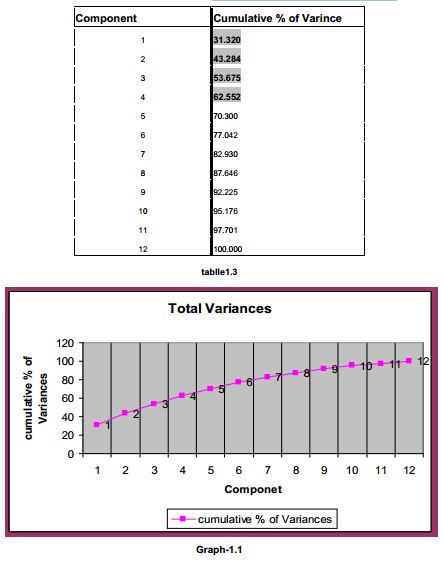

Determining Factors Based on Percentage of Variance

Number of factors can be determined on the basis cumulative percentage of variance extracted by the factors reaches a satisfactory level. It is recommended that the factors extracted should account for at least 60 percent of (from appendix B) variance.

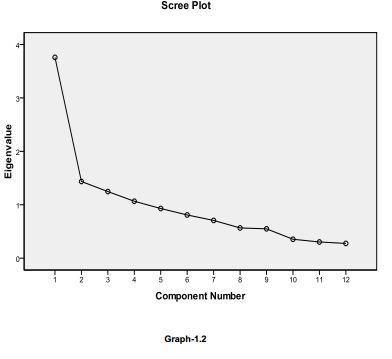

Determing factor Based on Scree Plot

Generally, the number of factors determined by scree plot will be one or few more than that he determined by the eigenvalue creation. Here in this research according to the given scree plot (graph 1) from the 5th factor the distinct break between the steep slope of factors are started. And the number factors suggested by the scree plot is 5.

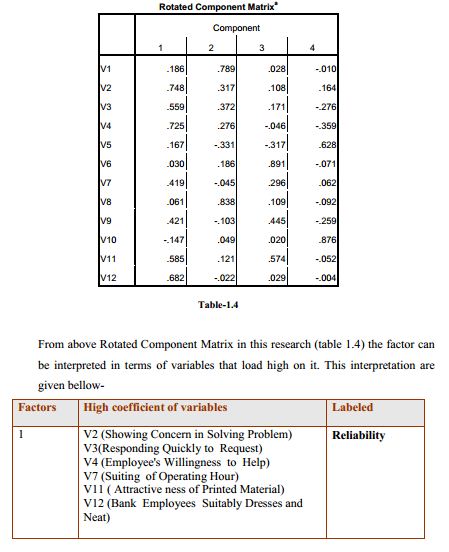

Categorizing Variable into Four Factors

T –test

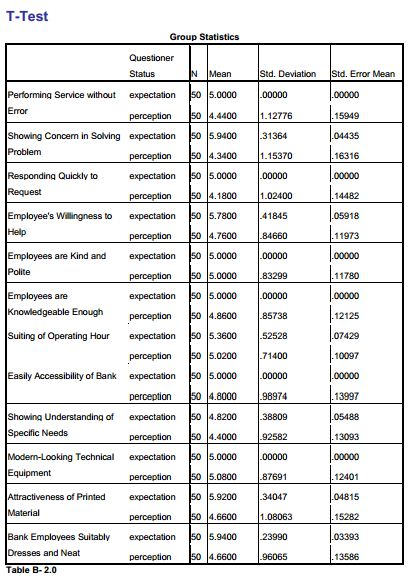

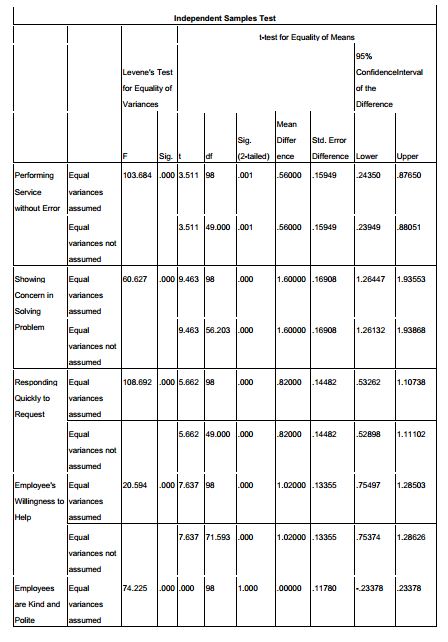

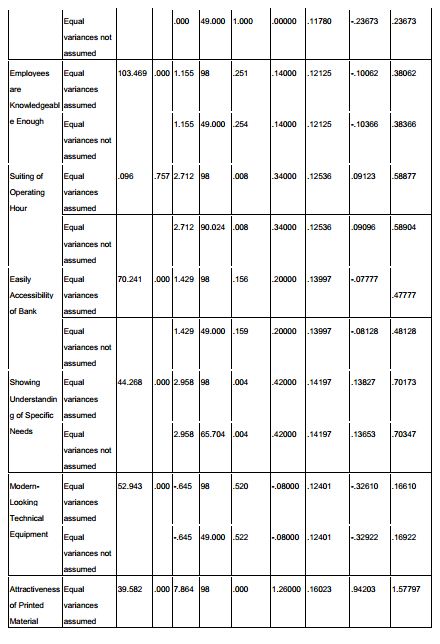

Gap between expectation and perception:

From the two sample mean test we find the differences between the expectation and perception of the customers towards their bank. In considering all the variables the null (Ho) hypothesis is there is no difference between the

expectation and perception. In other words the customers are fully satisfied with service quality if there bank. It means there is no need for further improvement.

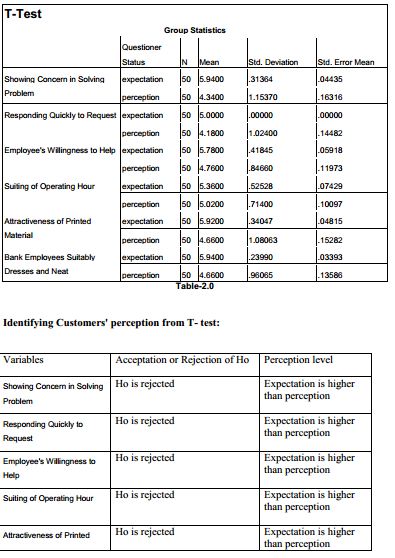

Ho: There is no difference between the expectation and perception. The result of two sample mean test of the research (Table 2.0, 2.1) are given in the following page-

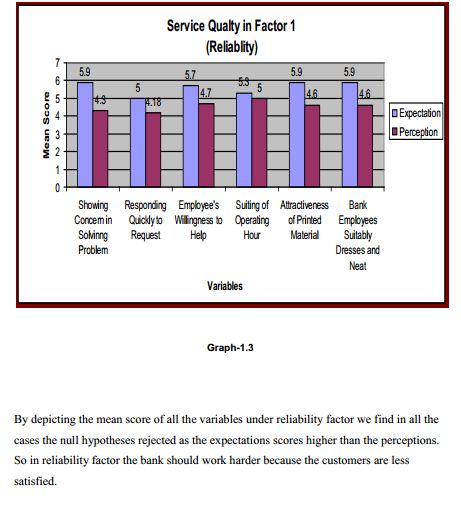

Measuring Service Quality in Factor 1(Reliability)

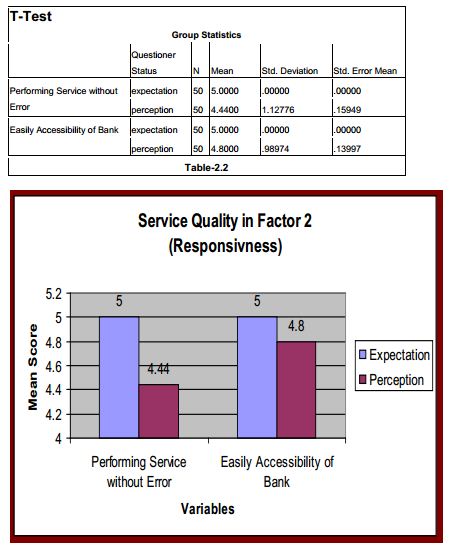

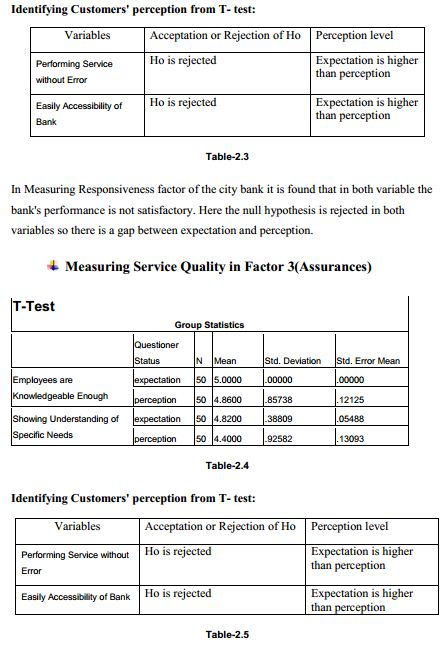

Measuring Service Quality in Factor 2(Responsiveness)

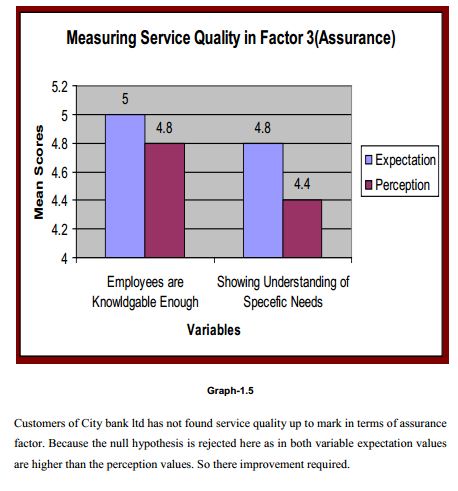

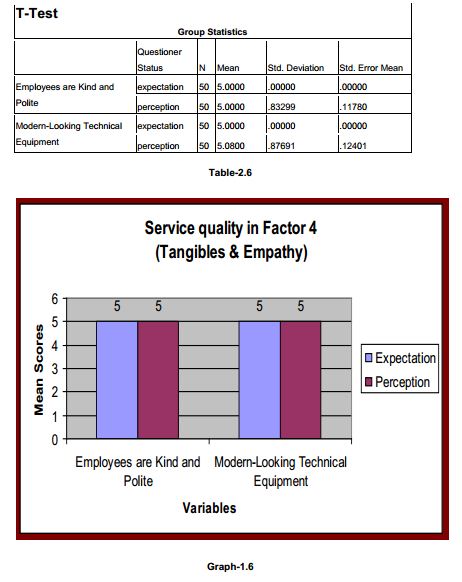

Measuring Service Quality in Factor 4(Tangibles& Empathy)

This factor tangible & empathy work as a very big advantage for the city bank. Here the null hypothesis is accepted. That means there is no difference between expectation and perception. No further improvement is required with theses variables.

Findings

- All the services of City Bank Limited can be categorized in to four factors. The four factors are- reliability, responsiveness, assurance and tangibles& empathy.

- Customers of City bank are pretty satisfied with their employees’ nature.

- Customers find that the employees are kind and polite to them.

- City Bank’s physical appearance is also a good advantage for the bank. All the equipment that are bank is using are modern enough to attract the customer.

- Bank failed to impress customers in winning the reliability of the customer. In capturing the reliability bank can focus on seven issues and the are- Showing Concern in Solving Problem, Responding Quickly to Request, Employee’s Willingness to Help, Suiting of Operating Hour, Attractiveness of Printed Material, Bank Employees Suitably Dresses and Neat.

- Customers of city bank are dissatisfied with responsiveness of the customers. And to omit this dissatisfaction employee should practice their service providing without minimum error. And also if bank can accessible to customer easily then this advantage can also minimize.

- The customers feel that the employees are not very keen to understand the customers need. Customers find difficulty to make them understand their proper requirements.

Limitation

- The major limitation of the study is in my research I have used convenience sampling technique, so the potential sources selections are biased.

- Confidentiality of data was another important barrier that was faced during the conduct of this study. Every organization has their own secrecy that in not revealed to others. While collecting data on City Bank Ltd, personnel did not disclose enough information for the sake of confidentiality of the organization.

- Rush hours and business was another reason that acts as an obstacle while gathering data.

- The findings of the survey are based on customers’ response in The City Bank Ltd. New Market Branch located in Dhaka City only. The results may not reflect the same for other branches of CBL outside Dhaka.

Recommendation

The City Bank Ltd. always believes in customer relationship and the customer always expect much more higher than to the others. The vision of the bank is The Financial Supermarket with a Winning Culture Offering Enjoyable Experiences. So it is very important for the bank that they should seriously focus on the customer. Though it is no

doubt bank is providing its services with the prime concerning to the customer but still the manpower it has need some trainings to understand their customers’ psychology.

Bank can conduct some useful research in several times to identify their customers’ satisfaction level. Bank can also ask their own customer’s to give them some suggestions so the customers can have better service and it will also make the customer feel important.

Conclusion

It was a great pleasure for me to make a reserch in “The City Bank Limited”. Since without practical exposure, it may not be possible to compare the theory what one has learnt with practical application. And it is well established that theory without practice is blind. The main focus of the report was identifying the satisfaction level towards The City bank Limited of its customer. Out of the above discussion a conclusion can be drawn after saying that, the present

customer dealing procedure is quite well but as the customers of City Bank expect a lot from the bank, bank have to compete with itself. It would be great opportunity of the bank if it focuses on some factors like responsiveness, assurance and reliability then to left behind well all other banks in Bangladesh. At this moment and the computerized transaction makes the system efficient and effective.

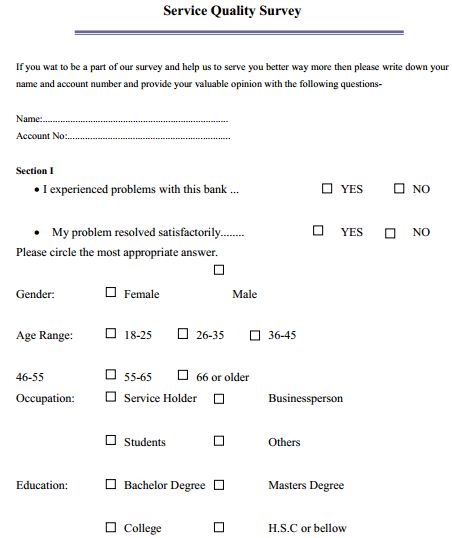

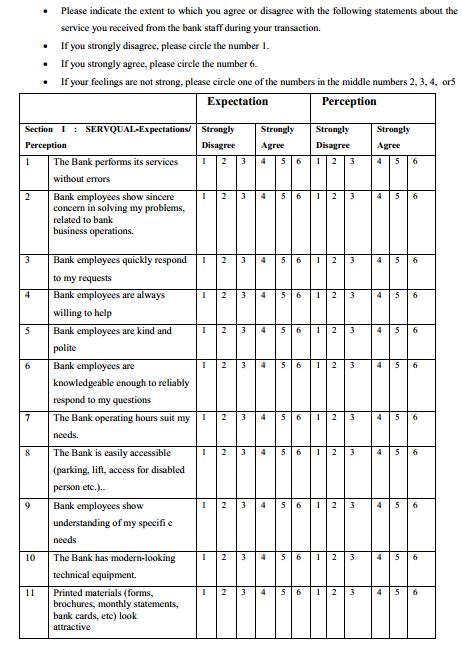

A. Questionnaire

Section II:

B. SPSS Output

Factor Analysis