The cumulative amount of depreciation cost attributed to a single asset after the asset was placed into operation is accumulated depreciation. In other words, it’s the sum of costs attributed to the asset in its useful life so far. A contra asset account is an accumulated depreciation, meaning that its natural balance is a credit that decreases the net value of the asset. Unlike a traditional asset account, a credit to a contra-asset account increases its value while a debit decreases its value.

Under the generally accepted accounting principles (GAAP), the matching principle specifies that expenditures must conform to the same accounting period in which the associated revenue is produced. The same sum is often added to the cumulative depreciation account if depreciation expenditure is reported for an entity, enabling the corporation to display both the cost of the asset and the asset’s overall depreciation. A company can spend a portion of the value of a capital asset throughout each year of its useful life by depreciation. This also shows the asset’s net value on the record. This implies that every year a capitalized asset is put to use and generates revenue, the value related to the depletion of the asset is recorded.

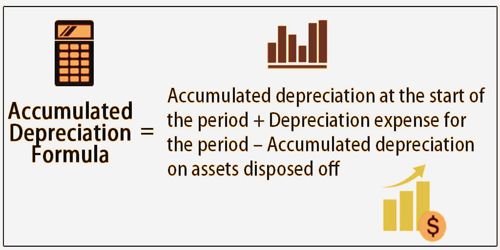

Accumulated Depreciation Formula

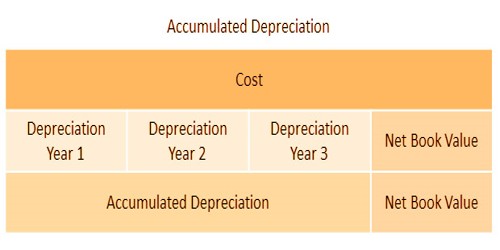

A lot of people confuse the cost of depreciation with an asset actually being expensed. When conducting financial modeling, financial analysts can produce a depreciation schedule to monitor the cumulative depreciation over the life of an asset. When they are acquired and listed on the balance sheet, fixed assets are capitalized. No costs are initially recorded on the acquisition date. Accumulated depreciation means that up to one point, the entire value of an asset has been depreciated. The depreciation cost reported in that period is added to the original cumulative depreciation balance for each period.

Instead, over the course of its useful life with depreciation, the costs of the asset are remembered ratably. The carrying value of an asset on the balance sheet is the distinction between its historical expense and cumulative depreciation. This method of cost allocation agrees with the matching concept as costs are recognized in the time span in which profits are generated by the aid. At the head of a benefit’s helpful life, conveying an incentive on the record will coordinate its rescue esteem. In many situations, we credit the amassed devaluation account in light of the fact that, over the long haul, the corporate records the deterioration cost that is gathered inside the contra-resource account.

Example of Accumulated Depreciation

When recording depreciation within the leger, a corporation debits depreciation expenses and credits accumulated depreciation. Let’s assume, for instance, an asset has been used for 5 years and has a gross cumulative depreciation of $100,000. If the company wants to sell the asset, the account would need to be zeroed out after the 5-year duration because the asset is no longer valuable to the company. Therefore, depending on the market value of the asset and the amount earned, there will be a credit to the asset account, a debit to the net depreciation account, and a gain or loss.

Fixed assets, accompanied by cumulative depreciation, are often mentioned at their historical expense. Over time, the cumulative balance of depreciation rises, contributing to the amount of depreciation cost reported in the current era. It very well may be deducted from the chronicled cost to show up at the current book esteem. Aggregated amortization and gathered exhaustion work similarly as collected deterioration; they are all contra-resource accounts. The naming show is simply unique relying upon the idea of the advantage.

The expense of straight-line depreciation is determined by finding the asset’s depreciable foundation, which equals the difference between the asset’s historical cost and its salvage value. The related accrued contra-asset accounts are credited to account for the expense if amortization or depreciation expense is reported for the year.

Information Sources: