Adjustment regarding undistributed Profits and Losses in terms of Retirement of a Partner

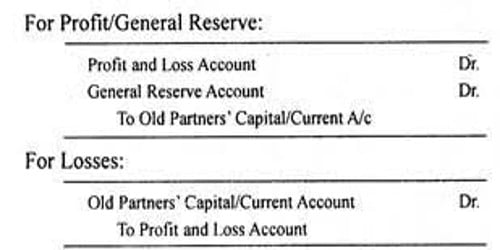

Any reserves or accumulated profits/losses appearing on the balance sheet should be transferred to the partner’s capital accounts. At the time of retirement of a partner, there may be some accumulated profits or losses in the forms of any reserve or credit balance of profit and loss account or debit balance of profit and loss account, etc. One of the forms of reconstitution of the firm is Change in Profit Sharing Ratio among Existing Partners. All such amount should be distributed among all the partners, outgoing or remaining, in their old profit sharing ratio. To expand the business in the future, the partnership firm reserves some profits as General Reserve or undistributed profits. Sometimes, only the share of outgoing partners may transfer to his capital account and balance is shown in the balance sheet. These accumulated profits appear on the liabilities side of the Balance Sheet. Such can be done only when the remaining partners agreed for it.

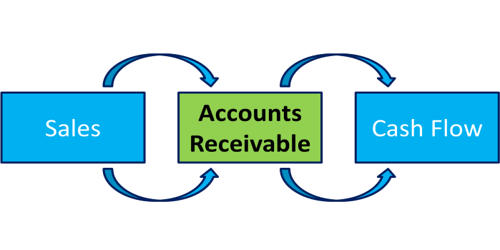

In Profit and Loss Adjustments and Appropriations, a screening company can disclose the details of Profits distributed after Net Profit has arrived.

Net Profit = Gross Profit – Administration & Selling Expenses – Other Expenses – Taxes – Depreciation + Other Incomes.

These undistributed profits belong to old partners. Therefore, these undistributed profits are transferred to the old partners’ account in their old profit sharing ratio before the admission of a new partner. After these adjustments, the general reserve or undistributed losses do not appear in the Balance Sheet. If the partners decide to leave them undisturbed it is necessary to make an adjustment entry in the books of the firm. After making all the adjustments in the Partners Capital Account, the amount that is due to him is paid to his Legal Representative. In that case, the share gained by the gaining partner, he must compensate the sacrificing partner that shares of profits and reserves which is proportionate to him.

![Report on Industrial Attachment at DIVINE TEXTILE LIMITED [ Part-3 ]](https://assignmentpoint.com/wp-content/uploads/2013/03/divine-group-110x55.jpg)