3.8. SMEs Access to Finance—Barriers and Windows

Among the many compelling reasons why SMEs fail to realize their full potential, inadequate access to finance is prominent and most commonly cited. With limited capital base of their own and little or no access to institutional financing they rely on inefficient financing service traditionally from informal sources, which eventually proves unsustainable let alone stimulate growth.

There were also attempts to channelize to the sector through public and private banks fund received from international agencies. There were provisions of favorable debt equity ratio, special interest rates and credit guarantee scheme. The central bank also issued directives to both public and private commercial banks regarding working capital loans, use of standardized documentation procedure and time limits for credit sanctioning and loan disbursement. Notwithstanding all these arrangements for financing small and medium enterprises, the actual delivery of institutional credit to this sector has been grossly inadequate. One of the main factors that have hampered flow of institutional finance into small and medium enterprises is a bank preoccupation with collateral based lending. Traditionally banks have used fixed asset ownership particularly land ownership as the basis for judging credit-worthiness. This puts small and medium enterprises at relative disadvantage as they often cannot put up such collateral for loan. Moreover, whatever collateral they can manage gets used up in taking the term loan leaving them with no means to seek working capital loan from institutional sources. Unlike their large-scale counterparts they cannot use influence and contacts and solve the problem by putting up collateral of dubious valuation. Banks, on their part, also tend to be less flexible about the collateral requirement in the case of the SMEs as they perceive SME loan to be more risky and the cost of monitoring and supervision of small loans to be higher.

Various alternatives to real estate based lending have been suggested for the SMEs. Group guarantee and peer pressure, successfully used in the case of micro-finance, do not appear appropriate for SMEs as these are mostly sole proprietorship units with capital size significantly larger than the amount typically disbursed under micro-finance. Use of assets other than land and building, such as fixture, equipment, vehicles etc as collateral is also a fairly standard practice in institutional finance but is of less use in the case of SMEs as these enterprises usually possess few such non-land assets. Sales proceeds, accounts receivable, inventory etc can be the basis of working capital loan, but this requires proper documentation of the transactions of the SMEs and close monitoring and supervision on the part of the lending institutions. Because of the informal nature of many SME transactions and high cost of small loan administration, use of such movable asset for working capital lending will involve certain difficulties.

SMEs as these enterprises usually possess few such non-land assets, Sales proceeds, accounts receivable, inventory etc can be the basis of working capital loan, but this requires proper documentation of the transactions of the SMEs and close monitoring and supervision on the part of the lending institutions. Because of the informal nature of many SME transactions and high cost of small loan administration, use of such movable asset for working capital lending will involve certain difficulties. Financial institutions could significantly reduce the risk when they are lending to SMEs without real estate based collateral if they (a) pre-screen SMEs on the basis of cash flow statements and information from business service providers and receivers to assess track records of firms and their ability to repay in future, and (b) implement close monitoring and supervision in the post-disbursement stage. In such cases, appropriate credit guarantee schemes will need to be devised for covering the lending institutions both for the risk involved as well as for the additional cost of loan administration.

In 2003-04, Bangladesh Bank set up a Tk. 10.0 billion refinancing scheme for credit to SMEs. Bangladesh Bank charges participating institutions 5% interest rate while the lending institutions decide on the lending rate of interest. This provides these institutions with the scope of attempting lending to SMEs without real estate based collateral as their risks will be covered through refinancing facility and they can accommodate any additional cost of loan administration through an appropriate spread between the borrowing and the lending rate. Because of the initial success of the program, government raised the amount to Tk.25 billion in the national budget 2004-05. Beside this, International Development Agency (IDA) has provided US$ 10 million to Enterprise Growth and Bank Modernization Project (EGBMP) during FY 2004-5. Moreover, ADB has finalized an agreement with Bangladesh Bank to provide additional US$ 30 Million to this sector. These huge resources would strengthen the financial programme of EGBMP. This would result in employment generation in one hand and enhancement of purchasing power of the poor on the other hand. Under this programme, the financing capabilities of various financial institutions and banks have been enhanced and up to April, 2005 Bangladesh Bank has disbursed Tk.1237.34 million for refinancing. Out of this, the contribution of World Bank was Tk.237.26 million while that of Bangladesh Bank was Tk. 999.98 million. Detailed refinancing activities of Bangladesh Bank (BB) to various financial institutions and banks are shown at table-5 below:

Table – 3.1: Refinancing activities of BB and other Bank and financial Institutes

| No. of Beneficiary IDA PortionName of the financial institution | Working capital | Mid term | Long term | Total | No. of beneficiary enterprise | IDA portion |

| National Credit & Commerce Bank Ltd. | 15.64 | 77.50 | 93.14 | 228 | ||

| Jamuna Bank Ltd. | 4.00 | 4 | 1 | |||

| National Bank Ltd | 4 | 4 | 1 | |||

| One Bank Ltd | 5.8 | 24.49 | 20.29 | 69 | ||

| The Premier Bank Ltd. | 57.931 | 16.55 | 6.63 | 81.10 | 84 | |

| BRAC Bank Ltd | 38.05 | 502.01 | 540 | 3551 | 219.75 | |

| South East Bank Ltd | 27.90 | 1.50 | 29.4 | 32 | ||

| Uttara Finance & Investment Ltd | 7.76 | 45.10 | 55.54 | 108.4 | 59 | |

| Prime Finance & Investment Ltd | 14 | 14.00 | 5.59 | 33.85 | 17 | |

| Midas Financing Ltd | 0.5 | 106.26 | 39.59 | 148.3 | 245 | |

| Fidelity Assets & Securities Co.Ltd* | 0.80 | 0.80 | 1 | 0.6 | ||

| IDLC of Bangladesh | 17.85 | 13.48 | 31.33 | 20 | 16.91 | |

| Phoenix Leasing Co.Ltd | 1.2 | 15.01 | 37.07 | 54.18 | 24 | |

| United Leasing Co.Ltd | 29.87 | 49.78 | 79.65 | 58 | ||

| Lanka bangle Ltd | 0.3 | 0.50 | 0.8 | 2 | ||

| Total | 173.081 | 856.13 | 208.04 | 1237.24 | 2192 | 237.26 |

(Source: Bangladesh Bank)

It would be seen from the above Table that up to April 2005 Bangladesh Bank distributed Tk.1237.24 million as refinancing to 7 banks and 8 other financial institutions. It may be mentioned that the same amount of money was distributed by the above banks and financial institutions to 2192 SMEs earlier as loan. Out of the total loan Tk.173.08 million has been provided as working capital, T k. 856.13 million as mid-term loan and Tk. 208.04 million as long-term loan. About 18 banks and financial institutions have so far signed agreements with the central bank to get access to the refinancing facility. Banks and other financial Institutions have so far financed about 3094 SMEs. The Asian Development Bank (ADB) has ploughed into some $ 50 million to the government under its Small and Medium Enterprise Sector Development programme of the total $ 15 million is provided for SME sector policy and institutional restructuring and $ 5 million as technical assistance for capacity building and training. The rest $ 30 million went to the central bank’s enterprise fund. Historically, the commercial banks have been used as the exclusive conduits of funds for the SMEs. There is a strong case for exploring other possible conduits such as non-governmental organization (NGOs) who have success stories not only with micro finance but also with regard to credit to SMEs albeit in a limited way. As they are more developmental in character than commercial banks which are primarily profit oriented, this may help try out lending to SMEs without real estate based collateral and without having to reduce vigilance in pre and post lending stages.

The lack of access of SMEs to institutional finance is observed to be even higher when it comes to women owned or women managed enterprises. There is a general trend towards rise in women entrepreneurship in Bangladesh, but women trade bodies claim that social acceptability of this trend is not reflected in the attitude of the lending agencies, which discourages them from seeking institutional finance. The other major problem SME entrepreneurs face in seeking institutional finance is with regard to the preparation of the project proposal. In spite of directives from the central bank to follow standardized procedure, the loan application process has still remained lengthy and cumbersome. The entrepreneur often lacks the ability to formulate a proper project proposal. Even when he prepares the proposal drawing on outside expert services, there is no guarantee that the proposal will be evaluated properly as the financial institutions themselves lack adequate capability for proper project evaluation.

Loan processing, particularly in the case of public sector banks, involves high transaction costs for borrowers in terms of time and visits needed and unofficial payments made. Because of lack of proper autonomy and accountability, the public sector financial institutions are beset with inflexibility, inefficiency, political interventions and corruption. Since the performance of the bank officials is not properly evaluated they lack the incentive to bring larger number of suitable borrowers, particularly those in the small and medium enterprise sector, within the fold of institutional financing. They adopt a passive and inflexible attitude towards the borrowers either to avoid the risk of making an inappropriate lending or to force the borrower to make side payments for more favorable handling of the loan application. These problems are unlikely to go away without major institutional reforms of the public sector banks. Another major weakness of business financing in Bangladesh is lack of its modernization for purposes of e-commerce. In the context of an evolving globalize trading system the importance of e-commerce can hardly be overemphasized. But due to the absence of congenial telecommunication facilities and appropriate financial systems, business enterprises particularly SMEs have not taken any initiative towards e-commerce.

Bangladesh faces formidable developmental challenges. With a population density of 928 per square kilometer, it is the most densely populated country leaving aside a number of city-states. Per capita GDP of US$ 440 barely distances Bangladesh from a small number of countries at the very foot of the income scale. About 42 per cent of the population lives on the wrong side of the poverty line. Agriculture accounts for nearly a quarter of the GDP employing more than half of the labor force. About 77 per cent of the population still resides in the rural areas. Although population growth rate has come down to 1.47 per cent, annual growth of labor force is estimated to be 4.3 per cent. With the absorptive capacity of the agricultural sector limited to at most one third of the new entrants to the labor force, the country is faced with the pressing need of creating employment opportunities outside agriculture. The role of SME assumes special importance in this context.

To overcome the hurdles of financing and to make time-based progress ‘Local Enterprise

Investment Centre’ (LEIC) has been launched to facilitate improved access for the Small and

Medium Entrepreneurs (SMEs) to capital, innovation, new technologies and business practices

by way of establishing partnership with foreign or large local enterprises. Canadian International Development Agency (CIDA) and IDLC Bangladesh Limited jointly set up the LEIC to help develop a more vibrant private sector, which will serve as an engine for innovation, structural change and economic growth. The International Finance Corporation (IFC), the private sector arm of the World Bank Group, has signed an Agreement to issue a local currency guarantee of up to $5 million with United Leasing Company Limited (ULC) in Bangladesh. Credit enhancement from the proposed guarantee will assist ULC to borrow the equivalent amount of local currency from Citibank Bangladesh and use the longer tenured funding to further expand its portfolio of leases to the SME sector in Bangladesh. The proposed guarantee will facilitate the mobilization of longer-term local currency financing from the more liquid foreign banks to leasing companies that serve the SME sector.

3.9. SME Financing Policy of SEBL

3.9.1 OBJECTIVES

The objectives of Small and medium enterprises financing credit policy of SEBL are described below:

- To establish a sound combination of policy guidelines, lending guidelines, procedural guidelines and other standards & factors for financing the Small Enterprises.

- To flow credit for creation of employment and generation of income on a sustainable basis through development of Small Enterprises and thus to enable the small entrepreneurs to ‘access to finance’.

- To accelerate forward linkage, backward linkage, value addition activities and productivity improvement in order to establish and expand small scale manufacturing sector.

- To promote women entrepreneurs of the country.

- To participate in the socio-economic development of the country.

3.9.2. DEFINITION

Small Enterprise means an entity, ideally not a public limited company, which fulfills any of the following criteria:

Criteria | ||

| Small Enterprise | Total Fixed Assets (excluding land & building) | Total no. of manpower employed |

| Service Concern | Tk.0.50 lac to Tk.50.00 lac | Maximum 25 |

| Trading Concern | Tk.0.50 lac to Tk.50.00 lac | Maximum 25 |

| Manufacturing Concern | Tk.0.50 lac to Tk.1.50 crore | Maximum 50 |

3.9.3TARGET GROUP

The target groups for SME financing of SEBL are Entrepreneurs who are running small business units and willing to expand the business, Entrepreneurs who are willing to set up small scale manufacturing units/ service oriented units, Entrepreneurs who are involved in agro-based & agro-processing activities in small scale, Small scale contractors who execute work orders, supply orders and are required to be financed for execution of contracts; Women Entrepreneurs shall be given preferences.

Enterprises/ business units will be broadly categorized as 1.Service, 2.Trade, and 3. Manufacturing. The priority sectors will be as follows: Light Engineering & metal working, Electronics & electrical, Agro-based and agro-processing, Leather and leather products, Software development, Plastic & other synthetics, Healthcare & diagnostics Educational services, Pharmaceutical, cosmetics & toiletries, Herbal medicine, Handicrafts, Furniture.

3.9.4. SELECTION CRITERIA

The selection criteria’s for SME credit are described below:

- The legal form of business of the borrower is Sole Proprietorship/ Partnership/ Private Limited Company.

- The business is legally valid and the business firm has got all required licenses, permissions, registration certificates which are up-to-date at the time of application of credit facility.

- The business firm is registered in Bangladesh with majority shares owned by Bangladeshi nationals.

- The borrower’s principal place of business is in Bangladesh.

- The business is profitable and has a defined market with clear growth potentials.

- The entrepreneur is skilled, experienced and so far successful for managing the business for at least 02 (two) years.

- In case of new entrepreneur, he/ she is experienced in working in similar line of business and has technical-know-how about the business which he/ she wants to establish.

- The age of the proprietor/ partners/ key person of the business firm is within 20 years to 55 years.

- A clear succession plan is present.

- The entrepreneur is socially acceptable and his/ her reputation, integrity, trustworthiness, commitment are satisfactory.

3.9.5. FORMS OF LENDING

The SE borrowers shall mainly be accommodated by the Product Program Guidelines (PPG) based products. In case of non-availability of appropriate PPG based product, the SE borrowers can be financed through Bank’s usual lending products. The SE borrowers who will intend to avail credit facilities through Islamic Banking System shall be accommodated by the existing investment products of Islamic Banking of the Bank.

The SE borrowers shall be accommodated in such a way that the purpose of credit facility matches with the type of lending product/ investment product. Following is the chart of purpose of credit facility which is not exhaustive; the Relationship Managers/ Officers shall assess the nature of financial requirements of the borrower and offer complete solution to meet borrower’s need.

| Purpose | Mode of lending |

| Fixed asset procurement (including capital machinery), Renovation of shop/ office/ business premises. | Term Loan. |

| Meeting up working capital requirement. | Overdraft, Term Loan (if monthly installment is commensurate with monthly net operating profit). |

| Expansion of wholesale & retail trade. | Overdraft, Term Loan (if monthly installment is commensurate with monthly net operating profit). |

| Stopgap of fund requirement. | Time Loan. |

| Import financing. | L/C, LTR. |

| Export financing. | BTB L/C, PC, ECC |

| Execution of work orders, supply orders. | BG, Time Loan. |

3.9.6. LENDING GUIDELINES

The minimum and maximum exposure of a bank on a single Small Enterprise shall remain within the range of Tk.2.00 lac and Tk.50.00 lac respectively subject to the following:

- In case of working capital finance: Maximum up to 100% of the net required working capital or 75% of the sum total of inventory and receivables whichever is lower.

- In case of fixed assets purchase: Maximum up to 90% of the purchase price.

3.9.6.1 Loan Tenor

In case of Continuous / Demand Loan: Maximum 01 (one) year. Again, In case of Term Loan: Maximum 05 (five) years.

3.9.6.2 Mode of repayment

In case of continuous loan, credit turnover in the account must be equal to the limit in a quarter and full adjustment within validity period. In case of Term Loan, the loan should be repaid by monthly/ quarterly installments through post-dated cheques.

3.9.6.3 Security

- Hypothecation on the inventory, receivables, advance payments, plant & machinery.

- Registered mortgage over immovable properties with registered Power of Attorney.

- Lien on deposits/ saving certificates/ ICB unit certificates/ financial obligations etc.

- Personal guarantee of the borrower. In case of limited companies, guarantee of all directors other than nominee directors shall be obtained.

- Personal guarantee of spouse (if married) or parents (if unmarried) of the borrower.

- Personal guarantees of two shop owners of the respective market/ two businessmen/ any other person acceptable to the bank.

- Postdated cheques for all installments and one undated cheque for full loan value including full interest.

- Any other securities to be deemed suitable by the Bank depending on banker-customer relationship

3.9.6.4 Loan Renewal

Renewal of Loan or Successive Loan depends on track record of previous loan. Usually, repayment behavior and expansion of business of the borrower are the main considerations for renewal and enhancement of the loan amount.

3.9.6.5 Time Frame for approval

The time frame for approving/ declining a credit proposal shall be maximum 07 (seven) working days at Branch/ SME Service Center level, and maximum 05 (five) working days at Head Office level, provided all required information/ documents are in place. Clean facilities (collateral free credit) can be given upto Tk.10.00 lac on any single Small Enterprise. For financing the Women Entrepreneurs in SME sector under refinance scheme of Bangladesh Bank, financing up to Tk.25.00 lac against charge on assets of the enterprise and personal guarantee only can be made. Highest priority shall be given for accepting and settlement of the Loan applications from the Women Entrepreneurs in SME sector within a reasonable time period. All regulations as specified under ‘Bangladesh Bank’s Regulations’ are to be met. Branches/ SME Service Centers shall adhere to the Credit Policy of the Bank and the relevant Circulars/ Regulations/ Guidelines of the Bank/ Bangladesh Bank/ any other regulatory authority.

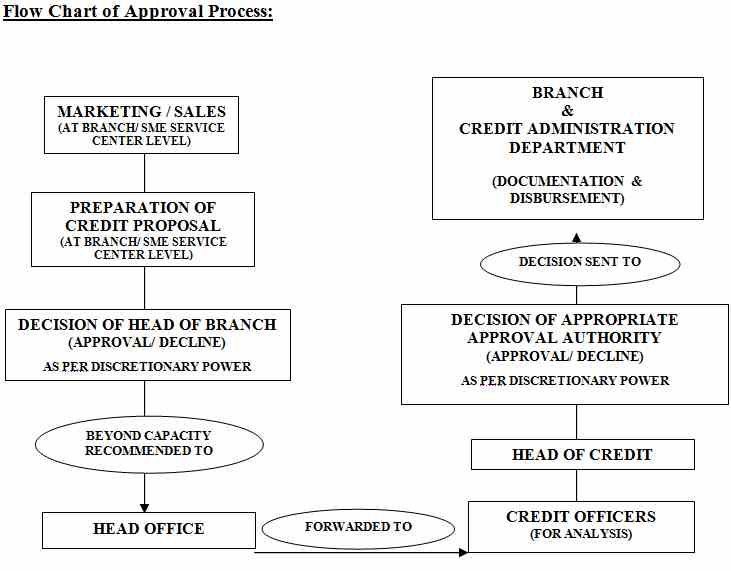

3.9.7 APPLICATION & APPROVAL PROCESSES

Any credit proposal and/ or pre-sanction Inspection Report/ call report/ visit report is to be originated from the Branch/ SME Service Center. The client shall have to open account with the relevant Branch/ SME Service Centre of the Bank. The client shall fill up the RFCF (Request For Credit Facility), Net Worth Statement, other pro forma (if any) correctly and completely. The client shall provide CIB undertakings, Financial Statements, other information/ papers/ documents required by the concerned official of the Branch/ SME Service Center. The concerned official of the Branch/ SME Service Center shall evaluate client’s proposal with due diligence, accomplish the relevant tasks meticulously and prepare the Credit Appraisal Form as per the prescribed format. Any requirement for further information regarding a particular credit proposal shall have to be communicated to the client within 03 (three) working days from the date of submission of the application by the client. If a particular credit proposal is found suitable, the Branch/ SME Service Center shall assign a unique identification number to the borrower and submit the credit proposal along with the required documents, such as Visit Report, Stock Report, CPV Report, Valuation Report etc. to the Head Office for approval. The unique identification number shall consist of three parts: 3-digit Branch/ SME Service Center code, 2-digit month number, 2 digit year number & 4 digit unique serial number. At Head Office, the assigned Credit Officer(s) shall appraise the proposal in line with Bank’s credit policies and guidelines of Central Bank & other regulatory authorities and place the proposal to the competent approval authority for decision.

3.9.8CREDIT ASSESSMENT & RISK MANAGEMENT

The sources of repayment shall be identified specifically and the repayment capacity of the client shall be assessed on the basis of assets conversion cycle and expected future cash flows. In the same connection, current & projected financial statements shall be obtained before processing a credit proposal. The Small Enterprises may not have proper books of accounts and they may not be able to prepare current and projected financial statements due to lack of sophistication and expertise. In such cases, the relationship officers at Branch/ SME Service Center level shall assist the clients in obtaining/ developing such books of accounts/ financial statements.

Branches/ SME Service Centers must assess current status of the particular sector / industry the Bank is lending to and its future prospects. Branches/ SME Service Centers must identify the key drivers of the clients’ businesses, the key risks to their businesses and their risk mitigates.

A written declaration is to be obtained from the client divulging details of various credit facilities being availed by the client from other institutions. The details given in the statement is to be carefully examined and fresh credit facility will be allowed only after ensuring that the total exposure in relation to the repayment capacity of the customer does not exceed the reasonable limits.

Updated and clean CIB report on the client must be in place while processing the credit proposal. Branches/ SME Service Centers shall conduct a thorough credit and risk assessment for each credit facility. The outcomes of such assessment should be presented in the prescribed Credit Appraisal Form (CAF), which will be forwarded to the Head Office for approval.

The assumptions and parameters used to project the future cash flows shall be documented and annexed with the cash flow analysis undertaken by the Branches/ SME Service Centers. Branches/ SME Service Centers shall obtain a copy of financial statements duly audited by a practicing Chartered Accountant, relating to the business of every borrower who is a limited company or where exposure of the Bank exceeds Tk.40.00 lac, for analysis and record.

Branches/ SME Service Centers shall obtain the prescribed RFCF (Request For Credit Facility) duly filled in properly under the seal and signature of the client for every credit application (including renewal, enhancement and rescheduling). Branches/ SME Service Centers shall conduct Contact Point Verification (CPV) and prepare CPV Report as per prescribed format for each client. Branches/ SME Service Centers shall obtain Personal Net Worth Statement for the owner(s) of the SE. Branches/ SME Service Centers shall maintain database/ list of declined credit proposals with firms’ name & owners’ name separately. Security documents are to be prepared in accordance with approval terms and must be legally enforceable. Branches/ SME Service Centers shall make disbursements only when all security documentation is in place. In case of third party deposits/ security instruments, in order to minimize any inherent risk emanating from accepting third party deposits/ security instruments, Branches/ SME Service Centers shall verify third party’s signature against the specimen attached to the original instrument and send the instrument to the issuing office for their verification and written confirmation on lien marking and encashment of the instrument.

A clear segregation of credit collection/ recovery activities from marketing/ sales activities must be made by way of assigning separate officer(s). Specifically assigned officer(s) shall carry out the SEF activities in order to establish separate risk management capacity for SEF. Productivity Tracking Analysis on each client is to be done through scrutinizing no of calls made, promise to pay, kept promise, broken promise etc. Branches/ SME Service Centers shall put maximum effort to minimize fraud risk by analyzing the CPV and validating the authenticity of all documentation. Branches/ SME Service Centers shall conduct regular inspections (at least quarterly) to ascertain the status of business activities for which the SE is financed. Such inspection has to be documented properly.

3.9.9 CREDIT ADMINISTRATION

3.9.9.1 Documentation:

Branches/ SME Service Centers shall ensure that all security documentation complies with the terms of approval. Branches/ SME Service Centers shall maintain control over all security documentation. They will also monitor borrower’s compliance with agreed terms and conditions, and general monitoring of account conduct/ performance.

3.9.9.2 Legal Vetting

Mortgage documents shall be properly vetted by the Bank’s Legal Counsel. Bank’s Legal Counsel shall certify that proper documentation, borrower’s legal standing and enforcement of securities are in place. Finally, Lawyer’s Satisfaction Certificate shall have to be obtained regarding documentation where there are securities/collaterals other than Personal Guarantee and Financial Obligation.

3.9.9.3 File Maintenance

Separate and independent file(s) for each customer shall be maintained by the Branch/ SME Service Center and Head Office. File(s) will be under the custody of the concerned Relationship Officer/ Relationship Manager at Branch/ SME Service Center and Credit Officer at Head Office who is handling the client within his/ her Division/Department.

3.9.9.4 Disbursement:

Branches/ SME Service Centers shall ensure that the disbursement of loan is made only after all terms and conditions of approval have been met and all security documentation is in place.

Branches/ SME Service Centers shall ensure that the loans are to be properly utilized for the same purposes for which they were acquired/ obtained. In case of need, a phase-wise disbursement may be allowed with the progress of utilization of fund.

3.9.9.5 Monitoring:

The success of the SE financing depends on the extensive and intensive post disbursement supervision, follow-up and monitoring. It must be ensured that the proceeds of the loan are not being diverted, the sponsors are very serious to the operation of the project, quality is updated and marketing effort is effective. Regular repayment must be ensured. Visit to the establishment must be done at least one in a month. The visit should be done for strengthening the spirit and loyalty of the customers. Monthly stock report is to be obtained duly filled in by the borrower and signed by an officer of the Branch/ SME Service Centers after physical verification, duly countersigned by the Head of Branch/ SME Service Center. Branches/ SME Service Centers shall maintain strong MIS (Management Information System) on its entire SE loan portfolio.

3.9.9.6 Compliance:

Branches/ SME Service Centers shall ensure timely submission of statements/ returns on SE financing as per requirement of Head Office or any regulatory authority. Branches/ SME Service Centers shall also ensure compliance with the Credit Policy of the Bank and the relevant Circulars/ Regulations/ Guidelines of the Bank/ Bangladesh Bank/ any other regulatory authority.

3.10. Bangladesh Bank’s Regulations for SME Financing

REGULATION -1

SOURCE AND CAPACITY OF REPAYMENT AND CASH FLOW BACKED LENDING

Branches shall specifically identify the sources of repayment and asses the repayment capacity of the borrower on the basis of assets conversion cycle and expected future cash flows. In order to add value, the Branches must assess conditions in the particular sector / industry they are lending to and its future prospects.

The rationale and parameters used to project the future cash flows shall be documented and annexed with the cash flow analysis undertaken by the Branches. It is recognized a large number of SEs will not be able to prepare future cash flows due to lack of sophistication and financial expertise. It is expected that in such cases Branches shall assist the borrowers in obtaining the required information and no SE shall be declined access to credit merely on this ground.

REGULATION -2

PERSONAL GUARANTEES

All facilities to SEs shall be backed by the personal guarantees of the owners of the SEs. In case of proprietorship concern, spouse’s guarantee other than the personal guarantee of the owner may be taken. In case of limited companies, guarantees of all directors other than nominee directors shall be obtained.

REGULATION -3

PER PARTY EXPOSURE LIMIT

The minimum and maximum exposure of a bank on a single SE shall remain within the range of Tk.2.00 lac and Tk.50.00 lac respectively subject to the following:

In case of working capital finance: Maximum up to 100% of the net required working capital or 75% of the sum total of inventory and receivables whichever is lower.

In case of fixed assets purchase: Maximum up to 90% of the purchase price.

REGULATION -4

AGGREGATE EXPOSURE OF A BANK ON SMALL ENTERPRISE SECTOR

The aggregate exposure of the Bank on SE sector shall not exceed the limits as specified below:

| % of classified SE advances to total portfolio of SE advances | Maximum Limit |

| a. Below 5% | 10 times of equity |

| b. Below 10% | 6 times of the equity |

| c. Below 15% | 4 times of the equity |

| d. Up to and above 15% | Up to the equity |

REGULATION -5

LIMIT ON CLEAN FACILITIES

In order to facilitate growth of smaller loans, The Bank is free to determine security requirements for loans up to Tk.10.00 lac.

REGULATION – 6

SECURITIES

Consequent to the regulation stated in Regulation -5, facilities provided to SEs shall be secured by the Bank as follows:

For loan amounting Tk.2.00 lac to Tk.10.00 lac:

As a minimum banks must take charge over assets being financed.

For loan amounting Tk.10.00 lac to Tk.50.00 lac:

a) Hypothecation on the inventory, receivables, advance payments, plant & machinery.

b) Registered mortgage over immovable properties with registered Power of Attorney.

c) Personal Guarantees of Spouse/Parents/other family members.

d) One third party personal guarantee.

e) Post dated cheques for each installment and one undated cheque for full loan value including full interest.

REGULATION – 7

LOAN DOCUMENTATION

For all facilities, Branches must obtain (as applicable) and not limiting to following documents before disbursement of loan can be made:

a) Loan Application Form duly signed by the customer.

b) Acceptance of the terms and conditions of Sanction Advice.

c) Trade License.

d) In case of partnership firm:

Copy of Registered Partnership Deed duly certified as true copy or a partnership Deed on non-judicial stamp of Tk.150.00 denomination duly notarized.

e) In case of limited company:

i) Copy of Memorandum & Articles of Association of the company including Certificate of incorporation duly certified by Registrar Joint Stock Companies (RJSC) and attested by the Managing Director accompanied by an up-to-date list of Directors.

ii) Copy of Board Resolution of the company for availing credit facilities and authorizing Managing Director/ Chairman/Director for execution of documents and operation of the accounts.

iii) An Undertaking not to change the management of the company and the memorandum and articles of the company without prior permission of the bank.

iv) Copy of last audited financial statement up to last 03 years (as applicable and subject to Regulation-10).

v) Personal Guarantee of all the Directors including the Chairman and Managing Director.

vi) Certificate of registration of charges over the fixed and floating assets of the company duly issued by RJSC.

vii) Certificate of registration of amendment of charges over the fixed and floating assets of the company duly issued by RJSC in case of repeat loan or change in terms and condition of Sanction Advice regarding loan amount, securities etc.

f) Demand Promissory Note.

g) Letter of hypothecation of stocks and goods.

h) Letter of hypothecation of book debts & receivables.

i) Letter of hypothecation of plant & machinery.

j) Charge on fixed assets.

k) Personal Letter of Guarantee.

l) Wherever practical, insurance policy for 110% of the stock value covering all risks with bank’s mortgage clause in joint name of the bank and client.

REGULATION -8

MARGIN REQUIREMENTS

Branches shall adhere to the minimum margin requirement as prescribed by Bangladesh Bank (if any).

REGULATION -9

CREDIT INFORMATION BUREAU (CIB) CLEARANCE

While considering proposals for any exposure, Branches should give due weightage to the credit report relating to the borrower and his group obtained from a Credit Information Bureau (CIB) of Bangladesh Bank. The condition of obtaining CIB report will be governed by rules & regulations as prescribed by Bangladesh Bank from time to time.

REGULATION -10

MINIMUM CONDITIONS FOR TAKING EXPOSURE

Branches shall, as a matter of rule, obtain a copy of financial statements duly audited by a practicing Chartered Accountant, relating to the business of every borrower who is a limited company or where exposure of a bank exceeds Tk.40.00 lac, for analysis and record. However, financial statements signed by the borrower will suffice where the exposure is fully secured by liquid assets.

It is recognized that a large number of enterprises other than limited companies (i.e., sole proprietorship/ partnership firms etc.) may not have proper books of accounts including balance sheet, profit & loss account and they may not be able to prepare current and future cash flows due to lack of sophistication and expertise. It is expected that in such cases, Branches shall assist the borrowers in obtaining/ developing such books of accounts as per forms/ formats prescribed by the Bank.

The Bank shall not approve and/ or provide any exposure (including renewal, enhancement and rescheduling) until and unless the prescribed Loan Application Form is accompanied by borrower’s basic fact sheet under the seal and signature of the borrower.

REGULATION -11

PROPER UTILIZATION OF LOAN

The Bank should ensure that the loans have been properly utilized by the SEs and for the same purposes for which they were acquired / obtained.

REGULATION -12

RESTRICTION ON FACILITIES TO RELATED PARTIES

The Bank shall not take any exposure on a SE in which any of its director, shareholder, employee or their immediate family members are holding 5% or more of the share capital of the SE.

REGULATION -13

CLASSIFICATION AND PROVISIONING FOR ASSETS

Existing norms for usual loans & advances shall be applicable.

For more parts of this post-

An Empirical Study On Southeast Bank Limited.(Part-1)

An Empirical Study On Southeast Bank Limited.(Part-2)

An Empirical Study On Southeast Bank Limited.(Part-3)

An Empirical Study On Southeast Bank Limited.(Part-4)

An Empirical Study On Southeast Bank Limited.(Part-5)

An Empirical Study On Southeast Bank Limited.(Part-6)

An Empirical Study On Southeast Bank Limited.(Part-7)